Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS: Price Analysis, Feb. 09

Hi Friends

Cryptocurrencies are part of evolving technological know-how and are nonetheless in a nascent stage.So, they're likely to stay really risky compared to the other matured asset courses.

The early buyers in cryptocurrencies were mostly technology enthusiasts who saw a future in them. After the humongous returns of 2017, more and more institutional traders want to become a member of the occasion.

This is changing the way in which the cryptocurrencies perform. Prior to now 90-days, the correlation between the S&P 500 and cryptocurrencies has risen sharply to 33 percent, which is way above the prior excessive studying of 19 percentage, in step with Nick Colas, co-founder of DataTrek study. The long-time period typical is much curb at 1 percentage.

2018 has grew to become out to be hugely terrible to both the inventory market and the cryptocurrencies. Lets see if the top coins factor closer to a resumption of the downtrend, much like the S&P 500.

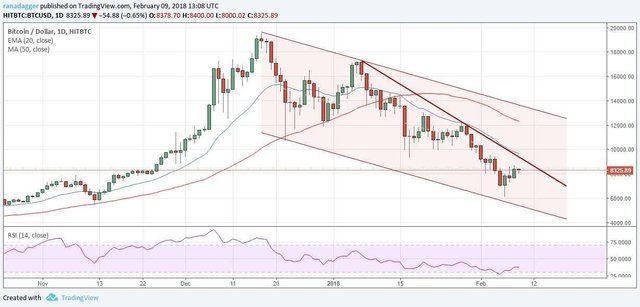

BTC/USD

even as it's higher to exchange with the trend, now and then, strong counter-pattern rallies can also be lucrative. Bitcoin is buying and selling within a descending channel with both the 20-day EMA and the 50-day EMA trending down. This suggests that it's in a tested downtrend. The current pullback is prone to face resistance at the downtrend line and the 20-day EMA.

BTC

In a downtrend, when the selling is overdone, and costs reach appealing levels, it may offer a short-term trading opportunity.

We think that if the BTC/USD pair holds above the February 06 lows for the duration of the subsequent leg down, the traders will have an opportunity to enter long positions. The perfect time to buy would be when costs get away of the downtrend line and the 20-day EMA. The profit purpose of any such alternate might be a move toward the resistance line of the descending channel.

However, if the fee breaks down and goes on to make a brand new low, the above-recounted trading possibility will be invalidated.

ETH/USD

Ethereum plunged from $1,265 levels to $565.54 levels inside 9 days. The February 06 low additionally coincided with the aid line of the descending channel.

ETH

The relocating averages have accomplished a bearish crossover, which facets to the probability of another leg down. We anticipate the current leg of the pullback to face resistance at the 20-day EMA. If the ETH/USD pair stays above the February 06 lows, it is going to point to a possible short-time period bottom, which can be purchased.

We should hinder the alternate if the cryptocurrency sinks to new lows.

BCH/USD

the day gone by, Bitcoin cash made a strong transfer up. It is now prone to move toward the downtrend line and the 20-day EMA where it would face robust resistance.

BCH

The BCH/USD pair will turn out to be optimistic within the short-term as soon as it breaks out and sustains above the downtrend line. We assume it to type a bullish setup in the following few days. The primary target function is a move to $2,072 stages.

We currently dont to find any bullish pattern; thus, we do not advocate any exchange on it.

XRP/USD

Ripple has brought on plenty of heartburn to its investors. On the present cost, it's still down about 67 percent from its peak. It has been trading in a small range for the past 5 days and isn't finding so much interest among the customers.

XPR

nonetheless, we think that if the XRP/USD pair breaks out of the 20-day EMA and the downtrend line, we are able to count on it to attract additional shopping, which will propel it towards the overhead resistance of $1.Seventy four. Hence, we must watch for a breakout above the 20-day EMA before purchasing.

Our view of a short-time period backside will prove to be incorrect if the cryptocurrency breaks down of the lows shaped on February 06.

XLM/USD

Stellar has end up range bound for the earlier three days. Intraday, it is dealing with resistance on the previous help of $0.41.

XLM

A smash above this level will once more face selling at the resistance line of the descending channel. The trend on the XLM/USD pair will trade handiest after it breaks out and sustains above the descending channel.

Stellar will come to be terrible if it sustains under $0.30 stages.

LTC/USD

Litecoin is practically the 20-day EMA, which has acted as strong resistance on two prior occasions.

LTC

If the bulls escape of this level, they're likely to face one more circular of selling across the $one hundred seventy five mark, which has dual resistance, from the downtrend line and the horizontal line.

As soon as the LTC/USD pair breaks out of those resistances, it's going to most often a brand new uptrend, which is able to elevate it to $243 and after that to $307.

Traders can provoke long positions as soon as the cryptocurrency breaks out and sustains above the $175 stages. We dont have a precise discontinue loss role. We are able to replace the same one once our buy levels are caused.

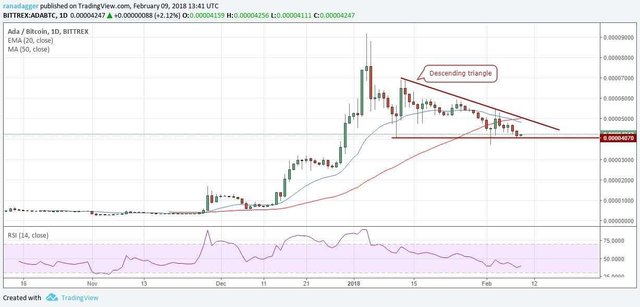

ADA/BTC

Cardano just isn't discovering purchasers. It continues to battle near the lows formed on February 02. It has also formed a descending triangle pattern, which is a bearish setup.

ADA

If the ADA/BTC pair breaks down and sustains beneath the horizontal support of 0.00004070, it's going to whole the descending triangle formation. After that, it is going to most likely slide to zero.0000246 stages where purchasing should emerge.

Our bearish view can be invalidated if the digital foreign money breaks out and closes above the downtrend line of the triangle.

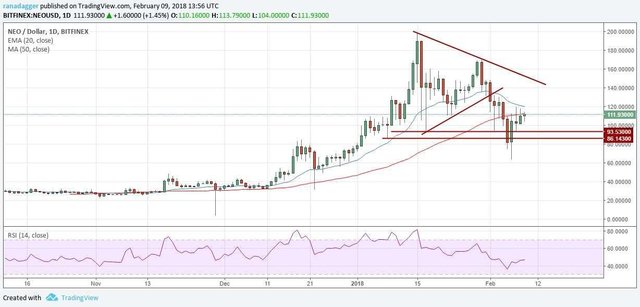

NEO/USD

NEO is dealing with resistance at the moving averages, as outlined in our prior evaluation. Moreover, it formed an within day sample the day gone by, February 08, and it's prone to repeat the identical pattern today.

NEO

These successive within day patterns have the same effect because the coiling of the spring. As soon as the bulls breakout above $a hundred and twenty phases, a speedy rally to the downtrend line at $one hundred forty could take location. Traders can hold an initial discontinue loss of $a hundred, which may also be trailed higher to shrink the hazard.

Alternatively, if the NEO/USD pair breaks down instead of breaking out, it's going to emerge as bad, and a retest of the February 06 lows is likely.

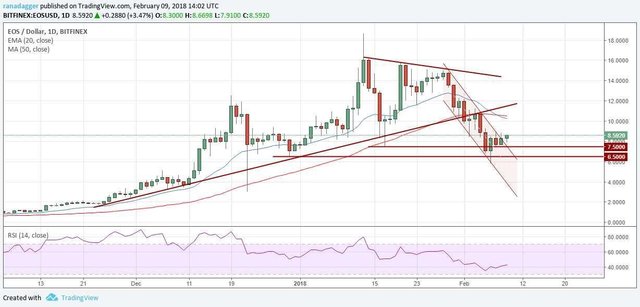

EOS/USD

EOS has damaged out of the descending channel, which elements to a waning bearish momentum. However, it has been facing resistance nearly the $eight.97 mark for a few days. A damage above this level is prone to propel the cryptocurrency bigger closer to $10 and then to $12.

EOS

Very quick-time period merchants can initiate an extended function in the EOS/USD pair at $9 and preserve an SL of $7.5. Still, it is a very dicy exchange; merchants should use best 50 percentage of their traditional allocation.