Important Cryptocurrency Custody Solutions for Consumers and Institutions

Self-custody is an essential (and essentially local) feature of cryptocurrency. A blockchain-primarily based digital asset can be stored by way of its proprietor with out the help of traditional economic intermediaries, inclusive of banks, registered brokers/sellers or certified custodians. But just because you could keep all your cash yourself, should you?

The solution relies upon on many elements, as an example, the variety of currencies, the frequency of transfer and the complexities and risks of self-custody which commensurate with the dimensions of price range being saved. Moreover, your custody solution will vary relying on whether or not you are a normal patron, a high internet well worth individual, an asset manager, a organisation, or a lately minted ICO challenge with cryptocurrency for your treasury.

While maximum customers will regularly decide on the self-custody choice, a few will likely preserve their deposits in hosted alternate money owed. ICO recipients will probably depend upon self-custody strategies, similarly to faraway bloodless storage if the amounts are big sufficient and the team has long time keep requirements.

Cryptocurrency custody is more difficult to implement for funding managers. Due to the regulatory nature in their operations, price range require stringent custody strategies that address risks along with security of the virtual assets, counterparty chance and operational efficiency that observe requirements in their regulator. Typically, these price range work with certified (or licensed) custodians with audited manage strategies who exist to defend those assets and minimise the hazard in their theft or loss, whether or not these are belongings in bodily or electronic bureaucracy.

From a era attitude, blockchain technology ought to rework the function of the qualified custodian at many levels:

● High stages of security can be achieved via sturdy encryption (which is at the bottom of blockchain era).

● Verification of price range can be granted to white-indexed originators (e.G. Auditors) through far off get entry to of blockchain addresses that reveal transaction history thru multiple levels of personal keys get right of entry to privileges.

● The evidence of life and manipulate element of a fund audit can be carried out speedy and almost in real-time, because the integrity of every transaction is effortlessly verifiable thru the report immutability function of the blockchain. “Proof of existence and manage of budget” at the blockchain has the promise of being a completely efficient system.

● Digital assets can be speedy transferred to a dealer, alternate, supplier, financial institution, or directly right into a purchaser-aspect relay for on-chain transaction processing.

● Specific compliance regulations may be embedded in clever contracts or via cryptographically cozy multi-signature guidelines, and they can be automatically enacted upon.

However traditional compliance law has no longer yet caught up to the above noted blockchain advances because those new blockchain homes have no longer been included into new compliance policies that would gain from the usage of them. For those identical reasons, finances are developing their personal custody strategies and techniques by way of combining new tech with conventional compliance strategies.

In a really perfect global, everybody could practice self-custodianship whilst supplying auditors and regulators the required transparency, protection and proofs. But the truth is special: at the same time as generation “can” do that, in basic terms cryptographic institutional practices aren't here yet.

For these motives, custody of crypto property offers a high barrier to entry into the crypto marketplace for institutional gamers. While self-custody is the favored method for people, institutional money desires institutional degree custody, but it’s not yet clean what the satisfactory answer is. As new gamers (hedge budget, VCs, trade-traded budget, mutual price range, asset managers) are getting into the marketplace, many are searching out 0.33 birthday celebration custodians as opposed to choosing self-custody.

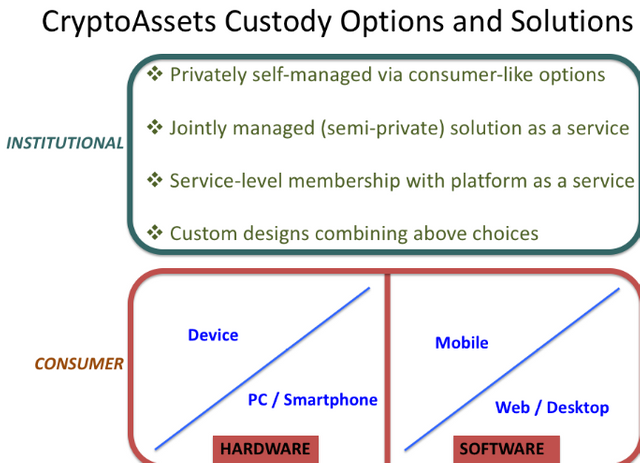

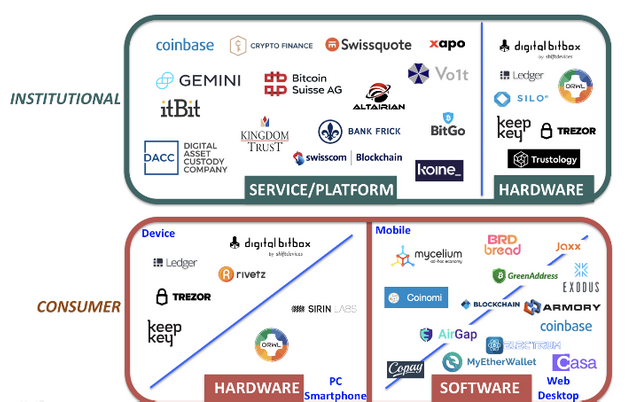

The purchaser aspect of the marketplace may be divided into hardware or software program-based totally solutions, every with their respective sub-segmentation: unique device vs. PC / smartphone, or cell vs. Web / computer. The institutional facet cannot be as effortlessly dissected into truly demarcated barriers due to the fact the lines of capability are overlapping among them. That stated, we've determined the subsequent segmentation characteristics to be useful:

● Privately managed technique, via patron-like alternatives. Nothing prevents an organization from adopting the identical techniques as clients, if they are satisfied with them.

● Jointly managed solution as a carrier, wherein the set-up and activation are semi-private, requiring co-ordination and approvals to be co-controlled in line with a fixed of regulations and techniques that govern the purchaser-company courting.

● Service-stage method equivalent to membership into a platform as a carrier, wherein the company handles all necessities and the patron instructs them to conduct numerous movements.

● Custom layout of a proprietary answer that could include a aggregate of the above picks.

The third-birthday party custody marketplace is surprisingly new and evolving speedy. The marketplace is not short of options, however a few homework is needed for each case in an effort to discern out what works and what doesn’t. Third-birthday party custodians trying to provide custody for institutions are still in the technique of developing their services and products, whilst institutions in search of third birthday celebration custodians are nonetheless figuring out what capabilities they need, and a way to evaluate the benefits and drawbacks of those answers, when in comparison to self-custody.

Most 0.33-birthday celebration custodians provide slight variations of a comparable carrier as they approach the same problem from one-of-a-kind angles. What this indicates is that we are now in an environment where a few groups have regulatory status and others don’t, some companies offer greater cryptocurrency choices than others, some provide fiat assist, a few have a prime brokerage carrier at the same time as others in simple terms attention on custody. This is all to mention that there's no apparent move-to institutional version yet.

Custody has been a popular subject matter right here at JM3 Capital. The market continues to be developing and there isn’t one silver-bullet answer, so we consider a mix of custody answers is the great choice. As a end result, our direction of motion has been to thoroughly look into as many options as feasible.

This method gave us an excellent knowledge of the custody marketplace, and we wanted to percentage our findings with the community. When getting to know 0.33-celebration custodians, we considered key functions inclusive of:

● Jurisdiction — Politically solid jurisdiction with a protracted records of recognising the rights of ownership

● Size of the organisation i.E. Wide variety of personnel, customers and property under custody

● Experience of the group operating the custody solution

● Regulatory status and Compliance– are they regulated? Relationship with regulators?

● Customer Support — Easily accessible? 24/7?

● Level of safety — e.G. 2FA/Multi-sig. Operational technique? Storage of belongings?

● Disaster recovery situations

● Private key possession/exclusivity

● Cryptocurrencies/tokens provided

● Fiat aid

● Minimum quantities required for custody/transactions

● Pooling or segregation of virtual assets

● Configurability of manner and custom workflows for transfers

● Assessment of onboarding, setup, safekeeping, restoration and protection strategies

● Costs inclusive of: setup costs, custody prices (as a % of AUC), transaction fees

● Liquidity: how long does it take to get get admission to on your price range and/or make a transaction?

● Prime brokerage offerings provided

As nicely as completing a due diligence questionnaire covering all of the applicable areas, the work of our operations team includes assembly with the custodians, reviewing manipulate reviews, following up with regard calls and constantly monitoring the monetary fitness of selected custodians. The studies made clean that what one custodian may have any other is missing, and there may be a popular tradeoff between security and operational performance.

Third-party custody is an area so one can keep changing and evolving, and the spreadsheet will remain up to date as JM3 Capital works and grows with the market. We may not have visible the entirety yet, but we see this as a useful useful resource that the network can make a contribution to.

Looking ahead, we will expect to see an increase of subsequent technology custody solutions so that it will be added in late 2018 and for the duration of 2019 (we know of a few that are in stealth mode).

Let me know your thoughts, and please sense unfastened to make contributions