Technology Adoption Phases – Cryptocurrency Bell Curve explains Current Crypto Mania

We are seeing a frantic and manic period in the cryptocurrency space. Many people are promoting themselves as crypto experts and investor gurus. While many others are capitalizing on this rush of excitements and media frenzy to make a fast buck. There are ICO’s – Initial Coin Offerings – that are largely a pump and dump scheme. Added to this there are the countless scams running online to trap the poor informed masses in spending money – I came across 37 scams thus far in my research for this article.

Thank you Facebook for banning crypto ads. We hope Youtube would do the same!

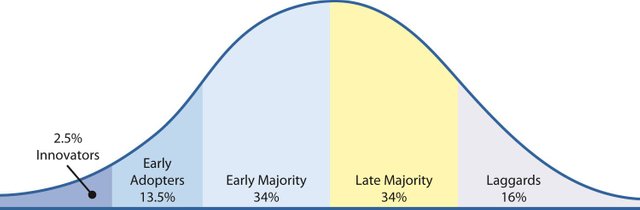

Technology adoption curve

The first part of this curve is the innovator. These as you would rightly assume are the founders of Bitcoin and the Blockchain including the guys at Ethereum as well as Steemit. There are many more but I am shortlisting. We are close to an ‘exit’ of innovation and moving quickly to early adoption. This why there is so much mania floating around and on deeper reflection you will note that most people don’t fully understand that much of Blockchain tech and cryptocurrencies. This is normal behaviour and we see it reflected in the crypto price corrections.Bitcoin is not a bubble but a correction based on mania and speculation hype.

FOMO is a major role player here and because of this we see stories of people loosing a lot of money because they take all their legacy investments and pump it into Bitcoin. When the market corrects they loose millions but when FUD [Fear-Uncertainty-Doubt] sets in they panic sell in the dip. All this can be avoided by enough research but in my experience gaining the required information is hard and takes time. Therefore in retrospect FOMO is the catalyst and difficulty in acquiring solid information from reliable sources lead many astray to ruin. This further adds to the market correction.

FOMO – Fear of missing out

FUD – Fear, Uncertainty, Doubt

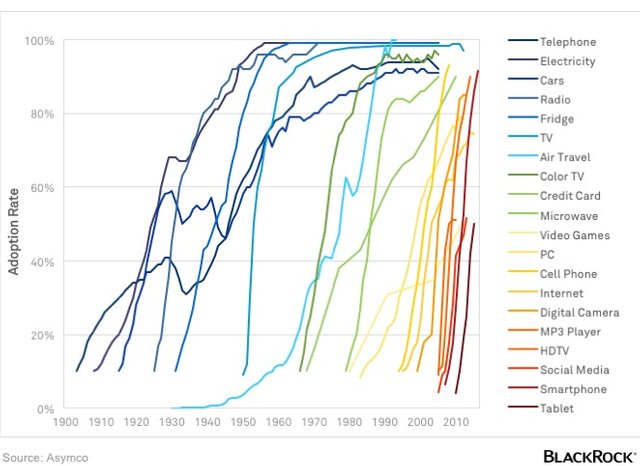

Early Majority will be happening in about 4 years. Normally with technology adoption as seen historically with tech like the internet and cell phones these took upwards of 5 years however we are seeing adoption rates speeding up. It is likely that early majority may even take only 3 years. Various factors will impact this such as information, media and government interventions. If we have a look at this graph it gives us some historical insight into what may happen and the speed it is happening at.

You can see the adoption rates from as far back as the introduction of the Telephone and Electricity. As we become more savvy and knowledgeable we become more welcoming of technology changes. We dont feel so scared anymore but as a caveat to this, we see cryptocurrency almost representing fear of internet.

We move onto the late majority. This phase is normally categorized by the elderly and those that push back against the change. I am noting being discriminatory toward the elderly but it has been studied and verified. Please read here for more information on the study. There will be many that pushback and finally have to adopt the technology as their circles of influence are using it regularly.

In the case of Cryptocurrencies at this stage we should find a mainstream buying and transaction means taking place as part of ordinary life. Government would have eased off and instituted controls and other measures to make the rest of the world comfortable. There may also be a reliable bear growth steadily climbing at this stage.

The laggards are the few that will have no choice as new technology is thrust upon them. They cannot hide or reject it any longer without negative impact to their lifestyles. They are normally the few that are terrified of change until it is forced upon them.

In closing if we reflect a bit closer we will see different market growth rates at different stages of the cyrptocurrency adoption rate. Right now there is bull growth and bull claw back but this shouldn't stop until about 2020. We are in for a highly volatile few years and possibly a few more corrections especially with Bitcoin and the various 'amendments' taking place to the blockchain such as the lightning network. Read more on Lightning Network.

This information makes a strong case for HODL which means to hold onto cryptocurrencies and not sell them. The choice is up to. I hope this sheds light on what going in the market now and what to expect.

Coins mentioned in post: