Wash Trading Exchanges Harming The Industry - Bibox Another Culprit

In recent months we have seen an increase in the number of reports highlighting the practice of wash trading on various cryptocurrency exchanges. One report in particular from Bitwise Asset Management (a cryptocurrency investment fund seeking to launch a Bitcoin ETF) has been eye-opening as it states that 95% of the trading volume on exchanges is in fact fake. Only a handful of exchanges seemingly do not engage in this practice.

For checking daily trading volume most people in the industry head to CoinMarketCap. It’s the most visited website in the crypto industry with almost 80M monthly visits according to data from SimilarWeb.

Previously our investigative team has dived deep into the Bitforex exchange in order to find examples of wash trading and why traders and projects hoping to list there should be wary. Now we’ll take a look at the same for the Bibox exchange, another exchange which actively engages in wash trading. We will highlight the discrepancies between their reported trading volume and traffic as well as some information we think refers to the people behind the exchange. However as the Bibox exchange lacks full transparency, even this information is up for debate.

Traffic

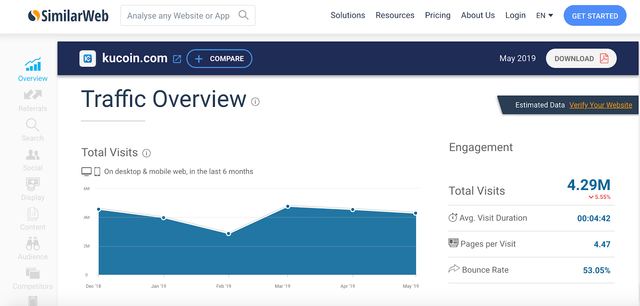

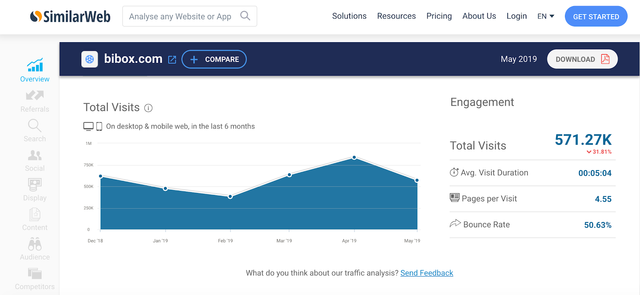

The first step to discovering whether or not an exchange is performing wash trading to fake its volume is to see the reported monthly traffic. Just how many people are actually visiting the exchange and actively trading. Low traffic numbers with high daily trading volumes indicate that an exchange is using wash trading techniques to inflate their trading volumes. One of the more reputable exchanges in the cryptocurrency industry is Kucoin. Kucoin for the month of May 2019 received around 4.29M visits to its website. Bibox however only receive 571k visits for the month of May 2019. This would seemingly indicate that the Bibox exchange should have a far lower daily trading volume than found on the Kucoin exchange.

Daily Volume

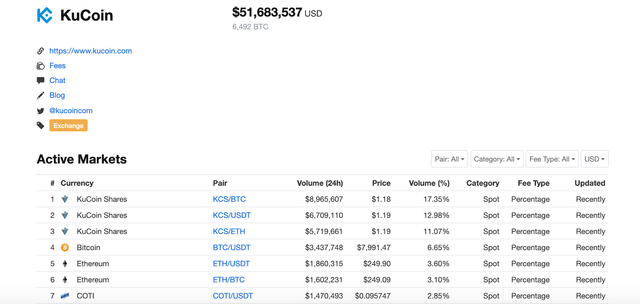

Once we begin to analyze the daily trading volumes for both exchanges it’s clear that the Bibox data is being vastly overstated. On June 7th 2019 at 2pm UTC the daily trading volume for Kucoin was around $51.7M USD. Considering their monthly traffic numbers this would indicate that the average user is trading about $361 per day. This is a reasonable number and shows exactly why Kucoin is generally seen as a reputable exchange in the industry.

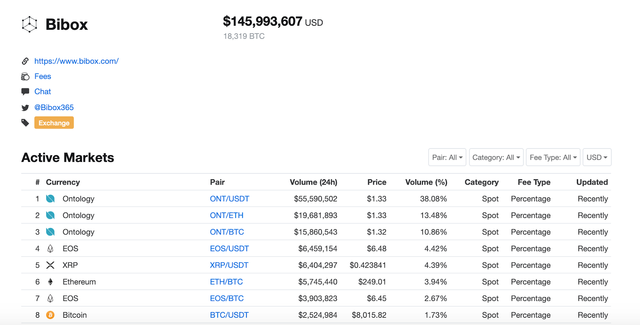

On the other hand, at the same time (June 7th 2019 at 2pm UTC) the daily trading volume for Bibox was almost 3 times that of Kucoin at around $146M. When we take a look at the monthly traffic levels this would indicate that users are trading on average of $7,667 per day! Numbers like these indicate that most of the volume is being artificially inflated by the exchange themselves in order to make Bibox seem more appealing to crypto traders and blockchain projects hoping to list on an exchange.

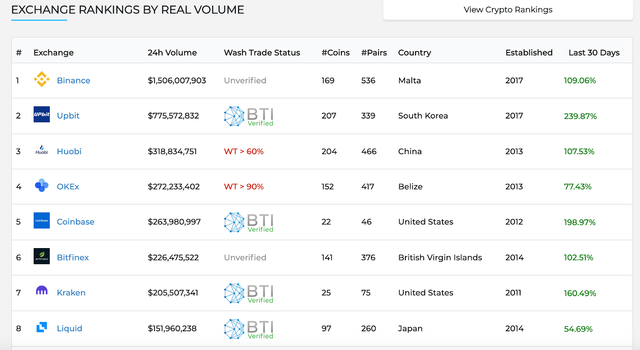

Blockchain Transparency Institute Data

Similar to Bitwise, the Blockchain Transparency Institute (BTI) has provided data in the past which highlights that a large percentage of the trading volume data of exchanges is faked. Their website now provides a look at some of this data and has a wash trade status ranking. As expected, Bibox has been shown to do wash trading on their exchange with a score of >90%.

Bibox Team & Legal Entities

According to their ‘About’ section, “since its launch in mid-November 2017, Bibox.com has been widely praised by experts and users for its fair, transparent, safe and stable features. Currently, they have built operating centers in the U.S., Canada, Singapore, South Korea, Japan, Switzerland, Estonia, and more countries and regions to better serve its users.”

While they state that users have praised the transparency of the exchange, there is no information on the website indicating the legal entity of the company. For a user seeking to find the details about the exchange and verify they are who they say they are, it is extremely difficult. Even in their support groups on Telegram and WeChat they do not provide this information.

However, our investigative team was able to locate some information we believe represents the legal entity of Bibox, which is registered in Estonia despite being a predominately Chinese exchange.

General Information

Company name: BIBOX TECHNOLOGY OÜ

Company type: Private limited company

Reg no: 14389881

Registration date: 13.12.2017

Registered capital: 2 500 EUR

Status: Active

Contact data

Address: Peterburi tee 53-101, 11415, Tallinn, Harju maakond, Eesti Vabariik

Responsible persons

Name: Lettica Oü

ID-code: 12281725

Role: A person competent to receive procedural documents

From: 13.12.2017

Name: Zesheng Chen

ID-code: 37702220128

Role: Management board member

From: 13.12.2017

E-mail address: [email protected]

This information can be verified by data found in the Estonian Company Registry here.

Aries Wang - Bibox Founder & CEO

Bibox is currently run by Founder & CEO Aries Wang. Telegram Username: arieswang. However, his name does not appear on the registered documents for the legal entity of the company. Considering this, Bibox’s claims of transparency should be taken with a grain of salt. In addition, there are reports that some blockchain projects who have dealt with Mr. Wang in the past had issues, including Bibox changing their policies without explanation and providing misinformation in order to extract funds from unsuspecting ICO projects.

In addition, Bibox has been conducting operations in New York. It is highly unlikely they will be able to conduct exchange operations there given their wash trading practices, however, it does provide another member of their team who can possibly answer questions about these wash trading practices. The person of contact for their project in New York is Roger Meng, New York City New York United States. email: [email protected]; [email protected]

Conclusion

The Bibox exchange has been using wash trading techniques for a long time to lure unsuspecting traders and blockchain projects to their exchange. Their claims of transparency appear to be false as indicated by the inflated trading volume, research by reputable authorities and the issues in locating their legal entities. Wash trading exchanges continue to be a stain on the cryptocurrency industry and culprits like Bibox need to be avoided by traders and blockchain projects alike.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://ledu.education-ecosystem.com/blog/wash-trading-exchanges-harming-the-industry-bibox/