Steem's monthly close price bounces back in April after deep lows in March

Apparently I forgot to post the monthly update after March came to a close. Chalk it up to my deep depression over the fact that March's monthly close was the lowest since December of 2019😉. (Not really. I actually just noticed that last night.)

In my March post - after the February close, I mentioned my opinion that Steem has decoupled from the BTC halving cycle. At this point, I'm also starting to think that BTC has decoupled from the BTC halving cycle. Time will tell.

Before we get to the numbers, let's review a couple of factors about the current market conditions in the Steem ecosystem.

A couple side-notes

There are a couple things that make market conditions a little bit different right now than what we've seen in recent years. First, the SPS is paying out to multiple proposals, which is introducing liquid SBDs into the ecosystem (Technically, I think it could be argued that from the exchanges' perspective, SBDs in the SPS are not liquid, and shouldn't be included in the circulating supply or the market cap (this might also be true of SP(?).) Second, after the February SBD delisting on upbit, SBD prices have returned to more natural levels

SPS

From 2020 until last year, there was basically no activity from the SPS. Last year, one proposal was approved, and in recent months a total of 5 proposals have been activated. This is adding about 700 liquid SBDs to the ecosystem per day. It's also adding 300 - let's call them "semi-liquid" SBDs per day to a "DAO reserve fund" that is targeted for disbursement under these rules:

- The multisig wallet of DAO Reserve must need at least 6 out of 10 signatures of top 10 vote share-holders to move funds.

- A steemit proposal must exceed the New Return Proposal to be considered valid.

- The daily fund requirement cannot be too high. The daily maximum limit is 100 SBD.

- No funds in the "DAO Reserve Fund" are transferable to any other account under any circumstances, except to "Proposal Funding".

Obviously, these are not huge numbers, but it's a difference that's worth noticing.

SBD prices

As SBD conversions have continued throughout March and April, the SBD supply and haircut threshold have continued their downward trends for the last two months. (But I don't have any charts for those)

At this moment, the median of the witness price feeds is $0.151, and the haircut threshold is $0.168288. Based on those numbers, we'd expect the SBD conversion price to be $0.897271. The external market price is $0.86, so external prices seem to be doing a decent job of staying near the blockchain's conversion price.

Now, on to the visuals

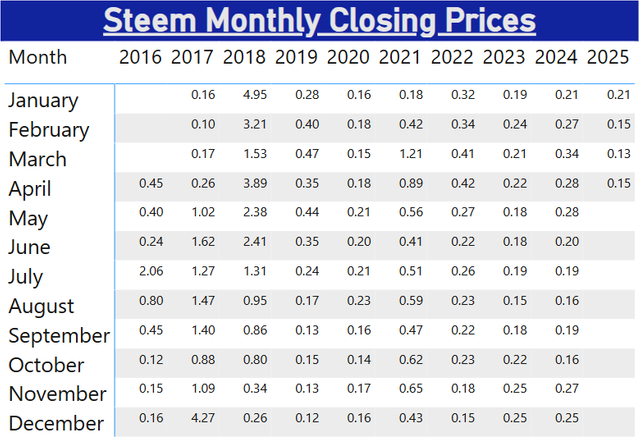

As far as the STEEM price, April was the first monthly increase since November of 2024. With an increase of $.02 or 18.75% to close at $0.150873, April was the 51st month with a monthly increase - out of 109. Overall, prices have gone up (if only a little) during 6 Aprils out of 10.

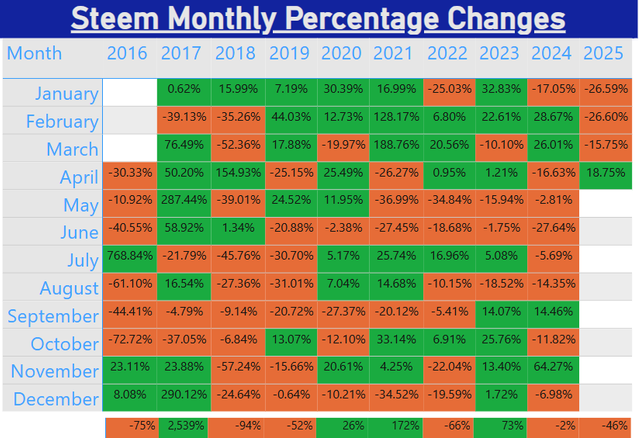

Here are the monthly changes, by percentage:

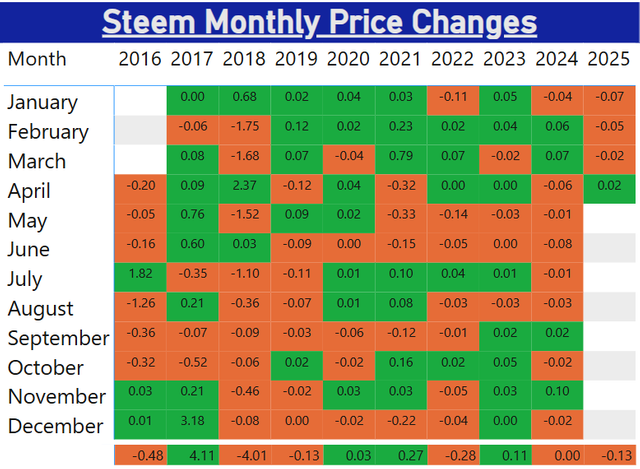

Here are the monthly changes, by value:

And here are the monthly closing prices

Conclusion

As previously mentioned, March's closing price was the lowest since December, 2019, but this month catches us up until February, 2025 (and August, 2023 before that).

This is the last month before we get to test the old cliché, "Sell in May and go away" one more time. Historically, May, June, and August haven't been great months, but July has been fairly strong. This year, January, February, and March all bucked historical trends, though, so the summer months could easily do the same.

What do you think for the next month? At the end of May, will Steem's price close over $0.150873 or under it?