A REVIEW OF THE STABLECOIN LANDSCAPE IN 2018

See here for my airtable, which contains the research I did on each of these coins:

https://airtable.com/shr879JQDl9xotjLj

BACKGROUND:

Bitcoin has proven itself a good store of value in the long term, but not so much a unit of account or medium of exchange. Hopefully this is improving with time and maturity. However; a main issue is that is purchasing power of these cryptocurrencies does not remain stable against goods and services.

Stablecoins are one solution, designed for price stability, and should be able to make payments like fiat currency but retain the desirable characteristics of cryptocurrencies (decentralized, immutable, trustless, secure, and so on). In addition, stability allows individuals to hold cryptocurrency without exposing themselves to losing net worth over time.

Maintaining a value of $1 in fiat, or any other constant value, will allow for the token to be an interface between crypto and fiat, and reduce the cross transactional volume and costs associated with it. We all believe in the future of cryptocurrencies, and their superiority to fiat, however, offering this stability is what the current climate needs with the dominance and widespread usage of fiat. Mainstream adoption will not occur without it.

Choosing a specific asset is tricky. If centralized, you can take on risks associated with that centralization. If it’s a cryptoasset, volatility may remain the problem without actual stable backing.

Stablecoins are also very important for decentralized exchanges which only deal in cryptocurrency, and so have no means for investors/traders to protect against volatility, other than transferring to a fiat exchange.

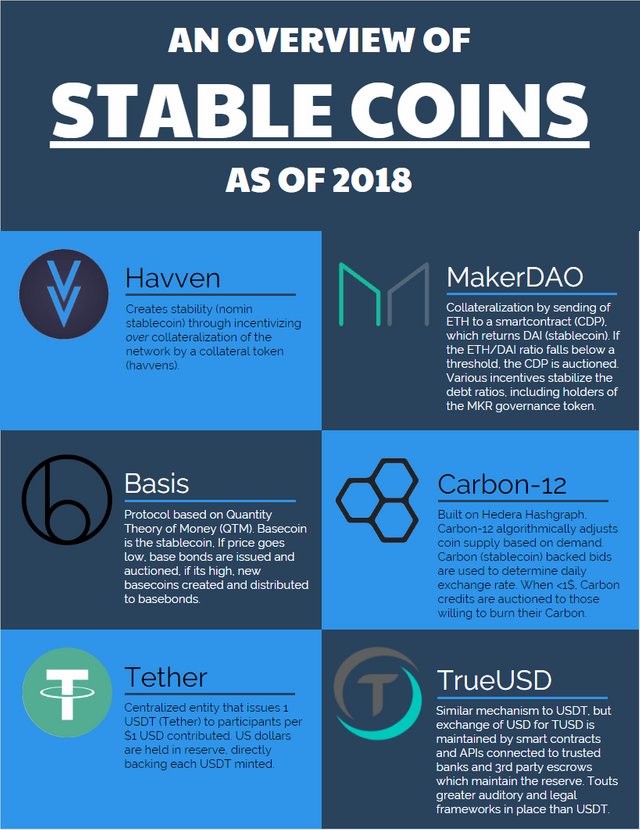

Below are a few of the prominent players in the Stablecoin space (as of 2018):

HAVVEN

What does Havven do?

It is a stablecoin, which uses fees to compensate those who collateralize the network, with fees in proportion to each individuals performance at stabilization. Collateral providers ultimately control the money supply. In this way, Havven rewards those who provide the stability, and charges those who demand it.

How does Havven do this?

It uses two tokens, 'Nomin' and 'Havven'.

Nomin has a modifiable supply, and serves as the medium of exchange, and is measured in fiat currency.

Havven is an ERC-20 and provides the collateral for the system and has a constant supply. This token represents the

value of the Havven platform. Its value is ultimately derived from the fees generated by the network through collateralization.

Ownership of havvens grants the right to issue a value of nomins proportional to the dollar value of havvens placed into escrow. Issuance of nomins requires a greater value of havvens to be escrowed in the system (with a collateral ratio of 1:5), providing confidence that nomins can be redeemed for their face value even if the price of havven falls.

Smart contracts are used in maintaining these equilibrium values. The smart contracts adjust the number of nomins in circulation.

Overall thoughts on Havven:

It distinguishes itself from others by being decentralized – collateralizes itself within the crypto ecosystem. Proof of solvency is on the blockchain – as opposed to Tether. The team; pretty good. Founder made the largest cryptocurrency exchange in Australia. CTO is director of engineering at MongoDB. They have an alpha model which users can access to test various economic scenarios on the Havven platform. They have released code for platform V1.

How does Havven compare to others? See my summaries below for some idea. Havven has also released its own comparisons of their collateralization scheme to that of MakerDao and Basecoin via their blogs.

TETHER

Tether’s mechanism is simple – ‘IOU’ issuance. When US dollars are deposited into Tether’s bank account, it creates the corresponding Tether tokens (USDT) in a 1 to 1 ratio. When Tether is sold, $1 is returned for each Tether. Tether can he held on and is supported by a number of exchanges, Bitfinex the most prominent.

Tether is centralized, the entire system relies on the honesty of Tether, the company. It is incorporated in Hong Kong. Perhaps a conflict of interest, Tether and bitfinex are run by the same management team. They have been surrounded with controversy, stemming from their lack of transparency and monetary policy. Friedman LLP, the independent organization hired to audit Tether, terminated their relationship with the project. They have still not disclosed a full independent audit for some time, so nobody really knows if the USDT are truly backed.

TRUEUSD

TrueUSD is the same centralized idea as Tether, but with a few extra safeguards It uses a smart contract that conducts the exchange of TUSD through APIs with trusted companies (escrows) and registered banks. The fiat reserve is not all held in one place, and TrustToken platform does not have access to any of the reserve.

The system does have fees of $75 or 0.1% (larger of the two), for purchasing and redeeming TrueUSD.

MAKERDAO

MakerDao is a decentralized autonomous organization that provides a decentralized solution to cryptocurrency stability. Their mechanism is Collateralized On-chain, and makes use of two tokens on the Ethereum Blockchain; DAI – a stablecoin, and MKR, a governance token.

How it works is thus: You send ether (ETH) to collateralized debt position (CDP), a smart contract, and are returned DAI. If ether’s value goes up, the system has incentives to encourage creation of more DAI. If ether goes down in value below a threshold, your CDP is auctioned off to cover the balance. If it increases too quickly for collateral to cover the balance, there are two safeguards (1) MKR can be created and sold – collateralized by MKR holders who are incentivized to regulate network parameters, or (2) global settlement of all CDPs.

MakerDAO’s team has been hard at work, and they have been a largely unnoticed project in the stablecoin space, not having any form of ICO. They are one to watch out for.

One criticism is that MakerDAO requires a high level of collateralization, and will require massive amounts of $$ to scale, making it an inefficient asset. Time will tell however, if the adage, “you get what you pay for”, does ring true.

BASIS (BASECOIN)

Basecoin implements an elastic money supply mechanism. It has three ethereum tokens in its model: Basecoin (stablecoin now known as basis), Base bonds, and base shares.

When basecoin price is low, Base Bonds are put up for auction at a discounted price, reducing the supply of Basecoins. Base Bonds promise to repay 1 Basecoin at some point in the future.

When the price is high and basecoin supply needs to increase, the protocol issues new Basecoins to pay back the holders of Base Bonds. If all Base bond holders have been paid but the price is still too high, the protocol distributes Basecoins to

Base share holders under the impression they will sell them in the open market, decreasing price.

Basecoin is compared to the Federal Reserve, and is theoretically based on the Quantity Theory of Money (QTM): the general price level of goods & services is directly proportional to money supply – this theory is considered controversial.

The source of stability in this system is the public bond buyers. However; at the outset, without enough users there will be inherent volatility in the system (see the irony here..). This is partly why basecoin is doing an ICO, to artificially buy basebonds and support its peg.

CARBON-12

Carbon-12 is a similar mechanism to basecoin, insofar as it implements an elastic money supply. However; Carbon-12 algorithmically adjusts coin supply based on demand, to maintain its correlation with the USD. The Carbon stabelcoin is pegged to $1, while Carbon credits are algorithmically adjusted supply to absorb changes in demand.

For example, when the stablecoin's value falls below $1, an auction is held, and users willing to give up their stablecoins (thereby reducing the supply and driving up the price) receive carbon credits in exchange.

Interestingly, Carbon-12 is using the Hedera Hashgraph, stating greater security, and unprecedented speed, and fractional cost compared to a Blockchain. They also cite direct inspiration from Seigniorage Shares, a stablecoin model proposed by Robert Sams in 2014 but never launched.

I was unable to determine if Carbon-12 is having an ICO, however, they have raised $2 million in seed funding to date.

BITSHARES

BitShares is an overcollateralized-on-chain mechanism, very similar to MakerDAO. It is built on the Bitshares platform and uses 2 different coins. One is BitShares and the other is the stablecoin, called BitUSD. Their system implements CFDs, contract-for-differences, where some users short BitShares and some users long BitShares. The speculators that make these trades for example, can make a short trade on margin by putting up $2 of bitshares as collateral to create $1 of BitUSD. They can then purchase $1 of BitUSD for $1 of bitshares, meaning 300 bitshares total of collateral. If the price of bitshares goes down, the collateral is converted to BitUSD to cover, it it goes up, and the gain can be realized by buying more BitUSD with collateral, destroying it to get more bitshares back.

There are also other pegged assets on the BitShares platform, including BitGold and BitCNY.

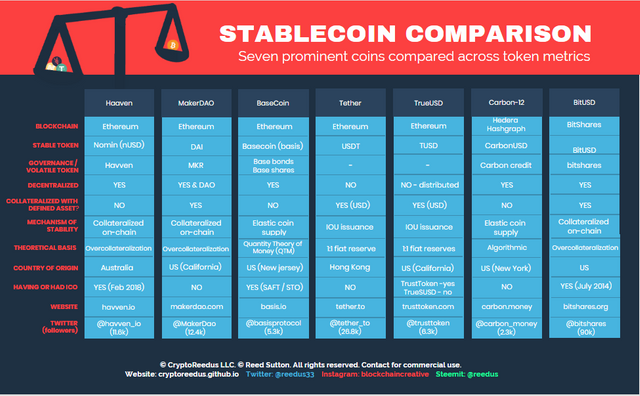

Here is a final summary of everything discussed in a comparison table:

Congratulations @reedus! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!