Crypto hedge fund creation has exploded in the last couple months, but it's only the beginning

Hedge Funds are entering the crypto space at a rate of 2 new funds per week on average.

Where there was once only a handful of Hedge Funds now numbers into the triple digits in less than a year's time frame.

In fact, according to Autonomous NEXT there are now 110 Cryptocurrency focused Hedge Funds in existence.

With 84 of them being launched this year alone.

(Autonomous NEXT is a financial technology research house)

The total assets under management totals around $2.2 Billion for the entire crypto Hedge Fund space currently.

$2.2 Billion is not a lot of money in the grand scheme of things, but institutional money entering the space is still in its infancy.

Most of the current cryptocurrency funds are small and have limited track records. That combined with the volatility of cryptocurrencies has kept the really big money on the sidelines to this point.

What do I mean by "big money"?

Think pension funds, mutual funds, insurance companies and major endowment money. All of which still haven't really started to dip their toes in yet

But what if they do?

Well, with the above listed funds and pools, we are talking about trillions of investment dollars, and that is trillion with a "T".

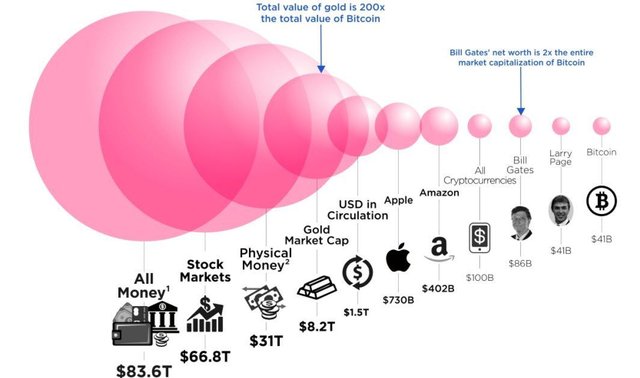

(This chart is a bit old and Bitcoin is now valued around $100 Billion, so it moves up the chart a few spaces, but this still helps illustrate the amount of money that is out there)

The entire crypto space is valued around $170 Billion currently and while that may sound like a lot of money it really is just a drop in the bucket comparatively speaking.

The gold market, the precious metals markets, and the currency markets dwarf that number significantly.

Then when you factor in the kind of money we are talking about in the funds that have yet to enter the space, we could see a moon shot in prices yet again.

Something akin to what we saw in the Spring of this year, you know were we saw prices go up by 10x in a lot of altcoins, but this would actually probably dwarf that as well.

Think about it, even if just 1% starts looking for an allocation in cryptocurrency, these things are going through the roof.

How likely is this to happen?

That is the big question.

Right now not a lot of that big money is very interested in Bitcoin or cryptocurrency, but that doesn't mean that won't change at some point.

The funny thing about these big funds/pools is that they often follow the herd in terms of where they put their money, so it won't really be about convincing all of them to invest in Bitcoin and cryptocurrency, it will be about convincing one of them and then heard mentality will take over.

Once one of these guys takes the plunge and starts getting all kinds of press for their forward thinking mindset and for realizing outsized returns, others are going to be chomping at the bit to follow suit.

Again, we are talking about 1% allocations here, imagine if that were to go to 3%, or 5%... think of what that might mean for prices?

In summation:

It's great that all these funds are entering the space, but really this is still in its infancy.

The total amount under management of $2.2 Billion is not a lot of money comparatively speaking.

Once this ball starts rolling (if it's not already), it's only going to snowball and feed off itself.

At just a 1% allocation by many of these major funds or investment pools and cryptocurrency is going through the roof, again.

It’s only a matter of time before this happens. I hope I have a few coins on gold when it does.

Yeah I agree