Common Complaints Crypto Day Traders Make & The Mistakes Behind Them

If you follow my blog, you'll know that I day trade and swing trade cryptocurrencies. I've been keeping track of my progress through weekly blog posts here on Steemit. The last couple of weeks have been very slow as the environment hasn't been very safe for day trading, and I have mostly been sitting on the sidelines, but I've been seeing people taking risks that they really shouldn't be taking.

This week I decided to write a post on the common complaints I see on Twitter and elsewhere from people who attempt day trading, and what these complaints reveal about their trading habits. I've caught myself saying or thinking a couple of these sometimes but try to learn from my mistakes moving forward.

DISCLAIMER: This is not financial advice, and I am not a professional trader. I am learning along the way and am sharing my experiences. Also, I'm not going to get into technical analysis such as reading candles, Bollinger Bands, RSI, or anything else. For this article, I'm going to stick to basic indicators.

Without further ado, here's the list!

(1) Whenever I sell, the price goes up.

I hear this one a lot. Most of the time, this could be a case of only remembering the times you've been burned by a so called "bad trade", but dig a bit deeper and you'll find a couple of reasons why this might be happening.

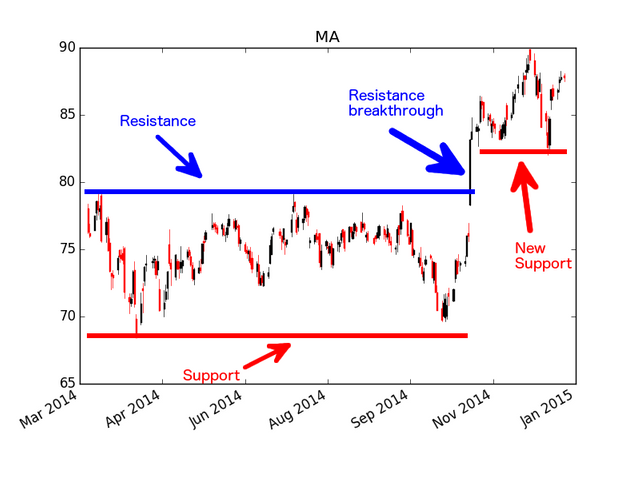

(a) Firstly, those who got into crypto trading during all time highs late last year (which is a lot of people) experienced rapid gains over a short period of time. Then during periods of correction people get impatient, expecting the price to keep rising. As the price continues to fall they eventually get fed up and sell, not wanting to take any more losses, without analyzing longer term patterns to see if the price is approaching a support level which often causes a reversal, or bounce. Then, when the price does bounce, they cry foul that this always happens when they sell.

(b) The second point ties into the first. New day and swing traders sometimes get emotionally attached to their investments and as prices drive upwards, they get greedy, only watching the rise and not paying attention to the signs that it might be time to exit the trade in preparation for a correction. Then, when the price reverses, instead of recognizing that a resistance level has been reached and exiting the trade, they continue to watch thinking that things will turn around again and continue going up for them.

The price continues to drop until it hits their original buy-in zone and they make the mistake of assuming that since they got in at this point, it will surely bounce back for them. Unless the buy-in was at a strong support level, this is not a safe assumption to make. The price drops further, the trader panics and sells at a loss, often times watching the price shoot back up a short time later and leading to the claim that prices always go up after they sell.

So what can you do to make sure you don't get caught in this cycle without having to rely on heavy technical analysis, which is over most people's heads?

(a) First thing is to always try to time your buy-ins at critical levels of support. That is, only buy at price points where you see repeated bounces. This is not a guarantee that the price will hold, however, so you will want to watch for good indicators such as strong volume, where there are a lot of buys happening. Positive volume is king, and will generally show that things are reversing.

(b) Secondly, do not FOMO buy. Buying based on a fear of missing out is the worst thing you can do, because you are buying purely on impulse and are potentially ignoring any signs that it may be too late to enter. Look at the bigger picture to make sure that the price isn't quickly heading to a critical level of resistance. Make sure the price spike you are seeing isn't extremely artificial, as it will likely come down just as fast, especially if it is a coordinated pump and dump.

(c) Thirdly, don't get emotionally invested in a currency if you are day or swing trading! If you cannot break yourself away from a trade at a logical short term point, you are better off finding a good, strong cryptocurrency to hold for the long term.

An example of support and resistance zones. Learning to recognize

them will increase your chances of success.

(2) I woke up in the morning to a huge loss.

This one is heartbreaking, because it can be so easily avoided. It often ties into the first mistake, as people tend to buy in at the wrong time and are setting themselves up for a loss anyway, but when that loss is monumental and you lose 20% or more of your investment literally overnight, it can be a shock. So, how do you avoid this?

(a) Measure your risk. This is extremely important. Before you enter a trade, make sure you understand what you might lose. This can be done by taking the steps in the (1) and ensuring you are entering at a good time. As I said before, even if you do enter at a good time, there is no guarantee that you will not take a loss.

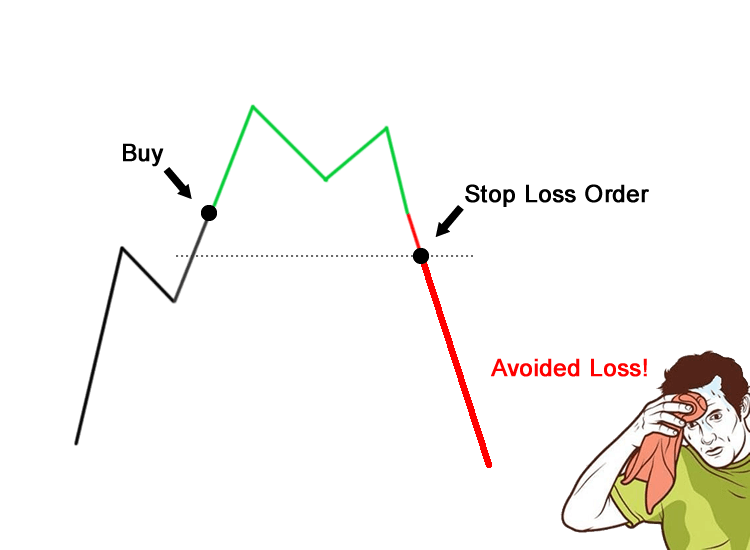

(b) Six words - "stop loss, stop loss, stop loss". Do not enter a trade and walk away, especially a risky one, without setting a stop loss. I'm not going to go into what a good percentage to target is in this article as it depends on the cryptocurrency you are investing in and the current market conditions, but a generous stop loss is better than no stop loss at all. By setting one, you are ensuring that you will not get trapped in a situation where the price drops farther than you are comfortable with. Even if the price shoots up again after your stop loss is hit, it's better to have protected yourself. You can make up that percentage loss another time. Remember, there will always be other trades. Better to take a 5-10% loss and get it back later than take a 30%-50% loss, which is extremely hard to recover from in a short amount of time, and is quite frankly demoralizing.

Always better to be safe than sorry!

(3) I got greedy trying to sell at the top and missed out on profits.

Everyone tries to sell at the top, but the truth is, it is very hard to accurately predict the optimal time to sell. Lets say you did everything right. You found a good coin to invest in, you bought in at a good support level, you scouted a resistance level, you set your stop loss at a comfortable point, and you are actively keeping an eye on things. Then, halfway to your ideal selling point, the price starts to reverse, and quickly. You sit staring at the screen, watching as the price drops below your buy-in, hitting your stop loss.

It happens. At the very least, you set your stop loss and learned a valuable lesson. You should practice adjusting your stop loss as the price increases towards your ideal selling point, that way, even if the price reverses on you, you will walk away with something, and can buy back in at a lower point again if you wish to.

Let's say you bought in at $105 with strong volume present, and you know that $100 is a strong support level with $125 being a strong resistance level (these are arbitrary numbers, just for example's sake). You intend to try and sell as close to $125 as you can, and set your stop loss at $95 just in case things go south. You watch as the price increases to $110, then to $115. If you were to sell at this point, you'd have made a profit of almost 10%, which is a very healthy profit, but you're still confident that you can hit $125. This is where you would close your $95 stop loss and set it higher, lets say at $110. If the price reverses to $110, you've just made close to 5% profit, which is still very good for a short term trade. As the price keeps inching up, you should be inching your stop loss up as well. That way you don't get caught off guard on a quick reversal, scrambling to take profits as the price quickly drops.

If however, you take a small profit after updating your stop loss and the price keeps going up after that, don't sweat it, and do not FOMO buy back in at $115 or $120. Take your profits and move on, or wait until the reversal hits the support zone again, reanalyze and decide whether you should re-enter. Chances are you can repeat the pattern and take home another 5% to 10% on the next cycle.

(4) I tried copying so-and-so's trades and got burned.

There are a lot of people online who offer great cryptocurrency advice and resources, and there are also a lot of people who offer terrible advice. Follow the good ones, avoid the bad ones, but whatever you do, do not follow blindly. Everyone says to DYOR (do your own research). You can help yourself a lot more that way. The most important thing to remember is that people who offer advice should be used as a resource only, and their advice should be taken with a grain of salt.

Technical analysis, especially, only paints a picture of what could happen. It is a guide and should be treated as such. Just because someone on Twitter or Steemit is always claiming that they're taking home huge gains every day doesn't mean they aren't losing also and not reporting those losses. Even if they are taking home huge wins every day, you will never be able to replicate them, because for every trade they enter and win, there are likely many trades they entered and posted about that triggered stop losses which weren't reported, or small 1-2% gains from updating stop losses that they also did not report.

So while they take a very small gain on a trade that they posted which you followed, you could be losing 10% or more because you couldn't follow their every unreported move.

(5) The 5 minute chart looked good for a while there.

People often think that since some short term trades can be executed within the span of a few minutes, that means they should be relying on 5 minute charts or smaller to make decisions. This is often a mistake, and very dangerous. At the very least, use the 15 minute chart to make decisions on short term trades. The 1 and 4 hour charts are a much better indication of what could happen. I have often scalped profit 5 minutes after entering a trade, but that doesn't mean I made the decision to enter the trade by looking at the 5 minute chart. Zooming out will give you a better idea of what you're potentially getting into, so make sure you don't use too narrow of a view.

That's it for now! I hope that this was helpful. Remember that if a potential trade leaves you with any doubts, it's better to not enter than to enter. Don't be impatient, don't be hasty, and don't be emotional! Do be smart, do be careful, and do be logical.

If you liked this article, please let me know in the comments or by upvoting, and be sure to follow me for more content like this!