New, proprietary analytics are allowing people to see several moves ahead in the trading game.

There have always been, and still remain, many questions about the nature and role of “inside information” in the world of cryptocurrency trading; questions that belie uncertainty about the market’s validity, legality, and future. As with many new technologies, cryptocurrency investing is a calculated risk, but how does one perform those calculations? Is being a cryptocurrency company, exchange, or originator (i.e. an “insider”) the only way to have a good vantage point from which to observe this risk — and your potential profit — within the space?

I believe the answer is a firm no.

Blockchain data, which contains ledger entries describing transactions between wallets that transfer cryptocurrencies within public blockchains, is revolutionarily transparent by design. This simple fact has a monumental implication: there is a complete and visible lineage of transactions that exists between wallets (“accounts” on a blockchain network are called “wallets”). This lineage allows observers to establish relationships between wallets, track the values of each transaction, identify the order in which interactions are occurring, and classify the types of digital asset being handled.

I know because I am a data science engineer at FRST Corporation, an enterprise-grade blockchain analytics software company. Our team of developers, engineers, and economists utilizes data — from Ethereum, Bitcoin, EOS, Litecoin, and other blockchains — to build tools for professional traders, blockchain researchers, university labs, government agencies, security experts … as well as retail investors looking for below-the-surface insights into activity on the network. The FRST platform’s unique point of differentiation is its ability to provide a deeper level of insight into blockchain transactions by condensing and annotating raw blockchain data into a queryable, actionable format.

The Mission

To illustrate what the FRST platform can do, let’s set some parameters around things we’d like to know but that aren’t directly embedded in the ledger itself. We are looking to:

Find the wallets of ICO Team Members, ICO Founders, and early-stage ICO Investors,

Identify key wallets that could have a meaningful impact on the price of a digital asset,

Locate wallets that have received tokens before an ICO event has begun, and

Create trading signals by tracking when and where said wallets are moving tokens.

But where do we begin?

Our Approach

Action:

We began by isolating all wallets that purchased tokens directly from an ICO origination contract. In order to achieve this, we must first index all Ethereum transactions ever (!) and research all relevant ICO contract addresses and dates. Fortunately, FRST has this readily available in an immediately accessible, “always hot” archive of all blocks. By filtering down to only the wallets that have participated in ICOs, we found a base number of individual wallet addresses with which to work. To give you a sense of scale, we were able to extract 1.5 million unique wallet addresses that participated in more than 500 ICOs. Next, the FRST platform allows us to filter our results further to only wallets that received tokens prior to the public ICO dates. It stands to reason that these are the wallets controlled by founders and the earliest investors — they were given the very first tokens before the public was offered a chance to purchase them.

Result :

By analyzing pre-ICO token transfers, we were able to dramatically decrease the number of addresses from 1.5 million to 270,000 unique addresses. Further, of the 500 ICOs we were initially considering, only 160 moved tokens to wallets before the ICO contract was active.

Conclusion:

Isolating these pre-ICO transactions helped validate our hypothesis. After much exploring and analyzing among the pre-ICO transactions, we successfully found many founders, ICO investors, and early stage investors and identified their wallets. On top of this, we lay our taxonomy of personas, which are classifications of wallets according to the series of events with which a wallet address has been involved. By looking at the wallets that received the most tokens during the pre-ICO period, we were able to tag the wallets that fit our “founder” persona. For example, we see pre-ICO transactions for 0x, Basic Attention Token (BAT), Gnosis, Aragon, and SALT distributing sizable amounts of tokens to various wallets prior to their public token sales. The wallets that received these substantial amounts of tokens before the ICOs’ respective go-live dates must have some sort of connection with the ICO. Once we are satisfied with these research steps, we can begin to convert the information into actionable trading signals based on when these addresses move their tokens and where they move them.

##Sample from our findings: Basic Attention Token

The Basic Attention Token (BAT) ICO held a crowdsale for BAT coins on May 31, 2017, which was fully subscribed for a total of $35 Million in under 30 seconds. Needless to say, this was a highly anticipated ICO — most likely because the founder of BAT, Brendan Eich, is very well known as the original creator of Javascript.

In our analysis, we found 4 transactions involving the BAT Token contract which occurred before the public ICO started. These transactions were:

BAT TX_1 — BAT Amount: 1

BAT TX_2 — BAT Amount: 7,999,999

BAT TX_3 — BAT Amount: 12,000,000

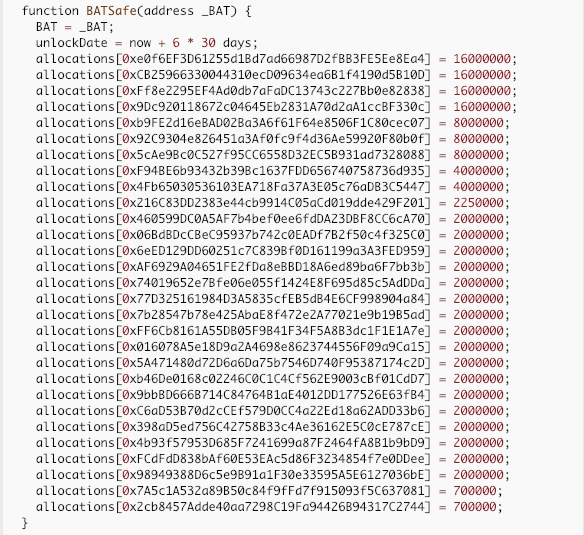

BAT TX_4 — BAT Amount: 113,650,000

Each of these transactions were sent from the original BAT contract (the origin wallet) to the same receiving wallet. The receiving wallet turned out to be the BAT TokenLockup Smart Contract, which was published on BAT’s Github repo and verified on Etherscan. This smart contract is a vesting contract for the founders, team members, and early investors of BAT, meaning it sets the rules for how and when the BAT founders would receive their allocation of BAT tokens over time. By looking at the BAT TokenLockup Contract, we can see the code for this smart contract, which shows exactly who is included in the vesting of the tokens and how many tokens are allocated to each recipient’s wallet. Below is the a list of all the addresses that receive BAT from the TeamLockup Smart Contract.

Following the Founders: 0x9dc920118672c04645eb2831a70d2aa1ccbf330c

Once we have identified a persona (“founder”) for the recipient wallets, the fun begins. Using FRST’s software, users can track these annotated wallets in real time and build trading strategies around them.

By monitoring the list of addresses in the BAT TeamLockup Contract, we can track when and where these addresses are moving their BAT Tokens in near-real-time. More importantly, we can see when one of these addresses moves tokens to an exchange wallet, signaling they are likely preparing to sell their tokens.

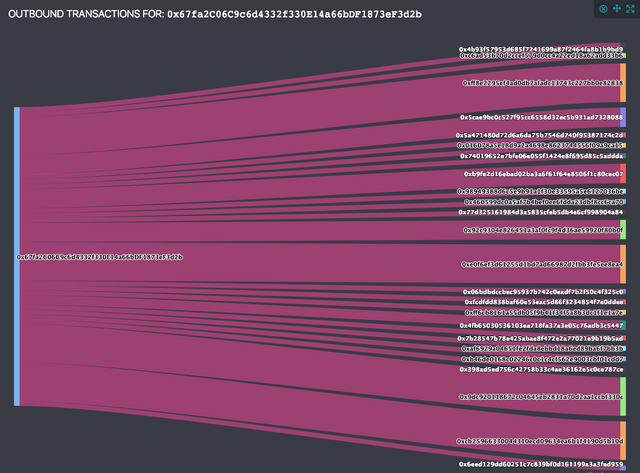

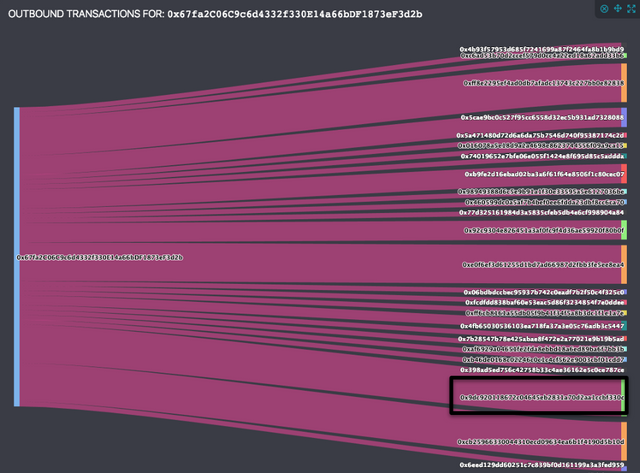

Below are images of how FRST tracks wallet activity in near-real-time. The address on the left (0x67fa2C06C9c6d4332f330E14a66bDF1873eF3d2b) is BAT TokenLockup Contract. The addresses on the right are a compilation of all addresses that have ever received funds from the BAT TokenLockup Contract. The thickness of the line represents the volume of tokens moved.

.

.

Token Distribution from the BAT TokenLockup Contract

We will be tracking the BAT token movement of address 0x9dc920118672c04645eb2831a70d2aa1ccbf330c. The line to this wallet represents the distribution event of 16,000,000 BAT Tokens, or about $2.8M worth of tokens at the time, from the BAT TokenLockup Contract to the founder.

Once we know the BAT tokens are in the founder’s wallet, we can now monitor those address to see if and when the BAT tokens get sent to another wallet. If the wallet owner moves tokens from here to a wallet that is known to be related to an exchange, we can recognize that as a high probability precursor to a liquidation of the BAT tokens on the exchange. This could be a signal that the founder (an individual with inside knowledge) has a reason to believe the BAT tokens are at a good (high) price to sell and an investor might want to mimic his action.

That having been said, insider selling may not be as interesting as insider buying — why? Our CEO, Karl T. Muth, has studied insider trading for over a decade and is an expert on the issue. He explains, in reference to insider behavior in equities markets, “There are lots of reasons that may be invisible to the market for why an insider suddenly sells his company’s stock. Maybe he just wants to diversify, maybe he is getting divorced and needs ammunition for a custody fight, maybe the dealership called and his car is ready for delivery, maybe he has decided to cover a sick parent’s medical expense. Meanwhile, there’s really only one reason for an insider to buy his own stock: he thinks it’ll go up.”

Whether the wallet being observed is buying or selling, the persona of the wallet’s owner matters. A founder of an ICO project will have information and incentives that are materially different from those of an outsider who is merely a large holder or a later (post-ICO) character in the story. That a wallet is controlled by a founder matters in both our initial analysis and in our interpretation of that wallet’s subsequent activities — in short, our hypothesis is that identifying where the tokens are moving is just as important as recognizing that they reside in a wallet belonging to a founder.

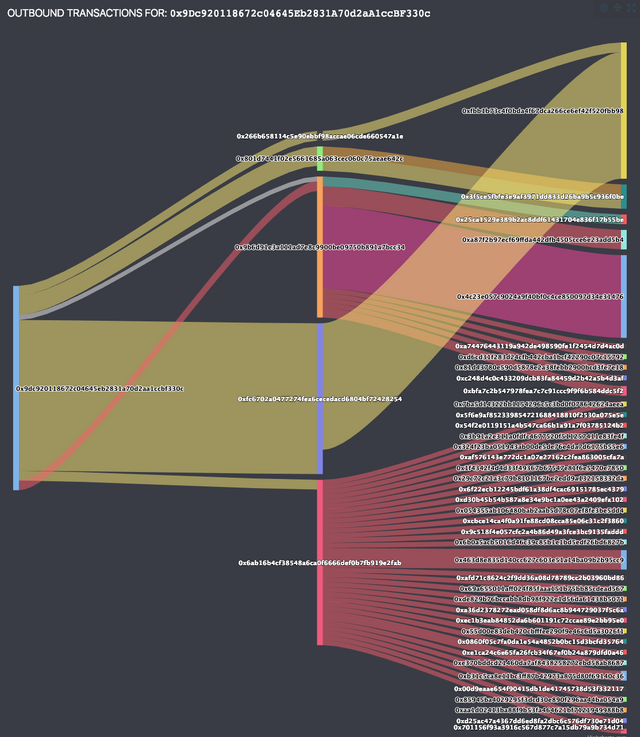

Fortunately, identifying exchange wallets (another type of persona) is even easier than finding founders’ wallets, since most exchanges make some or all of their Ethereum addresses public. The image below shows the outbound transactions of tokens from the previously mentioned founder’s wallet 0x9dc920118672c04645eb2831a70d2aa1ccbf330c.

Over a series of 39 transactions, we see 8,000,000 BAT tokens being sent from the founder wallet to 3 different addresses:

- 0xfC6702a0477274fEA6cecEDACd6804Bf72428254

- 0x6Ab16B4CF38548A6ca0f6666DEf0b7Fb919E2fAb

- 0x801d7441f02e5661685A063CEC060c75aEAe642c

Then, from these three addresses, we observed **7,950,000 tokens&& move to 2 other addresses:

- 0xFBb1b73C4f0BDa4f67dcA266ce6Ef42f520fBB98

- 0x3f5CE5FBFe3E9af3971dD833D26bA9b5C936f0bE

Thanks to FRST’s capabilities, we know that these addresses belong to Bittrex and Binance exchange wallets. In other words, what we are observing here is a BAT founder moving his or her tokens to exchange custodial wallets (an intermediary wallet held at the exchange prior to sale), then moving the BAT tokens into the exchange’s wallets for the actual transaction. This series of movements is a very common pattern for sell events because it represents the standard process for exchange trades. Between 12/01/2017 and 01/01/2018 0x9dc920118672c04645eb2831a70d2aa1ccbf330c moved 7,950,000 BAT tokens to an exchange at a median price of $0.38 per token, a total of roughly $3,000,000.

FRST’s platform allows for the observation of many different types of personas and transactional patterns that our customers can use to develop actionable insights — most of which can be partially- or completely-automated. Our native flexibility also allows users to create customized analytics based on their specific situation and requirements, to subscribe to alerts and notifications that they design, and to integrate our constant surveillance of the blockchain with variables used inside their own systems. Traders, researchers, and security analysts alike can use FRST’s robust taxonomies and toolsets to monitor transaction activity across a multitude of wallet personas, giving them a powerful capability for spotting everything from a competitor’s trading activity to suspect activity by a potential counter-party to wash trading among a cluster of wallets attempting to inflate trading volumes.

Tell Me More about FRST

Gladly! The FRST platform was built with professional traders, data scientists, and blockchain researchers in mind. Our current customers include major digital asset exchanges, hedge funds with dedicated crypto desks, venture capital funds, audit/compliance/KYC functions within institutions, and university and government research efforts in the blockchain space.

If you are interested in getting in touch with us or learning more about our team, please visit frst.com or email [email protected]. We are a friendly group of motivated folks, and we are always looking to add more rock stars to our team and community.

.png)

Congratulations @phatdoyle! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!