Cryptocurrencies Market Overview - March 22, 2018

Today in the news:

- News sources were reporting that Binance was being issued a warning by the Japan Financial Services. This was false information according to the Binance founder, but Bitcoin and most other cryptocurrencies dropped nevertheless on the news.

- A major European fintech investor and Block.one have announced a $100 million fund for EOS projects.

- The U.S. may start publishing crypto wallet addresses along with the names of people and organizations with whom it forbids citizens from doing business.

- The new chief of the People's Bank of China has said that 'Bitcoin provides freedom to anyone that uses it'.

- And more crypto news below...

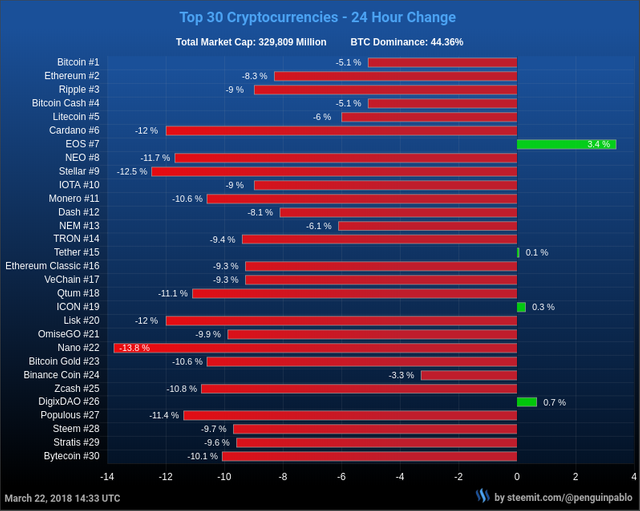

24 Hour Change

Realtime chart on my website CoinMarkets.today

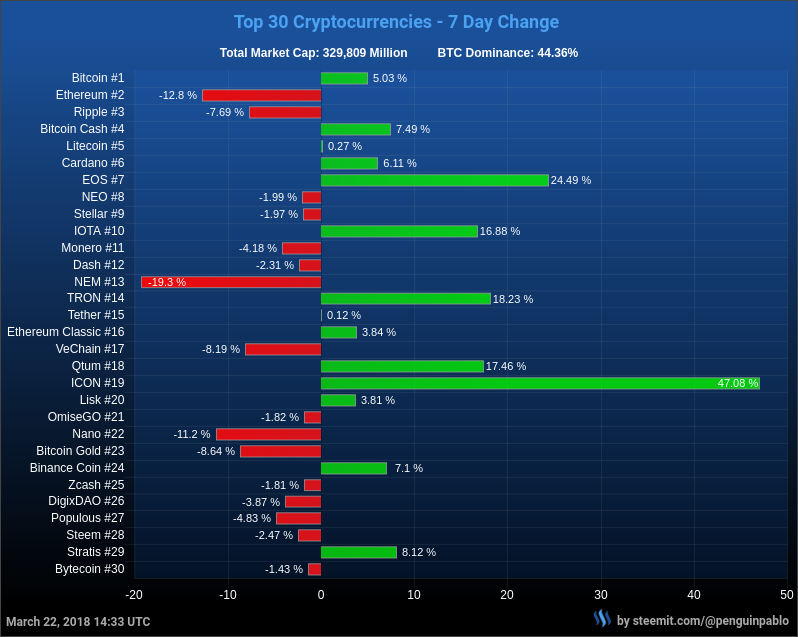

7 Day Change

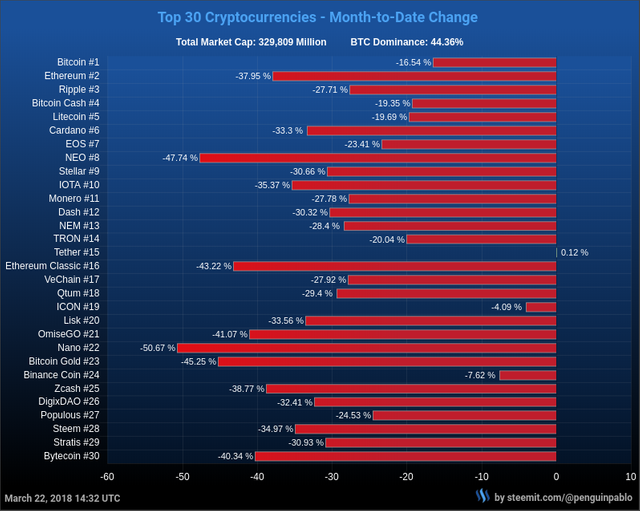

Month-to-Date Change

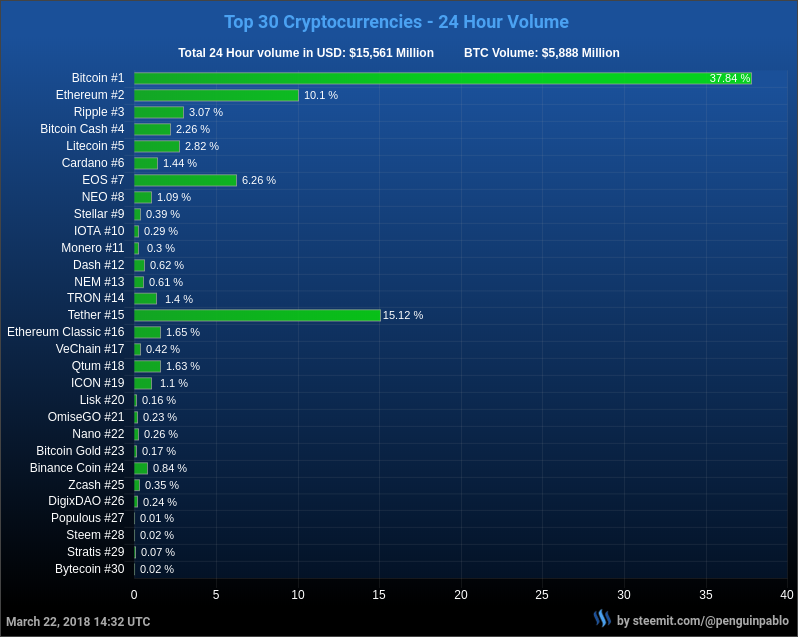

24 Hour Volume

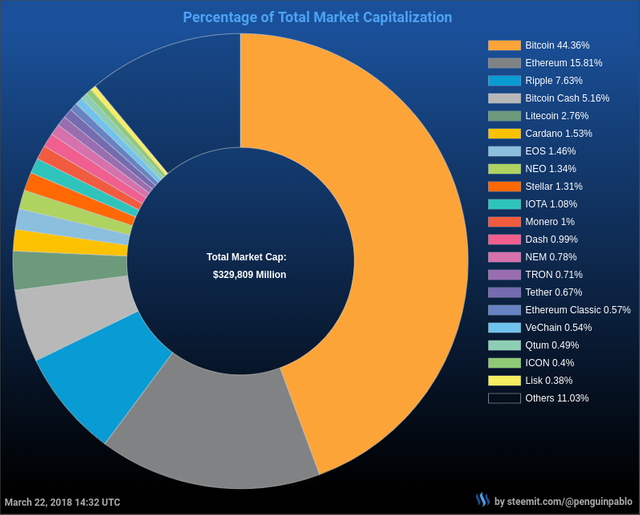

Market Capitalization

Bitcoin daily chart

Feel free to use and share my charts, but please mention me as the author.

Latest Crypto News - March 22, 2018

Pullback Ahead? Bitcoin Hits Stiff Resistance at $9K

The bulls' repeated failure to take out resistance around $9,000 has boosted the odds of a pullback in bitcoin prices, according to the technical charts.

Read more: www.coindesk.com

Bitcoin Falls on Fears of Regulatory Trouble for Big Crypto Exchange

Bitcoin fell after one of the world’s largest cryptocurrency exchanges was said to face a government rebuke for operating without a license in Japan, heightening concern that increased regulatory scrutiny will curb demand for digital assets.

Read more: www.bloomberg.com

Other sources:

- Binance Founder Denies Any Problems With The Exchange

- Bitcoin Price Falls As Markets React To (False) Japan Binance Threat

- Nikkei Report: Japan To Issue Warning Against Crypto Exchange Binance, Twitter Cries FUD

- Binance CEO Refutes Financial Watchdog Warning Reports

- Bitcoin stumbles as Binance faces potential regulatory backlash

US Could Put Crypto Wallets on OFAC Sanctions List

The U.S. Treasury Department may start publishing cryptocurrency wallet addresses along with the names of people and organizations with whom it forbids citizens from doing business.

Read more: www.coindesk.com

Korean Regulators to Probe Banks' AML Measures for Crypto Exchanges

Two South Korea financial regulators are reportedly launching a probe into domestic banks over their implementation of anti-money laundering procedures for cryptocurrency exchanges.

Read more: www.coindesk.com

Zcash's Coming Hard Fork Could Pave the Way for Even More

Privacy-focused cryptocurrency zcash is gearing up for its first hard fork. And while that may call to mind bitter debates over development or excitement about free coins, actually zcash's first hard fork - dubbed "Overwinter" - isn't about either. Instead, the cryptocurrency's developer team is hoping to lay the groundwork for more dramatic upgrades in the future.

Read more: www.coindesk.com

Bitcoin Q&A: Spam transactions and Child Pays for Parent (CPFP)

Can spam transactions be used to artificially drive up fees in Bitcoin? What is Child Pays for Parent (CPFP)? By Andreas Antonopoulos.

Major European Fintech Investor And Block.one Announce $100 Mln Fund For EOS Projects

The German fintech incubator FinLab AG and Block.one, developer of the Blockchain software platform EOS.IO, announced a $100 mln joint venture to develop projects that use EOS’ software

Read more: cointelegraph.com

IT Giant Fujitsu Unveils European Blockchain Innovation Center

Japanese multinational Fujitsu has launched a Brussels-based Blockchain Innovation Center to facilitate research and projects around the tech.

Read more: www.coindesk.com

Startup EverMarkets Aims to Shake Up Futures Trading With Blockchain

Blockchain company EverMarkets is developing a peer-to-peer futures trading platform based on blockchain technology.

Read more: www.coindesk.com

Edward Snowden: Public Ledger Is Bitcoin's Big Flaw

At a recent event in Berlin, Edward Snowden for the first time talked at length about the problems and benefits of blockchain technology.

Read more: www.coindesk.com

Bitcoin Provides Freedom, Says New PBoC Chief as China Opens Doors to $27 Trillion Payments Market

For the first time in history, the Chinese government and its central bank, the People’s Bank of China (PBoC), has opened its $27 trillion payment market to the world. Foreign firms are now allowed to apply for licenses to operate within China, competing against local service providers.

Read more: www.ccn.com

SteemBlockExplorer.com - SteemNow.com - CoinMarkets.today

¯\___(ツ)____/¯ Follow me @penguinpablo

Thanks for awesome information. Bitcoin will take her strong position very soon. Buy now or cry later.

More regulation bullshit. I hate the media more everyday. More mainstream = more people buying = higher market caps, however the constant FUD of late is so old.

Media should be banned from reporting just like google banned crypto ads. :)

The 7 days chart looks healthy. Some up, some down.

My biggest concern is that Thether started to print again. Should we worry about that?

I don't really worry about it. It could be a positive sign as well. For every US dollar that is deposited on Bitfinex one USDT is printed.

As we take a look at it from that perspective, it, indeed, would make sense.

Thx for the reply/

That last news is ridiculous insane amount of currency. Cryptocurrency could boom if it is used in transactions. $27 trillion! wow.

Damn, just when I thought things were back on the up and up.

Really a very nice information. I would like to ask how to influence the price of the bitcoin with policy in part of the country prohibits to conduct transactions

Your posts are amazing and good

Great overview, thanks for sharing. I've smashed the up vote button for you!

If you are looking to get hold of some crypto without investing or mining, look into https://www.crowdholding.com. They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

Good post, how i can get some of eos?

I'm so sick of media false reporting. Of course Nikkei is looking to take down the crypto market given they are a stock-based publication.

I guess we should take it as a positive, if crypto wasn't a thread that wouldn't attack it...