Investing 101: 5 basic tips for beginners in cryptocurrency

Hey guys,

Since Steem is getting increasingly more traction and cryptocurrency is getting more and more attainable for your average Joe to invest in, I thought it would be a good idea to give some basic investment tips.

Important Disclaimer: I am not a financial advisor or expert and not responsible for any losses you make or gains you don’t make because of this article. Your choices are your own.

With that being said, let's start.

1. Buy the dip

If a stock/bond/crypto is currently skyrocketing, it’s probably wise to wait until a dip. As we have seen with the incredible surge in the Bitcoin price, it’s not sustainable and there often will be a correction or even multiple corrections. This is ESPECIALLY true for cryptocurrencies as the underlying value is based on demand and supply alone. Bitcoin as an entity does not produce value as a company would, so price surges/drops are more frequent and severe. With the price being dependent on demand and supply, emotions can have a big impact, which is often based on news or opinions of influential people.

Buying the dip means waiting for a correction instead of jumping on the bandwagon when the price is already surging. A good point in time where you could have done this was a few days ago when the price dropped below the $2100’s.

But @patcher, how do I know when the price is at rock bottom?

Honestly, you don’t. You can use whatever strategy you want or draw whatever lines on a chart you want, but you never know for sure. This is why you shouldn’t invest all your money at once. We’ll come back to this in point 3.

But @patcher, I just want to invest, I don’t care about the short term losses, I’ll hold till BTC shoots up and hits 100k.

You should care about buying the dips even when you are only concerned about the long term. Let's say the BTC price right now is 2500 and it will be 100k in 10 years.

Bob doesn’t care about buying the dip and for the sake of simplicity, buys 1 BTC at 2500, manages to control his emotions in bear times and sells at exactly 100k. Simon keeps his cool and waits for a dip and again for the sake of simplicity buys 1.25BTC at 2000, he also manages to control his emotions in bear times and sells at exactly 100k.

Simon could buy 0.25 BTC more than Bob by waiting for the dip. Once they both sell their BTC, you can compare the difference it made: 0.25*100k. Damn, that's an extra 25k you made, just by buying the dip.

2. Don’t buy or sell based on your emotions

We already discussed this partially in point 1. You need to keep your head cool. In bad times, remember why you bought in and why the crypto is undervalued right now. Once you realize its undervalued; return to point 1, buy the dip. However, it can be even harder to know when to sell in good times. What if your investment 10folds or 20 folds? A good way to overcome these emotions is by setting goals. Set a target value at which you want to sell your investments and stay true to that goal. Since most of the cryptocurrencies value is based on supply and demand and thus is heavily influenced by emotions of other players, remember that most of the dips are temporary and can be seen as an opportunity instead.

3. Don’t go all-in

Since you aren’t sure when a possible investment has hit rock bottom, it’s unwise to put all your money which you have reserved for investing in at once. Yes, you may get lucky a couple of times and make some more money but there is another way if you aren’t too sure.

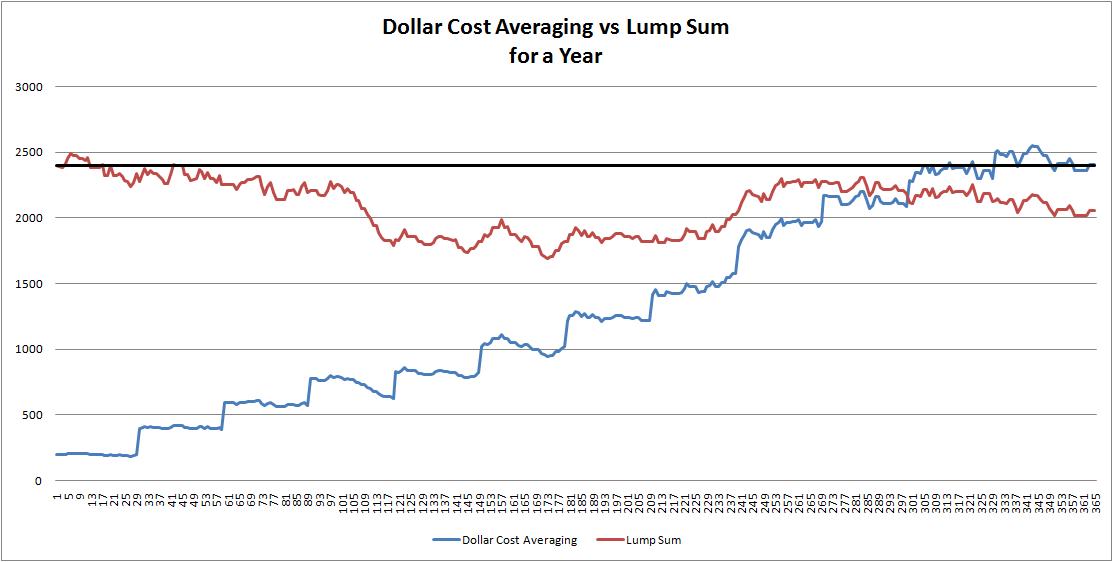

Dollar Cost Averaging

Instead of buying 1BTC for 2500, you spread this investment over 10 periods, buying 0.1 BTC each time. This averages the price you paid and ensures you don’t pay too much. It must be stated that you don’t get the best return either. It’s just a way to reduce risk, but less risk also means less reward.

But @patcher, less risk is good and all, but the less reward thing, I don’t like that. Isn’t there another way with which I can maintain this less risk, but still have the reward?

No. However, what you can do to increase the reward is instead of buying at a certain point in time every month, is combining the wisdom of dollar cost averaging with buying the dip. You buy some BTC every time there is a significant dip.

The current price of BTC is 2500, let’s say it drops 20%. Bob decides to go all-in and buys 1BTC for $2000.

He get’s the buy the dip now and is thrilled with enthusiasm. However, the dip wasn’t done yet and the BTC drops another 5 minutes after Bob bought. Simon Bought 0.5 BTC at the same time as Bob for $2000, he buys another 0.572BTC at $1750.

Simon just acquired 1.072BTC while Bob acquired 1BTC, they both bought at the dip and they both spend $2000.

But @patcher, be real here: 0.072 BTC difference. That’s a $144 difference, that won’t hurt me in 10 years.

No. It isn’t. it will result in $7200 if BTC is 100k by then. Imagine what the difference is if you do this multiple times.

BUY THE DIPS

4. Diversification is the free lunch of investing

Bob got somewhat smarter again, and is buying the dips now. He got his 1.072 BTC and is happy as a clam. 5 years from now, Bitcoin suddenly is surpassed by this new thing which had been around for 2 years called Trumpcoin. The slogan: Make crypto great again! was really catchy and this combined with the increasing pressure from Ethereum and another scandal with Bitcoin decreased the value to $50.

Simon however, was once step ahead and made sure he diversified his investments. He bought some of a few different coins which he inspected and analyzed first on long-term potential and value. He still had 0.2 BTC, but is hit much less severe.

The goal of diversification is to decrease the unsystematic risk. If you are only investing in 1 investment, you are prone to risk which can only impact that single investment. Sure, if you are a great investor and pick Bitcoin 2.0 you actually lose money with diversification, but chances are that if you aren’t a Bitcoin millionaire already you probably aren’t able to identify these opportunities.

But @patcher, what about an event that will strike all cryptocurrency?

Don’t invest just in cryptocurrency, if this is your first investment, be sure to diversify to other markets so you reduce risk. Get some stocks / bonds / commodities which don’t correlate with cryptocurrency and thus aren’t susceptible to this market risk.

5. Never invest money you can’t afford to lose.

Bob knows all the rules now, he buys some BTC, ETH Ripple and of course some STEEM, because STEEM is the future. Bob has 2000 dollar, but can only really afford to lose 1000 dollar. He thinks about all the upside potential and the amount of Steem power he could have if he invests 2000 dollar instead of 1000. He thus buys for $2000. Simon is in the same position, decides he can only afford to lose $1000 and invests 1000 dollar.

2 months later they both get a bill. They are neighbors and a tree fell in their backyard. The owner of the tree removal company is an absolute capitalist pig (as he should be)and bills them $1000 each to remove the tree. The same day, the cryptomarket got a big hit and was down 25%. Simon pays the bill, but still has his investment going for him in the long term. He will be a crypto millionaire anyway so with that perspective he already forgot about it the next morning.

Bob sells $1000 of this investments to pay the bill.

In this scenario, Simon still has $750 worth of investment while Bob has $500.

If you have come this far in this post, I don’t have to tell you that in the long term, that $250 dollar won’t be just $250 dollar anymore.

This is the most basic rule of investing. Don’t invest with money you can’t afford to lose. If you invest money you can’t afford to lose, you are playing a losers game. If you get an unexpected bill, you may just have to sell your investment at the WORST price in a long time just because you don’t have enough liquidity. If you follow Buy the dips, you can invest as much as you are able to over a time period. This should help with this point.

I hope I helped some of you guys with these examples. The scenarios used are of course not the only scenarios that happen and are cherry picked to enhance the argument. The idea behind these tips is to create a nice risk-reward portfolio and to decrease risks you don't need to take.

Don’t be like Bob

If you’ve enjoyed these 5 tips for basic investing, be sure to spread some wisdom: Upvote and Resteem

After you’ve done that, you may just as well follow me: @patcher

If you have anything you agree/disagree with or some additional tips or ideas for a possible part 2: Let me know in the comments below.

Thanks for reading!

I'm new to this so it's useful to me. I find myself making some dumb decisions and using emotions to invest, or not doing in depth research on newer alt coins about what makes them unique or different. I just jump on hype trains over and over.

It's great to hear that it's useful @jeremybro. Your own emotions can be your worst enemy, capitalizing on other people's emotions is another story!

Ouh let me second that Jeremy! :) Been there done that too, but that's how we learn!

Thanks @patcher for great tips! Recently wrote my own 10 commandments I follow when investing in CryptoCurrencies :)

Let me add the one I loved from Ray Dalio - "Remain Humble and Cautious - Always ask - What Don't I Know?"

I guess it goes together with Do Your Research! :)

And loved the quote you used here too - Try to be fearful when others are greedy and greedy only when others are fearful.” - Warren Buffet

If you are curious to see the post I did to continue learning here it is - 10 Ideas on How To Maximise Your CryptoCurrency Investment Results - https://steemit.com/bitcoin/@dainisg/10-ideas-on-how-to-maximise-your-cryptocurrency-investment-results/

Welcome to Steemit @patcher :)

Make sure to participate in this weeks giveaway to get known in the community!

Here are some helpful resources to get you started:

If you find this bot helpful, give it an upvote! It will continue to upvote introduction posts. Your upvote will give it more power in that. If you think you have something all new users should know, please tell.

This post received a 3.8% upvote from @randowhale thanks to @patcher! For more information, click here!

Great job sharing tips for new investors. Check out my article on Steemit providing tips for new cryptocurrency investors: https://goo.gl/iyrTNC

This is great advice for investors of all sorts. Keep it coming i'll be following!

Thank you very much @ysanti. That follow means a lot to me!

Thank you so much for this! Haha I wish I'd read this from your mind a few days ago. I jumped on the LTC bandwagon as it was rising (rookie mistake) because I thought it'd keep going up since it was supposed to hit Bittrex soon, buuuut I ended up buying near the ATH. Go me -_-

Hey @dunkey! Thanks for your kind words. It can be really tempting to jump on the bandwagon. If you are afraid of losing an opportunity, remember there are so many of them in this market. You'll get there!

Haha it happens. I mean, my 14% loss went to a 2% loss in like 6 hours. The market is so volatile! Anyways, I'm resteeming this for ya. It'll help you out, and I can bookmark it for some good basic guidelines! Cheers to ya

thank you @dunkey! that means a lot to me!

Great advice.

Hodl is a good word to know also.

upvoted and followed.

Thanks @henry-gant! Hodl takes some balls of steel too!

Welcome to Steem @patcher I have sent you a tip

All very valid points to be observed by both beginner and experienced.

I would add that most often a loss can turn into a win. If you find you're wrong in a investment play the quicker you exit the quicker you can put that investment in another more optimal position. Take your losses...look at it as paying your dues.

Hey @cryptologyx I would agree completely with that if you mean that you are wrong in the fundamentals of the investment. For market swings I wouldn't recommend to exit if it goes for a downturn as long as the underlying value of the investment is still the same.

dont be like bob! haha good tips

Thank you very much @blapone420!