Cryptocurrency Arbitrage - How I made $1,200 in one trade AND the 7 things I learned this week

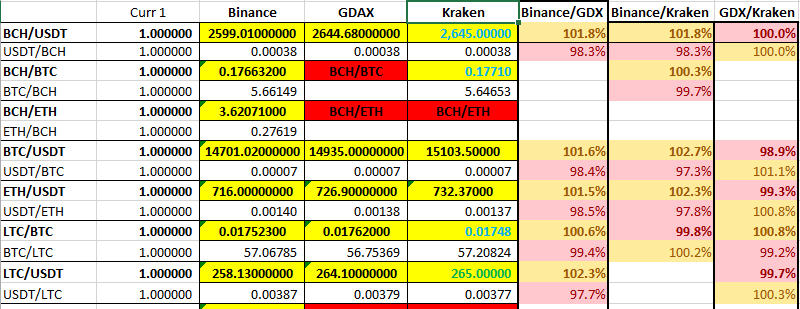

Hello! I'm relatively new to Steemit and am interested in sharing my experiences and learning from all of you as I dive into the cryptocurrency space head on. I am a big excel nerd and am also in the process of developing an online arbitrage platform that can show currency differences across multiple exchanges. I will provide updates as I have them (and the web address when it's ready for beta!). I'd be interested if anyone knows of something similar?

I am really excited to get in on the ground floor of this movement and share my experience. I am also moved to see real change being affected by the space (for example):

I sat down this week to analyze cryptocurrency across exchanges for imbalances (i.e. opportunities to buy low, sell high). I was lucky my first day, and found BCH (Bitcoin Cash, also called BCC on some exchanges) trading on Kraken at $2720.46 and GDAX at 2927.60, a difference of $252 per BCH. That's a pretty big spread and was a great opportunity to make some short-term gains. If you bought 5BCH in cash on Kraken, then transfered it to GDAX, and coverted it to cash, you could have made (pre-tax) $1,200 in that trade. Not too shabby for about an hour of time. Since then, there hasn't been much action in the markets the last two days. Tell me in the comments below what you have seen in the past. Was this last week an anomaly?

Speaking of taxation, there has been a lot of new information released recently on how the IRS intends to handle concurrency. Here is the current IRS reference:

https://www.irs.gov/newsroom/irs-virtual-currency-guidance

and here is the latest news item about the IRS and cryptocurrency moving into 2018 (as of 12/27/17): http://bitcoinist.com/cryptocurrency-investors-lose-tax-break/

Needless to say, arbitrage may not be easy, but it can be profitable.

Here are 7 things I have learned:

1. Watch your withdrawal limits.

Each exchange has their own rules. For example, Kraken allows up to $200,000 in withdrawals per month, $50,000 max per day. GDAX (without further verification) allows $10,000, no monthly cap. Be mindful when transferring funds in and out of these limits, or you could be caught mid-trade with a loss that was looking like a gain.

2. If you're planning on holding currencies long-term, divide them among the exchanges.

That will help mitigate cross-exchange risk (i.e. the time it takes to buy/sell/transfer across exchanges). If you have 5BCH in exchange A, and you want to buy 5BCH in exchange B and transfer to exchange A to capture a gain, you can sell the 5BCH in exchange A as soon as you bought the 5BCH in exchange B, then transfer between exchanges. You don't have to be subject to waiters risk. Tell me if anyone is using this strategy, or has a better one in the comments!

3. Make sure you're fully verified before starting

Different exchanges have different requirements to allow trades between exchanges and depositing money from banks. Make sure you get all the way through "Tier" verification on the exchanges you want to use before starting.

4. Try not to get frustrated

Kraken is SLOW and buggy, GDAX only really trades 4 currencies to USD, and there's no way to deposit USD directly into Binance. Some of these 'findings' were very frustrating for me, when I was trying to figure out what was possible across exchanges. There's a lot of details, and the devils in the details. Make sure you think through your trade from start to finish, including fees, before pulling the trigger on that next trade. Don't get too frustrated when the exchanges don't work like they're supposed to - especially Kraken.

5. Keep track of your transactions, fees and profits.

That is, if you plan on paying taxes. No really, it's good to keep track of your historical profits and losses. You also might begin to see specific trends in your trades.

6. Understand the process

Understand that you hold timing risk if you are simply transferring from one exchange to another. There's nothing preventing that BCH you bought on one side to be lower by the time it gets transfered to anther exchange. I have had BCH take over an hour on a low-volume day. LTC and ETH seem to move more quickly across the exchanges (15-25 minutes). Also, I have read that Zcash is supposed to be the next big thing, and may end up being faster. I haven't used it yet. What do you think, and what is your experience?

7. Take your time when transferring between exchanges

Make sure you're paying close attention when transferring between exchanges. When you transfer between exchanges you have to copy and paste the "address" from one site to another. MAKE SURE YOU'RE TRANSFERING THE SAME CURRENCY across exchanges. I have read many horror stories about people sending BTC to BCH addresses and LOSING EVERYTHING. Take your time.

Many more lessons to share as I learn them. I'm interested in your feedback on arbitrage, whether you do it, and what you've found to be successful.

such good advice. Our Indian exchange has imposed a withdrawal fee from today. Sad

I agree, such great advice. WE can all be friends and have great trading advice daily, that would be fun.

GREAT ADVICE

Followed!

Where you at mon?

as in where am i located? US.

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content!

Your post was approved by me. As reward it will be resteemed by a resteeming service.

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

You were lucky! Your post was selected for an upvote!

Read about that initiative

Very well documented, I'm pretty sure this can't be done anymore though