What the Verge? A Detailed Technical Analysis of XVG

A Wild Ride!

After the great debacle of New Year's Eve, it looks like Verge (XVG) is developing a very positive future. XVG is a privacy coin, which gained notoriety in early mid December following a very rapid run up in price. However, after the run up there was a swift correction which saw the currency dump over 50% of its maximum value. Though doubts were raised regarding the XVG development team and release timeline, technical analysis shows that the recent protracted retracement is simply a healthy correction. In this analysis, I will take a look at some of the fundamentals of XVG, as well as provide some outlook for what to expect with this currency in the short term.

What is Verge Currency (XVG)?

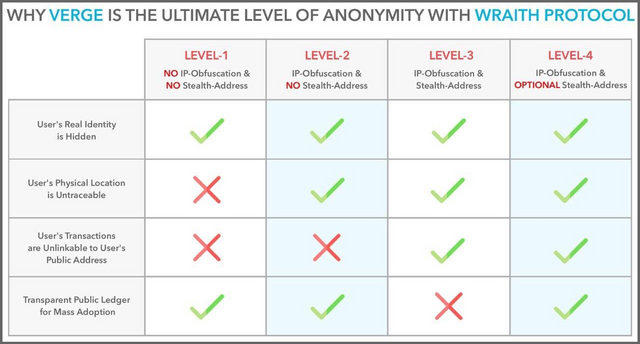

Verge is a new cryptocurrency which offers the ability for users to transact anonymously via onion routing protocols (i.e. Tor). Using the currency's Wraith protocol, relevant transaction data can be hidden such that one cannot backtrace transactions through the currency's blockchain ledger. While many new currencies offer this feature, Verge is unique insofar as private transactions are considered to be an optional feature. With the click of a button, transactions can be made either public or private. This makes XVG one of the most flexible cryptocurrencies on the current market and for this reason I believe that there is a lot of upward potential with this coin.

Looking at Some Fundamentals ...

XVG is a deflationary proof of work (PoW) cryptocurrency. With a moderate circulating supply (14.5G) and high circulating to maxsupply ratio (14.5G/16.5G = 87.9%), XVG certainly has the potential to achieve values in excess the 10$ range if market cap equivalent to XRP's currennt value (128M$) could be achieved in the future. As a open source project, XVG also offers its investors a degree of transparency and accountability.

Summary Technical Analysis

The chart above is my own detailed technical analysis of XVG. Data is plotted beginning in the first week of December and continues through the time of this post (Jan 5th 2018). The chart exhibits a beautiful fractal behavior which can be studied to develop strong confidence around XVG when it comes to investment decisions. For ease of analysis, the chart is broken into four regions, the final of which is my own speculation based on my insights into the data.

This is the beginning phase of XVG before it made its mid December debut. While there is much of interest to look at in this phase, I tend to see the nascent phase as a distinct cycle in cryptocurrency development worthy of independent study. During this phase, a cryptocurrency has little notoriety and it attracts niche investment capital from a few sources. During this phase, the cryptocurrency idea is still being formulated, and it had not yet hit the mainstream.

During the first impulse wave, XVG demonstrated an explosive performance which solidified its potential to become a very strong cryptocurrency. This phase demonstrates a very clean 1-3-5 Elliot wave behavior with identifiable subwaves within each step. It is interesting to note the fractal consolidation phase which occurs on the 2-3 branch of the first impulse wave and its relationship to the structure of the current consolidation phase.

After the initial pump, XVG entered into a long consolidation phase which sparked waves of doubt from many investors. However, Elliot wave analysis reveals that this phase reveals a very clear A-C-E pattern in which the E point lies on the ascending branch. This suggests that there will be an upward breakout coming soon for XVG. This comes at a good time for the XVG project, as they have been putting a great deal of effort into finalizing Wraith and have committed to restructuring their roadmap moving forward.

Today in particular marks an important point in the XVG consolidation phase as the C-D branch was completed. From an analytical perspective, this solidifies the correction hypothesis for XVG as we now have two points on the ascending and descending nodes. Prior to today, only the A-B and B-C branches were visible which tended suggested a lack of clarity as to the nature of the correction.

A Second Impulse Wave? XVG Moving Forward...

It is my opinion that XVG will rise quite sharply within the month of January. This rise will take the form of a second 1-3-5 Elliot impulse wave which will look very similar in form to the first impulse wave. This self similar progression seems to be characteristic of cryptocurrencies. During the first impulse wave, we saw the price move from $0.02 to about $0.30. By rule of fractal symmetry, it would not be out of line to look for a similar 10-15x increase from the current value of $0.16 upward to $1.60-2.40 at the maximum of the second impulse wave. This might then be followed by another protracted consolidation phase.

If the XVG price manages to break out of its consolidation triangle by the end of the month, the next point of resistance will likely be around the $0.30 mark (the previous all time high). Then, following a short corrective phase, I would not be surprised to have the price at $0.50 by the end of the month as we move along the 2-3 branch of a strong second wave.

Keep it real

@mxcrypt

Found this helpful? Feed me some crypto!

BTC Wallet - 3PPENyabp2gsEfNahLyhMsgdwtjbodrtFm

ETH Wallet - 0x7792cB95e9faa8B4049c88dD0dD567Cb843bc696

LTC Wallet - MXDmNsYKccTxnyXe4vpq3XrbstHsKex9S9

Legal Note: These solely my own ideas. This is by no means professional financial advice and I cannot be held accountable for any investment decisions undertaken by reading this article.