Blockchain-Based Marine Insurance Is Live

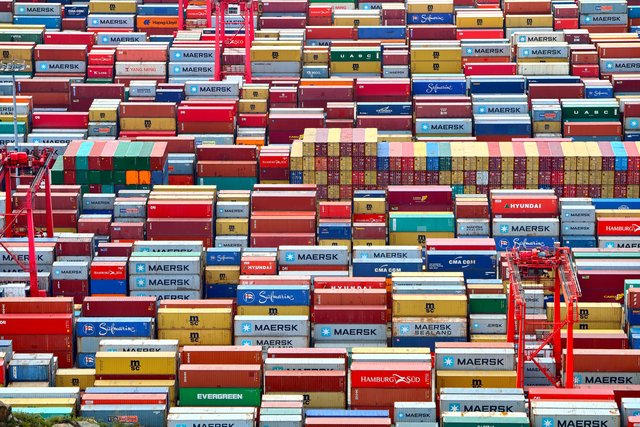

Consultancy EY, data security firm Guardtime, tech giant Microsoft and ship operator Maersk had joined to build a blockchain-based marine insurance platform back in September 2017, meant to be the first real-world use of the nascent technology in the shipping industry. This technology is now live in commercial use.

It’s called Insurwave and was based on Microsoft's Azure cloud-based technology. The end goal is to allow each party in the shipping insurance ecosystem to use a distributed ledger that would record shipment information and automate insurance transactions when needed. This drives up efficiency and transparency. Back in September, EY told CNBC that securing marine insurance data with blockchain was necessary due to the "complete inefficiency" of the industry.

Over the first year of its use in a commercial environment, the group expects Insurwave to execute over half a million automated blockchain transactions for more than 1,000 vessels. EY also plans to extend the application to other types of business insurance, including global logistics, aviation and energy.

Mike Gault, chief executive of Guardtime told Reuters in September that the blockchain was “absolutely essential” for this platform to function, as it was able to guarantee that all parties - from shipping companies to brokers, insurers and other suppliers - had access to the same database, which could be integrated into insurance contracts.

This is also the latest effort by Maersk to apply blockchain within their operations. The company is now working with a tech company IBM, building a global trade digitization platform based on the Hyperledger 1.0 platform, meant to record and transact cargo information along the global shipping supply chain.