Trading Lesson #1 - Indicator for Market Pivots

To kick this trading lesson series off, I first want to share with you one of the key indicators I use to help telegraph when the market is either pulling back or making a pivot.

Introducing the CCI calibrated with a Volume Weighted EMA.

This is a free indicator from the tradingview public library, and I have customized the appearance to washout the area with the -100 and +100 range lines. This is a VERY powerful indicator over the standard CCI as it first uses an EMA with a lookback period of '9', then adjusts +/- from this moving average according to weighted volume rather than pure price action.

This is usable on any timeframe, and in both Range and Trending markets as it will adjust to conditions responsively. This makes it more of a leading indicator than a lagging indicator. So how do I use it?

You use it the same way you use a normal CCI, as the value moves from below -100 and into the range space, this is a cue for going long. The same with the inverse for a short signal - as the indicator moves from above +100 down into the range space. For confirmation, you can use the middle crossing within the range space - this is also a very similar signal cue as using the RSI divergence oscillator.

How to filter between pullbacks or trend reversals?

The short answer to this is simple - utilize multiple timeframes to get a better understanding of when resistance/support, and how 'strong' that resistance/support will come into play.

For example:

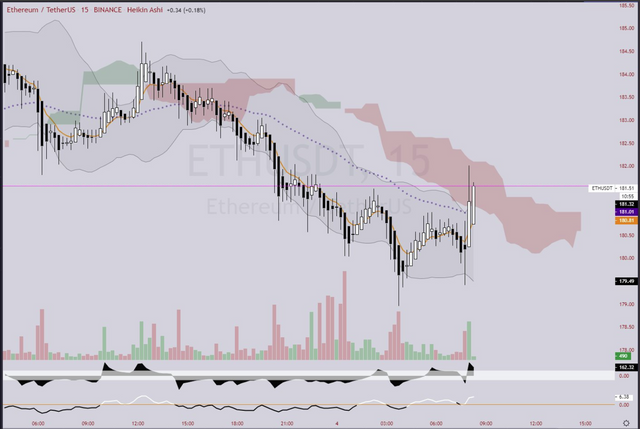

Above on the 15 minute chart, the market showed clear signs of change with the impulse move. I would speculate here that the next 8-16 bars (2-4 hours) are likely to carry bullish momentum.

Then I would compare with the 2 hour chart to further carry that speculation into the movement of the indicator to again speculate that this is likely to induce 2-4 more bars of upward momentum (4-8hrs), thus a strong chance to break the 50ma for additional momentum.

All of the previous information then tells me that even though the indicator signaled three days prior for a sell on the daily chart, the CCI should redirect back up due to the activity on the intraday momentum. Coupled with this is three types of resistance above the price on the daily - The Kumo cloud, the 50ma, and the 9ma. If the momentum pushes price above the dynamic resistance, that will be a bullish signal for many traders that also use the kumo cloud and 50ma (which alot do).

This is not the entirety of my analysis - however one of my entry criteria's is that both Intraday and Daily charts are in enough of an 'agreement' to harness more momentum via more traders utilizing Intraday or Daily charts.

With additional criteria met, I posted an entry 180/182 with a stoploss slightly below.

On the 4hr chart - this was my entry point. Following this signal I also anticipated the pullback and projected high, and the following dip utilizing Elliot Wave and Fibonacci methods with BBands, Pinbars and Moving Averages as further confirmation.

Thanks for reading and stay tuned for more as I run through the other tools/methods in 'Trading Lesson #2'

Disclaimer: I am not a financial adviser, this content is the sole expression of my opinion/experience and is not to be considered as financial advice.

Congratulations @mickbit! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!