Crypto: What if the altcoin season has already started…

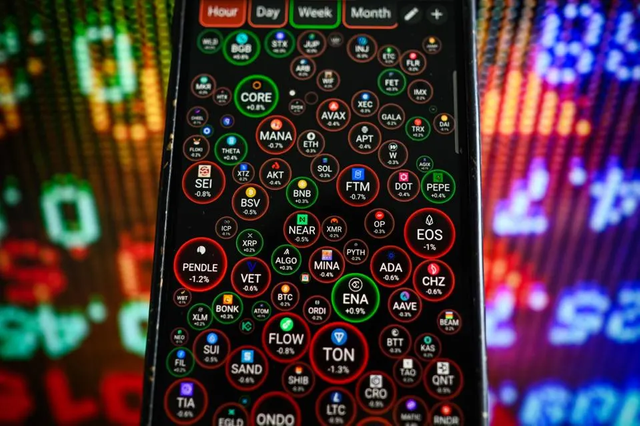

The expected altseason, where altcoins surge after Bitcoin's rise, seems outdated. The bull market isn't repeating past patterns. Capital is shifting in new ways, changing the market's rules. Meme coins, high swings in price, and big investors are reshaping crypto. This cycle marks a shift where old asset rotation gives way to market divisions.

Altseason's usual plan involves Bitcoin's climb, then money flowing into altcoins, causing them to skyrocket. This happened in the 2015-2018 and 2019-2022 cycles. But the current crypto rally acts differently. The Blockchain Center's Altseason Index showed signals in March 2024 and January 2025, yet they didn't last.

Analysts point to reasons for the change in capital flow. Meme coins gained popularity, taking attention from typical altcoins. These tokens are very risky. Analyst Miles Deutscher said speculative money moved to unstable, low-value projects. This money usually boosts the top 200 assets.

Many retail investors lost money. Insiders profited, but late investors saw losses of 70% to 80% on tokens like TRUMP (-83%) and MELANIA (-95%). Volatility rose as liquidity dropped. Unlike 2022, when losses hit centralized platforms, investors got stuck in assets they couldn't sell.

By focusing money on a few shaky assets, the market temporarily broke from tradition. This makes a general altseason unlikely this cycle.

Although a broad altseason is missing, altcoins are becoming specialized. Instead of rising together, asset classes move differently. CoinGecko data shows Real World Assets (RWA) jumped 1,500%. But GameFi's market value fell by half.

Another factor is big investors entering via Bitcoin ETFs. Since their January 2024 start, these products attracted $129 billion. They gave investors regulated exposure to BTC. Some think this reduced altcoin speculation. Others see it as a chance to expand crypto use. The launch of Ethereum ETFs in July 2024 shows big institutions want more than Bitcoin. But their impact is small, with net inflows of only $565,000.

These new trends hint at a turning point in the market. Investors should shift their focus. They should analyze performance by asset class, instead of waiting for an altseason. The days of all altcoins rising together seem over. A mature, segmented market driven by specific themes is taking over.