Top 8 Crypto Update: Ahhh! The Sky Is Falling!

.png)

My SteemIt blog has essentially become my hub to share what I'm doing in the crypto world as well as my notes on various books, podcasts, and videos.

Those seem to be the things that people on SteemIt gravitate towards from me. Therefore, I'm going to make my "Top 8" strategy a weekly thing. I'll make a weekly update so people can follow along to what I'm doing.

Before I say anything else... I do not provide investment advice. I do not provide cryptocurrency speculations. I don't know what I'm doing. I'm fumbling along and having some fun as I go. I could lose every penny I've put into this strategy and it wouldn't really have an impact on my life or financial situation. Don't play with cryptocurrency with money you can't afford to lose!

Saying that... Here's why I do talk about this stuff... I started paying attention to Bitcoin in 2011 when @MichaelX told me and @joefier to buy some. It was around $1 or so at the time and we ignored his advice. However, we kept an eye on it and dug deeper, trying to understand what it was all about. Fast forward 2 years to 2013. We still hadn't bought any and we had someone on our podcast who talked about how well it was doing. By this time, it was trading around $200 per coin. Joe and I thought that we had missed the boat and it was overvalued. We thought it could only go one direction from there... Down. We still didn't totally understand the technology or the future implications. We failed to see how it could gain mass adoption.

Earlier this year, 2017, we still hadn't bought any. However, there was a site where we wanted to purchase a product that's typically hard to find in the US. The site offered a 20% off discount for anyone who purchased their product with Bitcoin instead of USD. Wanting to capitalize on the discount, I finally bought some Bitcoin. The price at the time was about $2,200 per coin. I bought $100 worth. The product I was purchasing cost $60 worth of Bitcoin. I now had $40 worth of Bitcoin and had no plans for it. I'd check in on that $40 once per week or so... Every time I'd check in on it, it'd climb $10 or more in value.

This is when I started to pay attention and really dive in. We pulled @MichaelX on to the podcast twice. I watched every documentary. I read every article and listened to every podcast on the topic. I became a constant student of Bitcoin, blockchain, and other cryptocurrencies...

That's why I talk about it now... Not because I'm qualified to talk about it... But because I get really excited about the topic. I'm immersed in it now. I read about it every day. It's not in my nature to not talk about it and share what I learn along the way.

Now, I'm doing a little experiment where I've taken a little bit of money and spread it across the top 8 coins by market cap, according to http://CoinMarketCap.com.

Here's the breakdown of the strategy: https://steemit.com/cryptocurrency/@mattw/an-easy-way-to-ride-the-cryptocurrency-wave

Here's where I first invested myself: https://steemit.com/cryptocurrency/@mattw/a-followup-to-the-top-8-crypto-strategy-i-m-up-over-85

I had no plan on making weekly updates. However, I keep getting people asking me about how it's doing. Therefore, I'll do my best to make a post about once a week with how it's doing. This could fall apart tomorrow or it could shoot to the moon. I have no idea. This isn't training or advice... This is a journal.

Since, I'll be updating weekly, here's some quick details and rules I'll follow:

- I started with $340 on November 30th, 2017.

- I started by purchasing coins on Coinbase and moving them to Bittrex.

- I rebalance the portfolio to current top 8 any time any coin drops below 5% of my portfolio, when any coin exceeds 20% of my portfolio, or when a new coin enters the top 8.

- These rebalances allow me to continually cash out on winners and buy more on the losers.

- With my most recent rebalance, I moved my coins to Binance because a few coins I needed weren't available on Bittrex.

- I do have other coins outside of this Top 8 strategy but I won't be focusing on those because they're slightly more speculative and they're technologies that I think will be much bigger in the future. They include coins like Steem and BitShares. I may give updates on some of these from time to time as well.

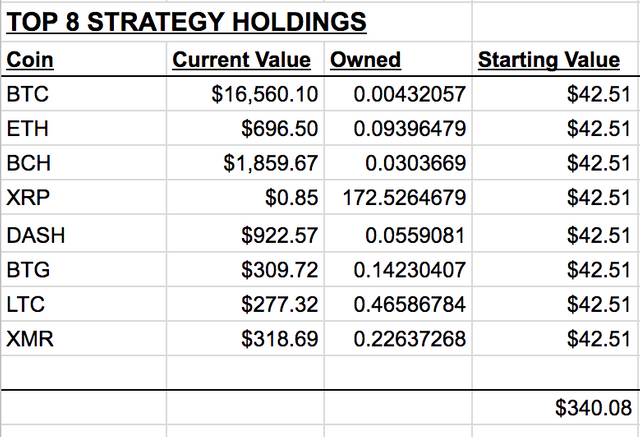

Starting Portfolio (November 30th, 2017):

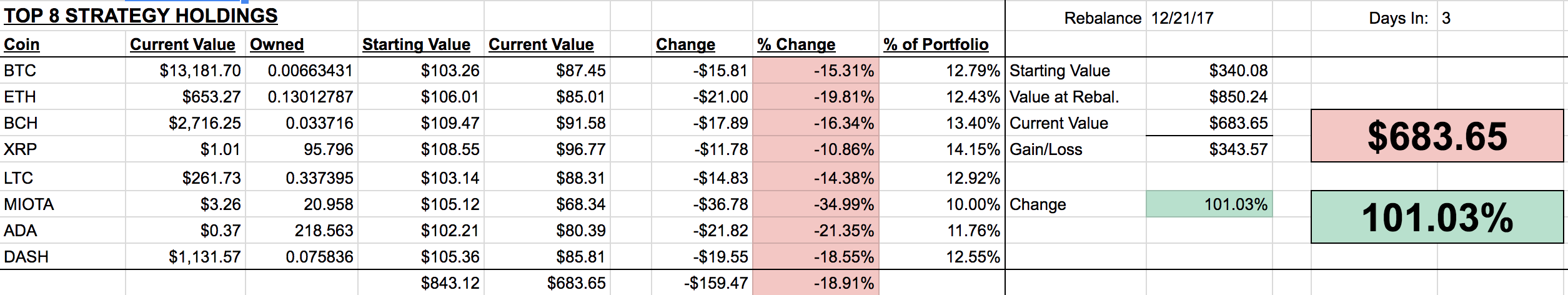

December 24th Update

I titled this one "Ahhh! The Sky Is Falling!" because lately the crypto market as a whole has dipped. The value of my portfolio has dipped with it. I can't go on Facebook without seeing articles from the people who don't understand cryptocurrencies saying "we told you so" or "no one seems to be talking up Bitcoin now."

Yes, unfortunately, my portfolio is down from my most recent rebalance amount and so is a lot of other people's. However, it's already rebounded quite a bit from lows just 2 days ago. I also believe that the time of year has a little to do with it. People have seen amazing profits from cryptos over 2017. What better time for people to pull some profits out than right around Christmas. It's just a blip on the overall upward trajectory that I think is going to continue to happen.

Yes, I'm down since last rebalance. But I'm not worried and I don't have enough of my own money in there that, even if it did drop to nothing, I'm not out much. I'd be bummed about it but I'd continue to build my business and my life wouldn't change at all.

As you can see, my most recent rebalance happened on 12/21 (3 days ago) because Ripple and Litecoin had become too much of my portfolio and Bitcoin dropped below the amount I wanted to hold in my portfolio.

The same day that I rebalanced was the day the dip started. Luckily, since I rebalanced right before that happened, my exposure was limited a little bit.

Overall, I'm 24 days in from when I first threw $340 at this and I'm up 101%. That's a 2.95% PER DAY return on my investment from the day I started. So, yes, things dipped a bit. But I'll take those kinds of returns any day, dips and all!

At the moment, IOTA is getting to be a smaller percentage of my portfolio and Ripple is getting to be a larger percentage. Neither have reached the point where they'd trigger a rebalance. So, for now, I'm just waiting it out.

I'll have another update for you in about a week. :)

If you enjoyed what you read here, don't just 'retweet' it, don't just 'like it' elsewhere. Make sure you sign up and UPVOTE it, here on Steemit and share in the rewards! Also, if you enjoy what I put out, be sure to follow me here on SteemIt as well.