An Easy Way To Ride The Cryptocurrency Wave

I've been studying cryptocurrency and investing a lot lately. I'm in several Facebook groups on the topic, I read a ton of SteemIt posts about it, I even have buddies like @michaelx, who are deeply entrenched in the crypto/blockchain world that I've had the opportunity to chat with on multiple occasions.

There's been one strategy that's stuck out the most to me that seems like the best way to go, in my opinion.

Unfortunately, I can't remember the name of the person who shared it and I haven't been able to re-find the post from the Facebook group that it was originally posted in... However, it's a simple strategy a not hard to remember.

Basically, it was suggested that I figure out an amount that I'm willing to lose (because cryptos are still a speculative investment) and simply spread that money evenly across the top 8 currencies by market cap. The original poster claimed that he tested top 5, top 3, top 10, and even top 20 and the best result always came from the top 8.

I, not taking things at face value, decided to dig deeper.

I wanted to know, if I had followed this strategy from January 1st of 2017, how much would I have now.

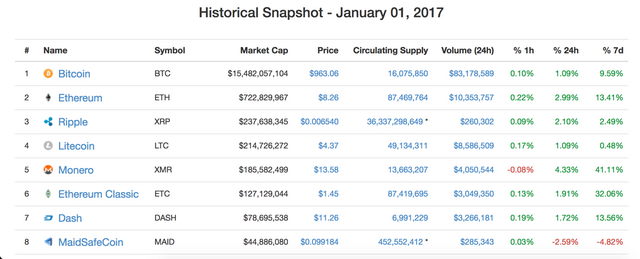

Here's a screenshot of the top 8 from January 1st, 2017:

Of those top 8, 6 of them are still in the top 8 as of today (Nov. 25th, 2017). Since then, Ethereum Classic and MaidSafeCoin have both dropped out of the top 8.

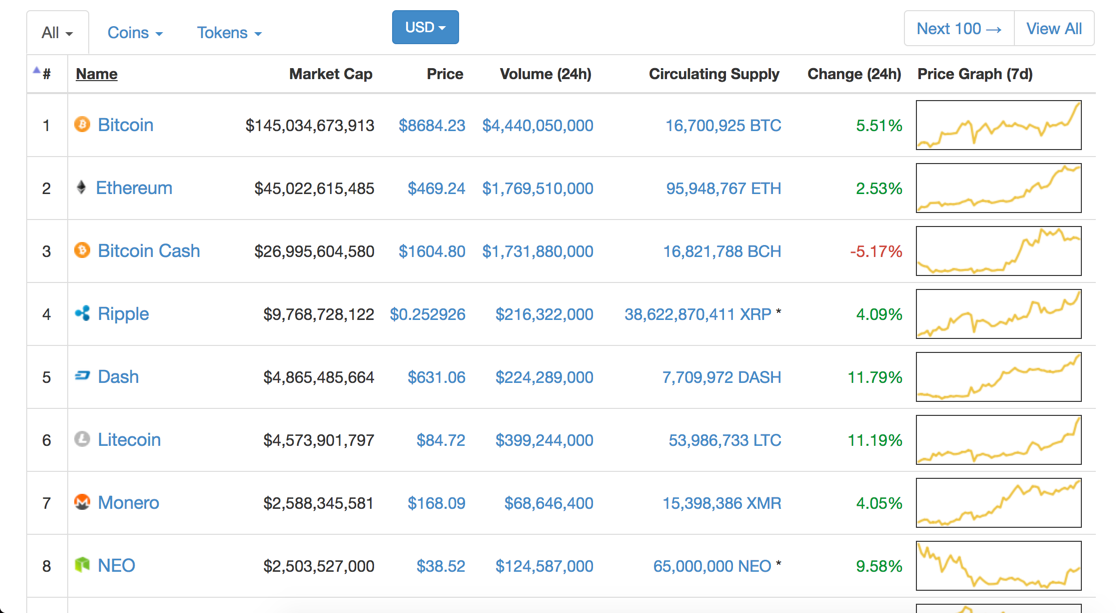

Here's what the top 8 look like today:

NEO and BitCoin Cash have both moved into the top 8.

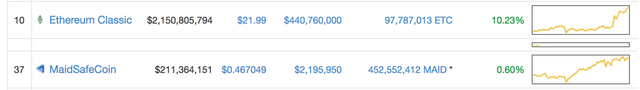

Here's where Ethereum Classic and MaidSafeCoin sit today:

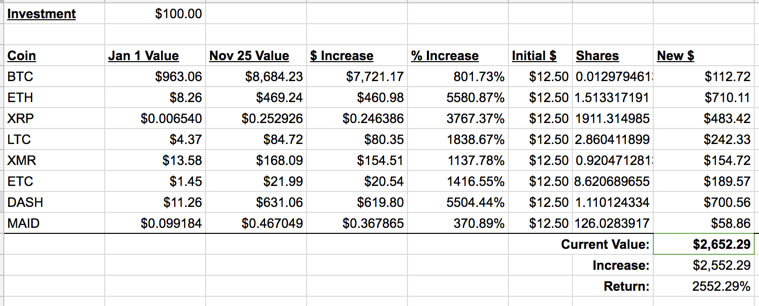

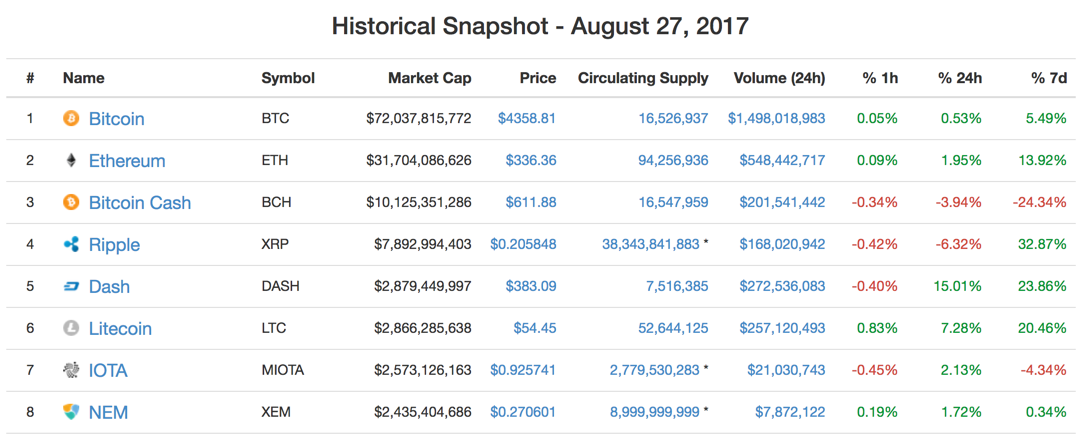

Now that we know where they were and where they are now, let's look at how much we would have made as of today at various investment levels. ($100, $500, $1,000, and $5,000)

If you were to invest $100 on Jan. 1st, 2017, you'd have $2,652.29:

(A return of 2552.29%)

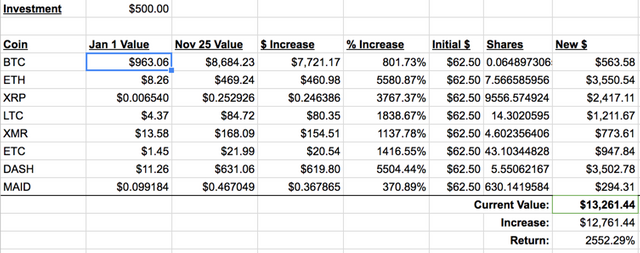

If you were to invest $500 on Jan. 1st, 2017, you'd have $13,261.44:

If you were to invest $1,000 on Jan. 1st, 2017, you'd have $26,522.88:

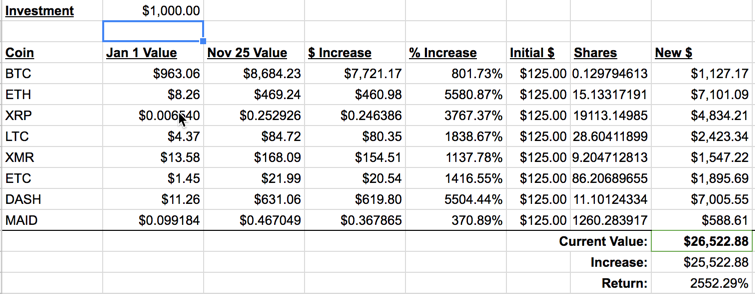

If you were to invest $5,000 on Jan. 1st, 2017, you'd have $132,614.42:

These returns are actually understated as well. They don't take into account the value of the Bitcoin Cash and Bitcoin Gold you would have received when the hard forks happened. For simplicity sake, I left those values out but, you'd actually be sitting on a bit more than what's stated above.

Now... Obviously, past returns are not going to be an indicator of future results and this is not investment advice. However, over the past year, had you followed this strategy, you stood to make 2552.29% on your capital.

Hindsight is 20/20 but it seems like a fairly sensible way to get involved in cryptocurrency to me. We're still in the early stages of this technology. Widespread adoption hasn't happened yet so I believe there's still a lot of room for upward movement with the tech.

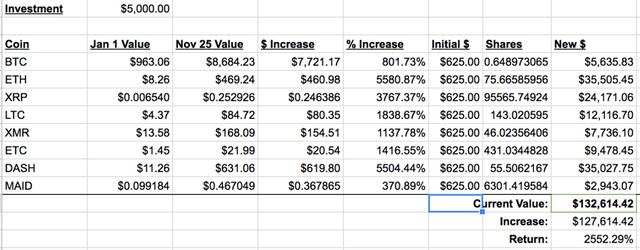

Just for fun, let's look at the top 8 by market cap from just 3 months ago.

Here's the top 8 on August 27th, 2017 (roughly 3 months ago):

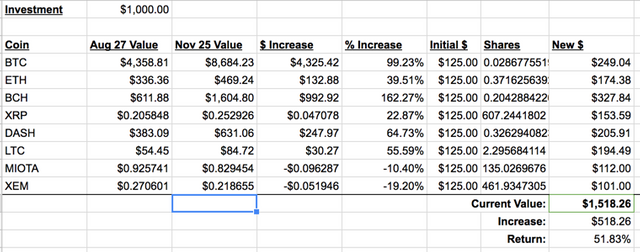

And here's what it would look like, had you invested $1,000 on August 27th:

Yes, you would have lost a little on 2 coins but made it up with the rest and you'd be sitting on a 51.83% Return on Capital over just 3 months...

Again, there's no guarantees of future results but it seems pretty clear to me that this is a safe a lucrative strategy.

To recap, the strategy is to simply pick a number that you're willing to lose if things go downhill and then spread that amount equally across the top 8 coins by market cap.

If you were to start today with $100, you'd put $12.50 in each of these:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Ripple (XRP)

- Dash (DASH)

- Litecoin (LTC)

- Monero (XMR)

- NEO (NEO)

Once invested, just leave it alone. Check in maybe once per month.

And that's it...

If you enjoyed what you read here, don't just 'retweet' it, don't just 'like it' elsewhere. Make sure you sign up and UPVOTE it, here on Steemit and share in the rewards! Also, if you enjoy what I put out, be sure to follow me here on SteemIt as well.

For anyone following along, I actually created an update to this post here: https://steemit.com/cryptocurrency/@mattw/a-followup-to-the-top-8-crypto-strategy-i-m-up-over-85

I think this will be a project for me to do for 2018.Thanks for drawing this up.

its good detail information and I always understand about crypto because it's still new for me and doesn't know much.but here i get to learn some crypto so i will thinking to invest in it.

Good analysis and plan. Nice and simple just the way I like it.

thanks for sharing this informative article.

Thanks for doing the math! :)

Great post Matt - I like this strategy more than the single coin investment strategies or any short-term investing. This is almost like a "set and forget" investment. Do you have any suggestions for when you'd reevaluate the specific coins you're investing in? Or would that be when you want to up your initial investment amount, you'd then select a new top 8?

Thanks brother man. My strategy behind it will be to pretty much ignore it. Every 4 to 6 weeks, I'll check in and rebalance things. I might consider selling off any coins that dropped out of the top 8 and reinvesting in whatever is the top 8 at the time. I'm not sure. I may just take the lazy way and forget that I'm even invested and see where I'm at in like 6 months. :)

Great article Matt - hindsight is clearly an exact science. I guess I should figure out exactly how to invest so that I too can stop sitting on the fence and buy some cryptocurrencies. Just to know which one.. but as per your article - the top 8 that have been consistently in the top since the beginning of the year, should be a safer bet. It's time.

Never a bad time to invest, but choosing which to invest in is clearly a difficult choice to make.

Looking back at your analysis makes me glad I quit my masters program and dumped my tuition into crypto. It sounds crazy in hind sight, but being a structural engineer gives me a bit if an edge in terms of realizing what the education system is about.

Back on topic, I'd skim the top 25 and see which have the biggest potential to continue progressing. Those will become the least risky investments. BTC, as much as I don't like it, will continue to dominate until the nodes call it quits when power becomes to expensive and the fees will be as much as the cost to sell your gold.

LTC is becoming one of my favorites at the moment and I'm looking to make a position happen by the end of the week.

I also liked LTC - I am still on the fence! How would you advise a new investor to 'analyze potential to continue progressing' - is it an experience thing or can you recommend some info I should follow?

You're going to find a 1000 answers to that. My way is to look at people first. Who are the users of a particular coin. Then I look at the landscape, what are the users using it for? and then I look at the future, where can this become useful.

bitcoin for example, the predominate users are investors. the landscape is becoming banks and wall st. what they are using it for is a store of value. for that reason alone, I dont think btc is going anywhere anytime soon, but by that same account, it isnt going to be used for day to day transactions. you'll need something like LTC to accomplish that.

Ooohhh I like that. Thank you - that's definitely a good place to start. It seems we learn something new all the time. I need to do some homework. I appreciate you.

@mattw do you have a shareable link for the spreadsheets that you are using to track the progress of these coins?

I actually didn't save the spreadsheet after taking screenshots. I'll re-make it and share it though. Standby. :)

Thanks for letting me know about the strategy.

Loved your article. What a clever strategy and I appreciate that you took the time to do the research to find actual gains. Very impressive. If only I'd had the foresight to do such back then. Now... I'm so tempted to... I might be convinced. Thanks!