Last Week in Cryptocurrency—Vo. 2

Da Hongfei, founder of NEO, stops the FUD this week. Illustrated by Matthew Lawler

Surviving the End

Hello all! It’s wonderful to still be here, having survived the ‘end of the world’ September 23 hype. But perhaps there has been a great change? There does seem to be some validity to the celestial sign of Jupiter leaving the womb of Virgo, after a 9 month stay. Could this be the sign described in Revelation 12? Regardless, I’m certainly choosing to look at the sign as a signal for a new order. In a way, I do imagine the old world order and financial system to have expired, while we welcome the dawn of a vastly improved financial system via cryptocurrency, that also promises to enable true price discovery for commodities.

Bold Calls

Bo Polney, who claims to have a sterling track record of calling the market bottoms and tops for Gold and Precious Metals, based largely on 7 year cycles using Daniels timeline, is calling for rocket-style price action in both Metals and Cryptos beginning roughly September 30 (He is measuring a week out from Sept 23) and through October. This is easily the bravest, and most specific call I’ve seen in terms of market projections, but it also resonates with A LOT of information and personalities I’ve found on the web. Many precious metals and crypto evangelists are calling for cryptocurrency to be the ‘canary in the coal mine’. Andy Hoffman on the X22Report recently made the switch from Metals to Crypto)and discusses how crypto will be used "as a monetary weapon to fight the fiat regime".

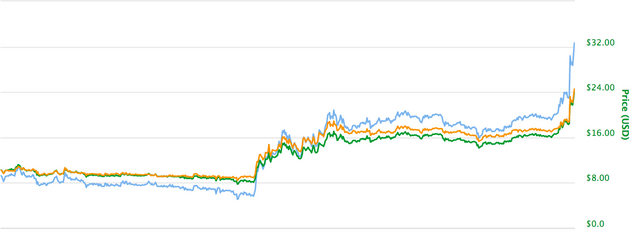

Yesterday (Monday), we are already seeing a decline in the DOW amid concerns over a US war with North Korea, while Bitcoin and it’s entourage of decentralized currencies are putting up big green numbers with NEO leading the top 20 in terms of % gain at over 35% presently. Also waaaay up is GAS, the dividend NEO holder’s are issued. The GAS boost may be on speculation after this document made it’s rounds on social channels. In short, GAS is being considered “Fuel for China’s Blockchain”, and is in much shorter in supply than NEO or ETH. Ethereum fees are paid with ETH, whereas NEO fees are paid with GAS.

”Any company or individual that wants to use NEO to develop smart contracts, raise funds, or register assets on the blockchain will have to pay a fee in GAS” - Palm-Beach-921.pdf

There seems to be a broad feeling, especially among NEO holders that the “China Ban” will ultimately bode extremely well for NEO and it’s GAS. That sentiment was given further fuel after an interview with NEO Co-founder Da Hongfei began circulating today, reinforcing the idea that a collaboration between NEO and the chinese government is “possible”.

All in all, it seems we are recovering from the China Ban as the total crypto market cap tops $136 Billion, while Jamie Demon at JP Morgan faces backlash for his baseless condemnation of Bitcoin.

Beyond Crypto

Another quite interesting announcement that stretched beyond even the innovative world of cryptocurrency, was Roger Ver's presentation at the Nexus conference in Aspen Colorado. He has been working on purchasing sovereignty from a government (didn't say which) for the worlds first free society

Expect more volatility, as usual, though many feel there is a long green light ahead for Cryptos and metals.

Disclaimer! I don’t have a crystal ball, there will be continued volatility to the upside and the down! Invest at your own risk! Have fun living through the greatest wealth transfer in the history of man!

Cheers,

Matthew