Last Week In Crypto —Vol. 3

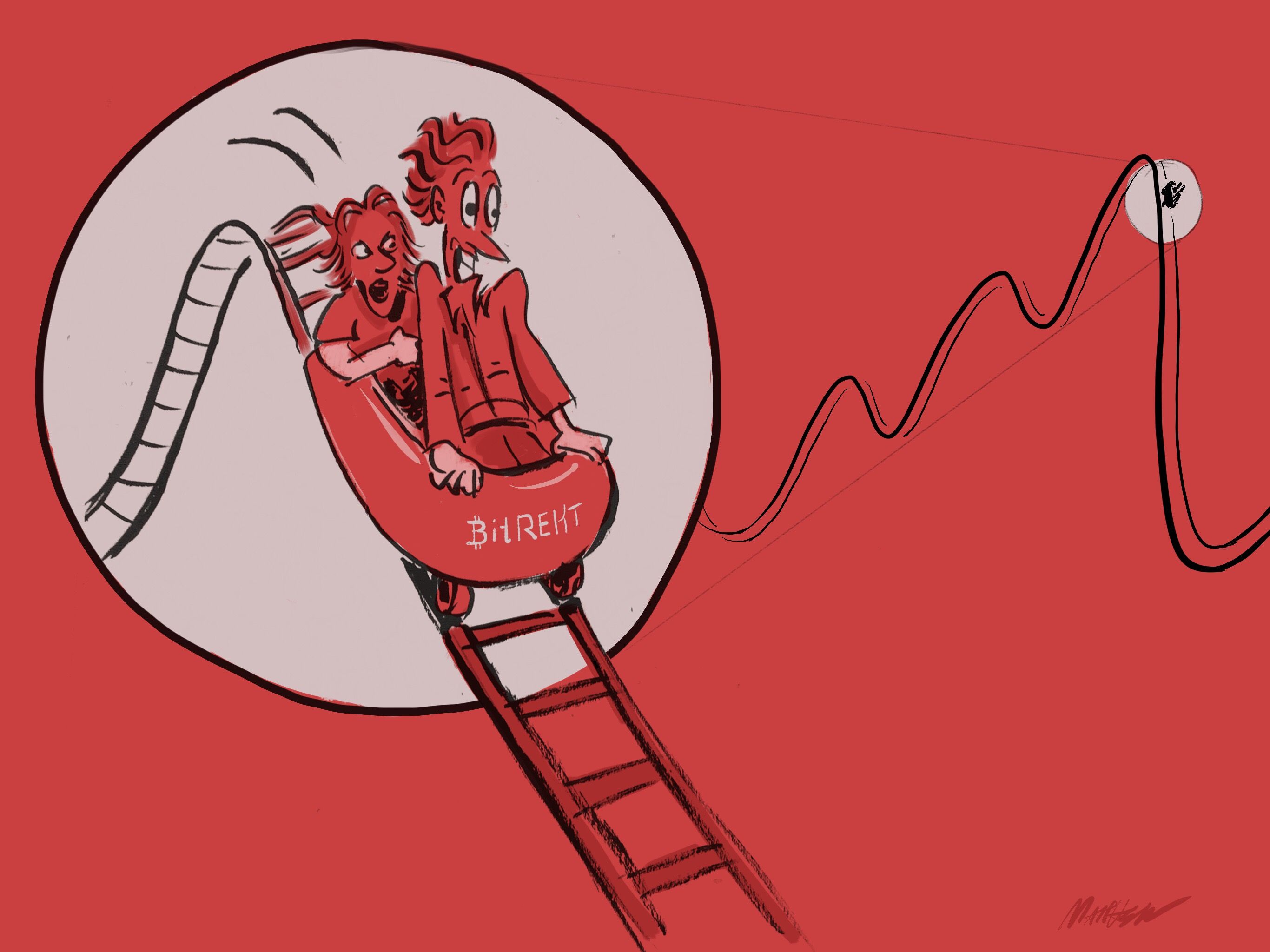

Learn to enjoy the BitRekt rollercoaster. Illustration by Matthew Lawler Creative

Since you missed me last week, I’m gonna cover the bipolar crypto-mania with a broad stroke for the last two weeks.

The weekend before last, all eyes were on NEO as it surged to almost $40 in anticipation of the Red Pulse ICO—the first ever ICO on the NEO platform—which just happened on October 8th. Immediately after the ICO, a NEO selloff initiated, and now we’re watching NEO and nearly every alt coin bleed out while Bitcoin reingages it’s ascent towards it’s previous all time high (ATH), and possibly a run towards $6000.

Not gonna lie, it takes one tough pussy to hodl NEO and other Chinese coins right now and I'm one of them (pussies are tougher than balls…if you’ve seen or experienced childbirth, then you know this—Let’s inverse traditional vocab on that one). I still believe strongly that China will ‘regulate’, rather than ‘ban’ ICO’s and exchanges. The moment this news comes out, you can guarantee a huge surge in Bitcoin and especially China based alts like NEO, QTUM, and Metaverse (ETP), among others.

Part of the reason for the alts bleeding while Bitcoin rises is that a lot of people want to get in on some free Bitcoin Gold when Bitcoin is expected to fork again on October 25th. While holding bitcoin at this fork is probably not a bad idea, there is broad concern over the legitimacy and organization of the Bitcoin Gold project, which I have yet to get to the bottom of. I hope to have more clarity for next week’s report. The opportunity cost of holding a lot of bitcoin is missing out on the alt-coin bloody fire sale that is happening now. Personally, I’m more inclined to lean towards shopping the alt sale. And on that note, I want to highlight some interesting projects that are worth watching and maybe dropping some coin on in the section after this truth bomb from IMF head, Christine Lagarde.

Incumbent drops truth bomb

The IMF head, Chistine Lagarde seems to have a much clearer crystal ball than Jamie Dimon, when she expressed her foresight of the End of Banking and the Triumph of Cryptocurrency— a surprising and candid statement from someone in such a position.

Projects to watch

Walton Chain

There were many other cryptos that made stellar runs early last week. Among them, Walton Chain making a huge breakout, multiplying it’s value over 4x ($1.70—$8.40) in the past week. Walton is an ‘internet of things (IoT) blockchain that uses RFID technology for machine to machine communication. Many speculators feel WTC can fin it’s way to $40 in the mid-term. (yes, wow!)

SONM (SNM)

Another exciting project that appears quite undervalued and very promising is $SONM, (recently moved from $0.09 to $0.23, and correcting to find support back at $.12 at time of writing) which aims at disrupting centralized big cloud-computing powers like Amazon Web Services and Google to distribute computational power to desktop and mobile devices all over the world, rewarding token holders and computing hosts. The author has made an initial investment in $SNM, and will likely be looking to increase that investment. There seems at least the possibility of a 100X here in the next year or two. Wouldn’t that be exciting to be a part of!?

Loopring (LRC)

It’s worth noting that while the vast majority of cryptocurrencies exist to help decentralize world commerce, we are trading on centralized platforms.

Loopring is a decentralized platform in development that recently saw a surge in market cap that this author was not able to be a part of, but is looking on with interest and curiosity, especially as it is having a major correction in this weeks blood-bath. Rumors are circulating along with screenshots from NEO and Loopring online communications that there is a partnership brewing. It seems natural to believe that decentralized exchanges are the future of crypto, so keep an eye on Loopring and it’s competitors (Cobinhood, Kyber Network)

Chainlink (LINK)

I was turned on to ChainLink after watching CryptoBud’s presentation on Youtube We may be hearing a lot more about Chainlink if it can does become the de facto way for business' to connect traditional 'off chain' data to blockchain based smart contracts.

“ChainLink is secure blockchain middleware that allows smart contracts on various networks to connect with the critical resources they need to become useful for 90% of use cases.”

“As developers begin to implement their chosen smart contract, they encounter the connectivity problem; their smart contract is unable to connect with key external resources like off-chain data and APIs. This lack of external connectivity is due to the method by which consensus is reached around a blockchain's transaction data, and will therefore be a problem for every smart contract network.” - CryptoBud

Metaverse (ETP)

The most recent coin to beg for attention on my radar is Metaverse. This could be another sleeping giant. It’s still very under the radar, and only recently got added to one of the larger western exchanges (Bitfinex). Metaverse is taking on quite a lot— it is aiming to be a very business friendly platform that combines the ambitions of NEO, Chainlink, and Civic, if you are familiar with those projects. What this means is that Metaverse has digital asset smart contract technology, provides a platform for digital identity, helps to migrate existing business data to the blockchain, while also providing a decentralized exchange. Wow. Is it too much? We’ll see. Given the current low market cap of ETP, compared it it’s own previous highs prior to the China FUD bomb, as well as it’s competitors, it does look like a strong BUY right now, in this author's opinion (trading at $1.28 at time of writing).

I think that's enough to digest from me for this week. Blessings on your search for meaning in the world while blockchain tech disrupts everything. And may you find the undervalued coins that you're looking for. May the world be effectively decentralized as soon as possible!

Cheers,

Matthew

Did I miss anything you feel should be included (of course I did!)? If so, please share the goods and the bads!

Disclaimer! I don’t have a crystal ball, there will be continued volatility to the upside and the down! Invest at your own risk! Have fun living through the greatest wealth transfer in the history of man!