Are You A Trader, Investor, Or Saver? (Hint: You're Probably A Saver)

There are a lot of people who fancy themselves traders in the cryptocurrency market, but holding coins for less than 365 days (such that you register trading-income tax rather than capital-gains tax) does not a trader make. There is another large group of people who fancy themselves investors, but truly they are (or should be acting like) savers.

First, we must define some terms. The three nouns in the title of this post are more different than they may at first appear to be. What is the difference between a trader, an investor, and a saver?

Trader - One who trades actively in the markets, often day to day. Think of a 1990's stock day-trader. These market surfers are subject (in the UIS, at least) to normal income tax on all of their gains, potentially up to 25%-35%. This makes it very tough to be a profitable trader - you either need a huge amount of capital, such that you can make a living on a percentage point or two after tax, or a huge amount of luck (latter not recommended.) As a result, being a trader is very risky, and a great many are losers in the long run (much like poker players.) You need a huge edge to succeed as a trader, or access to other people's money (tm).

Investor - An investor thinks they have an edge over the broader market, but not enough to trade day to day and incur the higher tax rates and more frequent exchange fees. They are more inclined to buying things they can hold for a year or three, perhaps even longer if things go well. They want the extra padding of the reduced capital gains taxes in case their plays don't turn out quite as shrewd.

Saver - Unfortunately, savers are often bamboozled into "active management" by Wall Street, which is code for "WS gets the guaranteed gains, savers take the risk." It's easy to see why, since they have rightly identified themselves as not having a "stock (or coin)-picking" edge.

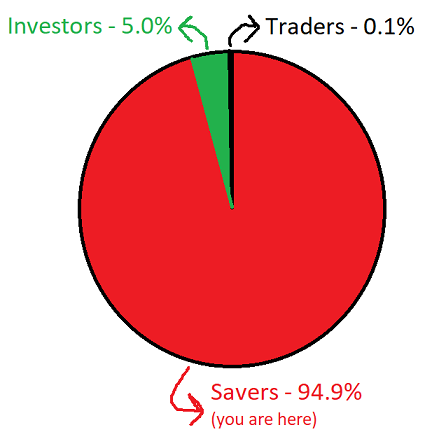

Here's a high-tech pie chart I cooked up to illustrate the rough distribution of traders, investors, and savers in the general population (as estimated by yours truly):

So, what's the point of making these distinctions? To be blunt, acceptable practice for traders will differ from that of investors and savers. However, people who push you investing advice and trades won't even consider that this distinction exists, much less ask you to take care in allowing for it.

The truth is that all of mainstream finance pushes far more risk onto the average person than they should really have. Most people are savers (if they are lucky) - they don't have an edge, they just need to transport capital through "time". Yet, they are constantly sold investments that do not even come close to meeting their needs. See my series of posts on perennial money-losing stocks that continue to be bid up with pension money (Tesla, Netflix, Hulu.)

Nobody is going to watch out for your money except you. Make sure you do an accurate appraisal of your own situation and skills before you do so...and don't forget we are more prone to overestimation of our knowledge than underestimation.

We also have a Radio Station! (click me)

...and a 10,000+ active user Discord Chat Server! (click me)

Sources: Google, Gizmodo

Copyright: MyCity-Web.com, thecollegeinvestor.com, Disney

"Make sure you do an accurate appraisal of your own situation and skills before you do so...and don't forget we are more prone to overestimation of our knowledge than underestimation." - this part can be really difficult and is known as the dunning-kruger effect in psychology and has led to some interesting studies.

also, resteemed!

By your description, I should be a investor. I only buy a little of crypto and don't really take big risk. I don't have so much to pour it as that will incur more debt. Looking at your pie chart, I could also be a saver in some ways. Thanks for sharing the difference of trader, investor and saver. It gets us to reflect about our way of investment!

"It gets us to reflect about our way of investment!"

That was my goal.

PS - You're probably more of a saver than investor.

Brilliant, a point I've been trying to raise on many forums to highlight the fact that all 3 types need completely different strategies and depend upon differing personal financial circumstances.

This is the piece that needed to be written and I hope it now gets seen.

Great work mate.

Thank you! I was hoping to tie this into some discussion of mainstream instruments (and note why Gold is so out of vogue), but it was already getting long!

I'm pretty much a saver Lex, one with high expectations! Cheers!

I still couldn't distinguish saver from the rest. I read it twice, but I couldn't seem to define it.

What caught my attention are the footers. I'll be checking out SteemFollower and SteemEngine. They sound useful and promising.

I've been buying dips and selling runs. I have a feeling at the end of the year it probably won't be worth it as I'm taking profit on such little money I'll either pay more taxes then what I'm actually earning or I'll be "earning" so little it's not even taxable.

That or the amount of money I'll have to pay a CPA to determine how much taxes I should be paying will be more than my earnings as well. Lol that could be the other hard truth.

i resteem your post.Thanks

Thank you.

Wondering how do you classify @haejin in your category though.

well, that depends if he takes is own advice or not...

Who do you think will win if there's a battle of greed between @haejin and Floyd Mayweather?

they would hype the fight, ask more money and split the profits, no matter who won

ROTFLMAO!

I have realized that I do not have what it takes to be a trader but I do try to buy the dips and sell the highs... (the really big ones)

That alone was a revelation and took away a lot of personal pressure. I do not need to be a trader but some smart investing and buying and selling where there is a clear advantage is just normal I would say.

I try to do the research and find out what is interesting

I guess that makes me a bit of an investor even if its just small amounts

all those self made really rich guys and gals started somewhere as well

Thanks a lot for calling me out @lexiconical! I thought I was all "investor-y" by cashing out a bunch of long positions thinking the US market was finally going to correct --- ugh, not so much! So anyone with a crystal ball willing to clue me in on when the correction is REALLY going to happen? @tamala apparently = SAVER 😜💰which I guess means I'm a HODL-er too?