The Ripple(XRP) Effect - Fundamental Analysis

Lately, there’s been a tremendous amount of buzz around Ripple(XRP), but is it only because of the massive growth we’ve seen in the past few 30 days, or is there something more?

In this article, I’ll dive into a brief back ground of Ripple, objectively examine the arguments for and against it, explore its potential from a economic standpoint, then close with potential threats to your investment and a summary.

Meet Ripple(XRP)

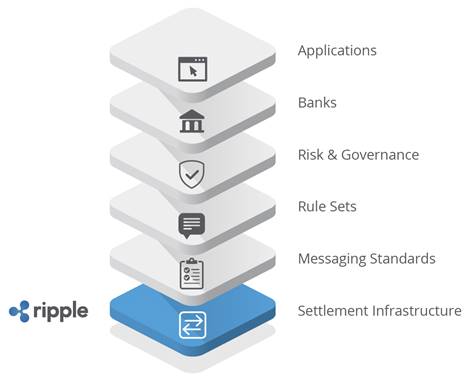

Released in 2012, Ripple aims to enable “secure, instant and nearly free global financial transactions of any size with no chargebacks” through their real-time gross settlement system (RTGS) and currency exchange and remittance network. Ripples distributed open-source internet protocol consensus ledger was created as basic technology for interbank and regulated financial institutions to integrate Ripple into their own systems. This differs from the Bitcoin full node and other crowdsourced altcoin consensus networks in several ways:

- Ripples common shared ledger is a network of independent validating servers which compare their transaction records, rather than the full network of nodes coming to consensus prior to each transaction, enabling faster transaction speeds.

- Although their protocol is open source, it was not created as a plug & play solution, like bitcoins full-node software, nor does it rely on crowd-sourced support.

- Unlike Bitcoin, Litecoin, Ethereum, and other Alt-coins, Ripple is recognized as legal tender by several governments, which gives it instant liquidity via financial institution, as well as purchasing power over material goods. Because of this, it cannot be evaluated in the same ways as other coins, which are largely evaluated based on assumptions & speculation.

In terms of value, it’s more like cash than a commodity. Because of this, it is evaluated in a much different way than Ethereum(ETH) and other alt-coins with intrinsic value, but is accepted much more rapidly because it’s easy for the mass-market to understand. Remember: without market acceptance, there is not value, regardless of how innovative something may be.

Just 4 short years after its release, on 01MAY17, Ripple announced that a consortium of 47 banks have successfully completed a pilot implementation of Ripple in Japan, making it the first country in the world to enable domestic and international real time money transfers via the cryptocurrency. This event lead the XRP value to sky-rocket from $0.051580 USD to an all-time high of $0.430085 in just 16 days… but why? Is it 100% speculation, or is there something else going on here?

“It’s not a real cryptocurrency!”

Or is it? Well, those whom bring this argument to the table are probably referencing facts that I’ve mention during my introduction to Ripple: Its a centralized and regulated crypto-currency which does not need global consensus for transfers, and it is built specifically for (and potentially by) financial institutions. Though a lot of the Anarcho-Capitalists may want to steer clear of this one due to its highly regulated nature, regular capitalist may believe these core differences to be its greatest strengths:

- Regulated - As I mentioned in my analysis on Ethereum(ETH), Bitcoin’s lack of regulation was likely he reason (or at least, that’s what they told us) that the proposed ETF failed to pass the SEC’s evaluation several months ago. If adhering to some sort of trusted regulatory standards, this could drive federal confidence, which in turn drive bank and lending institution faith…trickling all the way down to the consumers. This insures rapid mass market acceptance.

- Consensus - As mentioned before this is much different process than Bitcoin’s global consensus, which means that transaction times are nearly instant regardless of volume transferred. Additionally, all transfers adhere to distributive ledgers DLT standards, which is a requirement for many financial institutions to be insurable.

- Institutional Management - You’ve probably guessed this one already. Although the demand and speculative value is driven at some capacity by ‘the people’, this currency is about as close to the World bank and SWIFT as you can get. This is largely due to the amount

- Deliberate - It feels like a big bank, because it is. Ripple was built specifically for the financial markets, which is why they specifically targeted regulatory compliance.

Economic Value

As mentioned in the last point, Its easy to see that Ripple offers tremendous value to financial-institutions and retail investors. These two groups make up 358 billion (numbers from 2013) non-cash cross-country annual transactions, and the FOREX market which sees more than $5.1 trillion $USD each day. Per a report released by Capgemini and The Royal Bank of Scotland, this is growing at an average rate of about 7.5% each year globally, though China and other Emerging Asian economies have been leading the charge at around 21%.

Seems like a lot, right? Well, for sake of uncovering the immediate value of XRP, we will zoom into the recent adopters of the distributed ledger technology: Japan, India, and the Central Europe, Middle East & Africa(CEMEA) regions.

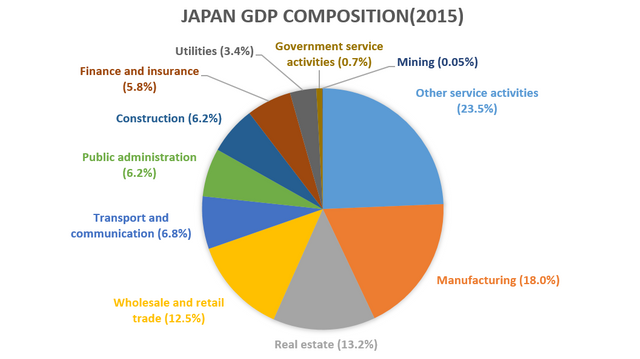

Japan is the third largest economy in the world by nominal GDP ($6.11 trillion), fourth by purchasing power parity(PPP) and second largest developed economy. Currently, their GDP per capita is roughly $48,412 (vs $56,430 in US) and their major trade partners include the US, China, Hong Kong, Australia and South Korea.

Aside from the speculation that they maybe soon pressure their trade partners (excluding the US and China) to adopt a system which allows for instant, near free transfers of funds, here’s where it gets interesting for the immediate future: Japan has already started accepting Ripple(XRP) as legal tender. If Ripple raises to just 25% of the overall transaction volume of P2P, P2B & B2B within Japan itself (represented in the chart by Other Services, Real Estate, Retail, Transport, Communications, Finance & Utilities) which is equal to about 20% of their overall economy, Ripple would be handling roughly $1.27 trillion USD in Japan – alone - every year. To put that in perspective, the current (at the time of writing) market capitalization of Bitcoin(BTC) is $30.7 billion USD (or >0.4%). Unlike Bitcoin, Ripple is legal tender which means that it can be exchanged for material goods and services, which means that it’s likely to have explosive acceptance in the local area.

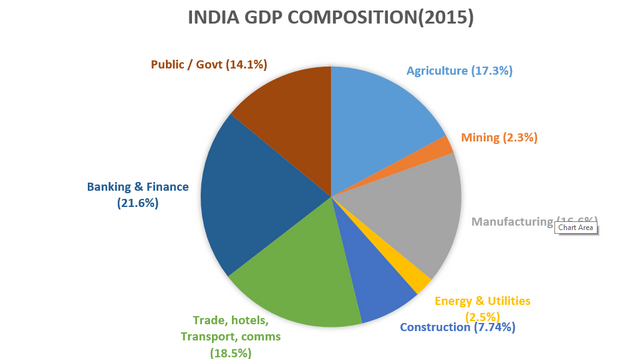

India-based Axis Bank announced in April that they will soon begin leveraging distributed ledger tech for cross-border transactions and to make banking simple and convenient for their customers. About 15 days’ prior, another large financial institution, Yes Bank, also announced that they would be adopting Ripples ledger for the same reasons. If Ripple continues to grow in acceptance at this rate in India, we could see another economy, roughly 1/3 the size of Japan’s ($2.074 trillion USD) add to Ripples annual transaction value. Now, from an economic stand point, this is most interesting because agriculture represents more than 50% of India’s employment, which means that India would be the 2nd case of consumer trading Ripple for staple foods.

It is likely that Ripple will not handle as large of a percentage of overall transaction volumes in India because only two major banks have adopted this currency and it is not the only Crypto. The latter is probably one of the most important variables, as this means that Ripple will be duking it out for market dominancy. As all of my projections are fairly conservative, I would estimate that Ripple will handle roughly 10% of India’s over all transaction volume in the next 365 days, equal to roughly $311.1 billion USD.

One last thing that I would like to mention is that India is literally the ‘I’ in BRIC and roughly 13% of the BRIC countries total output. If the BRIC comes to fruition, India may be able to convince it’s other close trade partners to jump on the XRP-Train as well.

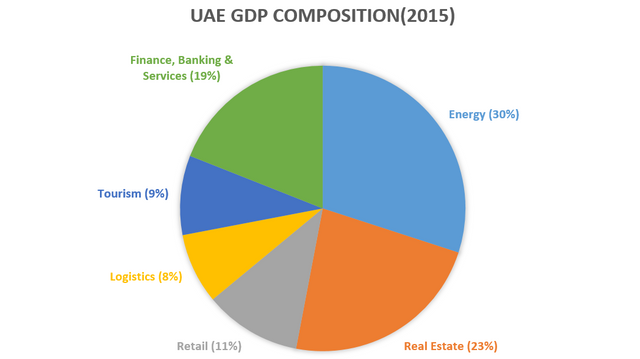

Abu Dhabi Bank, the National and largest bank of the UAE, has already begun offering cross-border transaction services with Ripples distributive ledger technology as well. As they deal extensively with their middle eastern neighbors, such as Saudi Arabia, and Qatar, the UAE is likely to set a trend for other CEMEA countries to follow.

This might be a surprise to some people, but Dubai’s largest industry is the energy sector (shocker!) followed closely by Real Estate and their Finance industry (double shocker!). Although their GPD is much smaller than Japan and India’s (about $370 billion USD), I am anticipating Ripple to handle a larger percent of the UAE’s transaction volume (31.11%), especially in the finance, Real Estate, Retail and Logistics industries. This is due largely to the fact that their population is only roughly 9.157 million, but most Abu Dhabi nationals are very financially inclined (or at least heavy spenders).

Potential Threats

As this threatens SWIFT (unless they are completely on board) and the US dollars’ supremacy in the economic & financial markets, I would not be surprised to see a false flag attack, in which the NSA attacks Ripple and blames it on North Korea or China. Frankly, this would be a cake walk compared to Stuxnet or WannaCry and they could probably hand the task to an MIT intern. Where semi-centralization is Ripples strength in terms of transaction speed and regulation, it is also the biggest security flaw and may open it’s user to some heart ache, hair loss and heavy drinking over the next several years.

Possibility

So, what is possible in terms of value over the next few years? Well, if we consider the following scenario:

- XRP accounts for roughly 20% of Japan, India full GDP, but 31.1% UAE’s GDP ($7.152 Trillion USD) total exchange volume in the next 2 years

- Max XRP Supply stays at 100 billion

- No other countries adopt XRP (not likely)

- No hacks or other catastrophic events remove confidence

- Exclude speculation, demand, rallies, and GDP growth projections for each country

Then we’re looking at each Ripple(XRP) market capitalization over ~$1.75 Trillion USD, making each coin $17.52 in real value. This means that if you were to invest today at $0.362794, your ROI would be about 4,989%. That said, I think that it’s likely it will go over $30 in the next 2 years, due to speculators flooding the markets and other countries signing up. Again, these are conservative numbers are based on total transaction value in USD equivalent.

For those whom subscribe, I will update as new variables are available to my appraisal

Bottom Line

Although it was most definitely created by an insider of the banking industry and does not ‘feel like a crypto’, I personally feel that due to its rapid market acceptance, liquidity and position as legal tender in 3 large economies, Ripple(XRP) is both primed for explosive growth in the near future and likely to be one of the safest value based Crypto-investments we can make today.

Another thing, China is the anchor of the West Pacific, so we should all watch their evaluation of Ripple, very closely. If they were to jump on the XRP-Train, you are likely to see Australia, South Korea, Indonesia and Singapore do the same.

If you enjoyed this article, be sure to share & subscribe, as I have kept my proprietary models and will update as major events and additional countries begin to adopt this currency. If you feel that I have missed something or am just flat out wrong, please be sure to let me know in the comments below!

Planned articles for the next 14 days:

- ICO advice from a Venture Capitalist (Follower Request)

- Paper Wallets (Follower Request)

- VIVA Analysis (Follower Request)

- Segregated Witness(Segwit) : Friend or Foe?

- A Kraken ate my gains...

- Fundamental Analysis: Stellar Lumens(XLM)

- Dual-Citizenship and Banking in Panama

- Rich vs. Wealthy

All analysis, numbers and projections are my own. Core information was gathered from reliable sources, such as the World Bank, IMF, CIA world fact book, eia.gov and more.

Wow man! You really helped me understand a little more about ripple. I have a little in my wallet and I really see potential. Thank you very much for sharing this information. Steem on!

Sometimes in recent future, it may be the second bitcoin. If it is accepted by all the banks worldwide it will be the strongest currency.

Hope Ripple will reach the Moon soon.

I've been looking for a good analysis of Ripple like this, thanks! I think I will buy some in this current dip.

I'm looking forward to your VIVA analysis and whatever else you post!

Hey @kenny-crane,

Thanks for your thoughts. I'm looking forward to VIVA as well!

A very good article @lennartbedrage. It is original content. This has been so scarce, unfortunately. Thank you.

I am sorry I am too late for giving a useful up-vote, but I am not too late for following.

I have a question about Ripple that would affect you analysis, if you don't mind:

How does the Ripple system use XRP? I mean that if a bank wants to use the Ripple network to transfer money, does it have to exchange their fiat money to XRP? Or does have to pay a transaction fee only?

I am sure you can appreciate the difference. If the bank has to pay fees only, then the size of GDP is not important, and hence, the analysis is not correct.

It seems that you have worked hard to write this post. Thanks a lot.

Not a bad write up.

Ripple's Consensus Ledger is very different than XRP

The one place you leave out is this difference. The Ripple Labs Consensus Ledger product certainly is described by your post fairly well. Everything that references XRP however, is not in fact a required component of the RCL network. While I will not argue about its possible utility, I will say that the current investors do not know what they have bought into and I am not certain how long this speculation can last (cough polo).

That is a very important point @kyle.anderson.

If XRP is not used as a currency for trade but only to pay fees, then the GDP would not matter that much.

I would really like to know what is the role that XRP would play in the Ripple network. If you can guide me, I would appreciate it a lot.

well really it is to improve liquidity and to provide fee incentives. although I believe both are broken in some ways. there are better solutions with smart contracts now.

banks are not using XRP rn.

As a cryptonerd, I have one policy when it comes to Ripple trading:

Always profit. Don't let those dirty banks see even a single penny of your funds.

Take as much profit as you can, and then buy truly worthy cryptocurrencies with it. Muhahah.

I couldn

t agree more. Lets steal some wealth from those pricks! :PPUMP AND DUMP!

The banks using the token only "own" it for about 4 seconds. Even if the price fluctuates, the use of "transaction insurance" will mean they didn't really "pay" for anything other than the cost of doing business.

Excellent read! thanks @lennartbedrage.

As a libertarian and decentralized at heart this is obviously not the preferred way to invest. But when you look at the bigger picture, it`s very obvious that the bankers are going to use their own tech and not an decentralized one. And with the amount of money that is likely to pour into this tech the value is doomed to up.

Very interesting post, thanks