Likely Response to the Recent Market Surge

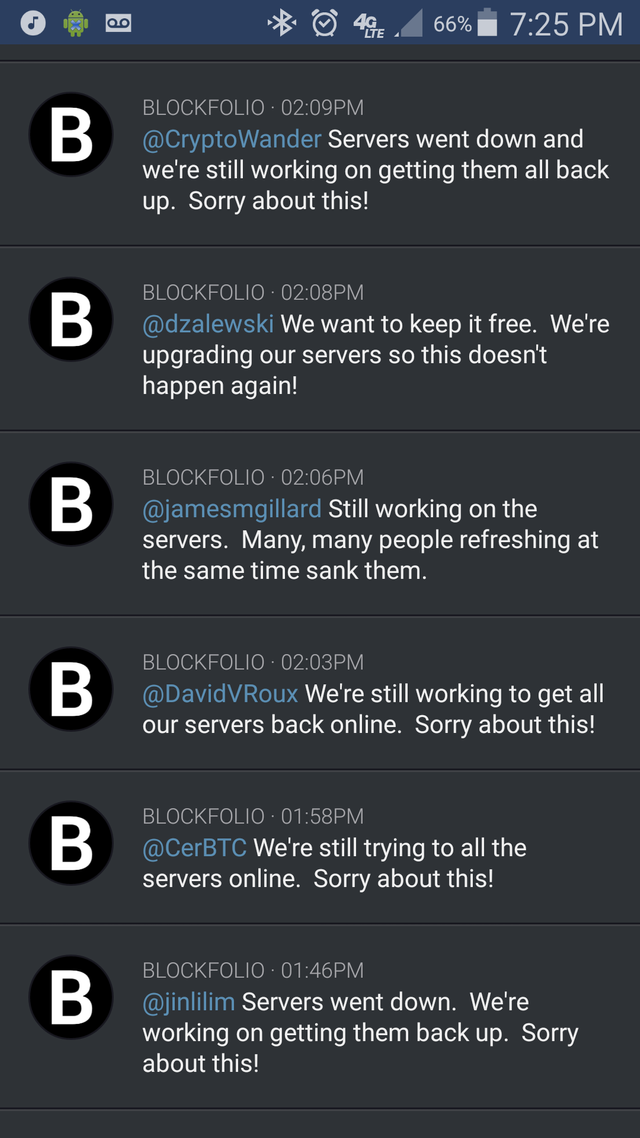

For the the majority of us early early adopters(which are not to be confused with visionaries), the past few weeks have been maddening. First Kraken slows up, then Poloniex users increase by 600% in less than 14 days. Shortly after, Bitfinex temporarily suspends new user sign ups until this afternoon, and both Blockfolio & CryptoTrader applications quit working, which according to their twitter was due to not being able to expand their servers fast enough.

As I'm always concerned with anticipating the markets, I can't help but wonder what type of changes that this influx is influencing for cryptocurrency enthusiast in terms of corporate interest, regulation, state control and more. What I believe that we're starting to see are infrastructural and security issues caused by the beginning of mass acceptance. As a snowball effect, these issues are likely to grow faster than the start-up phase of the crypto markets more rapidly than the decently organized entrepreneurs and community are able to keep up. This may pave the way for the high organized market movers of the corporate elite and bring about a new age in the markets.

Attracting Corporate Interest

The crypto community has been a relatively small (relative to the well defined FOREX, Securities, Bonds & Commodities markets) community of enthusiast, speculators and recently, capitalist, whom exchange cryptos on decentralized platforms across the web. Although I'm sure that profits were at the core of their intentions, securing sufficient equity to build an exchange could have been accomplished with a 5 man team of knowledgeable techies and a few million dollars in start up capital. In the case of Kraken, they were extremely successful. But what happens when twitter becomes riddled with complaints of 2 hour fill orders and extremely expensive business models like Coinbase are continue to handle the influx in stride? What happens when Bitcoin reaches 12 or even 18% market acceptance? Will the capable entrepreneurs be able to keep up with an enterprise volume of problems - and do they even want to?

I once treasured my skills as a self-taught programmer and capabilities as an entrepreneur. I felt like the sky was the limit and anything was possible if I had possessed enough passion about the idea I was trying to create. But, becoming a part of an executive team (and building several small s-corps from the ground up) changed my whole perspective on American and international business. Corporations have access to talent, capital and connections like you would not believe. Though I'm sure we can all think of poorly run corps, their abilities to network and create market moving alliances of most is completely unparalleled.

I love the free-market spirit of the crypto world. But as mass acceptance creeps upward and it has proven lucrative enough and it's infrastructural issues large enough, they may attract corporate grade attention, and we are likely to see them begin staking their claims on the markets in the next 18 months or less.

What drives this change?

Oddly enough, the people who will be responsible for driving this change are the same who are responsible for your portfolio gains over the past several months : The Layman's. Less capable than their tech savvy predecessors, these investors will be flooding the crypto markets with their retirement funds in pursuit of the American dream. As we saw in America in the years prior to June 6th, 1934, these ‘investors’ will likely suffer big losses, practice unsafe storage techniques and flock toward a turn key solution with seasoned corporate governance, bottom line driven models and commercial branding. In fact, we’re already starting to see small indicators of this type of investor, via markets for products like the Nano Ledger S, which was created for the less than computer savy investors whom are not about to jump on git-hub to learn how to create an encrypted flashdrive or paper wallet.

Another indicator that this scenario is about to happen is that the radio and news stations have already started talking about the gains that they would have made on Bitcoin, Ethereum(ETH) and many others. In fact, a friend had told me that his local station mentioned Litecoin(LTC) gains this morning!

Regulation

As I wrote in my post on tactics the central banks could deploy to pop the crypto bubble, it is not likely that the US govt is going to let an massive un-taxable market slide. Infact, show of hands (up votes): how many of you have made more on your crypto portfolio gains over the last 6 months than you did at your day job?

The fact is that the citizens whom they had planned to enslave with debt and fear, have recently created financial freedom in a way that would likely topple to expedite the already dropping confidence in the US dollar. To use the US debt (which I will write another article about later) as an example, America has $19.9 trillion dollars of public debt of which 60% matures in the next few years, and $12 trillion of consumer debt to lending institutions, mostly run by the central bank. And, with the threat of the gold-backed BRIC on the horizon, a strong Russia, rapidly expanding asset base of the Chinese and ever more popular socialist movement in the US; it is not likely that these crypto-gains will go untaxed or unregulated for long.

Ironically (or not), regulation is that only way that corporations grade exchanges and institutions will be able to enter our markets. Although it’s true that we will see larger market caps and some massive gains on the way to the top, we may also see unregulated and untraceable currencies fall quite far.

Why hasn't this happened yet?

By now, you may be asking yourself this question. Well, this scenario hasn’t happened yet because it simply isn't worth their time, which is because we (regular people) have not defined the market or brought it’s value up enough. According to data from Cryptolization, the total crypto market cap is currently at $84.6 Billion USD. So let's put this into perspective:

- According to Rueters, the global FOREX market, although shrinking in the last year, is worth $2.08 Quadrillion USD annually (based on avg $5.7 Trillion every day) or 2,459 times the value of the crypto markets.

- The US arms deal with Saudi Arabia is worth $110 Billion USD - that’s one deal, worth 130% of the total market cap of cryptos.

- According to Market Watch, the USS Gerald R Ford Class of aircraft carrier fleet is worth $130 Billion USD…. that’s one project, for a single General Contractor, worth 153% of the entire crypto market.

Conclusion

I think that a lot of us know that this is too good to be true (in terms of longevity atleast). I know that I’ve talked about a lot of gloom and doom, but there is are two massively valuable silver linings to all of this:

- Most of us will make some life changing gains on the way up, which could make some pretty interesting stories for the grandkids.

- The knowledge that the journey brings could also be life altering, in that it will teach many users higher mathematical skills, some low level computer programming confidence, IoT security practices, and medium/high level research skills.

Prior to the age of the Corporate/Regulated crypto markets, successful investors (analogous perhaps to the pioneers of the American west) will learn how to rapidly identify intrinsic value in a way that has never before been mainstream, as well as naturally identify market trends and apply basic economic theory for gains in other sectors. At the core of the changes that the blockchain will bring to the commercial industry are rapidly evolving people.

If you disagree or think that I have left something out, please let me know in the comments below.

Planned posts for the next 14 days:

- ICO advice from a Venture Capitalist (Follower Request)

- Paper Wallets (Follower Request)

- VIVA Analysis (Follower Request)

- Tezos Analysis

- Segregated Witness(Segwit) : Friend or Foe?

- A Kraken ate my gains...

- Stellar Lumens(XLM) Analysis

- Dual-Citizenship and Banking in Panama

- Rich vs. Wealthy - Which you would rather be

- What the US is doing wrong, and what it means for Cryto’s

- Bitfinex | In Depth Review

@lennartbedrage

Your are a very articulate writer and I appreciate your extensive research that is clearly evident! I have had similar concerns regarding the overly massive acceptance of cryptocurrency into the mainstream. Not that it's not exciting in one sense, but it there is also a flip-side as the fear of regulation would only become more likely.

One of the things that we all love about cryptocurrency is its freedom and how it is a brilliant example of free markets at work. I know that nothing this awesome last forever but I hope that the journey will be a long one and that this movement will transcend whatever negative agenda might come its way.

Thanks again for posting! Have a good one! :)

Thanks for your support and commetnts, @breakingtonight. It is a pretty awful topics to have to get on, but I want to stimulate a little food for thought to make sure that people retain the wealth generated by these exciting markets! I'll go over some ideas for this in other posts.

Thanks for your support!

You're welcome @lennartbedrage

I'll be watching for your next post!

Thanks for the thoughtful points. Looking forward to your future articles and analysis. No comments on Litecoin planned?

Oops, scratch that Litecoin comment, I see you just did an article on it. ;)

Hey @kongzilla, I posted an artilce warning my followers that Litecoin(LTC) was under-evaluated about 12 hours before the price jumps. Unfortunately, I noticed the problem about 72 hours ahead, but was traveling and unable to write and article.

@lennartbedrage

Completely unrelated topic but I couldn't find a better way of contacting you, sorry about this. I found you on the TDV forum where you linked some of your articles. First off, I really like all the analysis you've done, especially on ripple. I got some myself after being convinced, even though initially I absolutely detested the fact that it was so regulated. Hey, if the price goes up, who cares in the end :).

Secondly, I was wondering how good the premium membership for TDV is? Are the alerts and recommendations actually worth it or are the issues and alerts from the basic subscription already enough. I don't have much to invest in anyway, and I am not a fan of the stock market.

Thank you very much!

Hello @blimperman, I'm glad that you enjoyed the analysis and hope that you will follow and resteem for more of the same. Unlike my Sunday post on Litecoin(LTC), I hope to give a more than 24 hours notice of investment opportunities in the future.

The premium TDV membership only provides a preliminary stock pick recommendations, but leaves a lot to be desired. TDV doesn't run analysis on Cryptos at this time, but I will be canceling my subscription for other reasons.

Hope that this helps!

Yeah this helps a lot, it prevents me from throwing down at least 75 for a 3 month subscription. I may stick with the basic subscription though. May I know the reasons why you're canceling your subscription to TDV? It'll provide me with additional insights since you've been a member way longer than I have.

I'll also be sure to upvote your posts :), thank you!

I'm not in the business of slander, so the only thing that I'll say is that I'm not finding the value that I was hoping for, which is fine. It was worth the ride and now I know.

Congratulations @lennartbedrage! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Congratulations @lennartbedrage! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Congratulations @lennartbedrage! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

Amazing article. Loved the conclusion, especially the two bullet points. Thanks!