The Volatility Daily - 09/21/20: No Buy Pick Today!

Hey, what's up guys? Today there is no buy pick since the market is down once again, but here are our sell signals!

Note About These Charts:

Straight Green Line = Buy Line

Straight Red Line = Sell Line

Buy Signal = When price line crosses above both the Buy Line and Sell Line

Sell Signal = When price line crosses below the Sell line

Signals are generated at midnight UTC Time

Today's Buy Pick:

No buy pick today!

Today's Sell Signals:

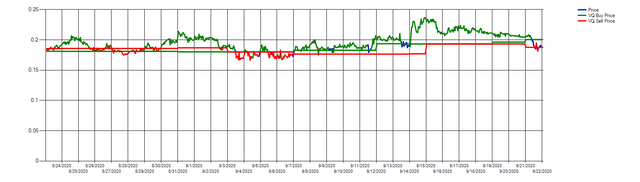

Metaverse ETP

Today, Metaverse ETP closed just below the sell line as of midnight UTC time so we need to sell this to reduce our risk. Let's sell this at the current price of $0.184984.

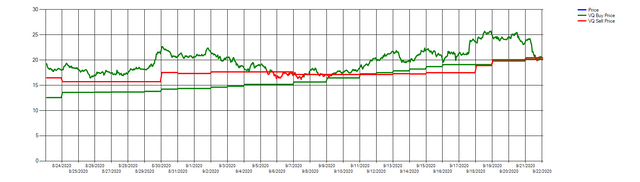

Neo

Today, Neo also closed just below the sell line as of midnight UTC time so it's time to lock in some profit! Let's sell this at the current price of $20.01.

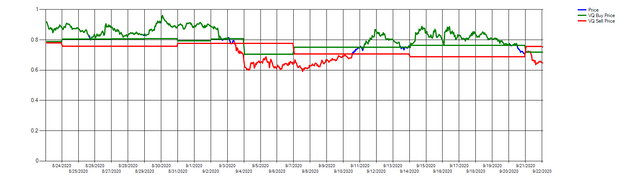

Ontology

Today, Ontology also closed below the sell line as of midnight UTC time so we need to sell this to reduce our risk. Let's sell this at the current price of $0.640865.

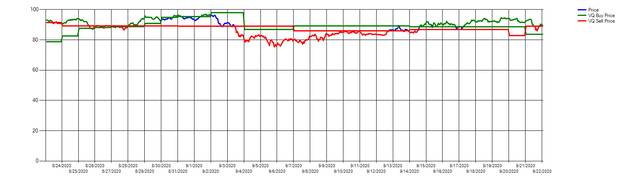

Monero

Today, Monero also closed just below the sell line as of midnight UTC time so we need to sell this to reduce our risk. Let's sell both of our current positions at the current price of $89.10.

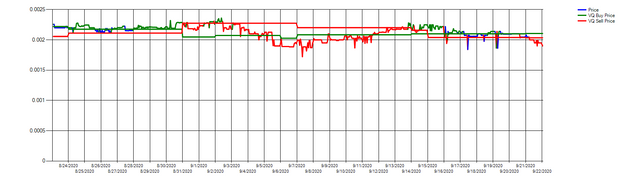

Everipedia

Today, Everipedia also closed below the sell line as of midnight UTC time so we need to sell this to reduce our risk. Let's sell this at the current price of $0.001807.

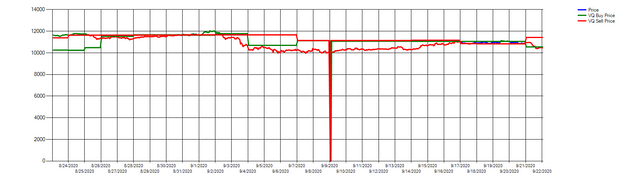

Bitcoin

Today, Bitcoin also closed below the sell line as of midnight UTC time so we need to sell this to reduce our risk. Let's sell this at the current price of $10,429.27.

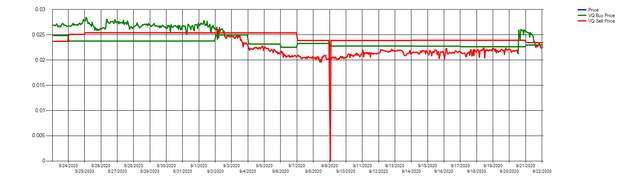

Ignis

Today, Ignis also closed below the sell line as of midnight UTC time so we need to sell this to reduce our risk. Let's sell this at the current price of $0.020804.

Current Returns

N/A

Average of Current Returns

N/A

Locked in Returns (Last 50 Positions)

Bancor - 96%

Stratis - 93%

Cardano Position 2 - 161%

Bitcoin Gold Position 2 - 106%

Storj Position 4 - 138%

VeChain Position 3 - 97%

Zilliqa - 111%

Stellar - 99%

Ethereum Classic Position 2 - 96%

Chainlink Position 6 - 325%

Tezos Position 2 - 118%

Maker Position 2 - 91%

Augur - 95%

Zcash - 98%

Ethereum Position 4 - 159%

Ethereum Position 5 - 162%

WAX Position 2 - 93%

WAX Position 3 - 97%

Decred Position 3 - 104%

Binance Coin - 96%

Peerplays - 100%

Maker Position 3 - 95%

Basic Attention Token Position 3 - 119%

Kyber Network - 93%

Arcblock - 76%

Bitcoin Position 3 - 99%

Chainlink Position 7 - 95%

EOS Position 3 - 90%

0x Position 7 - 102%

Monero Position 1 - 89%

Ethereum Position 6 - 99%

BitShares Position 1 - 71%

Decentraland Position 4 - 178%

Loopring Position 1 - 139%

TRON Position 3 - 118%

Aave - 83%

Loopring Position 2 - 93%

BitShares Position 2 - 58%

DxChain Token - 97%

AdEx - 87%

Quantstamp - 92%

IoTeX - 81%

Metaverse ETP - 97%

Neo - 113%

Ontology - 86%

Monero Position 2 - 97%

Monero Position 3 - 97%

Everipedia - 90%

Bitcoin Position 4 - 94%

Ignis - 88%

Average of Locked-In Returns

107.02%

Average of all Return Types

107.02%

Thanks for reading this edition of The Volatility Daily and stay tuned for more picks and more return data!

.png)