Korean Traditional Finance is Getting Destroyed by Crypto Like it’s Not Even Funny

Korean Traditional Finance is Getting Destroyed by Crypto Like it’s Not Even Funny

It's a big win for crypto this week, as two indicators show that cryptocurrency is pulling more interest on both the customer side as well as the employment side of things.

Bitcoin was built, in part, upon the idea that the banking system had failed the average person, and was taking advantage of the majority for the benefit of the minority. (Bitcoin White Paper) And although this is far away, a new poll conducted in Korea shows how much progress cryptocurrency is making, as well as how much upside we may have moving forward in the future.

Crypto and Stocks

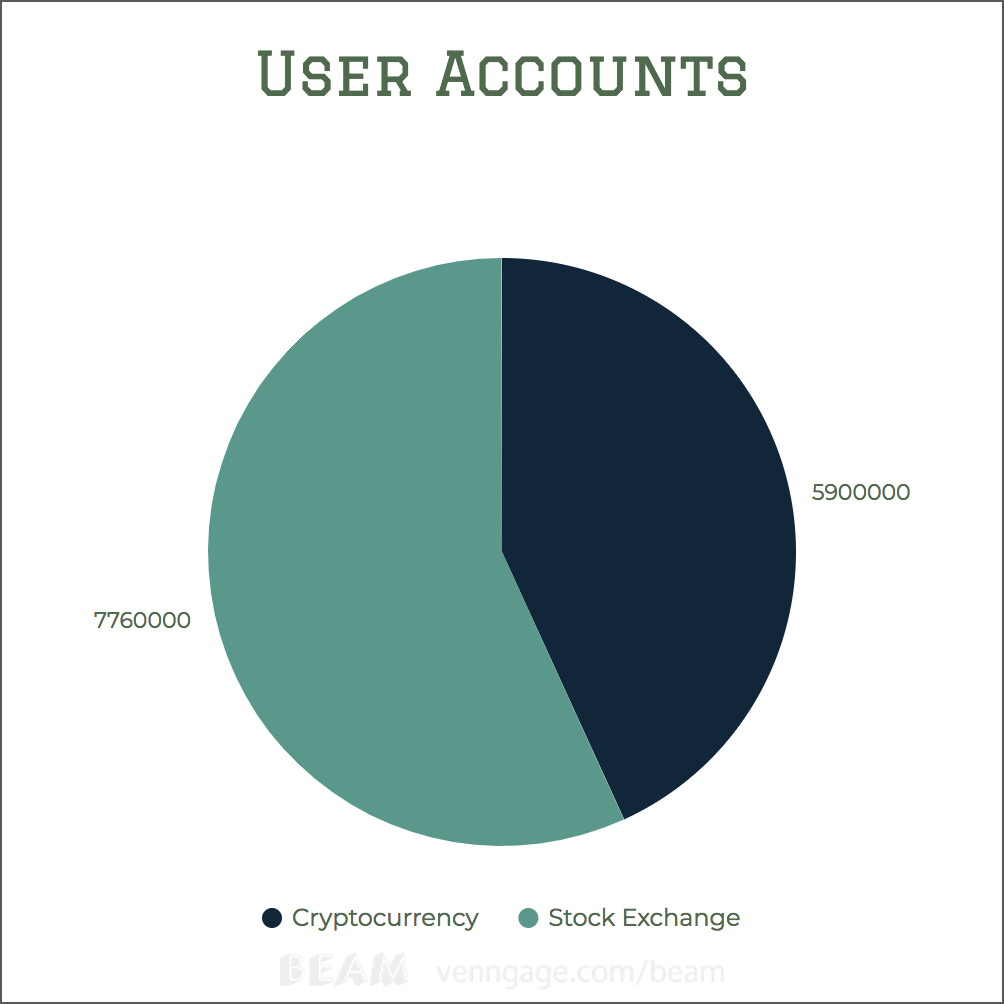

In Korea, a recent poll shows that the amount of cryptocurrency exchange accounts has exploded, moving from under 1 million last year to over 5 million this year in Korea. Not only is that 10 percent of the whole population, but more impressively that is ⅔ of the amount of accounts registered in the traditional stock exchanges in Korea. These users are spread among different exchanges with the largest being 3.3 million unique users on Bithumb, 2.9 on Upbit, and 700k on Coinone, with other exchanges have less.

But are the results of this new survey really a surprise? We have known since last August that the volume of crypto exchanges in Korea passed the stock exchanges here, and last August was a blip in crypto compared to what is today. And when you remember that Upbit didn’t even exist last August, that number is pretty incredible. It would be hard for anyone to say that cryptocurrency isn’t a thing at this point.

But then who are these new users, and how much time are they spending on cryptocurrency exchanges? The majority of the users, over 50% in fact are between 19 and 30. This is the effective opposite of stock exchange users, where 50% of users are between 40 and 60. These users are also spending significantly more time on these sites than those of traditional stock platforms, with Upbit holding the record for an average of nearly 500 minutes per day per user.

In the next year, I wouldn’t be surprised if 2018 is the year when number of crypto accounts surpasses traditional ones. It's only a matter of time before even stocks are traded as an asset on a blockchain, and Korea might be one of the first places where this takes place.

.gif)

http://www.yonhapnews.co.kr/bulletin/2018/03/02/0200000000AKR20180302152200033.HTML?input=1195m

Crypto and Finance

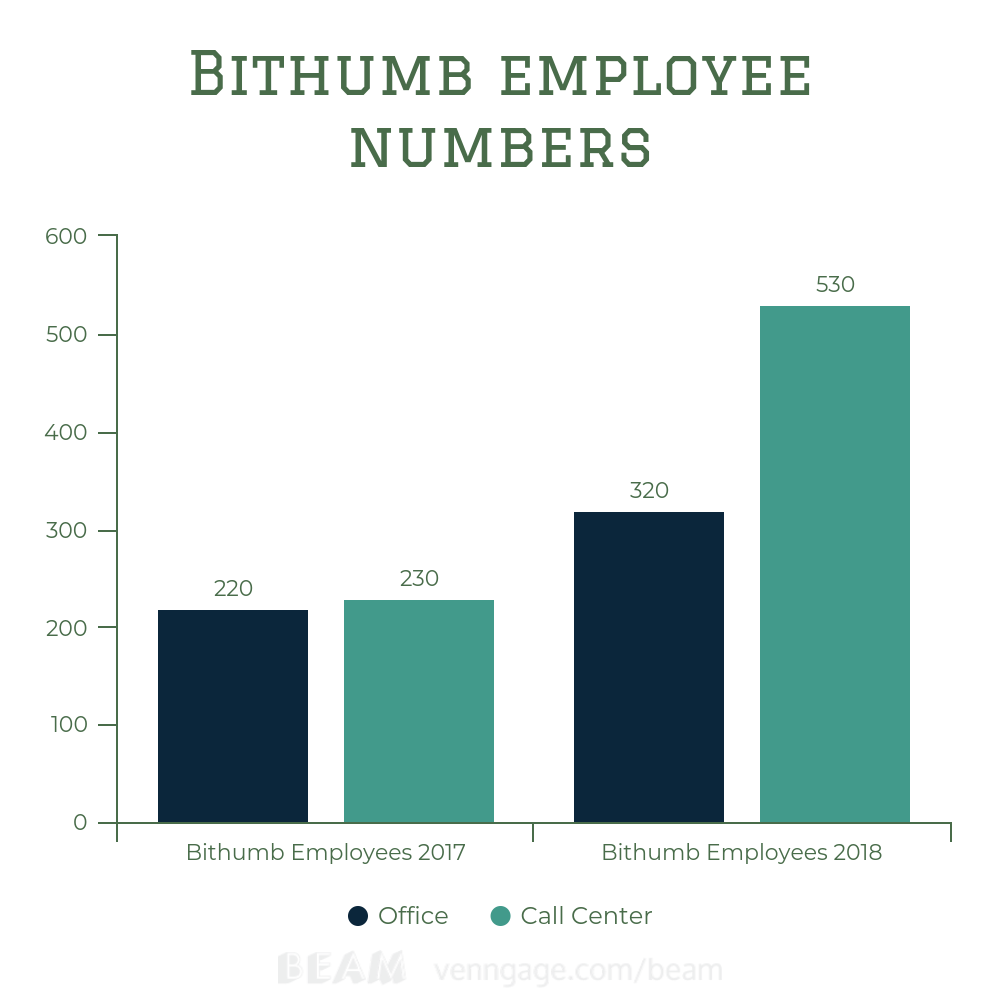

To add insult to injury, banks are also not only losing young capital to crypto, but also young employees. The financial and banking industry in Korea has been plagued the last year or so by scandals, and other issues. With the huge growth in cryptocurrencies, that has directed much of the young workforce elsewhere, seeking jobs that are both more fulfilling and have more potential. Cryptocurrency exchanges have stepped up to fill that void.

Currently Upbit and Coinone have around 100 employees, and Bithumb has around 450. But that is expected to increase. Upbit has announced that they are consistently adding employees, and Bithumb announced that they are planning to add 400 new employees to the 450 they already have. The need for these exchanges to hire employees who can read a white paper and understand it, and then provide information about it is high as many people, even investors are still lacking in basic understanding of blockchain technology.

But many and plenty of youth are excited about this space are stepping up to fill these positions. Development, security, and business strategy are spaces where exchanges have said that they have the greatest need for employees.

http://www.greened.kr/news/articleView.html?idxno=52942

So what does this all mean? I think it means great things are coming for crypto. It means young people are excited about this space, and are MUCH more interested in it than traditional markets. It means that these people, who are on the edge of technology and societal development are going to put their intellectual resources towards making this space succeed and work for everyone. And Korean youth especially seems to be making their own space in this industry. The CEOs of both Coinone and Korbit are both below 35, showing that this industry is one in which youth are and will continue excelling.

It means that over the next five and ten years, more adoption will come as more and more young and tech savvy people get into the market. And also it means finance is going to be something that everyone can be a part of, poor or rich, young or old, woman or man, north or south, cryptocurrency isn’t going to be a group for you and your friends from the country club.

.png)

Great article!!! It's very helpful to have the analysis showing the growth of crypto relative to the Korean stock market and banking sector. Good work.