CryptFolio - Here's How To Protect Your Portfolio In These Downward Trends Markets...

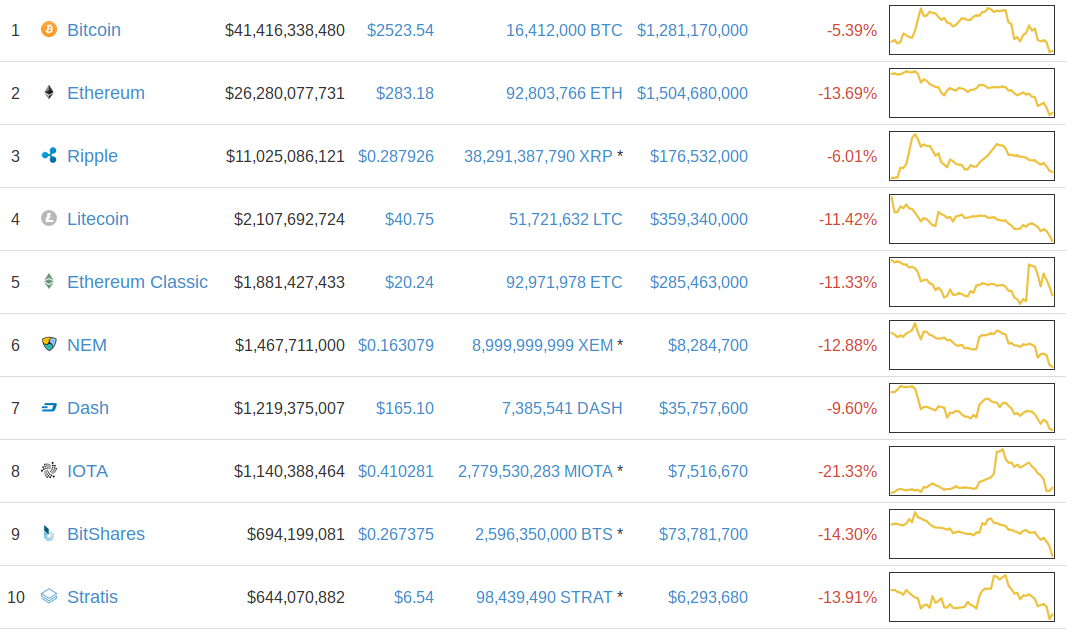

Red candles have painted the sky an ominous shade in the crypto universe over the last few days. Most have watched their portfolios dwindle in value, all by the same eerie candlelight. We often forget how lucky we are to be aware of this space, but in times like this being an investor in crypto can be disheartening. Just take a look at the Top 10 on Coinmarketcap; absolutely nothing is in the green, not even close!

When the tide of the markets turn, our approach to trading also needs to turn. No longer are we striving for increased profits, instead we must strive for decreased losses. If you’ve lost more money than you care to think about over the last few days, then never fear. There’s been a lot of talk recently about a cryptocurrency bubble, and I’ll admit we are likely in one; however, this sea of red isn’t indicative of that bubble fully popping. I read an investment book the other day that discussed the telltale signs of bubbles before they are about to burst. It compared the recent crashes in both the housing market and the dot-com bubble. The main take-away was that right before both of these bubbles burst, EVERYONE was aware of the money that could be made, and ‘dumb’ or ‘unaware’ was pouring in left, right, and centre. For example, in the housing market in the UK, right before the crash, several footballers (*sigh* soccer players) were seen on TV bragging about their property empires. The mainstream was well aware of the profit-potential in these markets, and that hype added to the crash. The good news for us is that whilst we’ve seen some outrageous profits, the general public is still largely unaware! We may be going through a slight bear market, but rest your weary heads, for the bubble has not burst… yet.

Nevertheless, we all want to protect our portfolio during these downward trends. If you’ve seen the value of your portfolio lose more digits than you’d care to think about in recent days, one of the tips below may be of use.

Go Fiat:

I hate to be an advocate of fiat, but it truly is going to be the option that minimises your losses. By doing this, you’re essentially attempting to short the crypto market. This is risky. Time it right and you’ll not only have protected the value of your portfolio, but it will have actually increased when you buy back in. Time it wrong, and well, you could miss out on the rise, and see even more value erased from your portfolio. This method will work best if you are able to constantly check the price, set price alerts, or buy orders to buy back in at the exact right time.

Move Position To A More Stable Coin:

Whilst many downward trends seem to impact the whole market, they do not seem to impact the whole market equally. By moving the majority of your portfolio to a small number of coins that suffer less, you can minimise your losses.

“All coins are equal, but some coins are more equal than others”.

Up until recently I’d have suggested Ethereum being one of these more stable coins, however, this no longer seems to be an option. Your best bet, statistically speaking, would be of course Bitcoin. However, Ripple and Dash have both suffered considerably less than the market average. Other than Bitcoin, my best ‘loss-minimising’ asset was PIVX. Of course, this is a rather defensive investment option, so it may not be ideal for everyone.

Pick A Winner:

Usually, it seems that groups of investors, or possibly single whales, choose a coin to move a large amount of money into during these downturns. This random coin then has its price pushed through the roof and manages to see profits whilst everything around it has failed. For example, today CloakCoin (haven’t heard of it? No surprise there) has risen by almost 30%. The best way to pick these winners? If you don’t have insider knowledge, may I suggest throwing darts at a board or astrology?

Use The CryptFolio Matrix:

The above options are methods that can be adopted once the downward trend has begun, but that isn’t always the best option. By the time you’ve become aware of the trend, transferred coins from your wallet to the exchange and decided on your move, it could be too late. For me, I use my CryptFolio matrix to manage my portfolio to ensure that it is protected against these trends. The matrix can be used to analyse your portfolio to see at a glance whether your assets are skewed towards short-term or long-term, high-risk or low-risk investments.

Following the matrix, my portfolio is currently split roughly 50% in Turtles, 40% in Whale Sharks, 8% in House Flys, and 2% in Snails. As a result, my portfolio is heavily skewed towards long-term, stable assets; each of these has varying degrees of real-life use cases which can be used to guarantee their value to some extent. Once the markets turnaround, a number of these assets will increase drastically as money flows back into the logical investment decisions. Consequently, I feel that I have not only been able to minimise my losses during this downturn, but also positioned my portfolio to increase the most when the market is back.

Portfolio management in the cryptocurrency space is not a long-term situation. A number of assets should be held for the long-term, those classified as Whale Sharks or Turtles, but importantly, the volatility of prices means that portfolios should be actively managed and analysed for optimal profits. I use the CryptFolio matrix as a way to stay on top of my portfolio, both in bear and bull markets.

Let me know what you think of my suggestions in the comments below! I’d also love to hear what tools or methods you use to manage your portfolios and why you have chosen that particular option.

---

This is part of a super regular segment I'll be doing, to make sure you don't miss out click through to my profile and follow me! Let me know in the comments below if you do, I'd appreciate it! Also, got any comments, questions or suggestions fire those at me too!

Disclaimer: For legal reasons, this is not intended as advice, I'm happy playing with fire with my own money, I do not by any means suggest you do the same moves I do. I will, however, be posting them, and the reasons here, and if you choose to follow me, then sweet!

This is indeed a very good advise, I dont like movign to fiat but I sometimes should.

I agree, it really isn't something I ever want to do, but you're right. Occasionally it is something we should all do to protect our profits!

Would you suggest the use of stop losses to minimize these losses, so that you can rebuy whatever currency is crashing at a discount. I tend to notice that the price drops of the alt coins usually is a much stronger loss than bitcoin.

In this scenario, would it be better to sell into bitcoin when these blood days are recognized early so that you can rebuy at a discount? I have never moved my money from crypto back to fiat, instead I usually use days like these to put addition fiat into crypto and look for alt coins on sale for a deep discount?

I am pretty new to trading, but yes, am noticing that there is a lot of blood and recoveries very often, and there has to be ways to use these swings to your advantage.

Thanks,

Tiff

Thanks for the question Tiff :)

Stop losses are definitely a good way to minimise your losses. However, you have to be careful, they are by no means guaranteed at the price that you set it at. You can lose a lot quickly by doing this. I believe this is why some people lost SO much money in the recent flash crash of ETH. Also, if the ration you use is, for example ETH/BTC, if both coins are dropping in value, setting a stop loss can be extremely complicated as the coins will keep losing value but the ration may never be triggered!

That's certainly a good method, going into fiat removes your exposure to the losses of course, but Coinbase (the exchange I use for injecting fiat) usually sells at a lower price, so unless you move early it won't work; thus Bitcoin is usually the best option. What you describe is called shorting, and does work, but only if other coins drop further than Bitcoin. If you're adamant on buying back into a specific alt you can also lose money by trying to time the market, but that's a risk you take for the opportunity to make more of your chosen alt.

For now, Bitcoin always seems to drop less than the market average so it is almost a safe haven. Although there are a number of events occurring towards the end of July and beginning of August which could change all of this!

Let me know if any of this doesn't make sense and I'd be happy to go over it :)

I upvoted commment but Haha I think I've upvoted too much.

But yeah, I was thinking either that or if you sold a currency that only dropped a little bit to buy one that really crashed hard, then hopefully in the day or two after the one that crashed hard would hopefully rebound a bit stronger as it might have been more over-sold than the one you sold. You'd maybe come out ahead with more coins in the other currency, which benefits the long game?

Yeah I appreciate the upvote :) but it may be weakening your Vote Power too much, especially if you upvote regularly :)

That's definitely a possibility. Although it usually would only work if the fundamentals of the cheaper coin were good; not everything will bounce back from a dip. Importantly as well, even if it does recover, it may take a long time to do so. At which point you either have to recognise a loss, sell and move on, or sit it out which could mean you lose out on the potential profits you could have made elsewhere.

It's a tricky thing to do!

Yeah I have been super active this last day and upvoted a lot of content. Is there like an amount of upvoted I should try to limit myself to?

And yeah I'm torn between shopping for some DGB on sale or putting it into steempower. I think the steempower probably might be better longterm.

That's great though, you're using the platform, that's always good :) Yeah there is, there's a thing called voting power, that needs to be at 100% to give the full power of a vote. Each vote reduces the power; although off the top of my head I don't know the exact mechanics of it sorry. There's loads of steemit articles on it though, try a Google search :)

Steempower is good but, and I think it's a massive but, you need a LOT to have any real impact, and you also have to lock it away for pretty much 2 years. Unless you've got a few spare Bitcoins I've always considered it better to invest. Entirely up to you though, I read somewhere you get interest on Steem Power, so if you're super confident Steem will increase it could be wise.

As for DGB I hold some myself, but I'm not aware of anything that would make me double down on it. Do you know if there's any news coming out soon?

The only thing a stop loss is going to do is get your order filled as the hedge funds controlling price can likely see the prices where stops are concentrated. That is indeed what happened to ETH last week. "Luckily" for those who did not use stops price recovered to $350+. The otehr problem with stops is that there is a very small window for sell orders to get executed through. Because the exchanges are so inefficient they might only be able to handle 25 sell orders at any given price out of the 250 orders that have had the limit sell triggered. In a fast market selloff, if price stays doooown, it is conceivable that someone with a stop set at say $250 on ETH would have ended up with the $13 if that's where price stayed until the Chinese mining machines matched up the buyer and selller. Crypto trading is certainly a way to eliminate your wealth very quickly as many will find out soon I'm sure.

This is great information!

Thanks, I always try to post useful info :)

good posts ! I'm going to follow for more quality posts like this.

Please check my posts too, and feedback is appreciated.

Great, thanks my friend! I will do!

great article! full coverage of all!

followed+upvoted+resteemed

Thank you my friend! Good to have you on board :)

Re: getting fiat in via Coinbase do you use your debit/credit card or SEPA? I haven't done the SEPA setup yet as it takes days and my bank charge £15 for it.

I didn't use Coinbase, I used Bitstamp when I first got into crypto. I used SEPA and paid £25! I now use Coinbase, I also recommended to a friend who put fiat in using debit card and he seems pretty happy with the system.

SEPA is recommended for big purchases. I take that as meaning anything above about £500. Although I don't know debit card is not suitable for larger amounts. I just use coinbase to cash out my inital stake plus a little extra 'me' money :)

Thanks @jhcooper7. Is it free to cash out via SEPA? My issue with the debit card is that the weekly limit is far too low for me right now. So was looking at SEPA to deposit a reasonable amount of GBP to have on hand for trades and benefit from lower fees (1.49% vs 3.99%)

I have not, as of yet, cashed out. My girlfriend is screaming at me but I have a long on Golem that I am waiting to close before I do cash out. I spoke the bank and there is no charge on their end, it is down to Coinbase.

That's good to hear then - don't want your profits to be tied up with paying fees! When you cash out on golem I assume you then transfer the proceeds (fiat/BTC/ETH/LTC?) to Coinbase and then withdraw via SEPA? Sorry for the questions! Trying to understand the end to end process :)

No worries, you only learn by asking! Yeah, I'm likely to do it via ETH as it is, or at least was last time I did this, a faster cheaper network. Once it's in Coinbase I have to sell it for Euro to then be able to get £s into my English account. It's a very long-winded process!

Why sell for Euro if you want £ in your English account? :) That's smart using ETH for lower trans fees I know BTC looks quite expensive (and is slow). LTC looks like it has low trans fees - I need to compare this to ETH

Coinbase won't let you withdraw £s unfortunately

Ive read and upvoted them both, I liked reading the first one better because it had more pictures wich made for an even more fun read but i liked the second one just as good.

Keep writing quality content!

Great glad you liked them! Thanks for the feedback, I'm going to try to incorporate more images going forward but I'm better with words than images and I sometimes can't quite find the right image to use unfortunately.

Congratulations @jhcooper7! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by gunni55 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

Here is the reviews of Cryptfolio Portfolio tracking