Cryptocurrency This Week: Tumbling Bitcoin, New Crypto Fund And More Important Happenings From The World Of Cryptocurrency, Bitcoin, ICOs And More

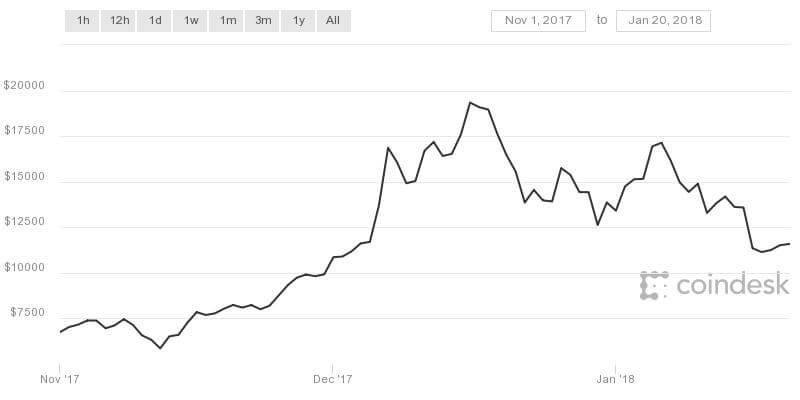

As Bitcoin price has plunged to $11.5K, critics have started writing this as the end of the road for Bitcoin. The analysis also depends upon how do we look back. If we are analysing Bitcoin pricing for the last one month the price has fallen by over 40% from $20K to $10K recently. However, if we take two months into account, Bitcoin price has gone up by over 50%, from $5.6K to $11.5K. The cryptocurrency market after hitting $750 Bn is down to $581 bn.

While many investors are shying away from investing further in cryptocurrencies, some investors see it as the perfect pucker up time.

India: Crypto Fund Authorito Capital Launched

Despite the Indian government having equated Bitcoin and other cryptocurrencies with Ponzi schemes, and issuing notices to over 500K HNIs involved in Bitcoin and other cryptocurrencies trading, Bitcoin community is still hopeful for a better Bitcoin future in the country.

As leading banks in India have reportedly suspended the bank accounts of leading cryptocurrency exchanges, Mohit Mamoria has founded a crypto fund named Authorito Capital that aims to help invest in cryptocurrency.

According to Mohit, Authorito Capital is like a mutual fund but for decentralized assets. Authorito Capital is an actively managed open-ended crypto fund. “For any investor, this fund is the easiest, diverse and the most secure way to start investing in cryptos. We are unique in the sense that along with trading, we also use mining to grow the Net Asset Value of the assets under management,” he said.

RELATED STORIES:

Cryptocurrency This Week: India And South Korea Shy Away From The Bitcoin Party And More

Cryptocurrency This Week: As Reliance Jio Plans To Launch JioCoin, KFC Announces Bitcoin Bucket

Cryptocurrency This Week: RBI Warns Over Bitcoin Trading, Petro Launch And More

The team at Authorito Capital will deploy this capital in various decentralized assets, including coins, tokens, and ICOs. Up to 20% of the money will be used to back blockchain startups by participating in their token sales.

Cryptocurrency: Closing Doors, As Bitcoin Caught Between The Walls

Unlike popular Bitcoin enthusiasts’ belief that China will soon open the doors for Bitcoin trading, China continues to harden its stance towards cryptocurrency. After throwing trading, ICOs and mining away from the Mainland, Chinese authorities have now planned to block domestic access to Chinese and offshore cryptocurrency platforms that allow centralized trading.

The other big market South Korea is also hardening its rules and regulations over Bitcoin trading. While the country has already banned ICOs, the Financial Services Commission is now considering to ban exchanges as well.

However, the KFTC which is investigating the 13 South Korean cryptocurrency exchanges for alleged violations of the South Korean Electronic Commerce Law, including Bithumb, Coinone, and Korbit does not have the authority to shut down their operations.

Europe: Narrowing Down The Bitcoin Path Further

After cautiously watching the Bitcoin rise last year, European policymakers have increased their scrutiny over cryptocurrency trading in their lands.

French Finance Minister Bruno Le Maire is among the most vocal advocates for regulation. Paris wanted to “avoid the risks of speculation or possible financial traffics linked to bitcoin,” reported Politico.

It is worth noting that former central bank Deputy Governor Jean-Pierre Landau has already been appointed to lead an investigative mission on cryptocurrencies and how they might be regulated.

Powered By Inc42 BrandLabs

Earlier, Inc42 had reported the European Union expected imposition of stricter rules on cryptocurrency exchanges in order to prevent terrorist financing and money laundering. After the EU meeting on anti-money laundering measures’ agreement, Europe’s Justice Commissioner Vera Jourova had stated, “Today’s agreement will bring more transparency to improve the prevention of money laundering and to cut off terrorist financing.”

ECB President Mario Draghi has stated that cryptocurrencies are beyond the mandate of the central bank — but that there is merit in examining developments more closely.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://inc42.com/buzz/cryptocurrency-bitcoin-crypto-fund/