ICN Hodler Report - Q4 2018

Yesterday we launched a revamped ICNHodler.com which was the result of some hard work in Q4. This post will summarize details of the changes and outline our plans for the future...

Q4 Summary

After a relatively stable Q2 and Q3, Q4 saw the crypto market capitulate with total market cap dropping from $220b+ to under $100b at one point. It means that 2018 will go down in history as one of those bubble-bursting years for crypto when looking back on price charts. However, crypto is still alive and kicking despite the massive financial losses shouldered by many projects & individuals in 2018. Will 2019 be the year of the security token? The security token offering? The year of a Bitcoin ETF? Nobody knows but if 2019 were to carry on where 2018 left off, we could see many more projects fold as they run out of cash and as their digital assets continue to haemorrhage value as more investors and enthusiasts lose interest and decide to cut their losses. With so much interest and development in the space though and with most projects being down 90%+ from their all time highs, it seems unlikely we'll drop further in 2019 simply because there isn't much more room to drop (unless you believe crypto in general is heading to zero and has no value beyond speculation).

New features / site updates

In the Q3 report, I said I hoped to introduce:

- Website Redesign

- DAA Profile Pages

- Coin Profile Pages

I managed to complete 2/3 with DAA profile pages being the one that let me down.

Website Redesign

The website hadn't undergone any major navigation or layout changes since it first went live in November 2017. Over the past year or so there have been many new features and sections added but they've been sort of tacked on one by one without much thought about the overall experience. This lead to a cluttered navigation and difficult-to-find sections which people frequently accessed. The homepage had also grown stale. It focused on latest subreddit content, performance of CCP assets and the ICN price. However, over the past year ICONOMI have all but shut down their subreddit, Columbus Capital Pinta no longer exists and the ICN price is somewhat irrelevant at the minute as it's no longer tradeable anywhere due to the eICN switch.

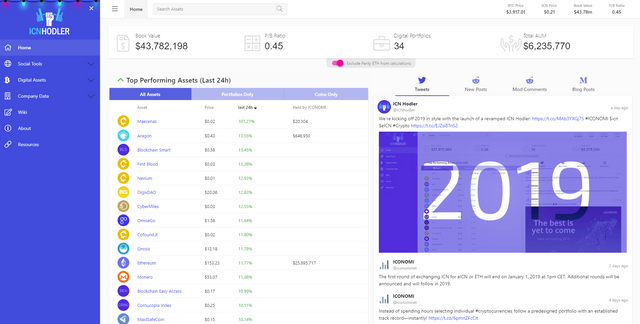

Navigation

The sidebar previously contained price information along with the balances of some key ICN-related wallets. The main horizontal navigation bar at the top of the page contained links to all of the site's various features. With the new design, this has basically been reversed. The sidebar now contains menus and submenus linking to various sections and the navigation bar contains a search bar and some critical pricing info / metrics. This change is more mobile friendly and also allows for faster access between pages on desktop. Dropdown menus no longer cover content so it's just a more efficient use of space too.

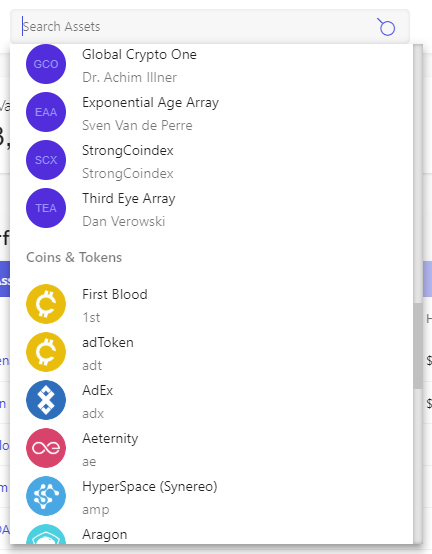

Search / Filter Assets

Previously, the site had no real search feature. There was a dropdown list of Digital Portfolios in the top right corner which you could filter but that was it. As part of the new design, I've introduced a search box option which is effectively a filter allowing you to search for either Digital Portfolios or regular digital assets supported on the ICONOMI platform. You can search by an asset's name or its ticker i.e. 'Bitcoin' or 'BTC'.

Homepage

The homepage has been redesigned from scratch. The first thing you'll see is a horizontal bar filled with 4 key stats: Book Value, P/B Ratio, Digital Portfolios and AUM. These figures are updated every few minutes and all link to appropriate sections.

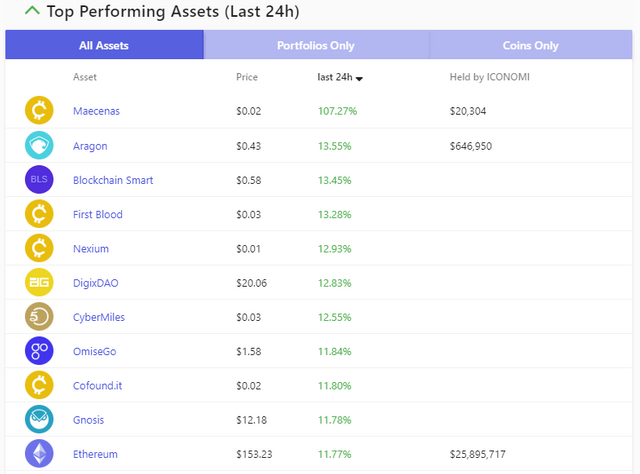

You'll then see two columns. One contains 24h performance data for all digital assets.

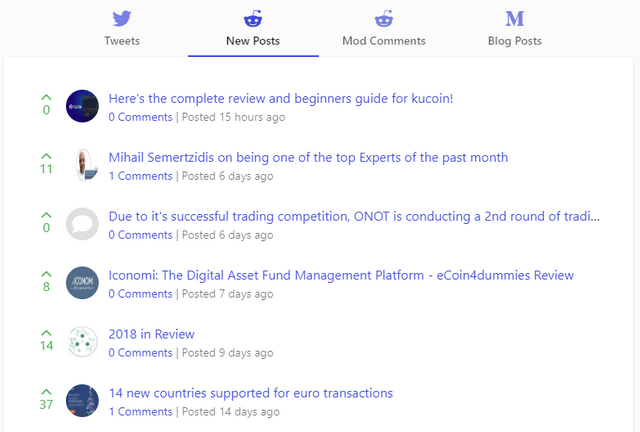

The other contains the latest tweets and social info from ICONOMI's twitter, reddit and medium blog.

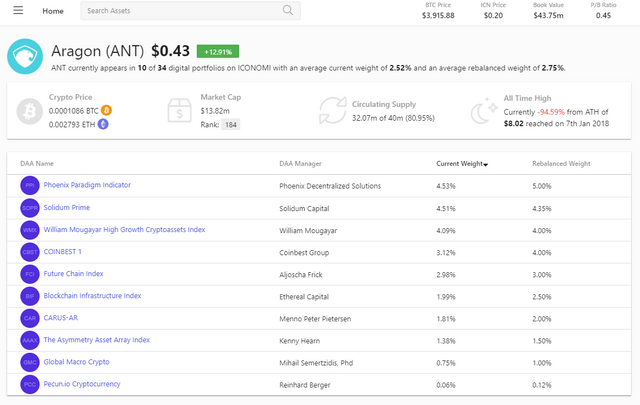

Coin Profile Pages

All assets now have their own dedicated profile page which displays pricing & performance data along with a list of digital portfolios which hold the asset and in what weight. This means that people can now search for a specific asset (i.e. TUSD) and discover digital portfolios through the coin profile page.

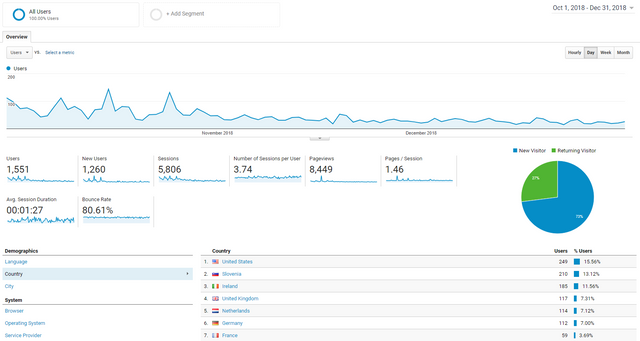

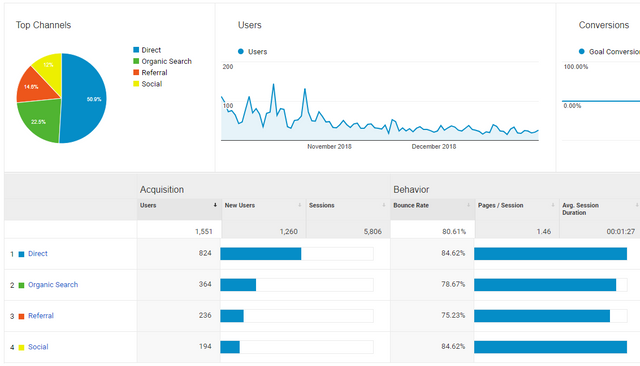

Q4 Traffic

Traffic stats in general didn't change all that much from Q3. We did however start some SEO work on the site in Q4 which resulted in a +60.35% increase in visitors to the site from organic searches (364 -v- 227).

1,551 users (-0.32%)

5,806 sessions (-32.63%)

30.90% returning visitors (-0.02%)

80.61% bounce rate (-5.58%)

Plans for Q1 2019

DAA Profile Pages

Planned for Q4 and not finished in time so will now become a goal for Q1 2019.

Digital Portfolio Ranking System

Performance over a specific time-frame is useful but can paint a misleading picture. For example if you sort Digital Portfolios by 24h performance or 6m performance that doesn't tell you much about what happened in between so it would be useful to have some sort of 'fair' ranking system that doesn't reward or punish digital portfolios based on when you happen to check 24h or 6m performance for example.

In Q1, I'll be introducing a new ranking system for digital portfolios and making the formula transparent. It will measure all digital portfolios on their daily performance over the past 365 days, with more weight placed on most recent performance. Think of it as something similar to FIFA rankings but for Digital Portfolios.

Measuring AUM to guesstimate deposits / withdrawals

Because ICONOMI now has a fiat gateway, measuring crypto deposits and withdrawals to and from platform addresses doesn't tell us much. In addition, deposits and withdrawals work differently now to how they worked when the feature was originally launched so this feature has become somewhat redundant.

A smarter, more all-encompassing way to measure the flow of cash to and from digital portfolios is to track AUM over time and make guesstimates based on that. As always, any guesstimates made will be explained and open to feedback so will be improved over time.

Thinking Further Ahead

A rethink and site redesign was badly needed in Q4. When re-evaluating everything, I also quickly began to question whether to rebrand and move away entirely from focusing on ICONOMI given that ICN Hodler's success hinges on ICONOMI's success and interest in what ICONOMI have to offer. What happens if ICONOMI ceases to exist? What happens if there's still no interest or growth in what they have to offer in 2019? Can ICN Hodler realistically be expected to flourish in those circumstances? The answer is an obvious no so at some point in the future, a rebrand and move away from exclusive focus on ICONOMI is probably inevitable to protect the project, my time and also to help expand the project and grow the audience. It may or may not happen in 2019 but I'm putting it out there so that it won't come as a surprise if and when it does happen.

Congratulations @jesusthatsgreat! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPHello @jesusthatsgreat! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko