Crypto Market Analysis & Regulation News - 2025-04-04

Today's Cryptocurrency Highlights

Welcome to your daily crypto news digest. Here's what's making waves in the blockchain world today.

Market Analysis

U.S. Stock Market Loses $3.5 Trillion in Two Days Amid Bear Market Concerns

U.S. Stock Market Suffers Historic Losses

The U.S. stock market has faced a staggering loss of $3.5 trillion over just two days, marking one of the most significant downturns in recent history. The S&P 500 index experienced an 8% drop, representing its largest two-day decline since the 2020 pandemic crash.

Adding to the concerns, the Nasdaq 100 has officially entered bear market territory. This development highlights the growing pressure on equity markets amidst macroeconomic uncertainty and investor concerns about inflation, interest rates, and potential recession risks.

The broader implications of this market activity could ripple across various sectors, including cryptocurrency, as traditional financial market turbulence often influences digital asset investment trends.

Stay tuned for further updates as the financial world navigates these volatile conditions.

Bitcoin Hashrate Hits Record High as Growth Continues

Bitcoin Hashrate Reaches All-Time High of 850 Million TH/s

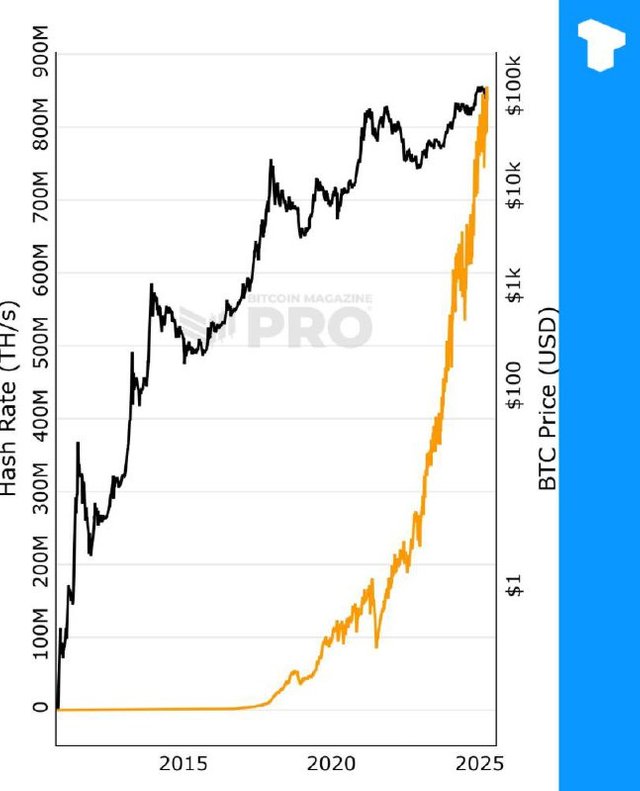

Bitcoin's hashrate — a key metric reflecting the overall computational power dedicated to securing the Bitcoin network — has consistently moved in tandem with its price since 2015. Recent data highlights that the hashrate has reached a new all-time high of 850 million terahashes per second (TH/s).

Significant Surge in 2025

Since January 2025, Bitcoin's hashrate has witnessed an impressive 50% increase, showcasing the continued growth and investment in mining infrastructure. This surge reflects rising confidence in Bitcoin's network security and underscores the ongoing expansion of mining operations worldwide.

This milestone is a testament to Bitcoin's resilience and its growing adoption within the cryptocurrency ecosystem. Analysts often view the hashrate as a leading indicator of network health and long-term price potential.

Bitcoin's consistent correlation between hashrate and price — with projections of price movement up to $100,000 — remains a point of interest for investors and market watchers alike.

Regulation

OKX Fined €1.1M by Malta's FIAU for AML Violations

OKX Fined €1.1M for Anti-Money Laundering Breaches

Malta's Financial Intelligence Analysis Unit (FIAU) has imposed a €1.1 million (~$1.2 million) fine on cryptocurrency exchange OKX. The penalty was issued for what the FIAU described as "serious and systemic breaches" of anti-money laundering (AML) regulations.

Compliance Inspection Unveils Violations

The violations were uncovered during a compliance inspection conducted in April 2023. The FIAU's findings highlighted significant lapses in OKX's adherence to AML procedures, which are critical for ensuring transparency and preventing illicit activities in the financial sector.

This development underscores the increasing scrutiny faced by cryptocurrency platforms from regulators worldwide as they strive to enforce compliance and maintain the integrity of financial systems.

U.S. House Committee Passes Anti-CBDC Act in Narrow Vote

U.S. House Committee Approves Anti-CBDC Act

The U.S. House Financial Services Committee has voted to pass the Anti-CBDC Act, a bill aimed at blocking the Federal Reserve from issuing a central bank digital currency (CBDC), also known as a digital dollar. The legislation passed with a narrow 27–22 vote, reflecting a divided stance on the issue.

Key Concerns Behind the Bill

The proposed law seeks to address growing concerns over:

- Financial Surveillance: Critics argue that a CBDC could pave the way for mass surveillance of financial transactions, potentially infringing on individual privacy.

- Role of the Federal Reserve: Opponents worry that issuing a digital dollar could transform the Federal Reserve into a retail banking entity, fundamentally altering its current mandate and operations.

Implications and Next Steps

The passage of the Anti-CBDC Act by the committee represents a significant step in the debate over digital currencies in the United States. However, the bill still faces additional hurdles before it can become law, including approval by both the House of Representatives and the Senate, as well as the President's signature.

This development underscores the ongoing tension between innovation in the financial sector and concerns about regulatory oversight and individual freedoms.

Broader Context

The U.S. joins a growing global debate over the adoption of CBDCs. While some countries, like China with its digital yuan, are moving forward with CBDC development, others remain cautious, citing similar concerns about privacy and the balance of power between central banks and commercial banks.

Project Update

Binance Pay Adopts USDC Stablecoin as Default Currency for New Users

Binance Pay Adopts Circle's USDC as Default Currency

Binance Pay, the payment platform developed by cryptocurrency exchange Binance, has announced that it is now using Circle's USDC stablecoin as the default currency for all new users. This strategic move underscores Binance's focus on leveraging stablecoins to streamline global payment processes and enhance user experience.

USDC, a widely adopted stablecoin pegged to the US dollar, is recognized for its transparency and regulatory compliance, making it a trusted choice for seamless transactions within the crypto ecosystem. By integrating USDC as the default currency, Binance Pay aims to provide users with a reliable and stable payment solution, reducing volatility risks commonly associated with other cryptocurrencies.

This development highlights the growing prominence of stablecoins in the crypto payments space, as well as Binance's continued efforts to expand its global reach and cater to a broader audience.

Key Takeaways:

- Binance Pay now uses USDC as its default currency for new users.

- USDC is a stablecoin issued by Circle, pegged to the US dollar.

- The move aims to enhance payment stability and streamline cross-border transactions.

For more details, visit Binance Pay's official announcement.

Source: Original Article

Follow our Steem account @ireh for daily crypto updates and insights.