Cryptocurrency investments compared to Private Equity investments

Private Equity

Private equity investments are investments that are not exchange traded. As such, there is no liquid market for these investments class. This makes it a riskier asset class than regular stocks and bonds, because those can be sold at any time. Private Equity investments usually have an investment horizon between 3-12 years, split (if all goes well) in an investment period, a maturity period, a divestment period and an exit. An early exit wouldn’t allow the investment to materialize and therefore it’s required to make longtime investments.

Private Equity investments are considered too dangerous for non-professional investors, because it’s hard to determine the long term profitability. In times of crisis, these investments don’t easily convert to cash. Although the secondary market has grown substantially over the last years, it still takes several months to sell a private equity position and it’s not unusual to sell at a discount of 5-10% of NAV. Furthermore, Private Equity is hardly regulated, so investors are not protected as usual in listed equity. Therefore, Private Equity investments are available for a restricted group of investors consisting of Family Offices, High Net Worth Individuals, Pension Funds and other professional investors. You might think you’re not invested in Private Equity, but if you have a pension fund, chances are small that you’re not.

Models range from direct deals, co-investments, funds, Fund of Funds and Listed Private Equity. All of them have their own specifications and it’s controversial if the last one really is considered Private Equity.

Funds are usually focusing on specific sectors or geographic areas. This could be “developed markets” like the US or Europe or “energy” for all sorts of investments in the energy sector.

Strategies can range from Start-ups (Seed or Venture capital), Growth capital, Leveraged Buyout, distressed and real estate.

Explanation of these models, sectors, strategies and geographies goes beyond the purpose of this article, but it’s important to realize that venture capital is a part of Private Equity.

For more info about this I recommend this book: Meyer, T., & Mathonet, P.-Y. (2005). Beyond the J-curve. Chichester: John Wiley & Sons Ltd.

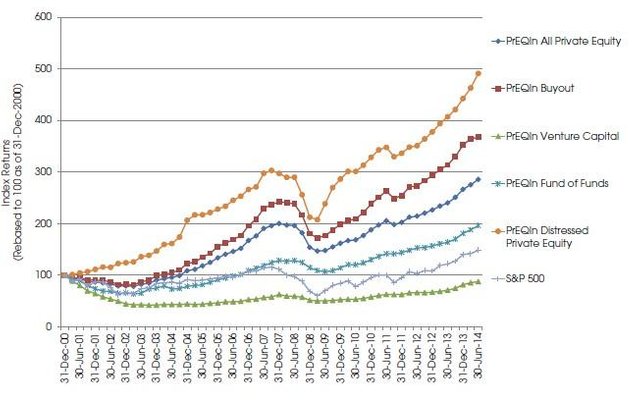

So why would professional investors be interested in these investments? There are 2 main reasons: High long term returns and little correlation with other investment asset classes. This is increasingly important in the last few years, because interest rates are so low, so investment profits have to come from somewhere else. The below picture shows Preqin Private Equity indexes for different strategies from 2000-2014. It’s obvious that many strategies perform better than the S&P 500, but there’s another important conclusion: the index of venture capital is underperforming. The conclusion of that line is: although there are some shooting stars in the venture capital sector, many unsuccessful startups are pulling the index down.

[Source](The 2015 Preqin Global Private Equity & Venture Capital Report)

In essence, wealthy investors invest in a team of professional private equity investment managers, to select and manage several investment opportunities. In return, the investment managers are paid a management fee and carried interest. over 3-12 years, these 2 can add up to substantial amounts. The latter one works just like performance fees, if the investment returns are above a certain watermark, the investment managers participate in the returns, to streamline the incentives. Within the sector, network is everything and although historic performance can’t guarantee future performance, private equity funds with a good image seem to benefit from their image.

As the cryptocurrency market is so new, there is no mature blockchain company, and all investments are to be considered venture capital. Private equity venture capital funds could invest in Blockchain startups. Actually Panterra capital specializes in blockchain only: https://panteracapital.com/

**Cryptocurrencies **

I don’t think cryptocurrencies need a big introduction. In the context of this article, they offer an investment opportunity to bypass many hurdles of the items listed above.

There are some cryptocurrencies that try to create a decentralized ecosystem specifically for fundraising. Good examples are Ethereum, Waves and Komodo.

Advantages of investing in cryptocurrencies compared to private Equity:

+Where investments in a pension fund are locked and illiquid, cryptocurrencies are liquid in a day.

+Great potential for long term high returns

+No management fees and carried interest to the private equity manager, plus avoidance of bank fees, admin fees, legal fees and the costs of your pension fund.

+Awareness of each investment

+Small investments are possible

But it’s relevant to realize the disadvantages:

- There’s no track record and it’s very early stage. Total loss is not unlikely.

- ICO’s are not regulated, fraud is not uncommon

- Inspired by the Preqin venture capital index, investing in all new ICO’s will not get you there. You must find a way to select or promote the right cryptocurrency investments.

- Responsible for own decisions and operational management.

- Very high volatility

Do you agree with these statements?

Thanks for reading!

Articles coming up:

The time value of money VS the money value of time

Securify: How to verify your Ethereum smart contract

Why I believe in a bright future for the Steemit platform

Tokens for sustainability – are they selfless?

This is an article to compare two asset classes, not investment advice.

i have learned something from your post, keep it up.

Great to hear, thank you for reading!

This post was resteemed by @reblogger!

Good Luck!

Learn more about the @reblogger project in the introduction post.

You were lucky! Your post was selected for an upvote!

Read about the bot

Congratulations @ghaaspur! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGreat read! Thank you for sharing this comparison. Your thinking and logic resonates with many. Resteemed.

so much informative post :-) thanks