How to Read Charts: Double Bottom

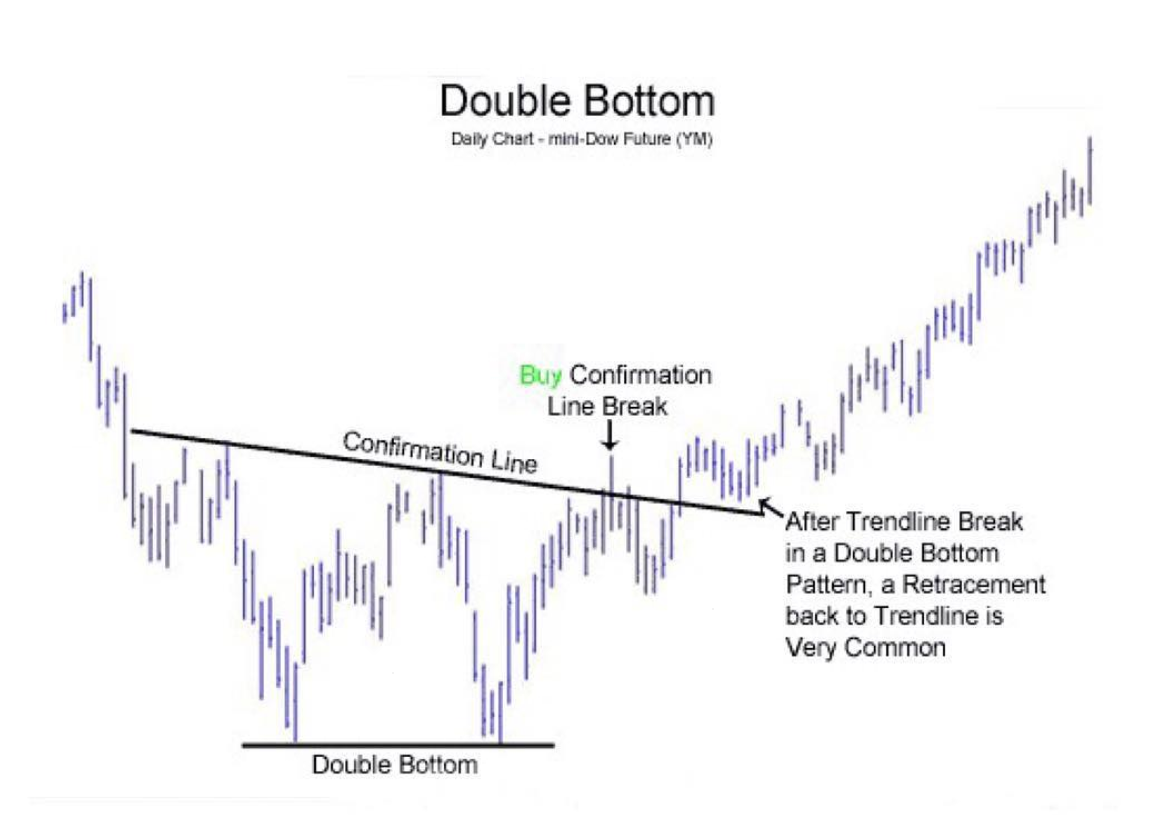

A double bottom is a charting pattern used in technical analysis. It describes the drop of a stock or index, a rebound, another drop to the same or similar level as the original drop, and finally another rebound. The double bottom looks like the letter "W". The twice-touched low is considered a support level.

BREAKING DOWN 'Double Bottom'

Most technical analysts believe that the advance off the first bottom should be 10 to 20%. The second bottom should form within 3 to 4% of the previous low, and volume on the ensuing advance should increase.

Time Frame for a Double Bottom Chart Pattern

As with all chart patterns, a double bottom pattern is best suited for analyzing the intermediate- to longer-term view of a market. Generally speaking, the longer the duration between the two lows in the pattern, the greater the probability that the chart pattern will be successful. At least a three-month duration is considered appropriate for the lows of the double bottom pattern, in order for the pattern to yield a greater probability of success. It is therefore better to use daily or weekly data price charts when analyzing markets for this particular pattern. Although the pattern may appear on intraday price charts, it is very difficult to ascertain the validity of the double bottom pattern when intraday data price charts are used.

Confirming a Double Bottom Chart Pattern

The double bottom pattern always follows a major or minor down trend in a particular security, and signals the reversal and the beginning of a potential uptrend. Consequently, the pattern should be validated by market fundamentals for the security itself, as well as the sector that the security belongs to, and the market in general. The fundamentals should reflect the characteristics of an upcoming reversal in market conditions. Also, volume should be closely monitored during the formation of the pattern. A spike in volume typically occurs during the two upward price movements in the pattern. These spikes in volume are a strong indication of upward price pressure and serve as further confirmation of a successful double bottom pattern.

Trading a Double Bottom Chart Pattern

Once the closing price is in the second rebound and is approaching the high of the first rebound of the pattern, and a noticeable expansion in volume is presently coupled with fundamentals that indicate market conditions that are conducive to a reversal, a long position should be taken at the price level of the high of the first rebound, with a stop loss at the second low in the pattern. A profit target should be taken at two times the stop loss amount above the entry price

Read more: Double Bottom https://www.investopedia.com/terms/d/doublebottom.asp#ixzz57ALQlz6j

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/terms/d/doublebottom.asp