Dinner with Candles or Candlelight Dinner? - The Psychology of Crypto Trading and Other Musings!

For this topic on the psychology of crypto trading, much has been spoken, written and taught about, but truth be told, we are like the parable of the blind men and an elephant, each of us will be having a different perspective on the same object of observation. For example, when someone tells you she had a wonderful dinner with candles, we usually conjure up the usual obvious image of candlelight dinner, but the reality is USUALLY otherwise.. ;)

The comic below says it all. :)

So here's the thing. The single most important trait a trader must have to beat the market is to master one's emotions. I cannot overstate this enough, as trading in cryptos is extremely risky due to its high volatility and unpredictability. As the crypto-sphere is still nascent and unregulated, there are bad actors who can easily manipulate the price and for smaller cap coins, it does not take much effort and capital to do so.

Market manipulation, according to Investopedia, is defined as:

“The act of artificially inflating or deflating the price of a security or otherwise influencing the behavior of the market for personal gain.”

Manipulations can take many forms, of which we will briefly touch on some common ways:

Wash Trading — One can create the impression that there is more market transactions than is actually occuring by buying and selling with one’s own funds with themselves

Pump and Dump — There are groups which initiate a collective buy in excessive amount of any targeted coin to inflate the price artificially (known as the pump) and then selling off their stake in stages to realise profits to unsuspecting traders.

Dark Pool Trading — Whales trading with one another away from Lit exchanges in order to avoid slippage. While strictly speaking, it is not manipulation, it does have an impact on the crypto spot price on Lit exchanges since the order book is not transparent when the big and ask is hidden from the order book. While it somewhat stablises prices, it can lead to flash crashes though, if a big whale dumps on the market, as it is dark. This means the trade is not transparent at all and will catch traders unaware and unable to react.

Shilling — Influencers can create hype and excitement for a coin to sway its price as if they have no vested interest but just reporting facts, but on the side, is really just for personal gain or an exchange of payment as a vested party.

Whale Trades — This is all too common in the crypto space where well endowed traders can use buy and sell walls, to push prices in the any direction they so chooses, or to contain prices in a certain range they like to it to be.

A successful crypto trader must be aware of the above possible manipulations when trading cryptos before he or she can grasp the emotions at play in the psychology of trading, because you can't protect yourself from what you are not aware of.

If you don't believe there is such a thing as emotions at play in the psychology of trading, the following comic narrative, which most if not all will undoubtedly identify with, will hopefully illustrate to you clearly that emotions is an all too powerful force that can bring your trading results to its knees at the blink of an eye.

FOMO

If you are a trader, whether a novice or an experienced one, the emotion of the Fear Of Missing Out is very real. If the price of Bitcoin goes from $1,000 to $10,000 and surges for a few days, it is very easy to nudge you to jump on the band-wagon. That is when you will FOMO. You do not fact-check as there is an irrational urgency to get on the gravy train lest you be left alone on the station platform when the gravy train leaves. You panic Buy!

FUD

So overtaken by FOMO, you are now onboard the gravy train and feeling very happy you managed to buy Bitcoin at $11,500. You see the price continue to surge to $12,000 but before you can catch your breath, it loses momentum and out of the blue, it reverses. You are hit with Fear, Uncertainty and Doubt. You think you have made a wrong decision as you see your profits decimated right before your eyes. You sell at $10,500. You convinced yourself that the good days are over and if you don't jump off the bandwagon now, you will lose much more. This seems like a good decision there and then because it is always wise to minimise your loss, you tell yourself.

TIMING THE MARKET

You have sold at $10,500 and lost a lot of money. To rub salt to your wound, the market surges again. If you go in now, you tell yourself you would be accepting your loss, but you won't admit to it, so you must wait for the price to drop back to $10,500 when you can get back in, as if you never have got out in the first place. You have to wait for the right moment. You see the price go back to $11,500 and then drop to $11,000. You wait. You tell yourself this is not the time. You believe it will drop back to $10,500. You start to time the market.

WATERFALL AND FALLING KNIFE

So you waited and waited and sure enough the market seems to be listening to you and drop back to $10,500. As you have begun to time the market, you begin to search for news of a market collapse and sure enough, you will find what you are looking for and an imminent collapse is called by some famous and influential chartists, calling a bottom at $8,000, so you withhold your trigger. You are convinced timing the market for entry is the best option to you, lest you make a blunder again by going in too soon.

MARKET FOLLOWS ITS OWN TUNE

Now the Bitcoin price has declined to $8,500 and looks like it should slide to $8,000, double and triple confirmed, since sentiments from the twitter world, telegram groups and tradingview are rampant with bearish comments and analyses. You believe it will be a self-fulfilling prophesy and you can't be wrong this time.

Yet you soon learn that the market listens to no one and only follows its own tune. It reverses again and starts to surge instead of touching down at $8,000, your self-imposed trigger level.

ALL-IN

You have sold at $10,500 and lost a lot of money. Now the price seems to be surging and looks like the market has shed its bearish sentiments and is building up to a bull run. From $8,500, it is now $9,000, then $10,000. You panic. FOMO kicks in again and this time you believe "This is it!". Instead of dollar cost averaging in, you decide to go ALL-IN.

TO THE MOON

Bitcoin reaches $10,500 and you bite the bullet and pulled the trigger. You have went All-In. You feel extremely happy as you have got in at break-even and all your losses are recovered. It looks like a parabolic bull run. You can't be wrong. You're invincible. At $12,000, it keeps building momentum. Next morning, it hits $13,000, $15,000, $17,000 and keeps rising by leaps and bounds.

GREED

This is a once in a lifetime opportunity for you to achieve financial freedom. Time to shop for your Lambo. It was so easy. You feel you are very smart, a trading guru in fact. Greed overwhelms you. Some wise trader said a parabolic run is surreal, unreal and UNSUSTAINABLE! But you are wiser; of course you are, because caution is thrown to the wind, isn't it? Besides, who does not love MORE bitcoins, right?

WTF

You feel like you're a trading champion, a gifted trader, destined for greatness. You went to sleep like a THE BIG BOSS. You woke up to THE BIG LOSS!

The Bitcoin price plummeted. You search for evey shred of positive news in your twitter feeds, in telegrams, everywhere, anyone. Price falls like a ton of bricks. Could be a black swan event. Maybe Mt Gox re-visited. At $9,000, you can't handle your nerves anymore. The FUD is too intense, you can't take it anymore, so you SELL!

ROCKET-SHIP OR SUBMARINE?

Your rocket-ship lost all its engines. You went All-IN, and the dam broke. You have used Scared Money, which is money you cannot afford to lose. You must recoup, but you realised for every 50% drop, you need 100% rise to just break-even. This time you really prayed for a protracted Bear Market and Bitcoin to drop to $1,000, or else you will never be able to get back in.

So you waited, and has been waiting since. :(

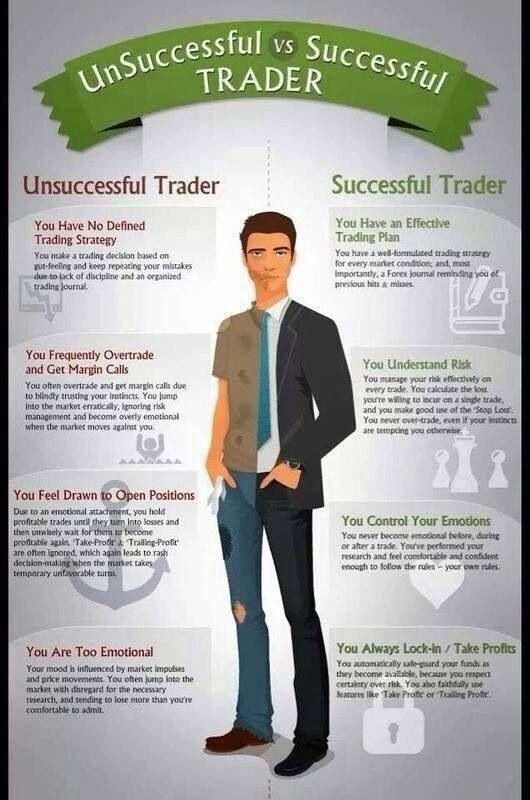

If the above seems all too familiar for you, then you have fallen victim to your own emotions and this is something you must never succumb into if you wish to be a successful crypto trader.

So, how can you overcome your emotions when you're trading? Hopefully the following video by MyStrategicForecast will give you an understanding of how you can rein in your emotions when you're trading.

Credit to MYStrategicForecast

In conclusion, let me share with you the below info-graphic that distinguishes between a Successful Trader and an Unsuccessful one. Tell me which one you belong to! :)

At this juncture, allow me to introduce to you a reputable crypto exchange based in Singapore that I have been using for my crypto trading and which I trust very much for its Ledger Vault security which secures your crypto assets in cold-storage so your assets are safe, among other great features. Do check them out!

ecxx.com is a digital asset exchange platform designed for both professional traders and retail investors. The platform allows users to buy, sell, and store digital assets.

By running on its own in-house proprietary system, ecxx.com is able to run a perfect ecosystem with high-liquidity.

With its vision to be the World's Leading Digital Asset Exchange, the group aims to deliver trustable and secured digital asset trading services. ecxx.com ensures discretion by protecting client assets with a world-class multi-layer security system.

You can register for a trading account here:

ecxx.com

Ledger Nano S Giveaway!

You could be our winner! To stand a chance, simply:

1. Follow twitter.com/ecxx_Official and retweet the twitter post

2. Register on ecxx.com and include invitation code ‘ledgernano’

3. Complete KYC successfully

I wish each and everyone of you a successful, fruitful and rewarding experience in your crypto trading journey!

Trade wisely, trade safely. :hugs:

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or coin picks, expressed or implied herein, are for informational or educational purposes only and should not be construed as personal investment advice. Always do your own research!!!

Congratulations @fourflames! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!