Cryptocurrency and ICO Market Analysis (July 8-22, 2018)

This report presents data on cryptocurrency and ICO market changes during 2018. Special emphasis has been placed on an analysis of the changes that have taken place during July 2018, including over the past two weeks (July 8-22, 2018).

Information as of July 23, 2018

Professor Dmitrii Kornilov, Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox

Dima Zaitsev, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox

Nick Evdokimov , Co-Founder of ICOBox

Mike Raitsyn , Co-Founder of ICOBox

Anar Babaev , Co-Founder of ICOBox

Daria Generalova, Co-Founder of ICOBox

Cryptocurrency Market Analysis (July 8-22, 2018)

1. General cryptocurrency and digital assets market analysis. Market trends

1.1. General cryptocurrency and digital assets market analysis

1. General cryptocurrency and digital assets market analysis. Market trends

1.1. General cryptocurrency and digital assets market analysis

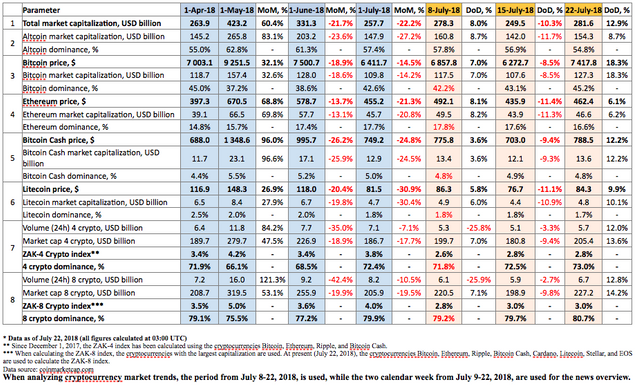

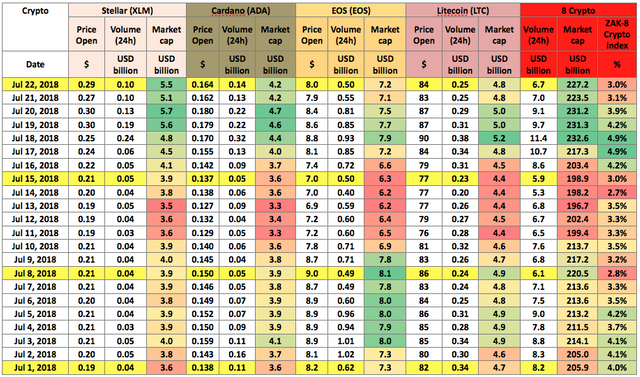

Table 1.1. Trends in capitalization of the cryptocurrency market and main cryptocurrencies from April 1, 2018, to July 22, 2018

Cryptocurrency market capitalization increased over the analyzed period (July 8-22, 2018) and as of 03:00 UTC equaled $281.6 billion (see Table 1.1). The growth compared to the start of the month equaled around $24 billion.

The dominance of the four and eight largest cryptocurrencies as of 03:00 UTC on July 22, 2018, equaled 73% and 80.7%, respectively, with bitcoin dominance sitting at 45.2% (see Table 1.1).

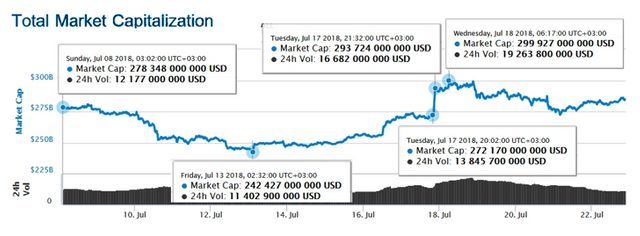

During the period from July 8-22, 2018, cryptocurrency market capitalization fluctuated from $242.4 billion (min) to $ 300 billion (max) (Fig. 1a), i.e. within a range of $57.6 billion. For its part, bitcoin capitalization fluctuated from $105.4 billion (min) to $130.2 billion (max), i.e. within a range of $25 billion.

It is worth noting the upward spike in the evening of July 17, during which cryptocurrency market capitalization increased by $11.5 billion over 90 minutes and the bitcoin price unwaveringly passed the $7000 barrier.

Figure 1a. Cryptocurrency market capitalization since July 8, 2018

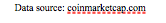

Figure 1b shows bitcoin capitalization (red line) superimposed on cryptocurrency market capitalization (blue line). The lines are practically identical, but more intensive growth in bitcoin can be seen compared to overall market capitalization. Ultimately, over the past two weeks Bitcoin dominance increased by 3%, from 42.2% to 45.2% (see Table 1.1).

Figure 1b. Capitalization of the cryptocurrency market (blue) and bitcoin (red) since July 8, 2018

There were no landmark events on July 17 that generated the sharp growth in capitalization. However, we can point to a number of positive news items on the cryptocurrency market that appeared the day before:

- The Hong Kong Monetary Authority and the Ping An Group are launching a joint blockchain-based trading system, i.e. the 2017 project to unite more than 20 banks in Hong Kong and Singapore into a single blockchain-based financial platform to reduce paperwork and fraud is starting to be implemented.

- CoinDesk published information concerning the international payment company American Express, which filed a patent application on systems and methods for blockchain based proof of payment that will use blockchain to confirm transactions, including to “unlock a hotel, rental or shared economy property door using the card (e.g., that was used for the payment), in order to find proof of payment on blockchain.” In addition, “the system may be leveraged to provide ticketless access to venues (e.g., a movie theater, sports event, concert, etc.) to a customer.”

- Coinbase Inc., one of the most popular cryptocurrency platforms, has announced that the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) have approved its acquisition of the broker-dealers Keystone Capital Corp., Venovate Marketplace Inc. and Digital Wealth LLC.

- The Swiss stock exchange operator is “open” to cryptocurrency trading on the new SIX Digital Exchange. SIX will also offer a full range of ICO advisory services.

- The SBI Holdings Corporation (Japan) has announced the launch of the VCTRADE cryptocurrency exchange.

- The Twitter account of the South Korean cryptoexchange Coinrail announced the resumption of trading and a total upgrade of the platform’s security system.

- IBM and the startup Stronghold will create the stablecoin USD Anchor on the Stellar blockchain. The coin’s price will be tied to the US dollar.

- The jump in the bitcoin price from $6700 to $7300 in one hour on July 17 resulted in traders closing their short positions in the amount of $180 million in only 20 minutes on the BitMEX exchange.

The rise and fall of cryptocurrency prices over the past seven days (July 15-22, 2018)

Last week’s leaders from among the top 500 cryptocurrencies by capitalization, which showed an appreciation of more than 100%, were the projects InflationCoin (+1,310%), Proxeus (+181.5%), and ToaCoin (+154%). The growth of Quantum Resistant Ledger (+73%), Bitcoin Diamond (+72%), KickCoin (+60%), Kin (+50.5%), and Dogecoin (+45%) should also be noted.

During the period from July 15-22, 2018, the change in the prices of cryptocurrencies in the top 500 ranged from -50.27% (RealChain) to +1,310% (InflationCoin). The price of InflationCoin is very volatile, as the 24-hour trading volume of this cryptocurrency rarely exceeds five thousand US dollars, meaning that the price of this cryptocurrency reacts very strongly to any purchases or sales worth more than one thousand US dollars.

The price of RealChain fell by more than 50% over the week, perhaps due to a downward adjustment after its rapid growth the week before, when RealCoin appreciated by more than 100%.

The price of 380 cryptocurrencies and digital assets from the top 500 showed growth, including 88 from the top 100.

Over the past week the number of cryptocurrencies with a capitalization of more than $1 billion remained the same at 19, with the price of all of them appreciating except VeChain (-3.11%), Ethereum Classic (-0.55%) and Tether (the price of which is tied to the US dollar). The price growth equaled: Stellar (+40%), Cardano (+22%), Bitcoin (+18%), EOS (+15%), Dash (+14), etc.

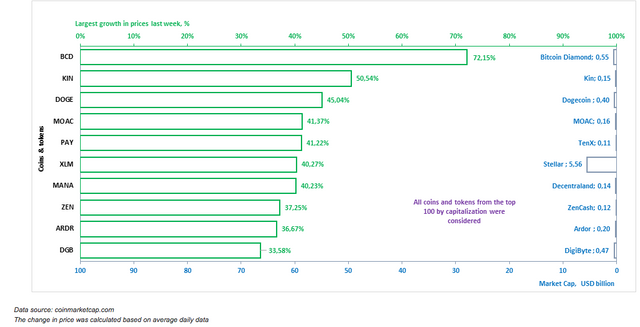

The coins and tokens from the top 100 that demonstrated the largest price growth are given in Fig. 2.

Biggest gainers and losers over the week (July 15-22, 2018)

The prices of some cryptocurrencies may fluctuate from -50% to +50% over the course of a single day. Therefore, when analyzing cryptocurrency price trends, it is advisable to use their average daily amounts on various cryptoexchanges.

Below we consider the 10 cryptocurrencies that demonstrated the most significant change in price over the past week (Fig. 2-3). In this regard, only those coins and tokens included in the top 100 (Fig. 2, Fig. 3) in terms of market capitalization were considered2.

Figure 2. Largest growth in prices over the past week (July 15-22, 2018)

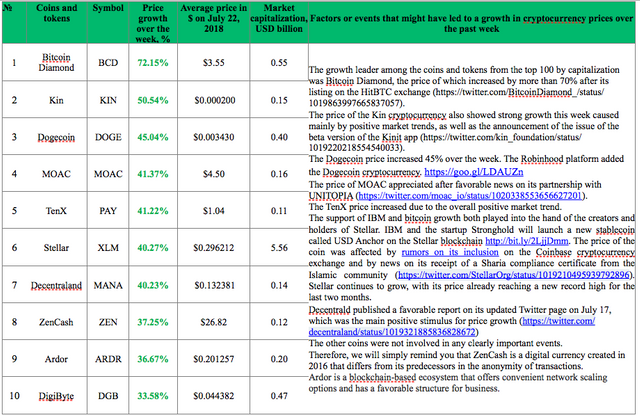

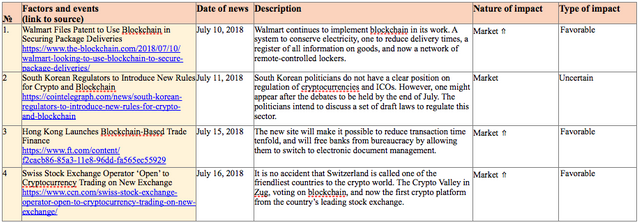

Tables 1.2 and 1.3 show the possible factors or events that might have influenced the fluctuation in prices for certain cryptocurrencies. Table 1.4 shows the possible factors or events that might have influenced the cryptocurrency market in general.

Table 1.2. Factors or events that might have led to a growth in cryptocurrency prices over the past week

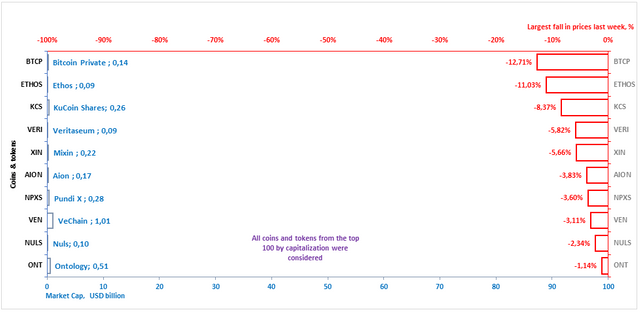

A depreciation in price was seen last week for 120 coins and tokens from the top 500 cryptocurrencies and digital assets by capitalization. The ten cryptocurrencies from the top 100 that experienced the most noticeable drops in price are shown in Fig. 3 and Table 1.3.

Figure 3. Largest fall in prices over the past week (July 15-22, 2018)

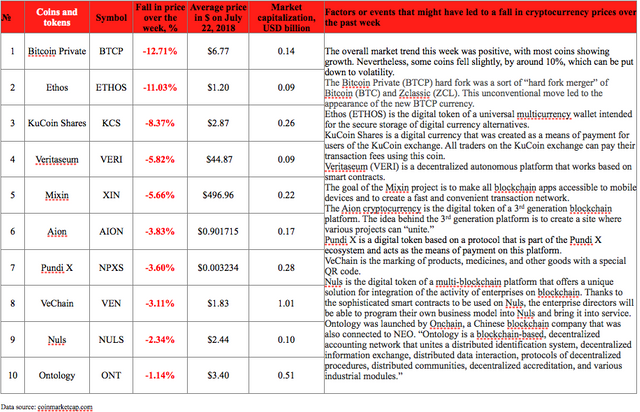

Table 1.3. Factors or events that might have led to a fall in cryptocurrency prices over the past week

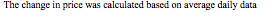

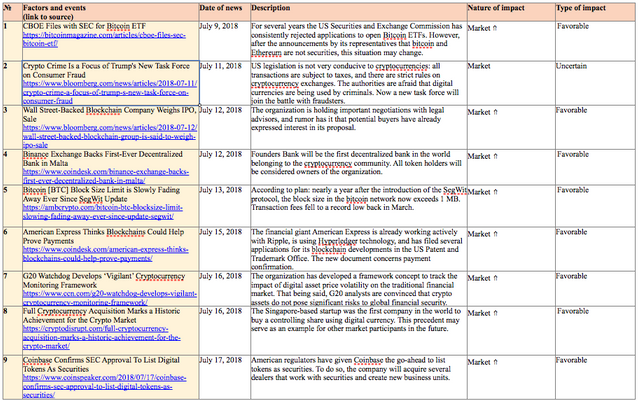

Table 1.4 shows events that took place from July 9-22, 2018, that had an impact on both the prices of the dominant cryptocurrencies and the market in general, with an indication of their nature and type of impact.

Table 1.4. Key events of the week having an influence on cryptocurrency prices, July 09-22, 2018

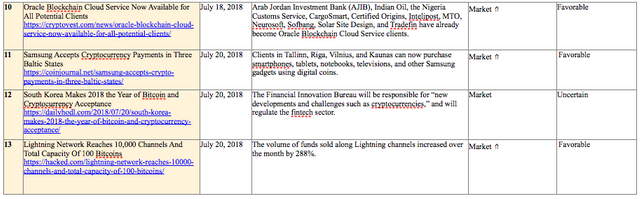

To analyze trading activity on cryptocurrency exchanges, the ZAK-n Crypto index is calculated (see the Glossary). The values of the ZAK-4 Crypto and ZAK-8 Crypto indices are presented in Tables 1.1, 1.5.a, and 1.5.b. In July the 24-hour trading volumes (Volume 24h) for the four dominant cryptocurrencies (Bitcoin, Ethereum, Bitcoin Cash, Ripple) equaled from $4.6 billion to $9.6 billion (Table 1.5.a). The value of the daily ZAK-4 Crypto ranged from 2.5% to 4.8% of capitalization. The highest trading volume was seen on July 17-18.

Table 1.5.a. Daily ZAK-4 Crypto index calculation (from July 1-22, 2018)

The 24-hour trading volumes (Volume 24h) for the eight dominant cryptocurrencies (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Stellar, EOS, and Cardano) fell to $6.7 billion by the end of last week (Table 1.5.b), or 3% of their market capitalization. The ZAK-4 Crypto and ZAK-8 Crypto indices are considered in more detail in Tables 1.5.a and 1.5.b.

Table 1.5.b. Daily ZAK-8 Crypto index calculation (continuation of Table 1.5.а)

Table 1.6 gives a list of events, information on which appeared last week, which could impact both the prices of specific cryptocurrencies and the market in general.

Table 1.6. Events that could have an influence on cryptocurrency prices in the future

1.2. Market trends

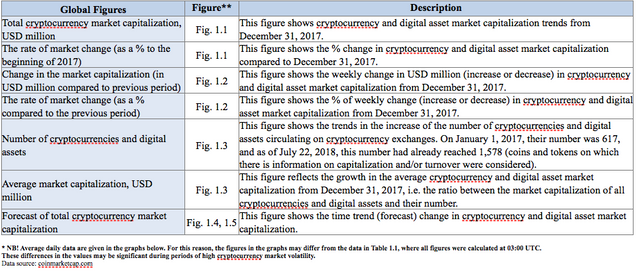

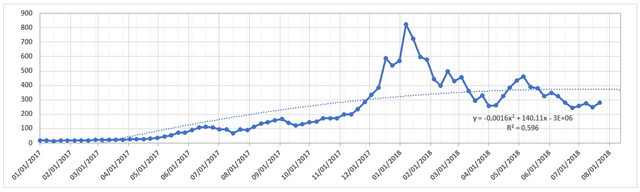

The weekly cryptocurrency and digital asset market trends from December 31, 2017, to July 22, 2018, are presented as graphs (Fig. 1.1-1.5).

Table 1.7. Legends and descriptions of the graphs

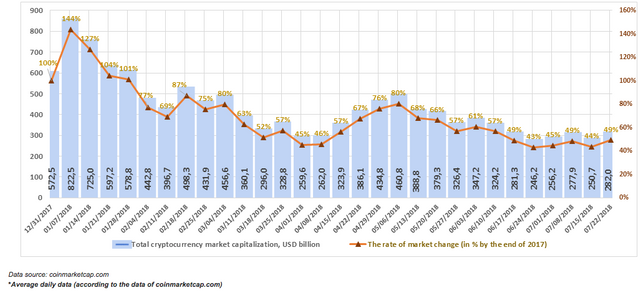

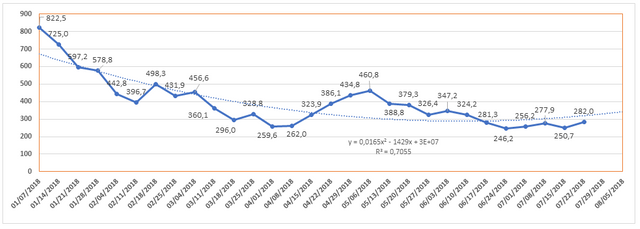

Figure 1.1. Total cryptocurrency market capitalization

Figure 1.1 shows a graph of the weekly cryptocurrency market change from December 31, 2017, to July 22, 2018. Over this period, market capitalization dropped from $572.5 billion to $282 billion, i.e. by 51%. Last week (July 15-22, 2018) cryptocurrency market capitalization increased from $250.7 billion to $282 billion (as of July 22, 2018, based on the average daily figures from coinmarketcap.com).

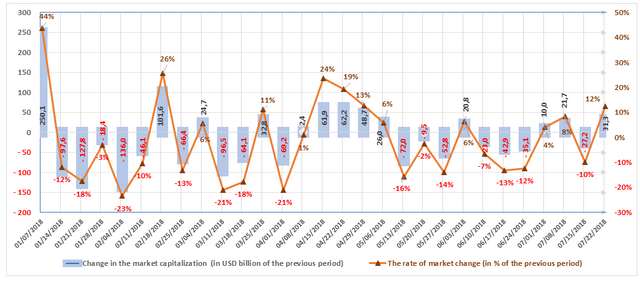

Figure 1.2. Change in market capitalization

The market is susceptible to sudden and drastic fluctuations. Nine of the thirteen weeks in the first quarter of 2018 were “in the red,” i.e. capitalization fell based on the results of each of these weeks, and the weekly fluctuations ranged from USD -136 billion to USD +250 billion.

Six of the thirteen weeks in the second quarter were “in the red.” The market grew based on the results of the other seven weeks. As noted earlier, a growth was seen in April, while in May and June there was generally a reduction in capitalization. The weekly fluctuations ranged from USD -72 billion to USD +62.2 billion.

Two of the three past weeks of the third quarter saw an increase in cryptocurrency market capitalization (with due account of average daily data of coinmarketcap.com, see Fig. 1.2).

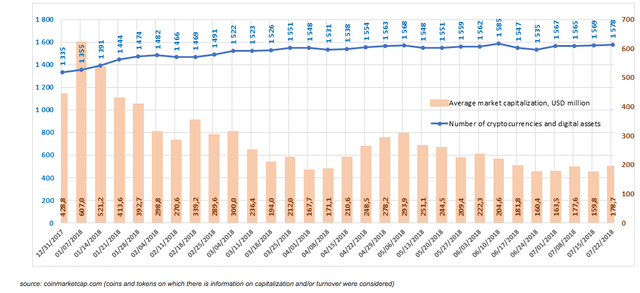

Figure 1.3. Number of cryptocurrencies and digital assets

Since December 31, 2017, the total number of cryptocurrencies and digital assets considered when calculating market capitalization has increased from 1,335 to 1,578. Over the past week their number increased from 1,569 to 1,578, and average capitalization increased to $178.7 million. In total, over the past month 70 new coins and tokens have appeared on coinmarketcap.com. However, it should be noted that a number of other coins and tokens were also excluded from the list. Among the tokens that were added to coinmarketcap.com last week, LemoChain, ContentBox, Elysian, Engagement Token, and Hashgard showed high trading volumes.

Figures 1.4 and 1.5. Forecast of total cryptocurrency market capitalization

The year 2017 is rightfully considered the year of the cryptocurrency, but the first six months of 2018 have brought ICO volumes to a new level. However, the buzz surrounding the cryptocurrency and ICO markets was gradually replaced with a period of reflection and the adoption of more informed decisions and strategies. In this period a more detailed market analysis is required for decision-making, a mature marketing policy is essential, business processes must become more efficient, legal norms have to be observed, and a clear behavioral strategy must be established.

The fall in cryptocurrency market capitalization by more than half since the start of the year has begun to have an effect on the volume of funds collected via ICOs and their development. Many startups were counting on an expanding market and the resulting increase in demand for their technologies and products. Naturally, this has led to a fall in their performance, and in certain cases to their failure. According to the estimates of the Satis Group dated July 11, 2018: around 80% of ICOs were identified as scams. The research performed by Boston College gave a less severe assessment of ICOs: 56% of ICOs died within four months after the completion of their token sales, meaning only 44.2% of startups survive after 120 days from the end of their ICOs. As Bloomberg reports: “Dead Coins lists around 800 tokens that are bereft of life, while Coinopsy estimates that more than 1,000 have bought the farm.”

The crypto mining sector also has its problems. In particular, the cloud service HashFlare terminated the mining of BTC because mining “continues being unprofitable.”

At the same time, former Trump aide Steve Bannon owns bitcoin and is working on the issue of his own cryptocurrency. Billionaire Mark Lasry expects the bitcoin price to grow to $40,000. In his column for Forbes, Clem Chambers, CEO of the British financial market website ADVFN, calls Bitcoin a logarithmic asset and speculates that bitcoin may return to its $20,000 price, and then increase to $200,000 or even $2 million, “if the market mechanism of the asset remains viral.”

Institutional support for cryptocurrencies is also developing. In Singapore they have launched the state-owned blockchain trading platform Open Trade Blockchain, which allows transactions to be performed and decentralized apps to be created.

On July 20, 2018 (+8 UTC), Huobi introduced a platform for creating cryptocurrency exchanges. Huobi Group announced the official start of its cloud business division, which will endeavor to provide a universal solution for the exchange of digital assets, enabling its partners to quickly establish the secure and stable exchange of digital assets.

“The first decentralized stock exchange” opened in Malta. The decentralized Maltese bank will launch two trade platforms together with Binance and OKEx.

Finally, the latest rating of cryptocurrencies from the China Center for Information Industry Development (CCID) was released. A rating was assigned to 31 cryptocurrencies. EOS took first place, Ethereum was in second, Nebulas was in third, while bitcoin came in a distant 16th. The three leaders in the previous CCID rating were EOS, Ethereum, and NEO.

ICO Market Analysis (July 9-22, 2018)

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

1. General analysis of the ICO market (by week, month)

1.1. Brief overview of ICO market trends

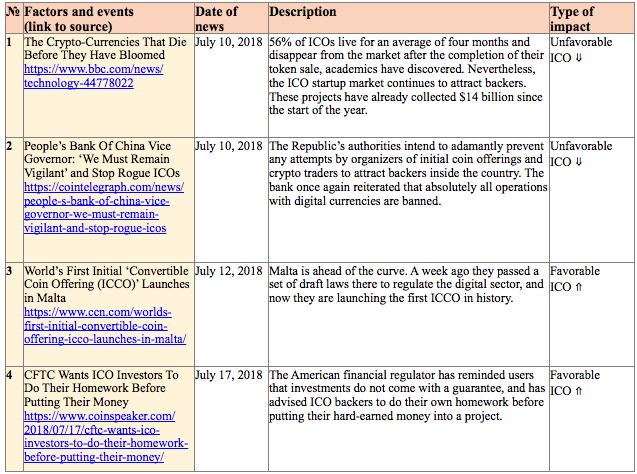

Table 1.1. Brief ICO market overview, key events, news for the two weeks from July 9-22, 2018

Table 1.2 shows the development trends on the ICO market since the start of the second quarter of 2018. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

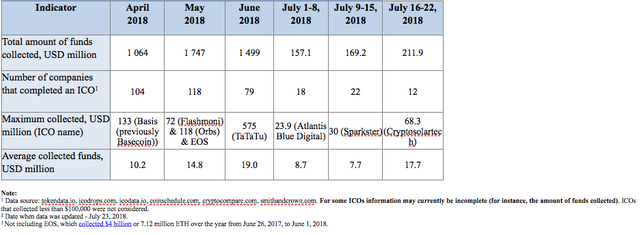

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1,2,3

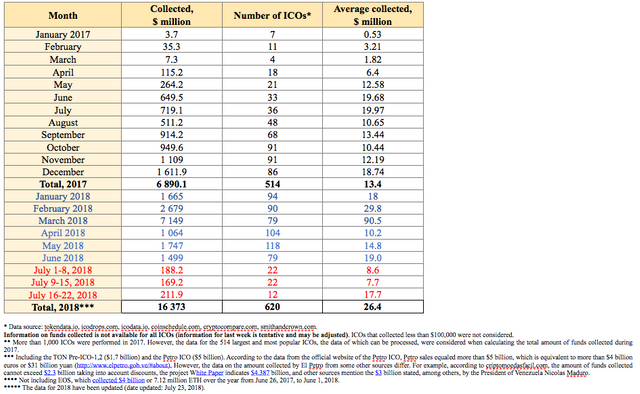

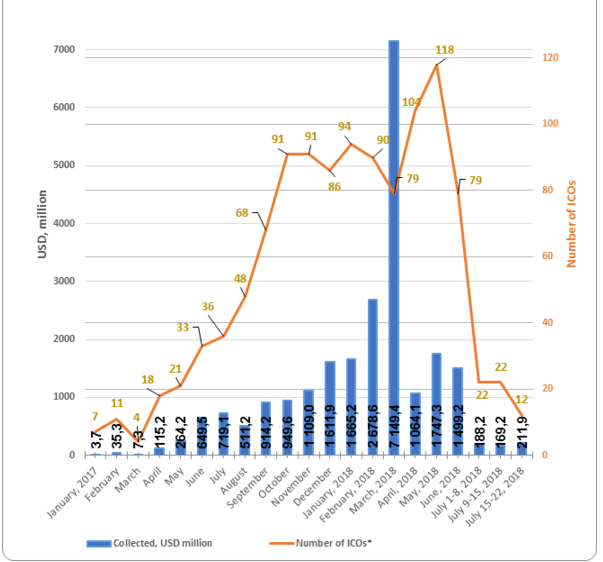

Over the previous period (July 9-22, 2018) the amount of funds collected via ICOs equaled $169.2+$211.9=$381.1 million. This amount consists of the results of 22+12=34 successfully completed ICOs, with the largest amount of funds collected equaling $68.3 million (Cryptosolartech ICO) (see Tables 1.2, 1.3).

Table 1.3. Amount of funds collected and number of ICOs

Table 1.3 shows that the largest amount of funds was collected via ICOs in March 2018, mainly due to the appearance of major ICOs. The highest average collected funds per ICO was also seen in March 2018.

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

1.2. Top ICOs during the analyzed period

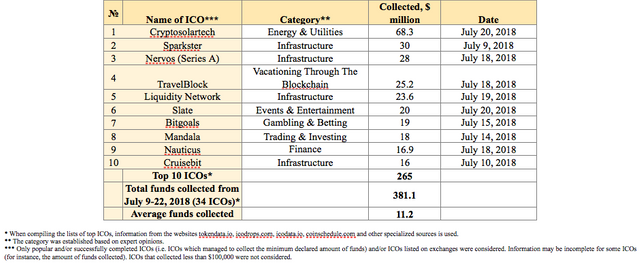

Table 1.4 shows the ten largest ICOs

Table 1.4. Top 10 ICOs in terms of the amount of funds collected (July 9-22, 2018)

The data for the previous period (July 9-22, 2018) may be adjusted as information on the amounts of collected funds by completed ICOs is finalized.

The leader of the period was the Cryptosolartech project, which is involved in cryptocurrency mining. This project’s goal is to collect funds for the construction of a photovoltaic electricity power station with a capacity of 45,000 kW, based on the conversion of solar energy. Funding of solar energy could be profitable, provided construction and equipment costs are decreased and the performance of the electrical equipment is improved.

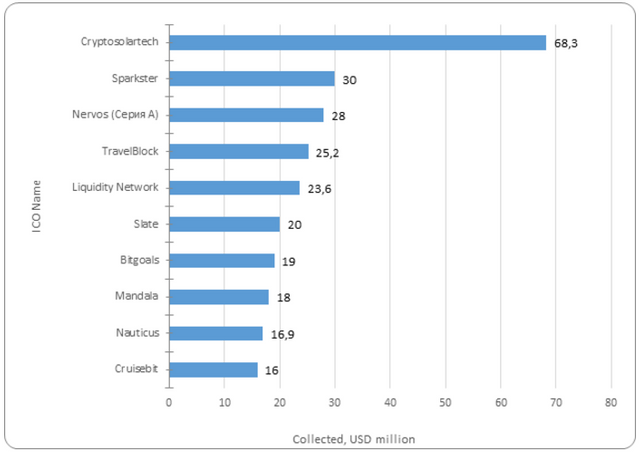

Figure 1.2 presents the ten largest ICOs completed during in early July.

Figure 1.2. Top 10 ICOs by the amount of funds collected (July 9-22, 2018)

1.3. Top ICOs in the Energy & Utilities category

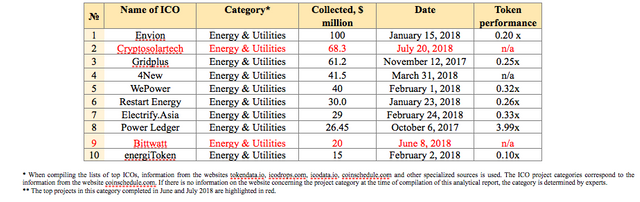

The list of top ICOs by category is compiled with due account of the categories of the leading ICOs for the week. The Cryptosolartech project collected the second most funds via ICO in the Energy & Utilities category (Table 1.5).

Table 1.5. Top 10 ICOs by the amount of funds collected, Energy & Utilities category

At present, all projects from the top 10 in this category have a token performance indicator of less than 1x. The most successful exchange listing among the ten presented is the Power Ledger project, as it has a current token price to token sale price ratio of 3.99x. When considering this indicator, it is important to remember that the Power Ledger ICO was completed on October 6, 2017, i.e. the 4x growth took place over approximately eight and a half months. Power Ledger’s current market capitalization exceeds $124 million.

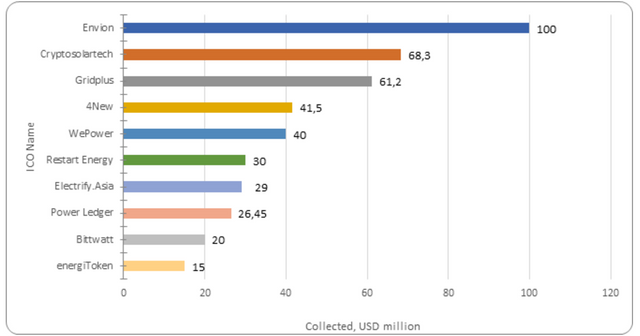

Figure 1.3. Top 10 ICOs by the amount of funds collected, Energy & Utilities category

During the analyzed period (July 9-22, 2018) at least 34 ICO projects were successfully completed, each of which collected more than $100,000, with the total amount of funds collected equaling more than $380 million. Last week’s leader was the Cryptosolartech project, which collected $68.3 million. The total amount of funds collected by a number of ICOs failed to reach even $100,000 (the information for some projects is still being finalized).

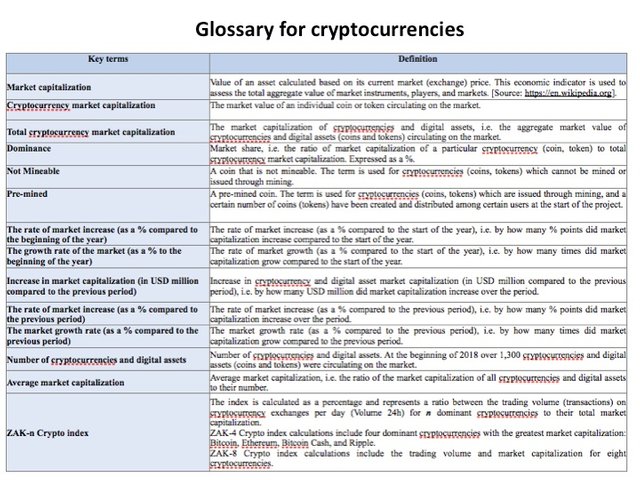

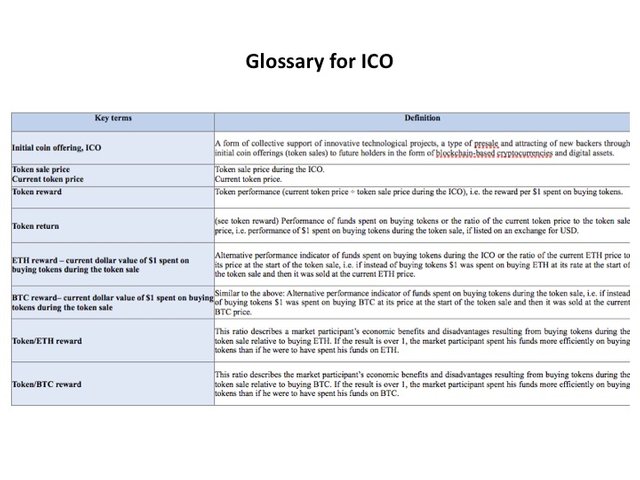

The Glossary is given in the Annex.

Annex

Glossary