Bitcoin TA - summary of analysts - 19. Feb 18

Regular daily update on BTC ta analysts opinions.

Own comment:

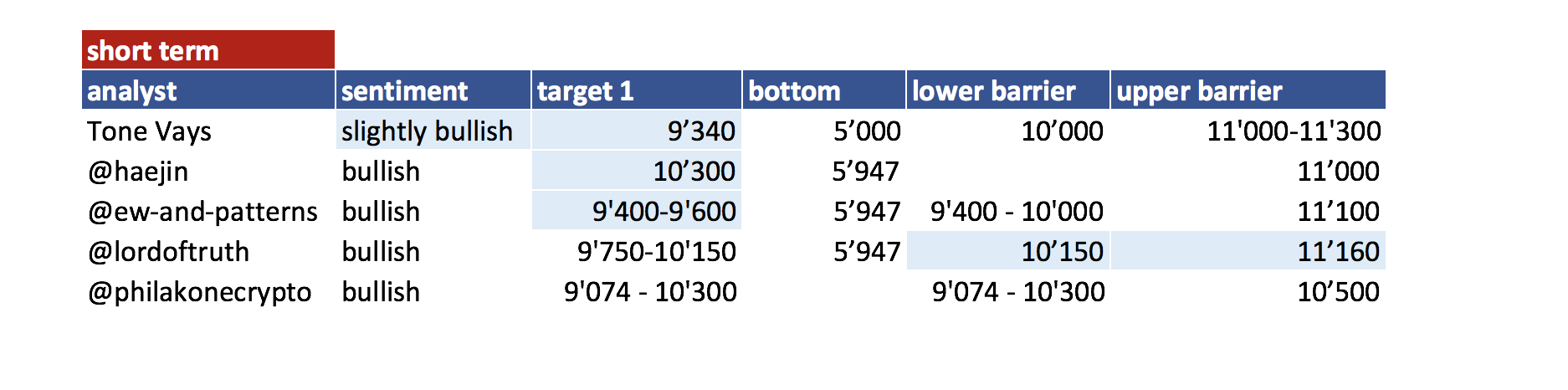

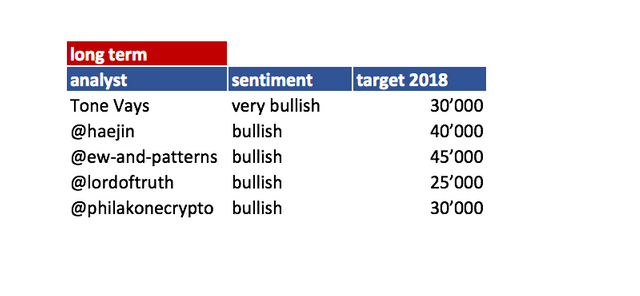

- In general bullish momentum continues. I put Tone on slightly bullish based on his analysis of the weekly chart although his count is not yet bullish.

- General sentiment - we see a pullback towards 9'400 - 10'000 before continuing bullish move. Major resistance is 11'000-11'300 and than 12'500.

Analysts key statements:

- Tone: On the weekly he very much liked the current week candle. Based on traditional markets the weekly turned already bullish when trading above the doji of last week. He number count however is more conservative but we are on track. Daily - looks bullish - major resistance (with 3 indicators coming together - fib line 11'300, ma50, TIST 11'200) . 4hourly and 1 hourly however look bearish. But still we are on track. He short term target is around 9'340 but generally bullish (see chart with target arrows below).

- @haejin: Wave 4 of higher degree wave C in progress which will bring us towards 10'300. Alternate count an ascending right triangle is in progress. That would leave one last wave down towards 10'700.

- @ew-and-patterns: Brief evening update from yesterday - bitcoin moves as expected. It seems A and B are completed and wave C down is next. Target 9'400-9'600 for that correction.

- @lordoftruth: Expected trading for today 9'700 - 12'000. Pullback will lead to 9'750-10'150 before moving up again (next target 12'600). Short term bullish.

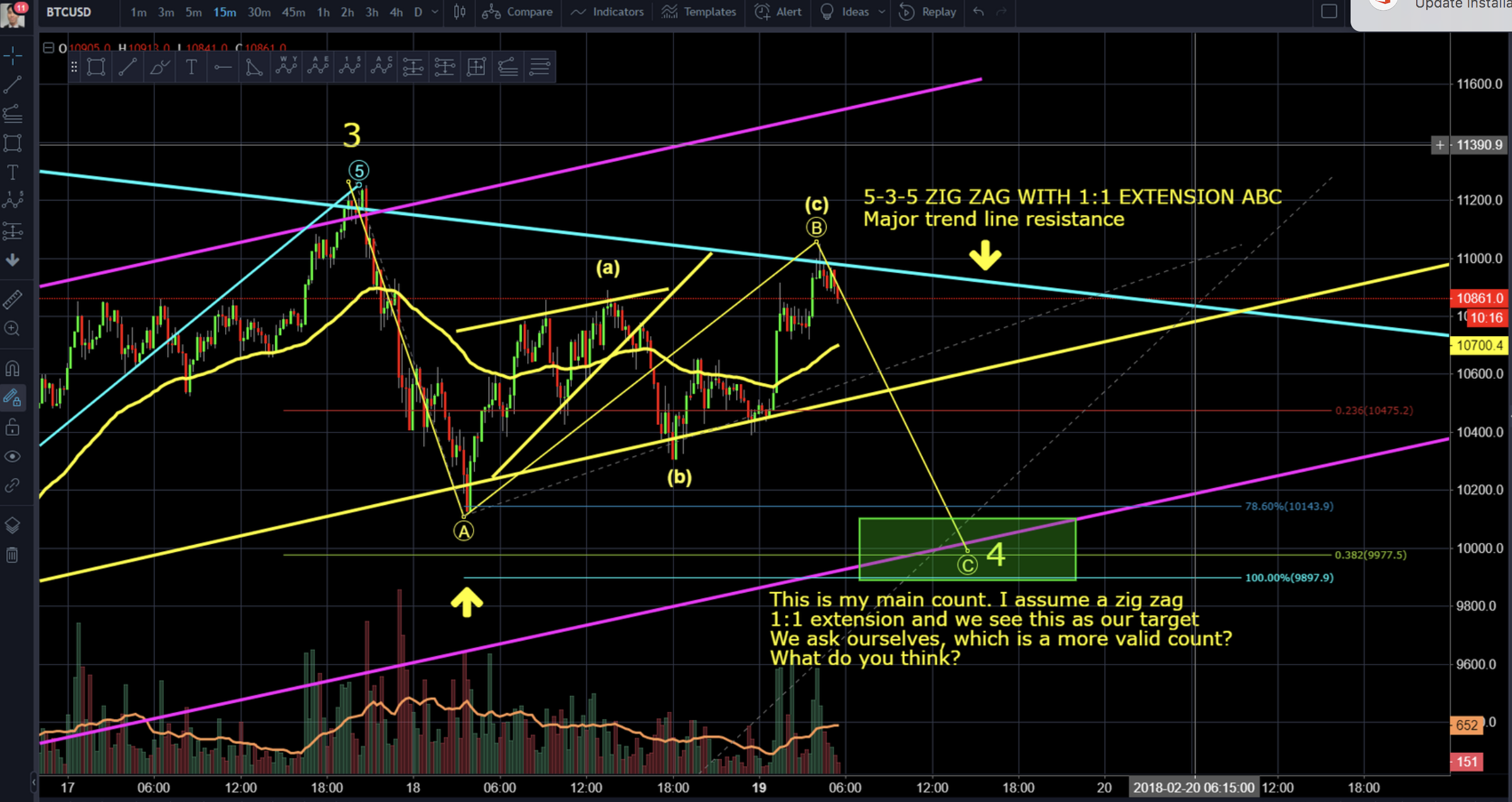

- @philakonecrypto: Indecisive elliot wave count. He believes the correction is not yet over because otherwise we would be in an incredible bullish market. We have also not yet reached 382 fib line. Below his main count targeting 10'000.

Overall sentiment: bullish

(last: bullish)

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 19. Feb | here |

| @haejin | 19. Feb | here |

| @ew-and-patterns | 18. Feb | here |

| @lordoftruth | 19. Feb | here |

| @philakonecrypto | 19. Feb | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target 1 = the next price target an analysts mentions

- bottom = price target analyst mentions as bottom

Both target are probably short term (so next few days/weeks) - lower/upper barrier = Most significant barriers mentioned by the analysts. If those are breached a significant move to the upside or downside is expected. It does not mean necessary that the sentiment will change due to that (e.g. if upper resistance is breached it does not mean that we automatically turn bullish).

If you like me to add other analysts or add information please let me know in the comments.

I think the correction was done

https://steemit.com/bitcoin/@lordoftruth/bitcoin-trend-midday-update

We are so close to 100 DMA ( 11150.00 ) and might go to 50 DMA ( 12650.00 ) in the next 24 hours !!

It does not "feel" so.

Thanks for the additional comment - I hope we break that 50 DMA soon!

I just subscribed and it is nice to have this reference. Glad I found this. Thanks for the effort.

nice post i will done upvote

thanks sir @famunger for this bitcoin analysts update

resteem & upvoted & comment

You can run with the bulls, but never against them

So, trading gods have the same feelings...should we say that the correction is finished?

Hey, swisschris, what's your idea of BCH?

You mean fundamentally? That would probably fill an own post. I think it is a question of believe (blocksize). What I found interesting though is that Microsoft research is not convinced of on-chain scalability (which would be block size increase). Here is a good article:

http://bitcoinist.com/farewell-bitcoin-cash-microsoft-chain-scaling-degrades-decentralization/

All that is gold does not glitter,

Not all those who wander are lost;

The old that is strong does not wither,

Deep roots are not reached by the frost.

Amagin post.realy nice job.

i think bitcoin is real man

I have to say this summary is of tremendous help! Thank you :)