Portfolio rebalancing

Portfolios are like cars. If you want the car to serve you faithfully for a long time - do not forget to regularly perform maintenance. The same with portfolios, the most important aspect of regular portfolio maintenance is rebalancing.

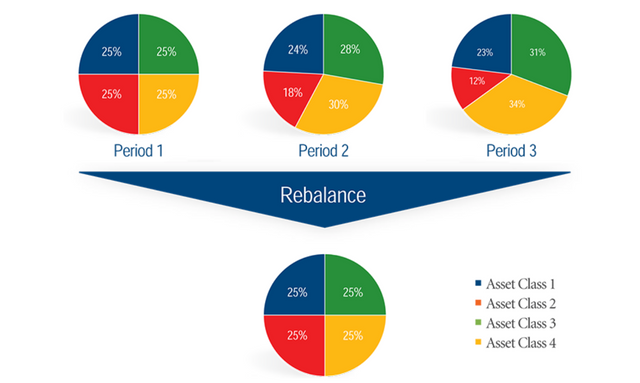

Rebalancing - bringing the percentage of assets of the investor in the original form.

To make it clear, consider an example:

Your investment portfolio consists of 4 types of assets of equal shares, respectively, each asset is 25% of your portfolio. Suppose, after an n-period of time, one asset grew in price, and its share became 30%, and another asset fell in price, accordingly its share fell to 18%. To restore the original balance, the profit received from the asset is sold alone and the asset 2 is purchased for this profit to return the previous percentage to the portfolio.

Rebalancing can be carried out not only by selling some assets and buying others. You can restore the portfolio balance at the expense of additional funds, as well as dividends and interest.

Restoring the original structure is a very important point in portfolio management. It is based on the fact that assets are characterized by a certain level of risk and profitability, which they are subject to in the long term.

Rebalancing forces sell what has risen in price and buy something that has become cheaper, which at first glance contradicts common sense. But on the other hand, with the fall of assets, this forces us to buy what in the long run will bring us greater profitability and record profits where we have already received it. This is the point.

Unfortunately, no one knows for certain when it is most profitable to rebalance. Markets are constantly in a dynamic, falling into panic, then into depression, then into euphoria. Attempts to guess the right moment to buy usually do not lead to success. Therefore, in order not to guess, two rebalancing mechanisms were invented: calendar and dynamic.

The calendar mechanism means rebalancing regularly at a given time interval - for example, once a month, quarter, half year or year. In this case, the investor chooses a specific date, in which he restores the balance of the portfolio.

Dynamic - not tied to any date or time limit. In this variant, the signal is the deviation of the share of the asset from the initial one by a certain percentage.

Which way to restore a portfolio is a personal matter for each investor, but the calendar method is more preferable because of its simplicity and sufficient efficiency.

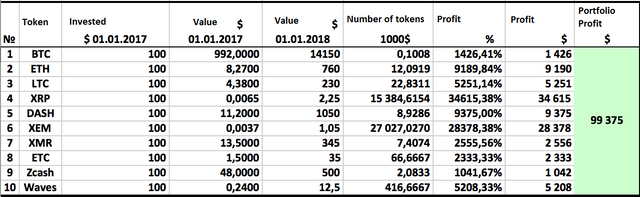

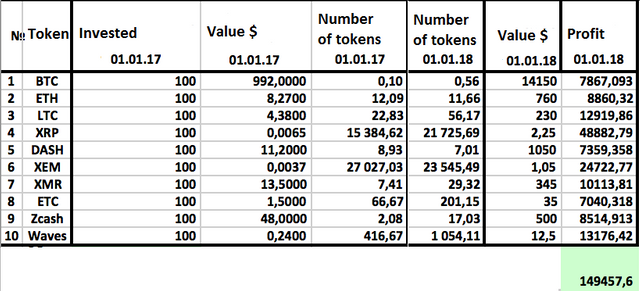

The example below shows 2 tables, one of which represents the total annual income, with the investment of $ 1000 in the top 10 of the Cryptocurrency for 1.01.2017 without rebalancing, and for the other total annual income, when investing $ 1000 in the same list, crypto, but with quarterly portfolio rebalancing.

The annual income of the portfolio without rebalancing.

The total income of the portfolio was $ 99,375

The annual income of the portfolio with a quarterly rebalancing.

The total return of the portfolio with rebalancing was 149 457 $

As you can see, the total income for rebalancing the portfolio exceeded income without rebalancing by 50%!

Invest smartly!

✅ @dimasty, I gave you an upvote on your first post! Please give me a follow and I will give you a follow in return!

Please also take a moment to read this post regarding bad behavior on Steemit.