How to profit from lending platforms

With the inevitable collapse of the Bitconnect lending platform in January 2018, many of their investors have lost significant funds. However, for the most risk loving investors, there are strategies which you can use to potentially profit from the explosion of lending platforms that has sprung up in Bitconnect's ashes. Please note that these strategies are for the most risk loving investors and not for the faint of heart. Also, everything contained in this article is my own personal opinion and should not be viewed as financial advice. I do not support nor hold any of the coins discussed in this article as these coins are beyond my risk appetite, hence I am going to steer well clear of them.

Strategy 1 - buy the coin

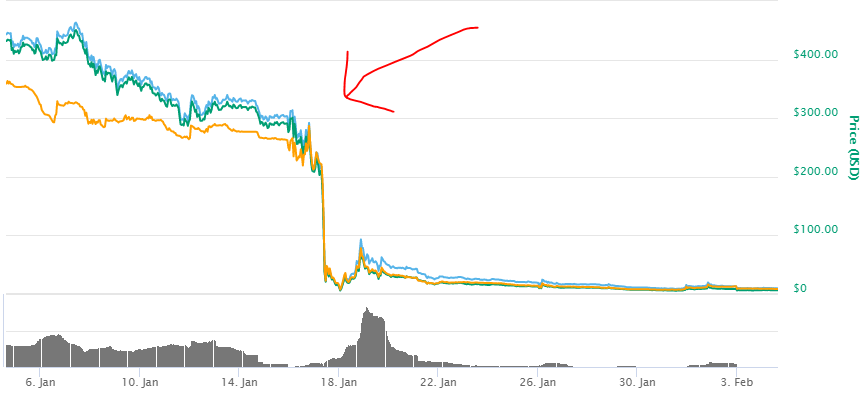

Instead of using the lending platform for each coin, you can buy and hold the coins themselves. For example, below is a chart of the Bitconnect (BCC) coin over the past 12 months according to Coin Market Cap.

BCC went from near $US0 to over $US400! Hence, there are a lot of profits to be made just by holding the coin. Of course, it wouldn't be as much as if you lent it out, however buying the coin but not lending means your funds are not locked up and you can sell at any time.

Strategy 2 - Lending but try to take profit as much as you can

With this strategy, you should take out your interest payment as much as possible and hope that the lending platform do not collapse before you recoup your money or your capital is released. Bitconnect lasted more than a year, which meant that if you invested very early on, you could have received your interest payments and capital back to boot, however you are essentially playing Russian roulette with your funds. If you manage to pull your funds out before the inevitable collapse like below:

I have deliberately left out other strategies like affiliate marketing which is the tactic used by CryptoNick, Ryan Hildreth, Craig Grant, Trevon James (aka Brown) and the other prolific promoters of Bitconnect because I think it is unethical. It is very obvious that these lending platforms which guarantees returns are not sustainable, so it would be wrong to peddle it to other people and be paid when others invest.

Again, the strategies I have outlined is extremely high risk, I cannot stress that enough. For example, as outline in an earlier post, here, the price for the Davor coin has crashed recently and at the time of writing, the lending platform is still up and running. Whether the price crash will trigger the Davor lending platform remains to be seen, only time will tell and it's only a matter of time. Sooner or later, these lending platforms will come crashing down and hopefully, you will be not left holding the proverbial bag when it does!

What do you think, do you guys have other strategies to try and profit of this lending platform craze?

There is no profit from scams, stay away guys. Invest in legit coins, it will pay back over the long term

I couldn’t agree more. I currently hold Davor Coin and I’m staking it waiting for another big pump. I wanna make the money i lost through Bitconnect back with Davor and completely stray from lending platforms. I wouldn’t advise anybody to loan money out if there is no proof of sustainability

Very interesting, but bitconnect has made me more skeptical than anything when it comes to lending. That bitconnect crash was insane. 450 to 5$.

Congratulations @cryptoweekly! You received a personal award!

Click here to view your Board