Make money through Cryptocurrency Arbitrage

What is Cryptocurrency Arbitrage ?

Cryptocurrency Arbitrage is simply just buying something and selling it at a higher price at the same time. Because you are buying and selling at the same time, there is essentially 0 risk and profit. So your risk/reward ratio is extremely high for arbitraging as there is very little risk . highly volatile assets like cryptocurrency are perfect for arbitraging the price disparities from different exchanges.

There is 1 risk to arbitraging cryptocurrency and that is counterparty risk. This is the risk of depositing and holding funds in a centralized exchange. For many people this is a low risk as they already do this, and if a trader already has coins on 2 exchanges, arbitrage it is basically risk free money sitting on one of the exchanges.

How to Find Cryptocurrency Arbitrage

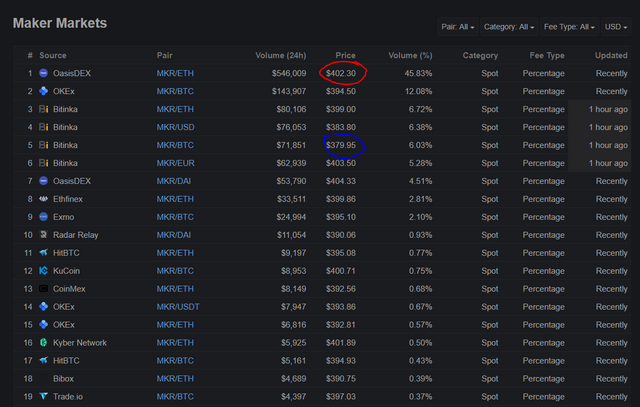

One of the simplest ways to find arbitrage opportunities is to check on coinmarketcap.com. Simply look at the markets portion of the coin page.

And check the prices at various exchanges

In this example it would be worth looking at the order book on Bitinka and Oasisdex to see if you could buy cheap at Bitinka and Sell expensive on Oasisdex. Keep in mind though this would require trading BTC/ETH pair as well.

For example, if you have accounts from different exchanges, you’d notice that buy and sell rates (BTC/USD & USD/BTC) have different real time prices. The picture below is a snippet from this website https://bitinfocharts.com/cryptocurrency-prices/ on Jan 26, 2019 at 10:30AM CST. Here’s one from coinmarketcap https://coinmarketcap.com/currencies/bitcoin/#markets

Based in the picture, If you bought BTC from quoine for $3,553 and sold it to lakebtc for $4,213 you would have gained +$660 for every 1 BTC. That’s about 19% ROI, assuming that buying and selling from exchanges is instant for the sake of this example.

Although the prices on exchanges are close from each other, they, however, are not exact. So long as the constant disparities on any asset from two different exchanges, arbitrage lives on for investors to take advantage of. It’s a very straightforward and a low-risk strategy. It might be simple, but there are a lot of factors to consider.

Factors to consider:

- Counterparty risk

- Trading fees

- Withdrawal times (time value of money)

- Withdrawal fees

Arbitrage Profit Calculation

Profit = (ExchangeAPrice- ExchangeB Price)- (ExchangeA fees + ExchangeB fees) - (ExchangeA withdrawal fees + ExchangeB withdrawal fees)

Bitcoin Arbitrage Strategies

Since the changes of prices in exchanges are constant, the arbitrage strategy, if done right, will always be strategy to take advantage of. Simple as it may seem fundamentally, arbitrage strategies were developed. Some to adjust with the nature of an asset in the market. They all have benefits to give and issues that they can fix, but they each have their own downsides as well.

Crypto-Crypto Arbitrage

Many exchanges allow you to instantly move your crypto holdings between exchanges. Any crypto token can be used for arbitrage, but let’s consider Bitcoin in this example.

If there is a significant difference between Bitcoin prices on two exchanges, arbitrage becomes a possibility. Consider trading Bitcoin and Ethereum in this situation:

Moving your crypto holdings from one exchange to another may be an issue, because some take a long time and the price may change while in orders. Most, however, actually allows you to move crypto instantly.

So ideally, if the prices difference of a Bitcoin, is significant enough to cover for the time factor if prices do drop, then an arbitrage can be possible. In this example, an arbitrage can be possible. The table below, is an example, let’s say you’re trading BTC for ETH.

|

Exchange A |

Exchange B |

|

1 BTC ⇆ 30 ETH |

1 BTC ⇆ 31 ETH |

The table above shows that you can get 1 ETH if you buy 1BTC on exchange A and sell it on exchange B. 1 As

of Jan 26, 2019 BTC is about $3.5K this and ETH is at $115. It is, however, a small return for a huge investment but it also isn’t that risky, especially if the exchange can transfer crypto instantly.

This is just an example and is a simple one. There are other strategies that are more complicated e.g. triangular arbitrage. In a triangular arbitrage, even if the exchanges involved can provide instant crypto transfers across exchanges, most correct their prices quickly.

If that happens and it gets corrected before you were able to trade your BTC for ETH, your loss would only be the fees. Therefore, what you should really look for, is an exchange that doesn’t correct their prices too quickly in order for you to perform a successful arbitrage trade.

This example does not account for over overall market volatility. If crypto crashes, whatever coin you have would crash with the rest of the market. This is where selling your crypto coins for stablecoins comes in handy. It can provide a temporary security for volatility. Here is a good article about stable coins, if you want to know more about stablecoins.

https://btcloans.org/stablecoins-are-cryptocurrencies-with-fixed-prices/

Crypto-Fiat Arbitrage

Bitcoin to USD and vice versa are available in most exchanges.

|

Exchange C |

Exchange D |

|

1 BTC ⇆ $4,000 |

1 BTC ⇆ $3,500 |

A $500 disparity is a very significant return for a $3,500 investment, that’s about 14% profit. The usual disparity level is around $100 for BTC to USD, but there are also remarkable ones. The biggest I know was a year ago, January 2018, when BTC in Coinbase was at $15,255 and Upbit was at $22,674.

In crypto-fiat arbitrage, time is a main obstacle. That’s why opportunities like these are difficult to take advantage of. And transferring fiat to and from exchanges, usually take several days. Especially if it’s an international exchange, they take even longer.

You also have to take into account the fees on exchanges and banks, and foreign exchange rates. Which usually eats into investments. So, basically, you can only take advantage of almost all arbitrage if you already have investments in multiple exchanges. However, it would be a large sum of money.

Automated Bitcoin Arbitrage

There are softwares that you can buy or an exchange with this particular feature or services you can subscribe to online that does all your arbitrage trading for you. It’ll aggregate and discover Crypto arbitrage and trade for you, with whatever you set the amounts or percentages to.

There are even platform that can perform complex trading for you like, SFOX, that can provide you with in-depth information about the market and use this for your advantage. Decision would have to come from you on how you want your assets traded, they just provide you with information.

This might be the best way, but as usual, there also are concerns about these services. They usually are a bit pricey, so, you’d really have make sure that the it’s worth it. There also are a lot of scam sites and services that would look very legitimate.

Example:

HitBTC

BTC/USDT price = 3980.00

Fee .1% = 3.95

Withdrawal Fee= 45 USDT

Binance

BTC/USDT price = 3900

Fee 1% = 3.90

Withdrawal fee (BTC) = $3

So in the scenario where you have 1 BTC on HitBTC and enough USDT to buy 1 BTC on Binance your profit will be as follows.

$24 = (3980-3900) - (3.90+3.95) - (3+45)

I used this example because if you are fine with leaving USDT on HitBTC you can actually make a risk free profit of $69. But, the things to consider in this scenario are:

- HitBTC has a bad reputation for locking user funds and poor service

- HitBTC has a bad reputation for slow USDT withdrawals

- You have to trust USDT

- You have to have total of around $8000 worth of BTC + USDT sitting on an exchange

So while it is technically a free $69 sitting on HitBTC exchange for trading the same BTC/USDT pair. The market is pricing in the above risks.

Factors to Consider

Bitcoin arbitrage is difficult to do consistently, but it still is possible to do. If you are considering on seriously using arbitrage as your strategy, here are a few factors to consider.

- Transfer times: Know how long it takes for exchanges to correct their prices and be familiar with how to navigate through them and etc. Because even if you saw the arbitrage opportunity right away. You might not be able to get the through the whole process in time.

- Market uncertainty: If you mainly use BTC for to trade for another crypto, the general market volatility would most probably affect you. As data shows, that most cryptocurrencies are obviously affected by BTC’s volatility, including stablecoins, though not as much. The variations in the market, at the same, can also be the cause of the disparities in pricing that you actually need for you to get profits.

- High investment requirements: Might cost you a large portion of your profit.

- Trading Fees: High trading fees can cut into your profit

- Withdrawal Fees: If you have to move cryptocurrency out of an exchange because of your arbitrage trade you will need to factor in withdrawal fee costs.

- Exchange Custody: Not your private keys not your cryptocurrency

Conclusion

Arbitrage is a great way to make mostly risk free money in cryptocurrency. It can be thought of as providing a service to the global cryptocurrency economy by moving all price disparities closer to a single global price. There are literally Billions of arbitrage opportunities between different coins and exchanges.

So if you happen to have some trading funds on different exchanges, take a quick look at varying prices and see if you can make some quick risk free profit with arbitrage. Most the times bots other arbitrageurs will have kept prices pretty close, but it never hurts to check and look if you can make some risk free money on funds you already have in different exchanges.