How to Trade Stablecoins

Trading stablecoins is one of the lowest risk ways to earn money in cryptocurrency. During high volatility you can earn upwards of 30% APR just trading stablecoins. This may not seem like that much when cryptocurrencies can move that much in a day, but with stablecoins your downside risk is much much lower so your risk/reward ratio is very attractive.

How it works

The idea is very simple.

Sell $1 for more than $1.

Buy $1 for less than $1.

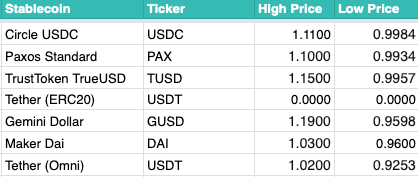

This may seem too simple, but premiums and discounts on stablecoins exist all around the cryptocurrency world. I have bought $1 stablecoin for as little as $.95 and sold it for as much $1.05. That is 10% on simply trading $1.

One nuance of this type of trading is that if you want to do it profitably and make it worth your time you will probably need to have quite a few USD to start.

1% of $100 is only $1.

1% of $10,000 is $100.

A $1 trade is probably not worth your time or fees.

A $100 on the other hand is a good day's work.

What is a stablecoin

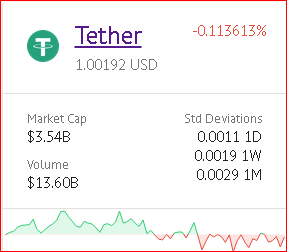

Stablecoins have become hugely popular in the cryptocurrency world and now between all of them have they have multi-billion market cap and billions of dollars of daily trading volume. They are simply tokens pegged to stable assets such as USD, CNY, EUR. The whole world transact in these currencies with multi trillion dollar market caps so they are considered “stable” in value.

USDT King of the Hill Best and Worst Stablecoin

The most popular type of stablecoin is fiat backed stablecoins like USDT. The idea is simple, have a bank account with $100M in it, release 100M USDT tokens. When someone wants to withdraw, simply withdraw from the bank account. So while the idea is simple and likely is mostly true, there is a lot of speculation and worry regarding the analogies $100M in the bank. A shady business, bad banking relationships, and other controversy surrounds the supposedly safe and secure $100M in the bank.

With that being said, if you want a liquid stablecoin where you can trade large volumes of nearly any cryptocurrency in the world. USDT is the leader by a long shot. In the last year some serious competitors have entered the market focusing on transparency and compliance relative to USDT. TUSD, USDC, GUSD, and USDS, to name a few. While TUSD is the oldest, USDC has quickly surpassed it in market cap and trading volume with its partnerships and liquidity sourced at poloniex.

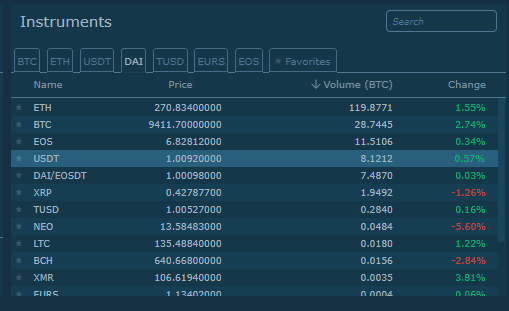

Where to Trade Stablecoins directly

More and more exchanges are enabling direct stablecoin trading pairs such as USD/USDT, DAI/USD, USDC/USD and others on Bitfinex. To DAI/USDT, DAI/EOSDT and others on HitBTC. When you trade stablecoins directly the math and calculation is very easy. You can litteral buy the other stablecoin for less than $1, and sell stablecoins you do have for more than $1.

This is the easiest way to trade stablecoins, but not the most profitable. If you look at the price charts supply and demand sometimes causes the prices to move up to 5% in either direction. But for the most part these trades stay within a few % as bots and other arbitrageurs will fill in when there is profit.

Trading it indirectly

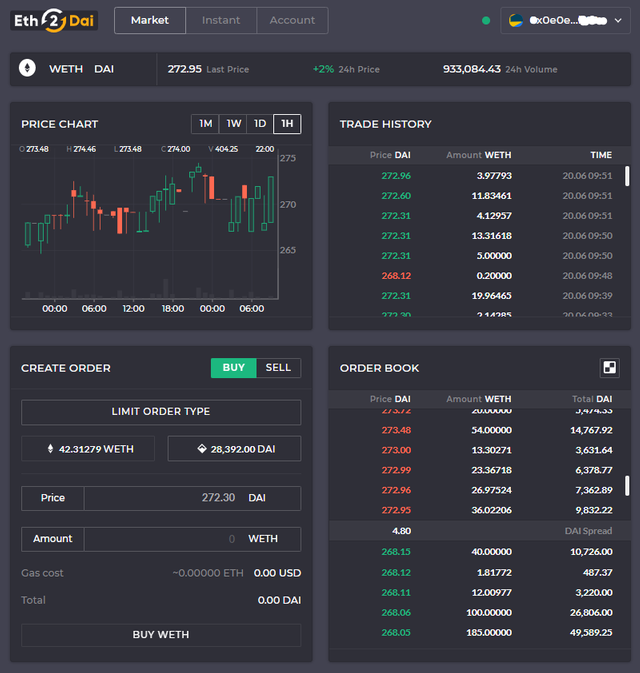

Trading stablecoins indirectly is an opportunity to make more profit as its much harder for arbitrageurs to keep these markets tight. The best stablecoin I have found to trade is the DAI/ETH and ETH/(xxx) other USD stablecoin pair.

DAI is a very cool but not very well understood cryptocurrency. It does hold risks, but the system has proven secure and resilient. Overtime DAI has become more and more liquid as a stablecoin, which has tightened margins. But there is still plenty of opportunities to make a profit with DAI.

The best place to trade DAI currently is on its native truly decentralized exchange eth2dai.com. As a truly decentralized exchange, every order in the order book as well as every trade performed on the exchange is an onchain transaction. This makes the exchange completely transparent, but slightly slow and expensive. During low volatility buy/sell orders cost around $.10 per order, but during periods of high ETH transaction activity it can cost as much as dollars per order. You can always use a lot fee, but it's a first come first serve so the orderbook or general market price could change a lot if your transaction took a few minutes to confirm.

Decentralized Stablecoins are the most volatile (relative to 1 USD) and profitable to trade. This is partially because they are newer and less understood, but more because they are generally less liquid as a market maker would actually need to create the DAI he/she could not just go to the bank and get a bunch of stablecoins to make a market.

Example:

Some positive Ethereum news came out, maybe Vitalik discovered a scaling solution. The market price on high volume centralized exchanges spikes up. ETH very quickly raises 10% in price.

Your opportunity:

Likely DEX exchanges like eth2dai.com will not move nearly as fast. So if you have your funds ready on eth2dai as well as opposite funds on a centralized exchange you could buy up the orderbook of ETH below the 10% price, and sell it instantaneously on the centralized exchange. So let’s say you buy 10 ETH on eth2dai for $400 and at the same time sell 10 ETH on a centralized exchange for $410, you just made $100 with almost no risk.

These opportunities generally happen when the price quickly goes up or down, but it can also happen when a very large order is placed on a DEX. For example 1000+ ETH sell orders have been placed on eth2da which can take quite some time to get bought on DEX’s. Also during panic, many users with buy orders can login to cancel their high buy orders fast enough so you can sell high on a DEX and buy low on a centralized exchange.

Understanding the risks

As one of if not the safest trade in cryptocurrency, it's important to remember that nothing is risk free. There are risks to everything in life, from smart contract flaws for DAI to 3rd party risks on fiat backed stablecoins like tether. One of the least desirable traits of stablecoins is that they all have downside risk, and none of them really have upside potential. But with that being said they are for the most part going to be around $1 all the time. Just be careful and keep an eye out for regulatory, contract, or custodial risks and downside potential for your stablecoins.

Because, the downside issue caused from panic, illiquidity, or some sort of combination of both, is also your opportunity to profit. For example USDT, as heavily criticized and complained about as it is. If you would have purchased it every time its traded at a discount of up to $.20, its historically always bounced back to 1 and if you had been a buyer during those times, you could have profited those 20% with relatively low risk (depending how you feel about holding tether.to 3rd party risk).