Cryptocurrency Investing - My ticket to freedom

I'm a dreamer. Always have been. Always will be. I dream of a life free from worry & stress. A life where I can sleep in when I want, spend more time with my family, and travel around the world visiting exotic locales. Most importantly, a life where I'm my own boss, in charge of my own destiny, with nobody to tell me what I can & can't do (except maybe my loving wife).

My reality is a long way from that dreamy ideal. For a long time I didn't have any hope. I thought I would be trapped in the iron manacles of corporate oppression forever. But a couple years ago a friend introduced me to Bitcoin. And I began to hope again.

Last week the price of Bitcoin surged to more than $1200, within spitting distance of hitting its all-time high (or ATH for short). To put that in perspective, I brought up my firm's commodities trading software and observed that our pricing engines were publishing a gold spot price of $1251.24 per ounce as of Friday afternoon.

Now, let's compare that with Bitcoin. Quoting Wikipedia:

The current all-time high was set on 29 November 2013 at US$1,242.00 on the Mt. Gox exchange.

So if Bitcoin breaks through that barrier to make a new ATH, it will be roughly equal in value to 1 ounce of gold. Pause and really think about that for a minute. A bunch of ones and zeroes, an intangible mathematical construct that you can never hold in your hands, could soon match or exceed the value of an ounce of gold. You know the term "precious metals"? Well now we're talking about "precious bytes".

I don't own any gold. Never have.

I do own a bunch of Bitcoin, bought way back when the price was "only" a few hundred dollars. And I couldn't be happier. It's maybe the third best investment I've ever made.

So you think Bitcoin is going to make your dreams come true?

Not by itself, no. It's true that to achieve my longed-for life of freedom, I'll need a source of money. And lots of it. Hard to escape that fact. The real question is, how do I get enough money so that I can walk into work one day, laugh in my boss's face and say "I quit, see ya wage slave"?

I like to picture my strategy as being somewhat akin to a network of tributaries, small streams that converge on one another to form a great torrent of water flowing down a mighty river to the ocean of a better life. Bitcoin is one of these streams of income. But it is not the only one.

I worry about my Bitcoin stream drying up, or being blocked by a fallen tree, or something. To ensure my raging river continues flowing unabated, I need multiple streams, so that if one is cut off the others may compensate for it.

What are these other streams you speak of?

Bitcoin is only one of a multitude of digital currencies, or cryptocurrencies as they are commonly known. There are many others, of varying quality & attributes. Some, like Bitcoin, are a form of digital money that you can use to pay for goods & services. Others, the so-called Bitcoin 2.0 coins, are more exotic and have additional uses beyond being a simple medium of exchange.

It is these more exotic cryptocurrencies that I like to invest in. They are at the bleeding edge of technology, pushing the industry forward and bringing much needed innovation. Think of Bitcoin as the Microsoft of cryptocurrencies, the behemoth that's been around as long as the industry has existed. You can't go wrong investing in the Microsofts of the world. But there's much more profit potential in companies like Google, Apple, or Facebook, all arguably more innovative and adaptive than Microsoft. They are the Bitcoin 2.0s. Bitcoin is great to have in my portfolio, but it's these other coins that will propel me over the finish line in the end.

Okay, I get the concept. Can you give me some specific examples?

Sure. Here are a couple of the more important streams in my tributary network:

Steem Power

You are already familiar with one very important Bitcoin 2.0 coin: Steem! My Steemit account is a cornerstone of my investment portfolio. It's also the worst investment I've made so far due to the ever decreasing price of Steem. But my strategy takes that into account, leaving me well positioned to benefit when the price eventually goes back up (I'm very much betting that it will).

Objective: accumulate at least 100,000 Steem Power over the course of a few years, enough to qualify as a decent sized dolphin, while earning "dividends" in the form of curation rewards.

Strategy: Dollar cost averaging is King here. I made my first Steem purchase on the Poloniex exchange, 1 Bitcoin (BTC) for 275 Steem last August. Wow that seems overpriced now. These days I typically buy in 0.2 BTC lots, with a new purchase for each 25% drop in price. All Steem gets powered up and I have never powered down, nor do I plan to before reaching my 100,000 Steem Power goal. I've invested more than twice what my account is currently worth, but the advantage of such a mechanical buying strategy is that when the price eventually bottoms, my average cost basis will be very close to the low. And if Steem ever goes back up to even $1, my worst investment ever will turn into my best.

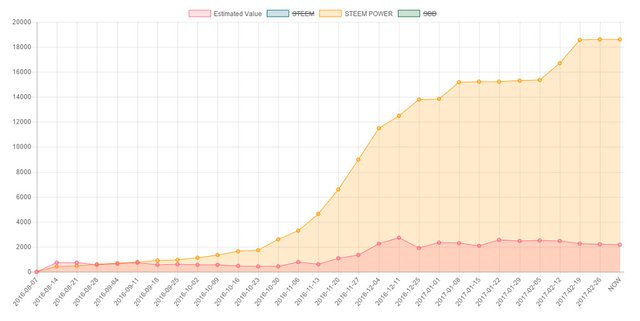

This graph from Steem Whales shows how my Steem Power balance has changed over the lifetime of my account, vs. the actual dollar value of my account. Today I'm nearly 1/5 of the way to my 100,000 SP goal.

Ether

I mentioned above that Bitcoin is the third best investment I've ever made. What then is my #1, you ask? That honor belongs to Ether, the cryptocurrency fuel that powers the Ethereum network. I missed the Ethereum crowdsale, but had the good fortune to stumble across a mention of it in early 2015, before the main Ethereum network went live. I was hooked on it from the beginning. Smart contracts are a revolutionary new form of software, and Ethereum is well positioned to be a leader in this space.

Objective: accumulate 1200 Ether (ETH), then hold long term for years, using the profits to pay off debt and diversify into other investments.

Strategy: I started buying into ETH when it first launched in August 2015, using a cost averaging strategy very similar in style to the way I buy Steem. I reached my initial goal in November of that year, then bought more using a loan in the first half of 2016 after the price took off. I have thus far achieved a return of more than 10x my initial investment. Hopefully Steemit will perform similarly at some future point.

Price graph from Poloniex, showing history of ETH / BTC prices since Ethereum's launch in summer 2015.

I hold many other cryptocurrencies as well, some of which are detailed in my introductory blog post from last August if you'd like to know more.

What are your most successful strategies?

Being successful in investing requires a calm, unemotional, logical mindset. One must be cautious and always skeptical of "the next great thing", which might turn out to be not-so-great after all. Protect your capital at all costs, because once you've lost it, that's Game Over. I invest according to these core strategies:

Look for bargains - smart money buys into new projects before they become widely known and start to take off. Always be hunting for original, innovative new cryptocurrencies that don't have a lot of competition, bring something unique to the table, and are not outrageously priced. Buying into every new pump & dump that comes along on Poloniex is NOT the way to do this!

Hold long term - I do short term trading every now and then, but I'm not very good at it. Being a day trader requires balls of steel and icy cold nerves. It's not for me. My greatest profits have been realized by ignoring day-to-day price fluctuations and holding long term. On some of my core investments, I will wait at least 6-12 months before I even consider selling any of it.

Use dollar cost averaging - As in the examples of Steem and Ether given above, I typically establish my large core positions by a series of small, regular buys over time, following a very mechanical purchasing schedule. This way you don't have to time the market (which I'm quite lousy at) or worry so much about falling prices. NEVER go all in with 100% of your funds at once. As a general rule, I stop buying once I have invested 5-10% of the net value of my whole portfolio.

Buy into ICOs - Initial Coin Offerings are a great way to get in on the ground floor of exciting Bitcoin 2.0 projects. I have bought into several, and made good money each time. Besides dollar cost averaging, this is the other primary method by which I add new streams to my tributary network of passive income. I'll have more to say about ICOs in my next post.

What do you see as being some exciting new opportunities in 2017?

This year promises to be quite a busy one for the cryptocurrency world. Next month we've got a final decision coming by the SEC on whether or not to approve the Bitcoin ETF planned by Tyler & Cameron Winklevoss. This decision, scheduled for March 11, will likely have a large impact on the price of Bitcoin regardless of which way the SEC rules. And later this year, several prominent Ethereum projects are scheduled to launch, which ought to have a very positive effect on the price of Ether.

I am personally focused on establishing 3 new revenue streams in the weeks / months ahead: Byteball, the Mainstreet Investment Fund ICO, and launch of the VIVA economic system by @williambanks are all fantastic opportunities. I'll end here with that as a teaser; more details on these projects to come in subsequent posts.

Until then, keep calm and Steem on!

Links for more info

My introductory post where I give more details on some of my investments:

https://steemit.com/introduceyourself/@cryptomancer/introducing-myself-tales-of-an-expat-code-slinging-crypto-enthusiast-part-2

My introduction to Ethereum: https://steemit.com/ethereum/@cryptomancer/ethereum-for-dummies-introducing-the-next-great-technological-leap-forward

Wikipedia article on the history of Bitcoin: https://en.wikipedia.org/wiki/History_of_bitcoin

This article proves my point that holding long term is a great strategy: Man buys $27 of bitcoin, forgets about them, finds they're now worth $886k

More details on the Winklevoss ETF: Bitcoin could soar if the Winklevoss ETF is approved

For more posts about cryptocurrency, finance, travels in Japan, and my journey to escape corporate slavery, please follow me: @cryptomancer

Image credits: The first two images in this post are taken from Pixabay and used under Creative Commons CC0. The two graphs are screen shots from my desktop PC. The last picture is a photo taken on my iPhone.

Achievement badges courtesy of @elyaque . Want your own? Check out his blog.

This is a classic example of contradictio in adiecto ;)

Heh, you're not wrong... maybe a cabal of women secretly rule the world, using their husbands as cover!

hi fellow crown holder! :) I share similar views with you and really hope that I can gradually achieve the freedom that allows me to do what I really want (crypto world is definitely on top of the list!) ... no wonder we all love viva.

btw, why do you like mainstreet? from my simple understanding, blockchain is only utilized to facilitate investment on the traditional economic activities. that means, the booming of blockchain economy doesn't increase value for it, but a booming US stock market does.

BTW, Mainstreet seems not open to many countries, not only US... Taiwan, Korea... both off the list... I don't know why... :(

I like Mainstreet as a diversification strategy, to get some exposure to businesses not directly related to crypto. What's interesting is that it provides access to the private equity market, which is an illiquid market not normally accessible to small investors such as myself. But by "securitizing the blockchain", Mainstreet is essentially creating a way to make that market liquid and open to everyone who meets their KYC standards.

It seems many people are having trouble getting past the validation on their sales page. It's a bit buggy (I suspect they didn't test it very well). They are recommending that anyone having trouble send them an e-mail with the required info that the web site asks for, and then they'll straighten things out.

thanks! it makes sense! :)

Very interesting post need to come back to it, when I gained more knowledge about crypto.

Glad you enjoyed reading it. If you have any specific questions about crypto, feel free to ask and I'll try to point you toward some good resources.

I might write a blog post about my difficulties. Do you mind if I name you in the comment section of it in order for you to find it?

No, not at all, feel free to do so and I will keep an eye out for it.

Is the Mainstreet Fund open to US citizens?

It is not. However, it is open to my Japanese wife, who invested using some ETH I gave her. Yet one more advantage of being an expat. ;-)

Their KYC sales page is kind of crappy, though. Nobody seems to be able to successfully verify their ID with it. My wife eventually sent an e-mail to Mainstreet and they gave her some alternate instructions which worked.

That's nice that your wife is on board with your investing interests. I feel like many Japanese people are wary of investing in stocks and especially untested things like crypto-currency. I read a little about KYC, it seemed to me that you need to buy in through ETH. Is that correct?

I too share your dream but am trying to get started somewhere on the ground floor. It's not an easy thing to do with two kids on an English teacher's salary in Japan, as you know. Do you have any thoughts or suggestions beyond what you've written about?

You can buy in through any major cryptocurrency. Assuming you can get past the Know Your Customer checks, the actual purchase is done through the Blocktrades web site. You can choose which crypto to send them, and then they send you back the equivalent amount of MIT tokens. You do need an Ethereum account to store the MIT.

As a good way to get started in crypto, I recommend opening a trading account on https://www.kraken.com . Kraken is a reliable cryptocurrency exchange that can connect directly to a Japanese bank account for withdrawals in yen. And yen deposits can be done by furikomi from regular Japanese ATMs. Whenever you have a spare ichiman lying around, zap it to Kraken and buy a little crypto. It's fine to keep a bit stored on the exchange, but once you've built up a sizeable amount it would be good to move it off exchange into a wallet account that you control the private keys to. I also like the Poloniex exchange; it supports a wider variety of cryptocurrencies than Kraken and is easier to use. But Kraken can't be beat as a Japan friendly onboarding ramp.

I too had very little money when I first got started. I wouldn't recommend it, but I used a cash advance from my US credit cards to buy my first couple Bitcoin. I finally repaid that advance just a couple months ago from some of my profits, and boy did that feel good.

I guess you've got to get started somewhere, but, yeah, a cash advance sounds a little risky. I'll sign up for a Kraken account and see if I can't find a little extra money lying around. Thanks for the advice!

You're welcome. Good luck, hope it works out!

Great read! It's exciting to see how people do with their investments. I have a similar portfolio and strategy. I expect great things from VIVA and I'll be interested in reading your future Byteball post. Wishing you a profitable future!

Thanks, and right back at you, we're all in this together! Hope your portfolio has a good year. VIVA is probably the project I'm looking forward to the most for the foreseeable future; I think it has the most potential of any of my investments except perhaps for Ethereum.

And thanks for the re-steem, much appreciated!

That was a really nice overview of cryptocurrencies and that has whet my appetite for more reading on the subject.

Thank you.

You're quite welcome. If I've managed to pique your curiosity in regards to all the possibilities out there, and inspired you to do some further reading, then I've accomplished what I set out to do with this post!

Great post and great investment advice. I too am looking forward to the mainstreet and Viva Crown ICOs.

Thanks, glad you liked it, and here's wishing us both success with Mainstreet and VIVA. I noticed the countdown timer on http://mainstreet.ky/ has reached zero even though the ICO (or ITO as they call it) isn't supposed to start until tomorrow. Wonder what's up with that?

What happened with the timer on the main Street site can easily happen if the countdown timer is using the wrong timezones. Those countdown timers are usually just little snippets of .js you copy and paste into a WordPress template. Ive made that mistake myself a time or two. Most embarrassing was a countdown timer for my wedding website.

Just wanted to say thanks for the mentions and I'm super glad you're excited about viva. We are launching a new

Makes sense. At first I thought maybe the timer was looking at my local timezone, but then it would have reached zero at midnight instead of earlier in the evening, so not really sure what it's based on. If you use one for VIVA, make sure you do it right! It's a small thing, but embarrassing and confusing to get it wrong.

Can't wait to see what's next for VIVA! Checking the VIVA Slack is always the first thing I do in the morning. :-)

Awesome! BTW the slack is going away. We're moving to https://chat.vivaco.in/

I've upvoted and resteemed your post!

Thanks, that's much appreciated! I'll sign up for the new chat as soon as possible, will be fun to see how that works.

Solid share of information. Many of the practices are the same ones for successful investing in any trade-able asset.

Indeed, I agree these kinds of skills are applicable across asset classes. The big difference between cryptocurrencies and more traditional things like equities is that crypto tends to be more volatile, so you need to really stay on top of risk management, especially on shorter timeframes.

There are days when I just want to kick myself because a few years ago people were GIVING AWAY bitcoin just to open up a wallet and I was like, "No thank you." ARGH!!!!

So here I am years later, stumbling into this wondrous place called Steemit and my goal is to be a whale. I wish I had the extra funds to buy more but for the time being my efforts will have to do.

Thank you for sharing your thoughts and experiences. My goal is to be self-sufficient, but I don't need luxury items. I just want a farm, a small house and a garden. I know I can achieve this! :D

I know what you mean, sometimes I find myself thinking "ah man, I wish I'd learned about Bitcoin a few years sooner." But that's why I'm always looking for fresh, new projects on the horizon. If you can find a way to get in on the ground floor of something that later turns into a tremendous success... well, I guess that's what every venture capitalist hopes for.

I don't really care about having a luxurious lifestyle either. All I want is a way to maintain my current standard of living and maybe buy a nice little house for my family. I don't need to be rich or anything. Surely that much should be achievable!

"They are at the bleeding edge of technology". Damn. You got me all excited now, because I too, share the same dream. In my case, it would release me from being a wage slave. I'm glad we share the same dream!

Oh and looking at your ETH chart. I made my first buy without knowing anything about crypto the night the DAO got hacked. My timing couldn't have been worse. Being a n00b, I didn't even know what a stop-loss was. Oh well.

Oh man, that is terrible timing! I hope you've had some nice successes since then to make up for it. That DAO hack set Ethereum back quite a bit. I think the community has largely moved past it now and is once again looking forward to the future with optimism, but sometimes when I'm trying to fall asleep at night, I can't help wondering where the ETH price might be now if all that hadn't happened. In the end, though, that experience made the Ethereum network stronger and forced developers to think long and hard about smart contract security. Better it happen early on in Ethereum's history, rather than later when the effects might have been even more severe.