✖ THE UNCERTAINTY, PAIN & THE UNKNOWN FUTURE FOR CRYPTOCURRENCY ?

✔ CRYPTOCURRENCY POSSIBLE FUTURE 2018 & SETBACKS -

ツ The whole crypto market as a whole is volatile and irrational beasts. 2017 was a monumental year for cryptocurrencies and the blockchain. The price of bitcoin rose almost 2000% from $1,000 in January to over $19,000 at its peak in December. Every great and successful investor has a plan that being said you will add one more tool to your arsenal today.

ツ Being positive that 2018 is set to be another breakthrough year for cryptocurrencies. Here are some of the predictions for the near future thats yet to come true.

✓1. More institutions people will get into cryptocurrencies.

"Our institutional investor base is very interested in learning more and getting exposure," said Michael Graham, a Canaccord Genuity analyst who has published several reports on digital currencies. "One of our major themes is that as we roll out through 2018, it's the year of institutions getting exposure to the space."

✓2. It will be a wild, volatile ride.

The contrasting views on the future of cryptofunds come as some analysts expect bitcoin to ride an even wilder wave this year. Ari Paul, chief investment officer of cryptocurrency investment firm BlockTower Capital, predicts that bitcoin will trade at both $4,000 and $30,000 at some point in 2018.One reason some analysts say bitcoin will ultimately rise further is that investors will bet on a payout from more splits in the digital currency. When some bitcoin developers decide to implement their own upgrade of the bitcoin network, bitcoin investors at the time of the split receive equal amounts of the split-off coin.

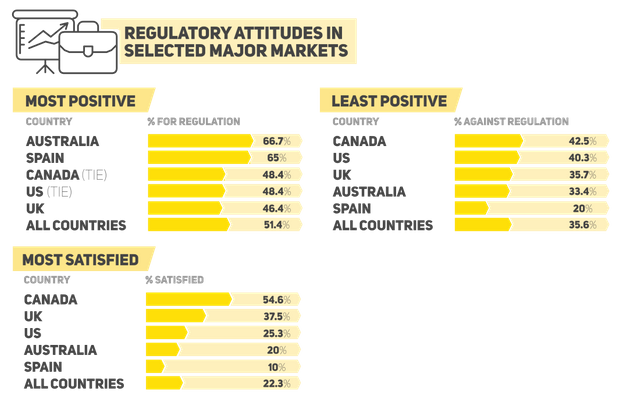

✓3. There will be more regulation and bitcoin's price will drop.

However, in the meantime, regulators will likely try to limit speculation in cryptocurrencies.

In the last several months, the SEC has become increasingly vocal in warning investors about the risks of cryptocurrencies. The commission also has suspended trading in some companies due to concerns about their claims regarding their token-related announcements.

"One of the things we'll see [is] enforcement here from the regulators," Canaccord's Graham said. He expects that greater regulation will cause a "major price dislocation event for the whole sector."

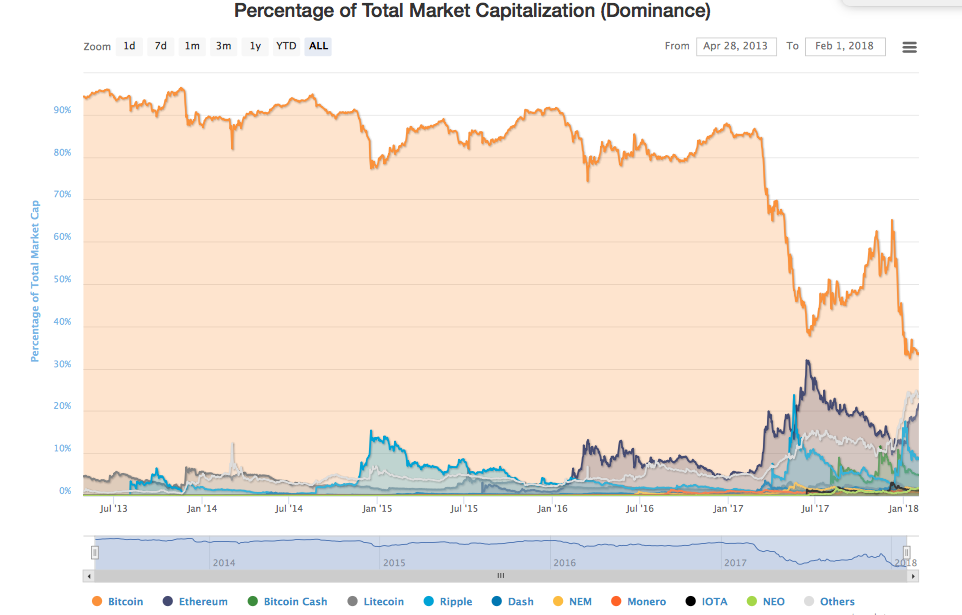

✓4. Bitcoin will prevail, while other cryptocurrencies grow.

While bitcoin's price has stagnated in the last two weeks, smaller digital currencies such as ripple, stellar and tron have surged into the ranks of the largest cryptocurrencies by market capitalization.

Erik Voorhees, CEO of digital asset exchange ShapeShift, said that in contrast to bitcoin's dominance on the platform a year ago, about half of transactions on the platform now don't involve the popular digital currency at all.

✓5. Stock investors may get a chance to invest in a digital currency-related IPO.

As interest in digital currencies has grown, the companies involved with the business have become billion-dollar entities. Leading U.S. cryptocurrency marketplace Coinbase, valued at $1.6 billion, has indicated it could pursue an initial public offering.

"I do think the public is going to see some crypto-owned IPOs this year and more broadly blockchain IPOs," Canaccord's Graham said. He said cryptocurrency-related companies that want to give U.S. regulators a better impression are likely "going to rely on old-fashioned equity."

✓6. The cryptocurrency market will continue to grow as institutional capital gets involved.

Last month CBOE and CME announced that they would start offering bitcoin futures bringing cryptocurrencies closer to traditional financial markets and adding legitimacy to a previously notorious asset class. Goldman Sachs was among one of the first institutions to announce that it would clear futures for its clients on a case by case basis and is set to launch a cryptocurrency trading desk by mid-2018. Other institutions will undoubtedly follow suit as clients demand access to cryptocurrencies and as the infrastructure required to trade them at an institutional level is built out. This includes exchanges offering much-needed compliance and security tools as well as appropriate insurance products.

✓7.ICOs will professionalize as experienced investors move into the market

Last year was a bull year for ICOs. Unprecedented amounts of capital were raised with some projects such as Filecoin and Tezos raising over $200m in a single round of funding. Of the 230 ICOs in 2017, many took place off the back of nothing more than an idea (usually formulated in a white paper), a team of developers, and little to no due diligence. This year experienced investors will get involved with this new means of funding. They will demand further business validation and transparency, bringing the ICO process closer in line with traditional venture fundraising and making it increasingly difficult to raise off the back of a white paper.

✔ LETS ALL STAY POSITIVE AND HOPE THE BEST FOR CRYPTOCURRENCY COMMUNITY AND MARKET 2018 AND NEVER ENDING FUTURE. "LIKE ALWAYS THANK YOU FOR TAKING TIME TO READ MY POST" - upvote will be appreciated.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cnbc.com/2018/01/05/five-predictions-for-digital-currencies-in-2018.html