Why Bitcoin Mining is a Terrible Investment — And Will Get Worse

Back in the heady days of 2017, investing in Bitcoin mining seemed like one of the easiest ways to make money you could possibly imagine.

Youtube, Twitter and Facebook were awash with dozens of mining schemes promising returns of 150% or 200% per year. And you didn’t even have to do anything — just sign up, pay your money and let the bitcoin roll in. What could be better?

Fast forward to today and the whole landscape looks a lot different. Check out any of the major mining schemes — Genesis Mining, Hashflare and the like — and quite simply you would be better off holding your cryptocurrency rather than investing it in mining.

For example, if you had 1 Bitcoin and invested it in mining in one of these schemes right now, you would get back less than 1 Bitcoin by the end of your contract. Even reinvesting it doesn’t help — you would just be compounding your disadvantage. It’s a loss-maker, plain and simple.

So what has happened in this short time to turn such a great investment into such a terrible one?

I have been something of a victim of this trend so decided to investigate exactly why it happened. Here is what I discovered…

It’s a Classic Tragedy of the Commons

Well, in the first instance we had the collapse in the cryptocurrency market, which has meant that the coins being mined are worth less than they were.

Much more important however — particularly to the long-term outlook for crypto mining — is the increase in mining difficulty.

This is a classic “tragedy of the commons.” In essence this is a scenario where you have some common asset that everyone can potentially benefit from. Imagine a big piece of land back in pre-industrial days that individual people could farm on.

Individually, each farmer wants to make the best he can of his situation and farm as much land as he can, as intensively as he can. But if everyone does this, then the land will become degraded, the soil will erode and the yield will drop dramatically. If done to an extreme, then the land might become barren and useless. So then everyone loses out — it’s a tragedy of the commons.

Bitcoin mining is a tragedy of the commons par excellence.

Basically what you had was an asset that was insanely profitable and everyone wanted to get in on the act. It seemed too good to be true.

The problem was, the more people who entered the market, the less profit there was to go around for each individual member.

Essentially there is a fixed amount of land (or in this case, a fixed amount of Bitcoin that can be mined at any one time). So the more people there are, the less of this land each one gets. Or a smaller slice of the Bitcoin pie, if you like.

This is reflected in the Bitcoin mining difficulty, which is essentially the difficulty of mathematical equations miners need to solve to verify transactions on the blockchain ledger. To ensure that all the Bitcoin isn’t mined at once, the more miners there are, the more difficult these mathematical equations become.

So the difficulty tells us very neatly how many miners there are (and the power of their mining equipment).

Difficulty Goes Crazy — Too Many Farmers on the Land

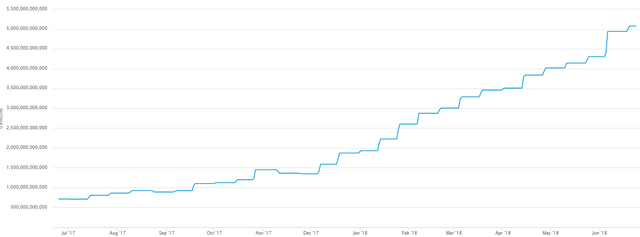

As you can see from this graph of the Bitcoin mining difficulty, it has continued to increase steadily over the past few months:

The mining difficulty increased a whopping 700% in 2017, pretty exceptional growth — and has continued unabated in 2018.

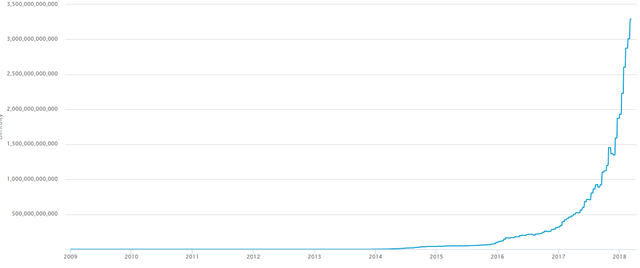

Viewed over a longer timescale however, you can see how the recent difficulty increases and have been more dramatic, almost exponential in fact:

As I say, these mining difficulty charts really just reflect the number of people (and their computing power) mining Bitcoin. Quite simply, there are now too many farmers on the common land. The land is degrading for everyone.

2018 — Price and Difficulty Part Company

Back in 2017, some people dismissed the rising difficulty, saying it was inherently connected to the price of Bitcoin, which was also rising almost exponentially. So — they claimed — if the price dropped, the difficulty would too.

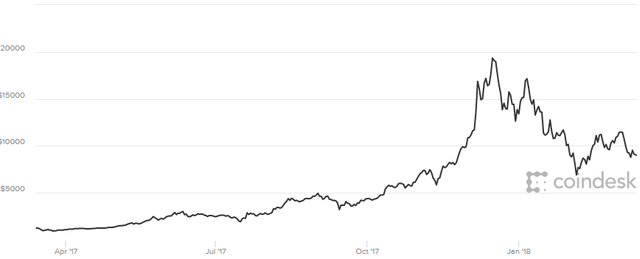

However, the link between the two was well and truly broken in early 2018. Just for a visual comparison with the two charts above, here is what happened to the Bitcoin price at the turn of the year:

So while the mining difficulty has continued to increase steadily, the price has halved.

This has obviously been a double-whammy for Bitcoin miners. It means you can no longer make any assumptions about price and difficulty tracking each other.

And Now For the Bad News…It’s Only Going to Get Worse

And the bad news is that this situation isn’t going to get better any time soon.

The problem is that because mining was so profitable in 2017, a huge amount of money poured into building new mining farms and launching new projects. Everything from private mining farms, to big public ICOs and mining companies launching on the stock market.

Here are just some of big ICO projects that have launched recently:

- Envion — a Swiss company focused on building mobile mining units and exporting them to locations around the globe, raised $100m in an ICO

- Miner One — aiming to raise $140m in their ICO (although currently well short of that target)

- Giga Watt — raised $20m in their ICO (although now being sued for being an unregistered security)

- ICE Rock Mining — currently having its ICO, aiming to raise $13.5m

- Moonlite — also in ICO phase and with a hard cap of $35m

So some pretty big sums of money that will be pouring into cryptocurrency mining in the coming months — and pushing up that difficulty…

But that pales into comparison with some of the corporate money that is piling in. Recently there have been a number of IPOs undertaken by companies intending to undertake industrial-scale crypto mining. They include:

- Hive Blockchain — a partnership with Genesis Mining and has raised $150m to invest in mining operations

- Hut 8 — a partnership with Bitfury which raised over $100m, with further expansion planned

- Long Blockchain — recently purchased over 1,000 Bitcoin miners

But then on top of all this you have all the private companies in places like Chain and Russia who have to date been the centre of the mining world.

Some of these companies have massive mining operations, like Bitmain with eight buildings and 25,000 mining rigs at just one of their mining farms.

Not to mention there are still hobbyists on YouTube building their own mining rigs, just to slice that pie into even thinner pieces.

It’s a Problem When you Have a Low Barrier to Entry

One of the reasons all this happened is that the barrier to entry to Bitcoin mining is incredibly low.

You basically have a situation where there is a legal industry that can effectively print money. This is pretty much what crypto mining is.

But virtually anyone can do it. All you need to do is buy some mining equipment, which you can get on Amazon, and set it up.

So not surprisingly, every man and his dog have wanted to become involved and there’s really nothing stopping them.

For most big industries in the modern economy, the barrier to entry is very high. Imagine you wanted to start another Google or Apple. Their brand power and established technology is so great you would have to spend billions just to get in the ballgame — and even then would probably fail.

Or think of Tesla and how difficult they are finding it to become a mass-market EV company. The barriers to a new company trying to replicate what Tesla have done are immense.

But to enter the Bitcoin mining game, you don’t need complex technology, an amazing brand, massive marketing teams, offices or really anything apart from somewhere to put your mining rigs and some electricity.

Not Just a Bitcoin Problem

You might think this is just related to Bitcoin and other coins are still really profitable to mine.

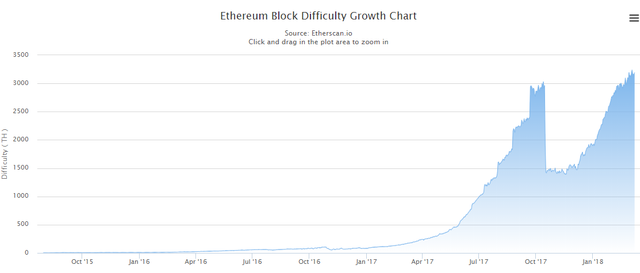

Well sadly that’s not the case either. Here’s a look at the rising difficulty of Ethereum in recent months:

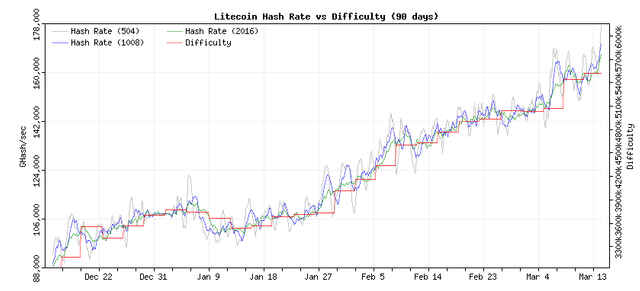

And here is Litecoin:

Pretty much all the major coins’ graphs look like this. So there’s no getting away from the fact that whatever you mine, the difficulty will have gone up considerably recently and is likely to continue going up.

That’s not to mention the potential for a large number of coins to switch to proof-of-stake from proof-of-work, thus eliminating the need to mine them altogether and reducing the pool of mine-able coins.

Where that Leaves Us — On the Road to Nowhere

There is little reason to think this situation is going to turn around. Yes, the cryptocurrency market could pick up again, thus making mining more profitable. But that would just tempt more miners into the game, thus increasing the difficulty. It’s kind of a catch-22 situation.

Last year I invested in some mining schemes and have been burned a little — although I got out early enough when I saw the writing was on the wall, so fortunately haven’t lost very much.

But for companies and individuals who have invested large amounts into mining operations, the future looks pretty bleak. The best they can probably hope for is that the markets increase, meaning the coins they have mined are worth more.

Plus some of the more niche mining operations may drop out as their business models become unsustainable.

But with Ethereum’s move to proof-of-stake — which is to be much welcomed given the amount of energy that crypto mining consumes — the overall mining market may shrink over the coming years, particularly if others follow Ethereum’s lead.

And countries could also clamp down on mining and tax it more stringently. Already China is banning mining and Russia looks like it may follow suit.

So all in all that piece of common land doesn’t look too inviting right now — it’s been over-farmed and probably best to stay away and look for an alternative patch to plough.

Upvote this: https://steemit.com/free/@bible.com/4qcr2i

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptocurrencyhub.io/why-bitcoin-mining-is-a-terrible-investment-and-will-get-worse-28e249dd2039

Coins mentioned in post:

Congratulations @cryptodan21! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!