Are Stablecoins a Cryptocurrency Volatility Solution ?

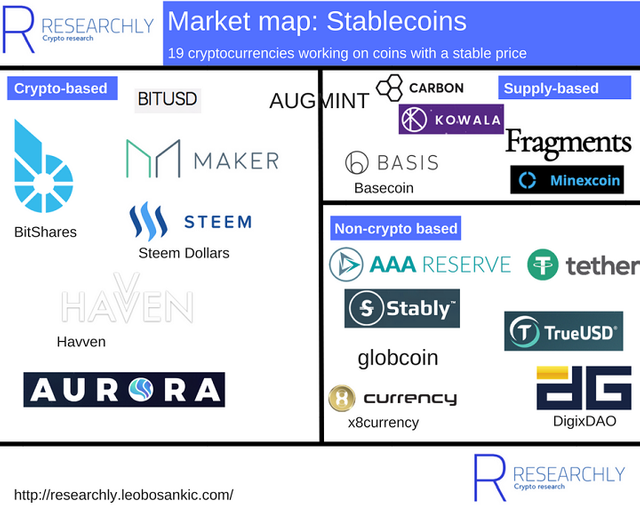

Stable coins is a cryptocurrency that is unaffected by price fluctuations, they are essentially stable and this stability usually comes from the support of some alternative value. The three most popular stable currencies on the market today are the USDT issued by Tether , the BitUSD based on Bitshares , and the Dai from the MakerDAO (MKR) project.

Stable coins are generally linked to stable assets such as the US dollar to achieve lower prices or zero volatility. There are three main ways to achieve stability.

1. Collateral-backed IOU (Fiat-backed)

Use fiat currency as a collateral for issuing cryptocurrencies. In addition to financial assets (such as the US dollar), other forms of collateral can also include precious metals such as gold and silver, and commodities such as oil.

Advantages: The price is stable and is not vulnerable to hacking due to uncollateralized items in the blockchain;

Disadvantages: Centralization - requires a trustworthy hosting to store assets, very high costs, slow liquidation, high levels of supervision, and need periodic review to ensure transparency.

Examples:

Tether: USDT claims that the unit issued by Tether per dollar reserves a reserve of $1, and Tethers can be converted to US dollars in a 1:1 ratio.

True USD: Held in escrow with identified banks. Stabilized by arbitrageurs buying or selling when price deviates from $1.

Stronghold USD: It is based on the Stellar blockchain.

2. Collateral-backed on-chain (Crypto-backed)

Use another cryptocurrency reserve as a collateral. This model was pioneered by BitShares. It’s also the model used by Maker, Havven, and others.

Advantages: More decentralized, can be cleared more quickly and cheaply, very transparent, collateral can be held in a smart contract, so the user does not rely on any third party to redeem it;

Disadvantages: Collaterals that support stable currencies are often unstable encryption assets such as BTS or ETH. If the value of the asset falls too fast, the issued stable currency may become a collateral.

Examples:

Dai/Maker: MakerDAO's Dai is widely considered to be the most promising crypto-backed stable currency. Backed by “over collateralization” with Ethereum and other crypto assets. This approach allows the user to create a stable currency by locking in collateral that exceeds the amount of stable coins.

BitUSD: Also referred to smartcoin, freely traded or transferred on the BitShares Blockchain and has a value of 1 U.S.Dollar.

Havven/Nomin: Backed by ETH held in 80:20 ratio to Nomin stablecoin in circulation. Nomin is stabilizied to $1 by its own reserve token Havven.

3. Seigniorage shares (Not backed)

Stabilizing the cryptocurrency by algorithmic expansion and contraction of prices, just as the central bank does for fiat money.

Abandoning the mortgage model, transplanting the central bank's currency control mechanism through algorithms. When the demand for stable currency rises and the price is greater than the anchored legal currency, the issuance of stable currency is issued.

Advantages: no collateral, the most decentralized, independent;

Disadvantages: need to continue to grow, vulnerable to the impact of the decline or collapse of crypto assets, and cannot be liquidated, difficult to analyze security boundaries.

Examples:

Basis(Basecoin): Use the central bank's mechanism to regulate supply and demand. The central bank can maintain the stability of purchasing power by adjusting interest rates, bond repurchase and reverse repurchase.

Saga: Backed by a variable fractional reserve of various fiat currencies.

Carbon: Users can choose to freeze some of the funds to manage the contraction and growth cycle.

Conclusion:

In essence, a stable coin is an asset that has the characteristics of stable value, it can become a value scale, value storage, and trading medium.

As a currency, stable coins should be able to be circulated globally, and the number of issues is not controlled by any central financial institution. Stable coins combine the advantages of both fiat currencies and cryptocurrencies—secure and stable.

The current reality is that since the USDT has become the “crypto US dollar”, any other stable currency that want to replace has a long way to go. Over the years, USDT has remained anchored in the US dollar, with very little price volatility and an advantage in terms of volume, and its success is undeniable.

MakerDAO (Dai) adheres to the spirit of liberal cryptocurrency, as a decentralized asset and autonomous entity. However, if the official cryptocurrency of US dollars is issued, will it eliminate the stable currency?

This problem can be attributed to: Do you prefer to place your faith on a centralized entity (the Federal Reserve) or a distributed institution?

Check also our previous blogs:

For Crypto Rookies – What is cryptocurrency exchange?

The 3 Challenges Bitcoin Mining Are Facing With In 2018

ICO Supervison Is Still In The Era Of Grassroots

Blockchain community are dealing with big security challenges

They are great as long as they can remain Stable.

A stable coin is a coin for which the price is linked with another asset price. As our article said the price remains stale when the asset such as US dollar is stable :)

NexusBot.io - Best Crypto Trading Bot

Welcome to NexusBot.io

hello Thank you for the information in this article.

i dont utilize these enough when the market starts to fall. if i knew then what i know, i would have dumped all my altcoins for USDT and then bought again at the bottom. great article, thanks!

Awesome! If you want to know more about stablecoins and cryptonews, do not hesitate to follow us on our social media platforms! Thanks.

Not possible. Stablecoins sooner or later will crash.

OK. Could you please let us know why you think of that?

Same thing happens when govt try to manipulate prices like in Venezuela o Argentina. You can't force a price just like that. Markets put the price tag, not a govt or central authority.

Congratulations @crypto4allblog! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @crypto4allblog! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Congratulations @crypto4allblog! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Well I think it is, Stable coins work as a bridge between the world of crypto and the world of fiat currencies. Stablecoins can also be used to provide access to a stable store of value for people in places with volatile national currencies. To know more about the role of stablecoins, you may check this blog article. https://blog.kucoin.com/what-is-the-role-of-stablecoins-in-the-cryptocurrency-market-sk-st