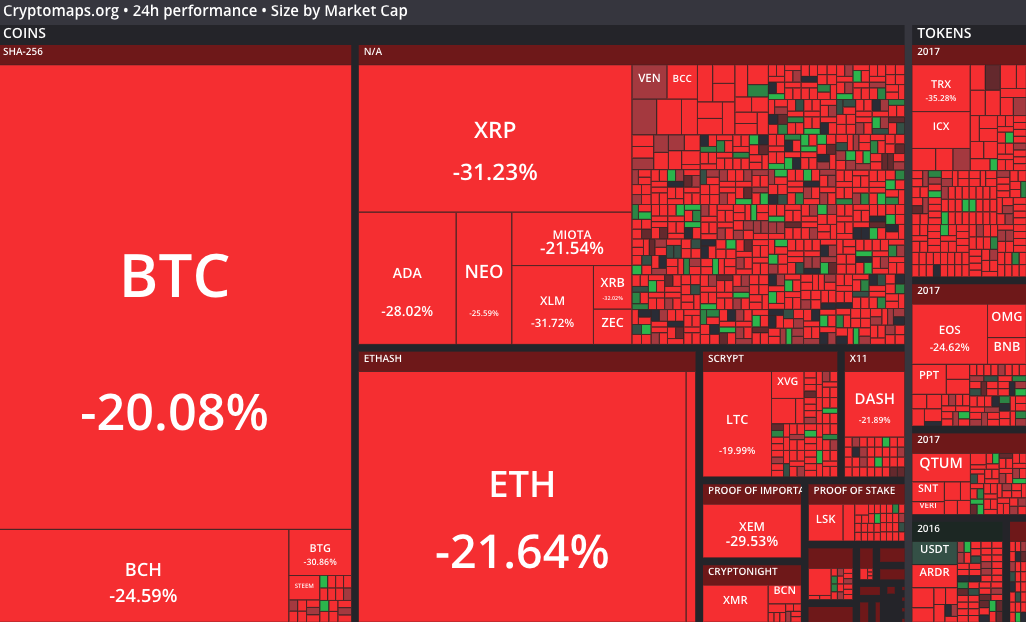

Market Crash Explained (Crypto Black Monday) - 16 January 2018

And here we are... puzzled by what exactly happened, checking Blockfolio/CoinTracking every five minutes to see how much your portfolio has bled, and scouring the internet for some sanity, hoping someone else out there may be HODLing too...

The date is January 16, coincidentally just under a month before Chinese New Year.

The morning started with news from the People's Bank of China (PBOC). Pan Gongsheng, vice governor of the central bank, said in respect of an internal bank memo, that the government would apply more strict regulation to end all cryptocurrency trading-related activities and services. After having banned cryptocurrency exchanges in 2017, the Chinese government plans to block domestic and offshore platforms that enable centralised trading; essentially the Great Red Firewall, but for cryptocurrency. The PBOC said that it would target individuals and companies engaged in centralised trading.

This clamp down by the Chinese monetary authority follows shortly after the news on 15 January 2018 that the South Korean government intends to outlaw cryptocurrency trading and exchanges. A press official at the justice ministry reported today that the proposed ban on cryptocurrency trading follows “enough discussion” with other government agencies, including the nation’s finance ministry and financial regulators. Nonetheless, this is a course of action which could take months, even years as legislation for an outright ban would still require a majority vote of the 297 members of the National Assembly.

And then there's the seasonal perspective. Opinions are floating around that from close to 23 days before Chinese New Year, for the past 4 years, there has been a dip in the cryptocurrency markets. In 2017, this started on 5 January, when the total cryptocurrency market cap declined from $21.9 billion to a low of $14.4 billion. Similarly, in 2016 the cryptocurrency market cap shrunk from $7.5 billion to $6 billion, before continuing on an upwards trajectory. And in 2015, the market cap went from $5.5 billion on 2 January to $3 billion (all figures are according to CoinMarketCap). Definitely, not an indicator to rely on, but a useful metric to factor in, particularly when one considers the a trader's desire to realise profits from the year's worth of trading.

What some would call a crash, the seasoned cryptocurrency community considers the market movements on 16 January 2018 a normal and even healthy correction in the market, and expect a strong recovery in due course.

One thing is certain though: 2018 is off to an interesting start.