ENTRY: Banking Sector of the Blockchain

ENTRY is a blockchain - based platform that is to be powered by smart contracts. ENTRY will not only acts as a bank offering easy deposits, payments and lending services, cross-border payments, ATM facility/convenient withdrawals, but also as a cryptocurrency exchange for the business and consumer world.

Bank of Blockchain??? Think ENTRY!!!!

The global financial crisis of 2008-2009 revealed significant weaknesses in the existing financial system and some of the vulnerabilities have already exhibited their impact on the interconnected global market. After the financial catastrophe, a cryptocurrency developed by a person or a group of people named Satoshi Nakamoto was birthed. This currency was to be a peer-to-peer “trustless”; electronic cash system based on a technology called blockchain in which each arising transaction is to be recorded in open ledgers.

ENTRY is a blockchain-based banking service accessible in the form of a crypto currency and fiat payment gateway for stores through web and mobile app versions with the aim of increasing the flow of cryptocurrencies in the real economy. It is an AI empowered multi-utility financial platform that will provide IBAN (International bank Account Number) to every of its users which will enable them store blockchain assets in their accounts in the form of digital assets. Blockchain technology in itself is like rocket science to most people. On one part they understand that blockchain technology is about digitization and on another part they are somewhat confused as to how that is gonna be achieveable but ENTRY is designed to facilitate the day to day usage of crypto currencies and fiat currencies without really having to be concerned about the technology behind the system.

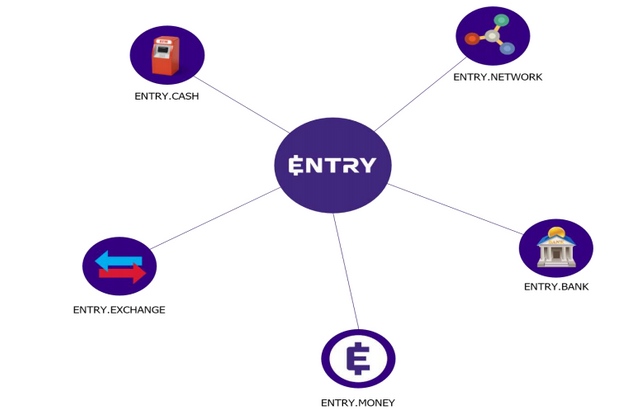

The ENTRY Platform

To be the gateway between traditional and new financial paradigms and systems led by cryptocurrencies and empower the financial ecosystem to have a framework that allows for inter-operability between the two.

The main objectives of ENTRY include:

To help cryptocurrencies achieve suitability for everyday transactions and open the world of crypto-finance to every citizen.

To keep a transparent record of all the transactions in the ecosystem.

To expand the use of cryptocurrencies for purchase and payments across the business world.

To create a simple and all-in-one platform to revolutionize the traditional methods of dealing with banking systems.

ENTRY’s suite of comprehensive banking products and services will ensure a new benchmark in banking and financial services.

To achieve the adumbrated points above, ENTRY is going to be a blockchain based platform with 5 core services namely Entry.Money, Entry.Exchange, Entry.Network, Entry.Bank and Entry.Cash that would integrate with Ethereum smart contracts to bring data security and transparency in transactions in the world of finance. Its infrastructure has been designed with a “one-window” approach that is to facilitate all the banking and financial services to its users under the same roof.

Entry.Money is a fiat and crypto currency payment gateway for e-shops, Entry.Exchange is an API enabled exchange platform for traders that facilitates easy currency conversions, Entry.Network integrates the complex processes in the ENTRY ecosystem using smart contracts, API, multicurrency wallet etc., Entry.Bank is a full-fledged blockchain bank with services like deposit, withdrawal, loan, factoring, insurance etc. and Entry.Cash is an ATM system for easy withdrawal of crypto to cash

ENTRY business model consists of 6 main elements namely:

• ENTRY.MONEY

Entry.Money will be a crypto currency and fiat payment gateway for stores that can be easily accessed through web and mobile app versions. It will provide IBAN (International bank Account Number) to every user of ENTRY to enable them to store blockchain assets in their accounts. Initially they will facilitate only Euro currency (in fiat currencies) for all the transactions but plan to put down roots in European countries which have a huge untapped market and then expand and incorporate all the major fiat currencies in the years to come. Entry.Money will allow users to deposit, store, withdraw and transfer fiat as well as cryptocurrency. Merchants will also be able to use the platform for simple conversions to ensure prompt sale of their goods and the merchant will get the sales price in the currency requested less the applicable transaction fees. Additionally, Merchans will be able to trade beyond national boundaries without any hassle of currency differentiation or fluctuation. Merchants will be able to trade in their own currency (say Euro for now), giving freedom to buyers to use any crypto currency for purchase (say BTC). Entry.Money ensures that the merchant receives the payment in Euro; this process of conversion and transfer will subsequently bring liquidity on Entry.Exchange..

Cross-border payments through Entry.Money of the absence of a global payment system. There are three challenges that must be overcome in order to improve the cross-border process:

● Slow, costly and inefficient cross-border payments for banks and businesses.

● Lack of a common global standard and variations between systems have reduced the ability of both banks and corporate treasury/enterprise systems to seamlessly pass data between each other.

● Government regulations are changing how payments are made. Payments are subject to domestic regulations, which compound the challenges of cross-border payments because often rules vary between an originating and receiving country.

These inefficiencies of the current cross-border payment system have opened the doors for new players to introduce alternative models in the financial system to optimize the existing cross-border payment system. Entry.Money will equally enable peer-to-peer hassle-free cross border payments at a very low cost. The blockchain based platform and widespread acceptance of cryptocurrencies have also made it convenient for people to remit funds to any country. For instance, if a person “Q”, a UK citizen wants to make a payment in Bitcoin to “R”, a person who accepts only US Dollars and resides in the US. Then “Q” can use ENTRY platform to make such transaction. This will revolutionize the acceptability of crypto across the world.

• ENTRY.EXCHANGE

Entry.exchange will act as a virtual clearing-house for all the transactions occurring on the ENTRY Platform. It will be readily compatible with major existing payment technologies and will be inter- connected to other exchanges to maintain liquidity for all platform operations. Initially, ENTRY will enable the users to buy or sell cryptocurrencies like BTC, , ETH BCH, and DASH ,LTC using Euro and will soon incorporate all the major fiat currencies like Pound (£), Dollar ($), Japanese Yen (¥) and many more to provide liquidity in the ENTRY ecosystem. It will have ENTRY Token as one of the main exchange pair in Entry.Exchange and reward those who will hold ENTRY Token in their account. We aim to enlist our Token on Every Centralized and p2p ultra-fast and instant cryptocurrency exchange.

• ENTRY.BANK

Entry.Bank will be a digital bank with traditional banking services provided using blockchain technology. The ENTRY will provide traditional banking services of deposit and payment to its users. Users can deposit blockchain assets in their Entry.Bank accounts and make easy payments to individuals, merchants or any other entity. Transactions flowing through ENTRY Token as the main currency of the platform will have a network effect and add financial value to the Token. Blockchain technology enables fast and hassle-free cross border payments at a very low cost.

• ENTRY.CASH

Cash machine/ATM system. Transfer, cash out or top up with cash (using agents or cash machines). Payment gateway for POS (real shops, service providers). Payment cards will also be added in the future for ease of access for both fiat and crypto. ENTRY Token Will be used in ENTRY platform as main cryptocurrency. Used in other platforms as main or side cryptocurrency. Tradable in exchanges.

CONCLUSION

ENTRY intends to earn from its services of Entry.Exchange (an exchange platform), Entry.Money (a payment gateway), Entry.Bank (a blockchain bank) and Entry.Cash (ATM

ENTRY’s business model is focused on disrupting the existing pillars of finance who only act as toll-keepers without providing any value-add to consumers and businesses. Removing the numerous intermediaries that already exists within the system would make the system faster, more secure and cost-effective for all involved. ENTRY Token is an electronic and virtual currency Token that will flow in the ENTRY ecosystem. It is the crypto-currency Token of ENTRY platform used for peer-to-peer transactions and micro payments. It will be the medium of exchange for transacting on the platform and

To get Additional information kindly peruse any of the listed materials below;

Websites- https://entry.money/

Whitepaper- https://entry.money/ENTRY_Whitepaper_v1.pdf

Facebook- https://web.facebook.com/entrymoney

Twitter- https://twitter.com/EntryMoneyICO

LInkedin- https://www.linkedin.com/company/entry-money/

Telegram- https://t.me/Entry_Official