Crypto Boom And Crash: The Intelligent Investor And Blockchain Technology

For a long time, I had a hard time to release a post about the basic crypto-market, however due to the current boom and crash, I believed that some individuals may be thinking about my viewpoint about this matter considering that I have actually been included with this market for the previous 4-5 years. I would be enjoyed have an extremely useful conversation in the remark area listed below about the important things I will state in this short article and beyond that.

Bitcoin(BTC) is now around 10 years old, and in the start, the promotion and use of it were so low that nobody took notice of it. A lot has actually altered ever since, from purchasing a pizza with 20 bitcoin to purchasing a pizza shop with one bitcoin.

Introduction

Bitcoin and the rest of the crypto-market are providing technological development in the period of the web. Their work will be considerable in the future when our digital identity takes a growing number of kind. Blockchain technology itself and all the applications the crypto-companies are developing will be a crucial part of our daily life. But, the existing crypto-market has its defects as a financial investment automobile since of missing policy and adoption, speculators all around the world are utilizing the marketplace as their play area; for that reason, intelligent financiers must keep away as long as the liabilities of the crypto business and the crypto market are not controlled. In this short article, we will take a look at the marketplace from various viewpoints and assess why the intelligent investor should, in the meantime, keep away from it.

The crypto-market is presently a high-risk market, equivalent to the tech-market in 2001/2002, and in sight of an international financial decline, individuals will pull their loan out of their riskiest financial investments and put it into safe locations like federal government bonds or elite business bonds. Therefore, I advise the intelligent investor to await more guidelines around the crypto-market, comprehend the innovations and business strategies of the various crypto-companies and after that invest wisely when the international stock and bond markets bring back a strong structure.

Source: ccn.com To get an understanding and extract the factors for what is taking place in the market at the minute, we will take a look at the capital circulation and the weight the exchanges have, the existing guidelines of various federal governments around the globe, and we will put cryptocurrencies into an international financial point of view.

BitcoinGenesis - A little piece of History

000000000019d6689c085ae165831e934ff763ae46a2a6c172b3f1b60a8ce26f

Above, you can see the hash address of the really first bitcoin- block, and the wallet that got the benefit for mining this block is most likely Satoshi Nakamoto's wallet. Bitcoin's origin was at a time when the monetary crisis of 2007/2008 remained in complete movement and states were bailing out banks that else would not have actually made it through the crisis. The hash address of the very first block includes the encrypted "The Times" newspaper title from January 3 rd, 2009, which is "Chancellor on brink of second bailout for banks."

The reason I am revealing this is that this info is still part of the blockchain system. It can not be removed or modified. Anyone who wishes to see this info is totally free to do so and anybody who wishes to become part of the bitcoin blockchain can go on the main site bitcoin.org, download the wallet and see the complete history of all deals. There is no requirement for 3rd parties or exchanges to assist you enter intobitcoin With all the buzz around the crypto-market, its basically current boom, and crash, I wish to advise everybody of the huge image behind bitcoin and the technology that was presented through it. We have a highly sustainable currency-like system that is running constantly on many computer systems considering that January 3 rd, 2009, 6: 15: 05 pm. The info of all the deals within this system can not be (let me state "easily") hacked, modified or likewise customized. I still discover it remarkable, and I hope that often we can look past the cost ups and downs and take a look at the quint-essence of bitcoin itself, value it and the brand-new things that were produced from it.

P.S.: I understand that Bitcoin's mining procedure has its defects with the unneeded high energy intake and the centralization of the mining power ...

Bitcoin's down pattern

The crypto-market is down to listed below $100 billion by the time of composing from an all-time high of $813 billion in January of this year. This is a decrease of 88% in 10 months, and the concern is 'Will the marketplace recuperate or will its worth reduce even more?'. I am presuming that the crypto-market still includes a huge portion of what I call "Boom Buyers." These are late-stage speculators that 'invested' their loan when the marketplace was at its greatest. These boom-buyers are really unstable speculators and will pull their loan out of the marketplace when crypto-market news however likewise monetary market news turn even worse.

At the minute, the entire crypto-market is basing on an extremely unstable fundament that is going to collapse when self-confidence in the international economy ends up being weaker. Investors can't count on any earnings declarations, balance sheets, or capital declarations that would reveal the health of acoin Missing security and policy from the federal government likewise come as a downside.

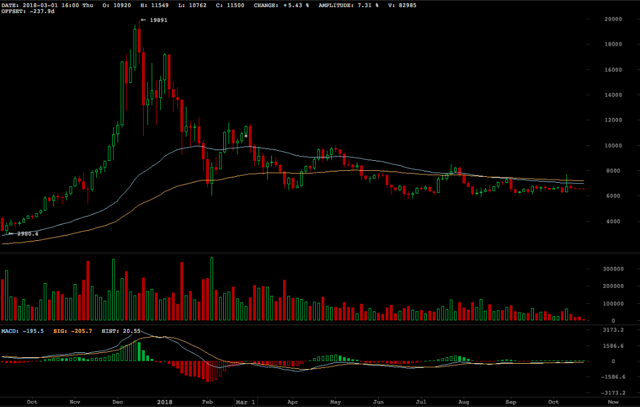

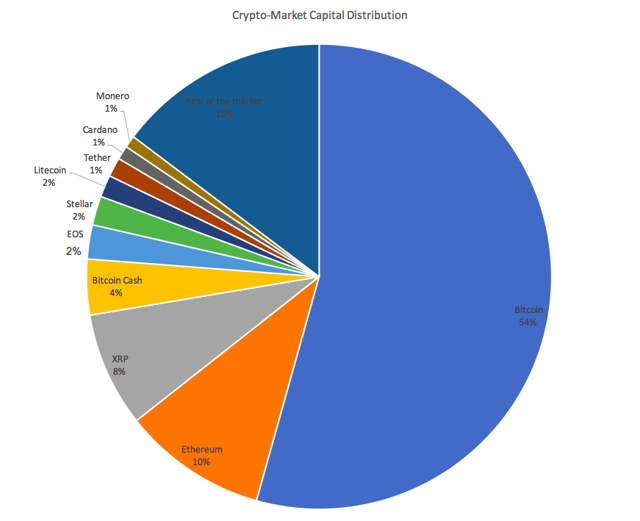

Source: Bitcoinwisdom - Bitcoin Candlestick chart - 1 candle light = 3 days When taking a look at the candlestick chart and the everyday trading volume, we can see that Bitcoin's everyday trading volume has actually been reducing for the past 12 months. A factor for the reducing volumes is missing out on adoption, which originates from missing out on policy of federal governments around the globe. The very same pattern holds for many other cryptocurrencies like Ethereum (ETH-USD), Litecoin (LTC-USD), Z-Cash(ZEC), Bitcoin Cash (BCH-USD), and so on. Bitcoin is still the medium to get in the crypto-market, and the majority of the other coins are matching Bitcoin's cost patterns. Continuing to catch the state of the marketplace, let us have a look at the capital circulation in the crypto-market. Source: Coinmarketcap Bitcoin,Ethereum, Ripple, and Bitcoin Cash are comprising more than 75% of the entire market capitalization. Bitcoin alone comprises more than 50% of the entire market followed by Ethereum andRipple Interestingly, the technology on which Bitcoin is based is currently outdated, and with its high energy intake, it is not a sustainable option to fiat currencies. Going an action even more into Bitcoin and taking a look at the 10 most significant wallets, we see the following:

| Wallet | Total BTC quantity |

| Binance-Coldwallet | 141,09640 |

| Bitfinex-Coldwallet | 138,66086 |

| Hubby-Wallet | 108,13465 |

| Bittrex-Coldwallet | 107,20307 |

| Bitstamp-Coldwallet | 97,84828 |

| 183 hmJGRuTEi2YDCWy5iozY8rZtFwVgahM | 85,94734 |

| 1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF | 79,95719 |

| 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx | 69,37012 |

| 1PnMfRF2enSZnR6JSexxBHuQnxG8Vo5FVK | 66,45207 |

| 1AhTjUMztCihiTyA4K6E3QEpobjWLwKhkR | 66,37881 |

Source: bitinfocharts.com

The 5 most significant wallets come from exchanges, and the last 5 come from unidentified owners. One problem that I see with Bitcoin and the crypto-market is that financiers and speculators are presently utilizing it and can just utilize it as a speculative property (the factor will end up being clear when we begin discussing guidelines and adoption in a later paragraph). Speculators and smart people produce groups on telegram or What sApp to enhance a few of the low-volume alt-coins for fast revenues. This procedure is called pump-and-dump and got prevalent adoption starting around 1 1/2 years earlier when the crypto-market was at its greatest. Since there are no guidelines or main federal government bodies that would supervise the marketplace and its individuals, the speculative nature of the crypto-market will be made use of.

While the bulk of speculators are holding their coins on the exchanges, there are the companies and significant stakeholders that still have a significant stake of the cryptocurrency. The crypto-companies disperse their coins to fund their task. While funding their task is genuine, the decline of Bitcoin's cost and all the other alt-coins will harm their only income source dramatically. Because of the high appraisal around a year earlier, these business have actually obtained resources like office, designers, supervisors, and so on, that require high capital injections to keep running. By dispersing their coins, hence diluting it at the very same time when the marketplace is crashing, they are speeding up the procedure dramatically. This advises me of the dot.com bubble in 2001/2002; the business that went IPO got their financing, however with the crashing market, no adoption, and no other stream of earnings other than the preliminary financing, these business were destined end up being insolvent.

I wish to call the existing crypto-market the wild west of digital change where missing out on laws, policy, and adoption are making this environment fantastic for people who are there for fast revenues. But it will take some time and a great deal of sacrifices to make this technology sustainable and successful.

Regulation and Adoption of Blockchain Technology

I wish to reveal the existing guidelines in 5 nations with the greatest everyday trading volume.

Japan

With nearly half of the daily trading volume going through the Japanese market (since March 2018), Japan is the most significant market for crypto lovers, and in Japan, Bitcoin has the status of legal tender (LegalTender indicates that a medium is formally acknowledged as a monetary medium and can be utilized for the exchange of products or that this medium can be utilized to snuff out public or personal financial obligation).The Japanese federal government has the most sophisticated set of guidelines of all the other nations and hence offers an efficient environment for the adoption of cryptocurrencies. A reason Japan is that advanced is that they presented those guidelines rapidly after the scandal withMt Gox, where 850,000Bitcoins were taken. The Financial Services Agency (FSA) supplied in 2014 the list below suggestions relating to cryptocurrency exchanges, which formally entered into impact in April 2017:

- Cryptocurrency exchanges must present a registration system.

- Making cryptocurrency deals based on money-laundering guidelines.

- A security system for cryptocurrency users.

U.S.A.

The United States is the 2nd biggest market for cryptocurrencies, however the currencies have no legal tender status in any jurisdiction. In the United States, Bitcoin and Ethereum are commodities, and all other coins are securities, depending on the result of the Howey Test That indicates that the business that release coins need to sign up at the SEC and follow these standards:

- Describe the function of business and the business's homes.

- Describe the type of security that is being provided.

- Full monetary declarations need to be revealed.

- Information about the business's management.

The exchanges are legal under United States law.

Europe

No legal tender status and the legality of the exchanges vary from nation to nation. Being in the European Union prohibits any specific member to present its currency.

UnitedKingdom

The cryptocurrencies have no legal tender status, however the exchanges are legal as long as they fulfill the anti-money-laundering and anti-terrorism requirement as do other banks.

SouthKorea

No legal tender status however exchanges are legal. Members of the exchange should be signed up with South Korea's Financial ServiceCommission Initial Coin Offerings and futures are still not within guidelines, hence forbidden in South Korea.

The missing policy within the most significant economies worldwide makes it tough for cryptocurrencies to be embraced in online commerce or brick-and-mortar organisations. Until the point when guidelines for cryptocurrencies are produced other applications will come and take the marketplace, for instance in China, the app We Chat is currently the top payment technique. It is rapid and practical for anybody to pay and make money, that makes it tough for other gamers to get in the marketplace. Additionally, the Chinese federal government is securing their economy and will not let a third-party currency that they can't manage join their market.

That stated, the missing out on guidelines will keep cryptocurrency as a speculative property in the near-term, a video gaming toy for speculators, which is harming the innovators and business owners that are attempting to get blockchain technology to the next level. In the middle of this market, the business are developing blockchain professionals that will, after a lot of the existing crypto-companies declare bankruptcy, be obtained by other monetary business that will then present their peer-to-peer currency in a brand-new and regulated method.

For anybody who wishes to state that Bitcoin can't stop working any longer, I simply recently checked out something that Jeff Bezos, the most affluent guy alive, stated at an all-hands conference at Amazon (NASDAQ: AMZN) and it advised me that even if we believe that huge business or currencies can't stop working, that those occasions are absolutely nothing extraordinary.

"Amazon is not too big to fail. In fact, I predict one day Amazon will fail. Amazon will go bankrupt. If you look at large companies, their lifespans tend to be 30-plus years. If we start focusing on ourselves, instead of focusing on our customers, that will be the beginning of the end. We have to try and delay that day for as long as possible."

Source: nypost.com

TheTrilemma

DaniRodrik, a financial expert operating at Harvard, provided us the theory of the trilemma, which mentions that globalization, democracy, and nationwide self-determination can not be attained simultaneously.

"We cannot have hyperglobalization, democracy, and national self-determination all at once. We can have at most two out of the three."

Source: "The Globalization Paradox" by Dani Rodrik

Where does Bitcoin position itself? Well, if every nation would accept Bitcoin as a currency, we would move towards hyperglobalization, however the nations need to quit their self-determination to some degree. We currently have 2 real-world cases which we can utilize to think of possible circumstances. First, the gold requirement that assisted at the start of the 19 th century to jump-start the international economy. The gold requirement assisted for a while however then wound up as a zero-sum video game where some nations cheapened their currency versus gold to promote exports from their nation. The 2nd example is the Euro-Zone where all members consent to utilize the Euro as their currency and for that reason quit their financial self-determination. The advantages of the Euro-Zone are its totally free borders and open market in between the member nations, however this comes at the cost that the Euro is a financial straight-jacket for the members. If a nation can't set its financial objectives, like in the example with Greece, nations with low outputs are at threat to default on their financial obligation.

I do not believe that any of the 2 circumstances is an ideal case for cryptocurrencies. Countries will not voluntarily accept to quit their financial power to make location for a currency that has a set inflation rate and a repaired quantity of supply. Using the blockchain technology as a medium to produce currencies with the choices to adjust inflation rates may be an ideal case for nations. Other than that, the technology makes it possible for business to produce gain access to controls, transports controls, or entire databases that will be more difficult to hack than existing systems.

I believe Bitcoin and other cryptocurrencies are still prematurely to be accepted as international currencies, specifically in establishing nations where a tight financial and financial control, see China, is necessary to protect development. Using cryptocurrency as a medium of exchange is appropriate as long as anti-money-laundering laws and controls are embeded in location that impedes the totally free circulation of currencies in between nations. But then we need to believe, "What is the benefit of using cryptocurrencies at the moment?"

The advantage of the cryptocurrencies is not the currency itself however the technology and knowledge of individuals within the market. Especially as a medium of self-determination for business, blockchain technology might offer them with a medium to release their stocks without paying millions in costs to the brokers.

Conclusion

Finding a star within this problematic market is tough however definitely possible, and I will quickly present some business that utilize blockchain technology and at the very same time produced a service strategy around them that use a development point of view and earnings for the investor. But currently crypto still indicates Bitcoin, and up until this does not alter and federal governments do not begin to control and embrace blockchain as a technology, the existing market will continue to suffer.

Uncertainty within the crypto-market integrated with sluggish adoption and policy from federal governments all around the world are simply a few of the reasons I advise the intelligent financiers to leave the crypto-market in the meantime. Within times where the instructions of international financial development is questioned, the United States stock exchange is filled with high unpredictability, and in the middle of a trade war in between the 2 most significant economies worldwide, the crypto-market is taking a success and will continue to do so as long as the international economy is unstable. Investors will pull their loan out of their riskiest financial investments and wait patiently for the international market to cool down once again.

Posted from Cryptotreat Cryptotreat : https://cryptotreat.com/crypto-boom-and-crash-the-intelligent-investor-and-blockchain-technology/