Bitcoin, Email And The Opportunity In Blockchain

What increases

Cryptocurrencies lacked a doubt the most incredible market story of 2017 Bitcoin, the crypto bellwether, was up over 1,300% (revealed listed below) however wasn't even near to being the leading entertainer. Other popular tokens like Ethereum and Ripple went parabolic at over 9,000% and 36,000% for the year, respectively.

^NYB information by YCharts

Misery enjoys business

If you missed out on the rally, do not be too difficult on yourself since you remained in actually excellent business. Here's what a couple of gray-haired financiers needed to state about crypto throughout and prior to the rise.

· Warren Buffett - "Stay away from it. It's a mirage, basically...the idea that it has some huge intrinsic value is a joke in my view."

· Jack Bogle - "Avoid Bitcoin like the plague. Did I make myself clear?"

· Ray Dalio - "Bitcoin today you can't make much deals in it. You can't invest it really quickly.It's not a reliable store-hold of wealth since it has volatility to it, unlike gold. Bitcoin is an extremely speculative market. Bitcoin is a bubble."

· Howard Marks - "Digital currencies are nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it."

· Carl Icahn - "It's sort of fantastic to me. If you check out history books about all these bubbles, like in Mississippi - where John Law walked around offering all this land in Mississippi that was sort of useless and the French were going nuts offering him all this loan. And then one night everything exploded ... to me, this is what this is.Seems like a bubble."

· Richard Bernstein - "One would have believed that financiers would have discovered their lesson from the deflation of the innovation and real estate bubbles, however that does not seem the case. The unfortunate truth is that a lot more financiers will likely get drawn into this bubble too."

I mainly concurred with the gray-hairs, however I likewise didn't believe BTC would simply vaporize into absolutely nothing. In my own words I composed, "Like all bubbles, it will burst, that much I agree with. But when all is done, I don't think we hear last of Bitcoin. Rather I think it matures and finds its place, wherever that may be."

So far in 2018, the gray-hairs are right. Crypto has actually crashed from its January high. The concern bagholders have now is what's next for BTC (and by BTC I indicate all cryptos in basic)?

^NYB information by YCharts

The larger photo

To be truthful, no one understands, I definitely do not. But those consuming over BTC rates might be missing out on the larger photo. Even if all cryptocurrencies wind up absolutely useless, there will still likely be a big, long-lasting opportunity in blockchain the underlying innovation.

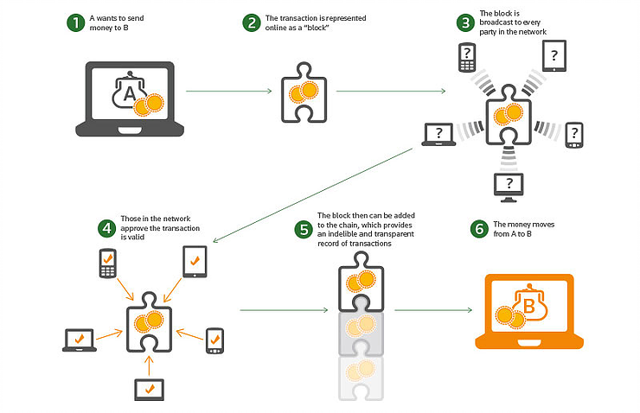

A blockchain resembles a digital journal that tapes deals in between celebrations. Each deal is tape-recorded as a block of code connected to previous blocks in a sequential chain noticeable to all celebrations included. The innovation is safe and secure, effective, and has numerous useful applications.

BlockchainExample

Source: World Economic Forum

Examples consist of enhancing the transfer of possessions like securities or property. Currently, the sale and purchase of such things need layers of intermediaries (brokers, clearing homes, title business, and so on). Each layer includes time, expense, and intricacy to the procedure, however they're required since there's no standardized, automated, and safe and secure method to all at once tape-record a deal for all celebrations included. Applications do not stop there, blockchain might interfere with whatever from medical records to stock management since the innovation is still in infancy.

The point is in spite of the rising interest in Bitcoin the currency, the genuine long-lasting opportunity might really remain in blockchain the innovation. Companies little and big are still rushing with how to take advantage of blockchain's capacity. FEET press reporter Sally Davies put the opportunity in appropriate context with her now popular example, "Blockchain is to Bitcoin, what the web is to email."

Easier stated than done

Blockchain's capacity is substantial, yes, however if just it were simple to record. As with any emerging opportunity, brand-new endeavors are multiplying quickly in this area. And while some sound appealing, some are overall scams, and many are unprofitable, economically unsteady, difficult to worth.

Despite that, there are lots of financiers who do not appear to appreciate the compound behind the cryptocurrencies or crypto-related business and stocks that they pump loan into.

Making sense of buzzwords

Take, for instance, Blockchain Technology Consumer Solutions (OTCQB:BTCS). This is a cent stock that gets promoted on unclear online forums all over the web however trades approximately practically 2 million shares a day.

On the surface area, it's simple to see why. A glimpse at the business's site offers enough buzzwords to send out crypto-speculators into a craze. In huge, strong letters the homepage checks out " THE BLOCKCHAIN SUGGESTS DISTURBANCE" Also showed is the business's redundant specialty, being, "The very first blockchain-focused U.S. Public Company."

That sounds excellent and disruptive and all, however what does it actually even indicate? Digging much deeper into BTCS' history exposes the business itself might not even have a conclusive response. Here's a summary timeline originated from its 10-Ks because 2008.

- 2008 - The business included in Nevada as "Hotel Management Systems," a business that created hotel operations software application.

- 2010 - Entered into a share exchange contract with To uchIT Technologies in Istanbul (Turkey), stopped operations as HMSI and ended up being a producer of touch-screen LCD items " to fit all kinds of applications"

- 2014 - TIT participated in an exchange contract with Bitcoin Store, LLC (OTCQB:BTCS) in Maryland, stopped touch-screen production and ended up being concentrated on developing an e-commerce market where individuals might negotiate in digital currencies.

- 2015 - BTCS included "Transaction Verification Service Business" to its activities (aka bitcoin mining). Notably, likewise included "Blockchain Technologies and Other Growth Initiatives" organisation.

- 2016 - BTCS stopped the e-commerce market, suspended bitcoin- mining, and now concentrated on producing " a portfolio of digital possessions consisting of bitcoin and other 'procedure tokens' ..." Also continued with "Blockchain Technology and Digital Asset Initiatives"

- 2017 - BTCS ends up being a cryptocurrency holding business. From its newest 10- K, "Subject to extra funding, the Company prepares to get extra Digital Assets to supply financiers with indirect ownership of Digital Assets that are not securities, such as bitcoin and ether"

BTCS has actually experienced an oscillating id of sorts. However, it has actually carried out on a number of things regularly.

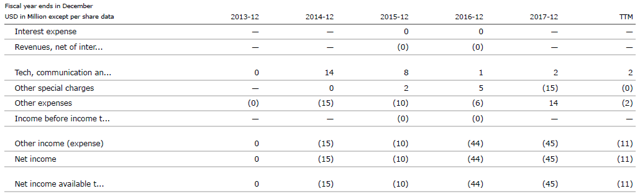

First, it's lost loan every year because it ventured into crypto, revealed listed below. In 2017 BTCS reported earnings of $4,480 and a bottom line of $45,065,336 Adding insult to injury, it's timing for ending up being a cryptocurrency holding business was off, to state the least.

BTCS Annual Income Statement

Source: Morningstar

Second, and possibly most regularly, BTCS continues to explain itself with all the ideal buzzwords. From its 10-Ks, "We are an early entrant in the Digital Asset market and among the very first U.S. openly traded business to be included with Digital Assets and blockchain innovations."

Walking the talk

Of course, not all business in the area are all talk and buzzwords. One business that might be various is BTL Group (OTCPK:BTLLF) based out of British Columbia, Canada.

On the surface area, it has resemblances with the similarity BTCS, another blockchain cent stock, an odd past, and no incomes. However, a more detailed look likewise exposes some contrast.

BTL was initially included in 2011 in Alberta, Canada as Northern Aspect Resources However, it was arranged as a "capital pool company," which indicated its primary activity was to determine, assess, and eventually purchase or get organisations, residential or commercial properties, and/or possessions.

In2015, the business discovered its target in Blockchain TechLtd Post- acquisition Northern Aspects altered its name and BTL Group was born. From beginning, BTL's technique was various. The business was more focused, arranged, and tactical.

The business's creator Tom Thompson, now CTO, was flanked by a skilled group of business executives and consultants. Instead of making unclear claims about being an early mover in blockchain innovation, BTL concentrated on establishing an exclusive item with genuine advantages and a clear long-lasting goal.

BTL's flagship item is Interbit, a brand-new kind of blockchain advancement platform created particularly with big corporations in mind. BTL acknowledged standard blockchains would not scale to fulfill enterprise-level needs. Interbit addresses that provide by integrating numerous blockchains together that can fulfill numerous needs in a synchronised and collaborated method. The result is business can utilize the platform to rapidly and quickly establish, embrace, and incorporate blockchain applications with integrated personal privacy, scalability, and resiliency.

Not just does the story sound excellent, however BTL is likewise strolling the talk. In 2016, BTL partnered with Visa (V) to pilot a " initially of its kind blockchain based cross-border service." Not just was the pilot effective, however it supplied crucial proof-of-concept and market acknowledgment for BTL.

In2017, BTL partnered with a group of worldwide energy business consisting of Britsh Petroleum (NYSE: BP) and ENI Energy (E) to establish and pilot an energy trading service utilizing the Interbit platform. The pilot showed the platform would increase security and performance throughout the trading cycle consisting of for validate, settlement, audit, compliance, reporting, and danger management. Since then BTL has actually broadened the task to consist of 9 worldwide energy business and is working to advertise " a brand-new requirement for energy trading."

The point exists appears to be more compound than buzzwords at BTL. BTL's CEO Dominic McCann amounts it up well with an easy quote, "While others contend for time in the spotlight, we have actually been hectic structure something really game-changing"

Of course, when all is stated and done BTL, like the others, is still not rewarding and is dealing with a restricted quantity of capital. This is all speculation about possible and it's completely possible that BTL will lack money prior to its items accomplish monetary practicality.

The bottom line

I'll end with a crucial note, I just recently composed a short article about the obstacles of stock-picking. Ironically, I share my viewpoint on 2 stocks in this post.

But to be clear, I am not choosing or suggesting any stock here. Though I choose BTL to BTCS, both business are unprofitable and both stocks are extremely speculative. Neither stock is proper for the huge bulk of individuals, in my viewpoint. In addition, I'm never a specialist on cryptocurrency or blockchain.

I blogged about the stocks merely to make a point about the numerous unpredictabilities in the crypto/blockchain area, and how business running because area might not constantly be what they appear.

The bottom line is whether you purchase cryptocurrency, blockchain, or associated stocks, be really cautious, do your due diligence, and do not purchase more than you want and able to lose.

Disclosure: I am/we are long ETH-USD, BTLLF, XRP-USD.

Posted from Cryptotreat Cryptotreat : https://cryptotreat.com/bitcoin-email-and-the-opportunity-in-blockchain/