Original BTC research: Dollar cost averaging vs buy-and-hold for accumulation

In my last few posts, I have highlighted how my own trading strategies did against Dollar cost averaging / DCA (they did relatively comparable). In this post, I want to do a more generalized comparison.

The comparison will be between buying and holding (buy all) vs DCA. Let's say that the first day Bob invests in BTC is the day he invests all that he is comfortable with. Dan, on the other hand, decides to just invest a tiny amount on the first day but sets up a bot to consistently buy for the same amount daily no matter what.

Who do you think will do best?

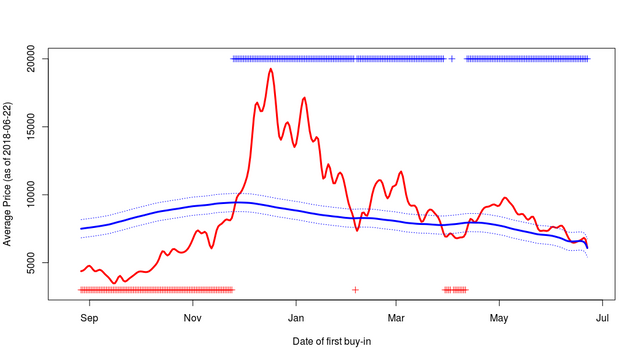

That question depends on when they first began. Let's investigate the last 300 days and see how both would be doing right now. Red indicates buying all Bob and blue indicates DCA Dan:

Whenever the blue line is below the red DCA Dan would have done better. When the red line is between the blue dotted lines, the prices are essentially the same (within one standard deviation of the daily fluctuation in prices (669 usd)). A red + in the bottom indicates that Bob was better off and a blue + in the top indicates that Dan was better off.

If we, for instance, compare the first of January then Bob would have bought his BTC for a price of 13657 while Dan's average price as of this writing would have been 8840 by buying until today.

One clearly sees two facts:

a) The blue line is much smoother than the red line indicating that exact time you start to DCA is not so crucial.

b) Over the last 300 days, you would sometimes have been better off with DCAing and sometimes with buying all. However, in all of 2018 sometimes buying all would have left you much worse off and other times it would have left you just slightly better off.

In the current market that is, sadly, declining there has only been a handful of days in which DCA lost to buy all. When DCA has been losing it has typically been a smaller amount than when buying all lost.

My conclusion is thus in line with my previous research posted here: DCA is a strategy that requires less focus on the markets and it often performs well if one's goal is to accumulate BTC.

I hope that I am presenting things clearly, otherwise questions and comments are more than welcome.

If you find this post interesting, please consider to share it/spreading the word. I am still very new here at steemit and I hope to share my thoughts with as many people as can benefit from it.

Best of luck with your cryptos whatever you decide to do.

Please Upvote➜https://steemit.com/christianity/@bible.com/verse-of-the-day-revelation-21-8-niv

Congratulations @citizenkane! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes