ASIC Resistance is a MYTH : DASH is Conquered

Most new crypto coins like to spruik some algorithm that they claim is “ASIC Resistant”. While nobody wants to see mining of their favourite crypto coin get centralised, what this "ASIC Resistance" claim really means is that the big players have YET to build an ASIC that is optimised for that algorithm.

Any algorithm can have an Application Specific Integrated Circuit built for it that will perform better than your PCs CPU and/or your GPU, it’s just a question of whether your coins market cap and the mining revenue they can make from it is worth the effort.

You don’t believe me? Let me give you a recent example of DASH and the X11 algorithm.

This is the chart for the DASH networks total hashrate. The network hashrate is what determines the difficulty of mining a particular crypto and as the difficulty goes up the harder it is to get the mining reward. Do you see what I see? About 3 months ago (late July 2017) the network hashrate was around 14 TH/s and now it is up around 320 TH/s. That’s an increase of almost 23 times!

You might think, that’s ok, DASH has been growing and going up in price so that might seem normal. Here is the DASH price in USD for the same period.

The DASH price has been doing OK, but it has less than doubled. This means that people who previously invested time and resources into mining DASH (which uses the X11 algo) have seen a huge drop in the profitability over this period - A drop which I estimate to be over 90%.

Why has this happened? Let me introduce this bad boy - The D3 Antminer….

This ASIC was released to the market in the last couple of months and it has had an immediate effect on the network hashrate for DASH. I bought a Genesis Mining X11 contract earlier this year and got 500MH/s for about $2250 USD (yes, I do have sour grapes) and this thing has 30 times the hashrate for a cheaper cost. It’s pretty hard to compete with that sort of power.

But wait, wasn’t the X11 algorithm supposed to be ASIC Resistant?

X11 is actually not one, but 11 different algorithms which are chained together. Let me quote from http://cryptorials.io/glossary/x11/

It is known as a chained algorithm because it uses 11 different algorithms which are chained together. These are: blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, and echo.

It is ASIC-resistant and suitable for both CPU mining and GPU mining.

So 11 different algorithms…yep that’ll be ASIC Resistant won’t it? Nice try, but NO!

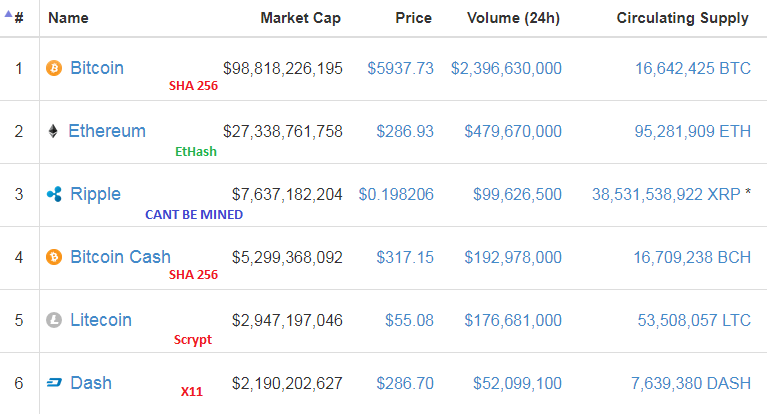

The truth of it is that you can build an ASIC for any algorithm if it’s worth enough to make a profit. Let’s take a look at the top crypto coins by market capitalisation and see if I can illustrate my point.

Do you see what I see? The ASIC manufacturers are just working their way down the list…but they’ve missed Ethereum and it’s EtHash algorithm. Does this prove me wrong? Well maybe, but I suspect that an ASIC for EtHash hasn’t been developed because Ethereum has been planning to move away from Proof of Work to Proof of Stake. When that happens everyone who’s invested in mining with EtHash is suddenly going to have a heap of expensive mining hardware looking for a new purpose so I’d suggest Ethereum was passed over for that reason. The move to PoS was supposed to happen this year but it’s been postponed…..

Then we have Bitcoin Gold making the news right now. Why is that? Well it’s big “Value Add” to the Bitcoin crypto-sphere is that it is going to use a new mining algorithm that is "ASIC Resistant" so that we can have a decentralised Bitcoin network once more. They are going to use Equihash. Yep, good one guys! If you succeed in making BTG worth something, you will fail in the long run just like the others because history will repeat. But don’t worry because you’ll make a shedload of cash from your pre-mine in the process. Just how stupid do you think crypto investors are? Actually don’t answer that…..

So it all sounds a bit dire. Do we accept that any new algorithm that might claim to be “ASIC Resistant” is a lie and trying to decentralise crypto mining is just a pointless exercise? Is it inevitable that any crypto which is successful and has a big market cap will have an ASIC developed for it that will inevitably centralise the mining? Should we move to Proof of Stake or Graphene or some other form of mining and ditch Proof of Work altogether?

Maybe? Or maybe all we need to do is keep coming up with new mining algorithms and put a hard fork in our favourite cryptos roadmap every 6-12 months to drastically change the algorithm. It sounds like a joke, but if we did that then maybe we shift the goalposts enough that the big centralised miners have a huge disincentive to invest in developing an ASIC for each algorithm.

Images and Credits

https://www.coinwarz.com

https://www.poloniex.com

http://cryptorials.io

https://www.cryptocompare.com

https://fs.bitcoinmagazine.com

https://makemoneyonline.zone

https://s3.amazonaws.com

This is an excellent analysis.

You know, the crypto world is in a catch-22. We need BTC to continue to do well in the short term because it's the entry point for investing in alts. But in the long run, the BTC tech is outdated, sluggish, and exceptionally prone to centralization (as you demonstrated).

What do you think are some ways we could move away from PoW and the current BTC hegemonic model? We can't possibly sustain hard fork after hard fork and think everything is OK.

Thanks. I totally agree on BTC tech being outdated. It only has the #1 position it does because it was first to market and has maturity on its side, but there are lots of other cryptos out there with better tech right now.

I think the first thing we need is more trading pairs on the exchanges, which goes hand in hand with having more arbitration bots to support liquidity for those pairs. The only way the role of "gateway to crypto" is going to be pried away from BTC is if you can trade alt coins with something other than BTC.

I personally like Delegated Proof of Stake but I think it could also be better. Masternodes are also a good idea but they need a low barrier to entry or its just going to be for the wealthy only. I like the idea of rewarding everyone who runs a reliable node to support a network. PIVX has an interesting "See Saw" algorithm which has potential too and balances reward between PoS and Masternodes.

It's probably worth a whole post on the subject of toppling BTC hegemony. Maybe one for next week :)

I'm partial to DPOS, too. Also, agree on getting more trading pairs on exchanges. Not sure how to influence this, though. I would definitely be interested in helping with the topic of of toppling BTC hegemony.

Its tough for the average user to influence these things as it normally comes down to a supply/demand argument for exchanges. Though maybe with the disruption of these Bitcoin forks coming up that will push demand along a bit.

For guys like us it's probably just about pushing awareness of the issues and making sure the best solution is in the forefront of peoples minds when the wind changes and something needs to be done.

Definitely agree. Thanks again for this great post on ASIC resistance. More like this!

Dash is doing significantly well at getting fiat trading pairs. Dash is already big(10th in volume and 6th in market cap) and has excellent community and tech behind it. Dash is the best contender against BTC. I'm also a massive fan of NEM and PIVX. Most exchanges does have Fiat-ETH trading pairs. NEO may get lots of interest from China eventually.

It's the mainstream attention and financial newsletters that's pumping BTC. After SegWit2X we could end up seeing some massive falls. Privacy coins are picking up attention. I do believe zk-SNARK to be the best tech. But the way Dash handle privacy is also elegant and has not been broken.

https://www.dashforcenews.com/blocksci-paper-highlights-blockchain-traceability-issues-potential-future-risks-dash/

https://www.dashforcenews.com/the-unique-hidden-benefit-of-dashs-privacy/

So it's between Dash and PIVX. There is no point in using any other coin with zerocoin when you have PIVX. Dash gives us the more elegant solution by emulating cash instead of encrypting. I think both methods are excellent.

steemit is a really good place to spread awareness. I'm sure lots of people got to know lots of great products/projects through steemit. If we can get more people into steemit it'll be easier to spread the word about scalable, private coins with great utility and other amazing works like SONM, MaidSafe, BAT, WTC, EOS, Komodo etc.

I was very bullish on DASH a few months back but have cooled off a bit after discovering STEEM and DPoS. I was attracted to the InstantSend feature and the Masternode idea which is clever. Still a bit of question over scalability and transaction throughput in the long run though which is why I like DPoS.

I might be wrong but from what I remember there was no DPoS when Dash started. With masternodes they created the closest thing to it. What they did was revolutionary. Many have copied it since. Scaling maybe a problem with PoW but at least Dash is set for 400MB blocks. With X11 ASICS around the mining process will have to change. But every other aspects is way ahead of the competition.

I think DPoS could be further improved with an importance model. Think the reputation in steemit. If we can incorporate a system that measure activity/contribution/importance to the network, things will be even better.

I also think having an extra layer of PoW or some other brute force type security can be helpful. There is no such thing as too much security. I love the delayedPoW in Komodo. If you need to break KMD, you need to break BTC first.

We could even see coins that exist mainly to provide a PoW layer of security to other coins. Instead of Dash masternodes using just X11 they could incorporate multi-algorithm multi-layered PoW security into their PoS masternode network. As BTC fade away we could even see projects using delayed X11 PoW increasing the value of Dash.

Let's see what would happen.

It all sounds good. I agree DPoS > DASH > BTC

The crypto tech is evolving quickly and it's great to see. I think DASH has every chance of being a market leader and with proper governance and funding for development with a decent market cap they are miles ahead of most.

Great insights @buggedout. So true, that there is a direct relationship between the opportunity for financial and the development of disruptive technology to take advantage. Basically, for all the mining POW schemes, if it can be done on a bunch of separate systems it can be consolidated into one. It just takes the desire, talent, and resources to make it happen.

I think many in the crypto mining sphere don't get this and believe the marketing "ASIC resistant" claims. When in fact it really is an economic incentive equation.

You summarise it beautifully. "It is an economic incentive equation" hits the nail on the head.

Vertcoin has already proved to be asic resistant. Asic manufacturers very very likely won't target vertcoin because they have before and vertcoin ended up altering its mining algo. It also has a memory intensive and growing memory algo which makes asics difficult to optimize for but ideal for GPUs.

According to Wikipedia "Vertcoin has already forked two times to a new PoW function because of a veritable threat of centralized mining." so it kind of proves my point. They are a great example of my final suggestion of regularly changing algorithms to throw off the ASICs.

https://en.wikipedia.org/wiki/Vertcoin

But as for the bit about "... a memory intensive and growing memory algo which makes asics difficult to optimize for but ideal for GPUs" I think you might have drunk too much of the kool-aid there ;)

Haha yeah im wrong on the memory part but the devs have proven to adapt to asics being developed which is as resistant as it gets imo. You're right that an algo in itself isn't very resistant but what incentive is there to make an fpga asic for vertcoin when the asics made require firmware upgrades and the devs have proven to respond to asics developed relatively quick?

source

Yes, I agree with you. I wasn't really aware of Vertcoin before and the success they have had staying ahead of things. By the sounds of it they've got a good approach to ward off the ASIC developers and are agile enough to go through with it.

I agree, ASICs will be in every crypto. There is always a specialized computer that can do it better than a regular one, and if not, smart people will figure it out. It's the same with anti-hacking tools.. hackers will always find a way around it. It's an ongoing battle that probably never ends.

Same with ASICS.. if there is money to be made, somebody will figure out how. I don't get caught up too much in the ASIC resistant hype. For me, it's only beneficial in the short term for small miners, because it allows them to hop from project to project and keep mining.

Yes, HYPE is exactly what it is. HYPE and FUD are two of the biggest issues in the crypto space so if we can dispel just a little bit by getting some facts out there then it's a good thing :)

I've been impressed by the Proof of Importance used in NEM(XEM) which is a coin I love more and more as I learn more about it. It's a real sleeping giant. Has no coin creation. The Tx Fees are given to those who mint the blocks. Instead of the Stake in the blockchain NEM measures your importance to the network. If you participate in the network and is involved in legitimate transactions you are more important thus has a higher chance of getting to mint a new block.

Since no new coins are created and you need a massive network to make it appear you are making legit transactions, the incentives to attack the network is very low. I'm not a programmer or blockchain expert. When I researched I found POI to be a really great system that is superior to PoS. Expert analysis from the community is welcome.

I never looked into NEM much somehow, but maybe I should because POI sounds very interesting indeed!

That's just tip of the iceberg. NEM recently had their first ICO COMSA which exceeded 86 million USD(yes, it supports smart contracts and before the end of the year they'd be doing 4000 onchain transactions per second. Take that that Buttcoin.

Also take a look at the partner companies:https://nem.io/enterprise/partner-companies/

NEM is a sleeping giant along with BTS, EOS, SONM, MAidSafe.

NEM does sound interesting. I had a very brief look at it some time ago and it didn't quite "click" for me as I didn't see a standout value add or point of difference beyond the POI. Might be time for me to have another look :)

https://forum.nem.io/t/nem-will-surpass-bitcoin-eventually-and-heres-why-and-when/7447

I didn't care much about NEM at first either. But more I lean the more I love. There are so many use cases with NEM. You have voting, crowdfunding and encrypted messagingfor future Snowdens and privacy lovers: https://nem.io/enterprise/use-cases/

Here is a list of partners from across the globe:https://nem.io/enterprise/partner-companies/

Here is their blog:https://blog.nem.io/

If Ethereum is a PS4 NEM is a Acer Predator 21X $9,000 gaming laptop. I'm not exaggerating. Take your time and research.

thanks for bringing that up.i also ordered a dash contract with GM last year.lucky im in the green but it turned to shit as your post is saying.i can see that in my payouts,only every second day..ive got a 150MH

i can understand you are a bit sour,nicely said.

lucky i didnt load up,a while back when they had it in stock again...

I'm not too sour as I expected my profitability to decline (but not this quickly). Haven't done the math yet but I might have been early enough to get in the green before the ASICs hit. It's not GMs fault the 2 year contract is now near worthless. My issue is with the crypto project teams who are falsely promoting "ASIC Resistant" algos when it is really just marketing BS.

yes mate,i agree.not GM fault.

the wild west: crypto...

good to hear that you hopefully made it in the greens.im sure there are a lot of people which aint in that position i reckon.

According to the Ethereum white paper:

The current intent at Ethereum is to use a mining algorithm where miners are required to fetch random data from the state, compute some randomly selected transactions from the last N blocks in the blockchain, and return the hash of the result. This has two important benefits. First, Ethereum contracts can include any kind of computation, so an Ethereum ASIC would essentially be an ASIC for general computation - ie. a better CPU. Second, mining requires access to the entire blockchain, forcing miners to store the entire blockchain and at least be capable of verifying every transaction. [...] one notably interesting feature of this algorithm is that it allows anyone to "poison the well", by introducing a large number of contracts into the blockchain specifically designed to stymie certain ASICs.

It does sound good. Then again I thought using 11 different algorithms chained together sounded good....

At the end of the day if someone wants to build a device that can do it more efficiently than the average ETH miners PC then they will. Sure they might need RAM, they might need a copy of the blockchain, they might need some computational power....but it can be done. I'm sure it WOULD be done for ETH at the current market cap if they weren't planning to move away from PoW mining.

The "poison the well" thing is interesting. I'm curious as to how that would work and how it would be able to disadvantage a next-generation ASIC without affecting the average miners PC. It would need to be able to differentiate between the two. I am sceptical.

Thanks a bunch for all this important information and education, in my case! It made me wonder if anything of this could even affect Bitshares?!. ;)

Namaste :)

Bitshares uses Delegated Proof of Stake and basically the network votes for who is going to produce the blocks and get the reward. It is a totally different form of mining that should never have to worry about ASICs.

Therefore, more reasons for everybody to jump on the bandwagon right?!? ;)

Namaste :)

This is an important difference between Proof of Work and Delegated Proof of Stake. Most of my current crypto holdings are in DPoS currencies. Steem, Bitshares, Lisk. I think they have a significant advantage over Proof of Work based currencies.

I Guess Simply Holding The Tokens Would Be Much Profitable Than Investing In A Cloud Mining Service Then :p

As with anything, it depends. For DASH this time around - for sure. But if your crypto is stable for a long time (and the network and hashrate are also stable) then mining can pay off in the long run. It's a bit too volatile so far in 2017 though.

Hi @buggedout, this post was resteemed by @currentnews. You can check it. Upvote and follow me and let me grow. thanks

Thanks. I appreciate the Resteem :)

Great post. Equihash has all along been used on zcash but no ASIC seem to have been compatible with the algo for now. Equihash claims to dwell on RAM space rather than processing power. As the trend goes from top-down as you rightly stated bitmain or some other company might come up with something

https://steemit.com/bitcoin/@tokenizer/yet-another-fork-bitcoin-gold

Once ZCash gets up around the market capitalisation of DASH I am certain someone will have a go at building an ASIC for Equihash. Maybe even sooner if BTG goes ok.