Deep Dive: SEC & CFTC Testimony on Crypto Before Banking Committee

The heads of the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) testified on the topic of cryptocurrency and distributed ledger technology before the Senate Banking Committee on February 6, 2018.

I watched the 2+ hours of the testimony and read the majority of their 100+ pages of pre-written testimony (SEC, CFTC) -- all so you wouldn’t have to. (If you’re wondering, the answer is: yes, I probably need to get out more.)

The following is a deep dive on the developments from the hearing, with a moderate sprinkling of snark.

The Players

U.S. Senate Committee on Banking

A bunch of mostly old, mostly white, mostly wealthy, mostly dudes who pride themselves on being responsible stewards of our current disaster of a financial system. More than anything, really, they’re a bunch of blowhards that love to ram in talking points to appease their wealthy campaign donors & lobbyist cronies.

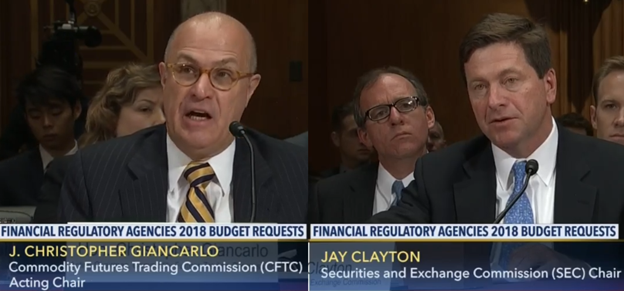

Jay Clayton, SEC

Jay Clayton is the Chairman of the SEC, the federal agency tasked with enforcing federal securities laws and issuing regulations upon the securities industry, including various stock exchanges. Appointed by President Trump in 2017, Clayton has a background in big-firm securities law (shocker, I know)

Chris Giancarlo, CFTC

J. Christopher Giancarlo is the Chairman of the CFTC, the federal agency responsible for regulating futures and options markets. Giancarlo was appointed by President Obama in 2014 to be a Commissioner at the CFTC, and then named as acting Chair by President Trump in 2017. Prior experience: finance & corporate law (no way!)

Broad Assessment (TLDR)

Overall I’d consider the hearing a moderately pleasant surprise for crypto investors. Both agency heads came off as knowledgeable – or at least well-prepared – as to crypto and blockchain technology. And while both men acknowledged that more regulatory oversight was likely, they generally limited the scope to instances of “fraud and manipulation” as per their respective agencies’ mandates. They also displayed some candor in noting where regulatory protections offered to investors in securities markets would often not be available to cryptocurrency investors.

Giancarlo came off almost “bullish” on cryptocurrencies and the underlying technology. He noted a number of potential benefits to distributed ledger technology ranging from finance to charity to agriculture. He also probably earned some “woke points” from his kids when he dropped references to “HODL” and “if there was no bitcoin, there would be no blockchain.” It appears the CFTC is poised to take a regulatory hands-off approach of “do no harm” while the technological markets are still in their relative infancy.

Clayton was more measured on his outlook but also acknowledged benefits of the technology. He made it clear, however, that ICOs are entering the regulatory crosshairs of the SEC. More on that below.

On The Issues

Crypto’s Intrinsic Value

The chairs appeared split on defining the intrinsic value of cryptocurrency. While Giancarlo acknowledged the value derives from mining and related energy costs, Clayton seemed dubious. He suggested value has not “manifested…in the market yet” from the “perspective of Main Street investors”. Clayton further stated that high price volatility hinders crypto’s utility as a transaction medium.

ICOs

Perhaps the harshest language of the hearing came from Clayton regarding ICOs. He stated with essentially no equivocation that ICOs are securities offerings and will be regulated as such:

“I believe every ICO I’ve seen is a security…You can call it a coin but if it functions as a security, it is a security…Those who engage in semantic gymnastics or elaborate re-structuring exercises in an effort to avoid having a coin be a security are squarely in the crosshairs of our enforcement provision.”

– Jay Clayton, SEC Chairman

Clayton noted that to date no ICOs had been registered with the SEC. He also further issued a warning to celebrity promoters of ICOs:

“If you're promoting securities, you're taking on securities law liability."

– Jay Clayton, SEC Chairman

No reports yet on whether Floyd Mayweather and DJ Khaled were phased by Clayton’s warning shot. I’m guessing “nah”.

image

Takeaway: Certainly some pointed language here on ICOs. What Clayton is getting at is if the “coin” offering is structured or sold as an investment, i.e. something promising or even suggesting an ROI, the SEC will likely consider it within their regulatory & enforcement domain. Ultimately, given the SEC’s limited resources (more on that below), I expect enforcement to remain mostly as reactionary measure limited to prosecuting fraudsters and Ponzi schemes. Anyone in the ICO-sphere should certainly watch this space.

Regulatory Enforcement & Limitations

Both chairs acknowledged that regulatory enforcement would largely be limited for a couple reasons:

(1) resource limitations -- namely hiring freezes and budget restraints on both agencies; and

(2) jurisdictional limitations – meaning their legal authority is generally limited to preventing & punishing fraud and manipulation in U.S. markets.

In response to how to address states like Russia & Venezuela that attempt creating & using cryptocurrencies to evade sanctions, the chairmen acknowledged the jurisdictional gaps and legal grey areas that exist for enforcement.

As to new CME and Cboe Bitcoin futures markets, Giancarlo put a positive spin on the development, noting that they can now analyze the data for fraud and manipulation.

For cases of fraud, hacking & theft in the crypto-sphere, Clayton emphasized the distinction between crypto cases and traditional schemes like Madoff. With the Madoff Ponzi scheme, the SEC can aid in recovering stolen funds. However, when engaging in investing online with offshore entities, the chances that they can do anything practical to recover funds are “very, very low.”

Takeaway: Legal jurisdiction and borders are a bitch, huh? Almost like Satoshi had this stuff in mind when inventing a borderless, decentralized, anonymous currency…

Exchanges

In response to the explosion of crypto trading exchanges, Clayton defined the issue facing regulators is whether the traditional “approach to the regulation of sovereign currency transactions is appropriate for these new markets.” He further elaborated on the heightened risk profile associated with crypto trading:

“Many trading platforms are even referred to as “exchanges.” I am concerned that this appearance is deceiving. In reality, investors transacting on these trading platforms do not receive many of the market protections that they would when transacting through broker-dealers on registered exchanges…such as best execution, prohibitions on front running, short sale restrictions, and custody and capital requirements.”

– Jay Clayton, SEC Chairman

Further regulation to be considered:

“…the currently applicable regulatory framework for cryptocurrency trading was not designed with trading of the type we are witnessing in mind…[W]e are open to exploring with Congress, as well as with our federal and state colleagues, whether increased federal regulation of cryptocurrency trading platforms is necessary or appropriate. We also are supportive of regulatory and policy efforts to bring clarity and fairness to this space.”

– Jay Clayton, SEC Chairman

Takeaway: Honestly, I read this as a sound presentation of the challenges facing them, and that’s about it. When you hear phrases like “open to exploring…with federal and state colleagues,” it signals to me that they’re a long way away from any real action as to exchanges.

Crypto-backed ETFs

Clayton continued to throw cold water on establishing crypto-backed Exchange-Traded Funds (ETFs). He echoed his prior statements on the topic, claiming that ETFs with crypto underlying assets have challenges related to “price discovery, custody, and issues surrounding volatility”, and thus he doesn’t want to approve any such products until “we can get comfortable with those issues” (whatever that means).

Takeaway: Still in a holding pattern here. No forward progress.

Parting Thoughts

Overall, the hearing should have a calming effect on the crypto investing community. Both men were well-versed on the challenges and limitations surrounding regulation. And neither offered half-cocked notions of banning crypto, or classifying the entire system as criminal or a Ponzi scheme – as we’ve seen from other governmental and financial leaders from across the globe.

Personally, I welcome the increased focus on ICOs as the space certainly has an issue with fraud, abuse, and theft. If the government can create a real deterrent to fraudsters and scammers, it will only make the market more appealing to borderline and dubious casual investors.

I hate how quick governments jumped onto either making profit through taxes or along with banks try to stop crypto but they will never succeed!

Exciting times ahead? 😊

Damn, thanks for the info.. this was really informative.. i wish i woulda caught it while it was newer but better late than never right? Lol.. thanks for doing all the work.. i appreciate it 😉

You got a 7.45% upvote from @bid4joy courtesy of @bubbleboy!

This post has received a 11.15% UpGoat from @shares. Send at least 0.1 SBD to @shares with a post link in the memo field.

Invest your Steem Power and help minnow at the same time to support our daily curation initiative. Delegate Steem Power (SP) to @shares by clicking one of the following links: 1000 SP, 5000 SP or more. Join us at https://steemchat.com/ discord chat.

Support my owner. Please vote @Yehey as Witness - simply click and vote.

Sneaky Ninja Attack! You have been defended with a 1.18% vote... I was summoned by @bubbleboy! I have done their bidding and now I will vanish...Whoosh

You got a 1.21% upvote from @buildawhale courtesy of @bubbleboy!

If you believe this post is spam or abuse, please report it to our Discord #abuse channel.

If you want to support our Curation Digest or our Spam & Abuse prevention efforts, please vote @themarkymark as witness.

You got a 4.76% upvote from @nado.bot courtesy of @bubbleboy!

Send at least 0.1 SBD to participate in bid and get upvote of 0%-100% with full voting power.

This post has received a 1.62 % upvote from @boomerang thanks to: @bubbleboy

This post has received gratitude of 1.18 % from @appreciator thanks to: @bubbleboy.