How to Survive the Current Volatility in Cryptos

How to Survive the Current Volatility in Cryptos

If you’re new to cryptocurrencies, the recent volatility can be unnerving.

Since its January highs, the cryptocurrency market has fallen

as much as 66%.

And bitcoin fell 70% from peak to trough.

Since rallying off the lows, we’ve seen yet another downturn.

Naturally, new investors in this space are scared.

But it’s important to understand that volatility and the cryptocurrency

market go hand-in-hand.

We can use bitcoin to demonstrate.

In 2017 alone, bitcoin saw five corrections of 30% or more.

We saw “crashes” of 34%, 33%, 39%, 40%, and 30%.

Let that sink in for a moment.

That’s just over one year.

For reference, the U.S. stock market hasn’t had a crash of 30% or more

in nearly a decade.

Stepping back and looking at the entire history of bitcoin, we can see that large corrections—

like the one we’re seeing now—are the norm.

In 2011, bitcoin dropped 93%.

In 2013, it dropped 70%.

And over 2014 and 2015, it dropped 86%.

So while the current 70% drop is scary, it’s normal when viewed in context.

Bu if you look past the daily price movements to the big picture.

And what you will see is another great year shaping up for cryptocurrencies.

One of the big themes emerging is what we call the “New Wall Street Narrative.”

Wall Street has a history of using “narratives”

to drive investment decisions.

The internet “new era” and the “housing plateau of prosperity”

are two good examples of these narratives.

The new narrative emerging from Wall Street is that adding cryptocurrencies

to institutional portfolios will help tame volatility.

And that is going to take the cryptocurrency market to new heights in 2018.

We’re already starting to see it play out.

In early February, JPMorgan published a research report on cryptocurrencies

called “Decrypting Cryptocurrencies: Technology, Applications, and Challenges.”

It was quickly labeled the “Bitcoin Bible.”

And it confirmed our thesis when it concluded:

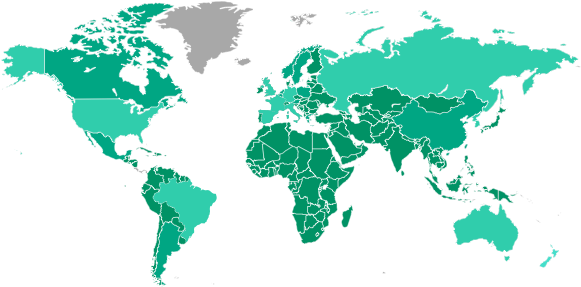

If past returns, volatilities, and correlations persist, cryptocurrencies

could potentially have a role in diversifying one’s global bond

and equity portfolio.

A month later, investment management behemoth BlackRock—which has $5.7 trillion

in assets under management—put out commentary on cryptocurrencies which stated:

Our bottom line: We see cryptocurrencies potentially becoming more widely

used in the future as the markets mature.

Shortly after the BlackRock commentary, Wellington Management published its own

report on cryptocurrencies.

Wellington, which has over $1 trillion in assets under management, stated it was evaluating

adding crypto assets to its client portfolios.

As you can see, the narrative is growing louder.

At the same time, one of the key pain points for institutions is close to being resolved.

That pain point is custody.

You see, institutions need a third party they can trust to store client funds securely.

But there haven’t been any institutional custody providers in the crypto market.

While many are working on such a product, we think Coinbase will be the first to provide one.

In November 2017, the company announced Coinbase Custody—a digital currency custodian for institutions.

And it’s getting closer to being released.

Coinbase just hired Eric Scro as the vice president of finance.

He was the former head of finance at the New York Stock Exchange.

And one of his chief roles is to help serve institutional clients

and promote new product offerings like Coinbase Custody.

Here’s what I concluded: We’re going to see 5–10% of global stock wealth

diverted into the cryptocurrency market under the narrative of lowering risk.

Now is the time to use the weakness in cryptocurrencies to pick up bitcoin

and add to your positions.